Smart Money, Bright Future: The Ultimate Guide to Financial Planning for College Students

College is an exhilarating time – new friends, exciting subjects, and newfound independence. But with that independence often comes a significant challenge: managing your money. For many students, college is their first real dive into financial responsibility, and it can feel overwhelming.

The good news? You don’t need a finance degree to master your money. This comprehensive guide will break down financial planning for college students into easy-to-understand steps, helping you build smart money habits that will benefit you for life, not just through graduation.

Why Financial Planning Matters for College Students (More Than You Think!)

You might be thinking, "I’m just trying to pass my classes, why worry about money now?" Here’s why getting a handle on your finances during college is incredibly important:

- Reduces Stress: Financial worries are a huge source of stress. A clear plan can ease anxiety and let you focus on your studies and college experience.

- Avoids Unnecessary Debt: College can be expensive. Smart planning helps you minimize student loans and other debt, giving you a better start post-graduation.

- Builds Essential Life Skills: Learning to budget, save, and manage credit now sets you up for financial success in your adult life. These are skills they don’t teach in every class!

- Creates Opportunities: Having a handle on your money can open doors – whether it’s studying abroad, taking an unpaid internship that leