Solvency vs. Liquidity: Differentiating Crisis Types for Financial Stability

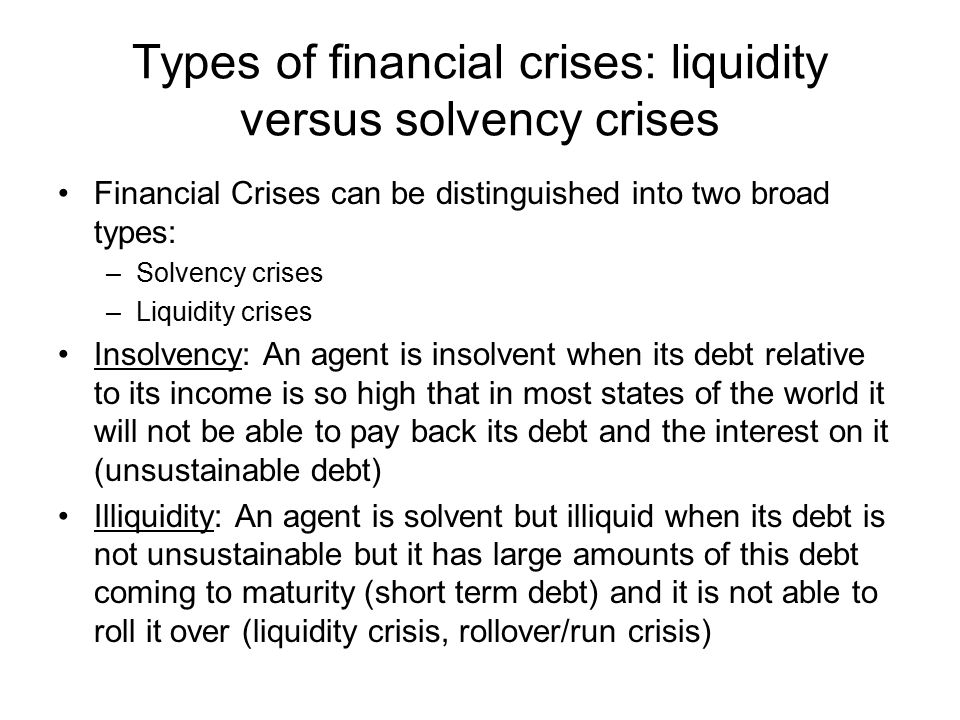

In the complex world of business and finance, understanding the health of an organization is paramount. Just like a doctor checks different vital signs to assess a patient’s well-being, financial professionals look at various metrics to gauge a company’s financial stability. Among the most crucial, yet often confused, concepts are solvency and liquidity.

While both are essential for survival, they represent different facets of financial strength and can lead to distinct types of crises. For beginners, distinguishing between a solvency crisis and a liquidity crisis is key to understanding why businesses fail, how to prevent such failures, and what proactive steps can be taken for robust financial health.

This comprehensive guide will break down solvency and liquidity, explain their unique characteristics, differentiate between the crises they can trigger, and show you how they are interconnected.

Understanding Financial Health: More Than Just Profit

Before diving into the specifics, let’s establish a foundational understanding. A business can be profitable on paper but still face financial distress. Why? Because profit is about earning more than you spend over a period, while solvency and liquidity are about your ability to manage your debts and access cash. Think of it like this:

- Profit: Are you making money? (e.g., selling lemonade for $1 when it costs you $0.50)

- Solvency: Can you pay all your long-term debts if they were due today? (e.g., Do you own more than you owe on your house, car, and credit cards combined?)

- Liquidity: Do you have enough cash right now to pay your immediate bills? (e.g., Do you have enough cash in your wallet or bank account to buy groceries today?)

Understanding these distinctions is the first step towards truly grasping financial stability.

1. What is Solvency? The Long-Term Financial Foundation

Solvency refers to a company’s ability to meet its long-term financial obligations. It’s about the overall health and sustainability of the business over an extended period. Think of solvency as the deep financial roots of a tree; if the roots are strong, the tree can withstand storms and grow for many years.

A solvent company has enough assets (what it owns) to cover its liabilities (what it owes) in the long run. It’s a measure of a company’s ability to stay in business and continue as a "going concern" for the foreseeable future.

Key Characteristics of Solvency:

- Time Horizon: Long-term (years, decades).

- Focus: Overall financial structure, debt-paying capacity, and net worth.

- Key Question: Does the company own more than it owes? Can it pay off all its debts if needed?

- Analogy: The foundation of a house. A strong foundation means the house will stand for a long time.

- Primary Financial Statement: The Balance Sheet (Assets, Liabilities, Equity).

Signs of a Solvency Crisis:

A solvency crisis (also known as financial distress or bankruptcy risk) occurs when a company’s liabilities exceed its assets, or it’s clear it won’t be able to pay its long-term debts. This means the company’s "net worth" is negative or dwindling rapidly.

- Persistent Losses: The company consistently spends more than it earns over long periods, eroding its capital.

- High Debt-to-Equity Ratio: The company relies too heavily on borrowed money compared to the money invested by owners.

- Negative Net Worth (or Equity): The total value of everything the company owns is less than what it owes to others.

- Declining Asset Values: The value of key assets (like property, equipment, or inventory) drops significantly, reducing the company’s ability to cover debts.

- Inability to Secure Long-Term Loans: Banks and investors refuse to lend money due to the company’s poor financial standing.

- Frequent Sale of Core Assets: Selling off essential parts of the business just to stay afloat.

Consequences of a Solvency Crisis:

- Bankruptcy: The ultimate outcome, leading to the liquidation of assets or reorganization under court supervision.

- Loss of Investor Confidence: Investors pull out, making it harder to raise capital.

- Forced Asset Sales: Companies might be forced to sell valuable assets at a loss to repay debts.

- Loss of Reputation: Damages the company’s standing in the market.

- Job Losses: Employees are laid off as the company downsizes or shuts down.

Example: Imagine a manufacturing company that invested heavily in new machinery, taking on a huge loan. For years, their products didn’t sell well, leading to consistent losses. Even though they might have enough cash for daily operations for a while, their accumulated debt and declining asset values (old machinery, unsellable inventory) mean that, in the long run, they can’t pay back that massive loan. They are insolvent.

2. What is Liquidity? The Day-to-Day Cash Flow

Liquidity refers to a company’s ability to meet its short-term financial obligations as they become due. It’s about having enough readily available cash or assets that can quickly be converted to cash to cover immediate expenses. Think of liquidity as the daily blood flow in a body; without it, even a strong body can’t function.

A liquid company can easily pay its bills, salaries, rent, and other operating expenses without delay. It’s about having enough cash in the bank, or easily accessible funds, to keep operations running smoothly.

Key Characteristics of Liquidity:

- Time Horizon: Short-term (days, weeks, months).

- Focus: Cash flow management, working capital, and ability to convert assets into cash quickly.

- Key Question: Does the company have enough cash to pay its bills today, next week, or next month?

- Analogy: Your daily pocket money. Enough to buy groceries and pay immediate bills.

- Primary Financial Statement: The Cash Flow Statement.

Signs of a Liquidity Crisis:

A liquidity crisis (also known as a cash flow problem or short-term insolvency) occurs when a company doesn’t have enough cash to cover its immediate expenses, even if it has valuable assets or is profitable overall.

- Delayed Payments to Suppliers: The company struggles to pay its vendors on time.

- Bounced Checks: Checks written by the company cannot be cashed due to insufficient funds.

- Inability to Pay Salaries: A critical sign of severe distress.

- Overdrafts: Consistently going into overdraft on bank accounts.

- Reliance on Short-Term Borrowing: Constantly taking out high-interest short-term loans just to make ends meet.

- Slow-Moving Inventory: Products are not selling, tying up cash in inventory.

- Uncollected Receivables: Customers are slow to pay what they owe the company.

Consequences of a Liquidity Crisis:

- Operational Disruption: Inability to buy raw materials, pay staff, or keep lights on.

- Loss of Supplier Trust: Suppliers may demand upfront payments or refuse to do business.

- Damaged Reputation: Affects creditworthiness and relationships with banks.

- Missed Opportunities: Cannot invest in growth or take advantage of discounts.

- Forced Sales of Liquid Assets: Selling off easily convertible assets (e.g., marketable securities) to raise cash, sometimes at a loss.

Example: Consider a highly profitable software company that just landed a massive new client. They have signed contracts for millions of dollars, making them very solvent. However, the client’s payment terms are 90 days, and the software company needs to hire new staff, buy new equipment, and pay rent today to start the project. If they don’t have enough cash on hand or easy access to it, they could face a liquidity crisis despite their long-term profitability.

3. The Crucial Differences: Solvency vs. Liquidity Side-by-Side

To solidify your understanding, let’s put these two concepts head-to-head:

| Feature | Solvency | Liquidity |

|---|---|---|

| Time Horizon | Long-term (overall financial viability) | Short-term (immediate cash needs) |

| Primary Focus | Ability to pay all debts, total assets vs. total liabilities | Ability to pay current bills, cash flow management |

| Key Question | Can the business survive in the long run? | Can the business pay its bills today/this month? |

| Analogy | The strength of a building’s foundation | The daily flow of electricity to the building |

| Main Concern | Risk of bankruptcy, long-term sustainability | Risk of operational disruption, missed payments |

| Key Indicators | Debt-to-Equity Ratio, Solvency Ratio, Net Worth | Current Ratio, Quick Ratio, Cash Flow Statement |

| Crisis Signs | Negative equity, persistent losses, inability to get long-term loans | Bounced checks, delayed payments, overdrafts |

| Primary Goal | Long-term financial health and growth | Smooth day-to-day operations |

4. Can One Lead to the Other? The Interplay

While distinct, solvency and liquidity are deeply interconnected. A problem in one area can quickly spill over and trigger a crisis in the other.

How a Liquidity Crisis Can Become a Solvency Crisis:

This is a common path to bankruptcy. If a company consistently runs out of cash to pay its immediate bills, it might resort to desperate measures:

- Selling assets at a loss: To raise quick cash, the company might sell valuable assets below their market value, eroding its long-term asset base and thus its solvency.

- Taking on expensive short-term debt: High-interest loans to cover daily expenses can quickly pile up, making it impossible to pay off the principal, thus damaging long-term solvency.

- Missing out on opportunities: Without cash, the company can’t invest in growth, new products, or essential maintenance, which hurts its long-term profitability and solvency.

- Operational collapse: If a company can’t pay suppliers or employees, its operations will grind to a halt, leading to a complete breakdown and eventual insolvency.

Example: Our profitable software company from before, if it can’t find short-term cash, might be forced to sell future client contracts at a huge discount to a factoring company, or take out a cripplingly high-interest loan. This immediate need for cash (liquidity problem) directly damages its future earnings potential and long-term financial structure (solvency problem).

How a Solvency Crisis Often Manifests as a Liquidity Crisis:

An insolvent company, by definition, has more liabilities than assets in the long run. This long-term weakness inevitably affects its short-term cash flow:

- Difficulty securing loans: Banks are hesitant to lend to an insolvent company, making it hard to get even short-term operating loans.

- Suppliers demand upfront payment: As word spreads about the company’s financial woes, suppliers lose trust and demand cash upfront, drying up lines of credit.

- Declining sales: Customers and business partners might avoid dealing with a company perceived as unstable, leading to reduced revenue and cash flow.

- Loss of investor confidence: No one wants to put money into a sinking ship, cutting off a vital source of cash.

Example: The struggling manufacturing company (insolvent) will eventually find that no bank will lend it money, suppliers demand cash, and customers are hesitant to place orders. Even if they had a small amount of cash today, the fundamental weakness of their long-term financial position means they will soon run out of cash to pay daily bills, leading to a liquidity crisis.

5. Protecting Your Business: Proactive Measures

Understanding the difference is only half the battle. The other half is taking proactive steps to maintain both solvency and liquidity.

For Solvency (Long-Term Health):

- Maintain Healthy Profitability: Consistently earn more than you spend. Profit is the engine that builds equity and strengthens solvency.

- Manage Debt Wisely: Don’t over-borrow. Ensure your debt levels are sustainable and that you can comfortably make interest and principal payments.

- Control Operating Costs: Keep a tight rein on expenses to improve your profit margins and overall financial strength.

- Strategic Asset Management: Invest in assets that generate revenue and hold their value. Avoid speculative or non-performing assets.

- Reinvest Earnings: Reinvesting a portion of profits back into the business can build equity and strengthen the balance sheet.

- Regular Financial Reviews: Conduct deep dives into your Balance Sheet to monitor your asset-to-liability ratio.

For Liquidity (Short-Term Cash Flow):

- Cash Flow Forecasting: Create detailed forecasts of your incoming and outgoing cash. This helps you anticipate shortages before they happen.

- Build a Cash Reserve (Emergency Fund): Just like individuals, businesses need a buffer for unexpected expenses or revenue dips.

- Efficient Accounts Receivable Management: Send invoices promptly and follow up on overdue payments. Cash in customers’ hands isn’t cash in yours.

- Optimize Accounts Payable: Pay your bills strategically. Take advantage of payment terms (e.g., 30 days) but avoid late payments that incur penalties or damage relationships.

- Manage Inventory Levels: Avoid tying up too much cash in unsold products. Efficient inventory management frees up cash.

- Establish Lines of Credit: Even if you don’t need it now, having a pre-approved line of credit from a bank can be a lifesaver during a liquidity crunch.

- Monitor Liquidity Ratios: Regularly check your Current Ratio (Current Assets / Current Liabilities) and Quick Ratio (Cash + Marketable Securities + Accounts Receivable / Current Liabilities) to ensure you have enough short-term assets to cover short-term debts.

Conclusion: Vigilance is Key

Solvency and liquidity are two sides of the same coin – financial stability. Solvency is the long-term structural integrity, ensuring your business has a strong foundation and can pay its long-term obligations. Liquidity is the short-term operational fuel, ensuring you have enough cash to keep the daily operations running smoothly.

A healthy business excels at both. Neglecting one, even while excelling at the other, can lead to disaster. A profitable but illiquid company can go bankrupt, and a highly liquid company built on a mountain of unsustainable debt is a ticking time bomb.

By understanding these critical differences and proactively managing both your long-term financial health (solvency) and your day-to-day cash flow (liquidity), you empower your business to weather financial storms, seize opportunities, and achieve sustainable growth. Financial literacy, even at a beginner’s level, is your best defense against crisis.

Frequently Asked Questions (FAQs)

Q1: Can a profitable company have a liquidity crisis?

A: Absolutely, yes! This is a classic scenario. A company can be selling lots of products (generating profit) but if its customers pay very slowly (e.g., 90 days), or if it has huge upfront costs for projects, it can run out of cash for daily expenses. This is often called "growing broke."

Q2: Is a solvency crisis always worse than a liquidity crisis?

A: A solvency crisis is generally more severe in the long run as it points to a fundamental flaw in the business model or financial structure, often leading to bankruptcy. A liquidity crisis, while disruptive, can sometimes be resolved with short-term solutions (like a small loan or accelerating collections) if the underlying business is otherwise sound and solvent. However, a prolonged liquidity crisis will eventually lead to a solvency crisis.

Q3: How often should a business monitor its solvency and liquidity?

A: Liquidity should be monitored constantly, often daily or weekly, through cash flow forecasts. Solvency should be reviewed at least quarterly, but ideally monthly, by analyzing the Balance Sheet and key financial ratios.

Q4: What’s the single most important financial statement for each?

A: For solvency, the Balance Sheet is crucial, as it shows your assets, liabilities, and equity at a specific point in time. For liquidity, the Cash Flow Statement is paramount, as it tracks the actual movement of cash in and out of the business over a period.

Q5: Do these concepts apply only to large corporations?

A: No, these concepts apply to businesses of all sizes, from a sole proprietorship to a multinational corporation. Even personal finance involves solvency (your net worth) and liquidity (your checking account balance). Understanding them is vital for anyone managing money.

Post Comment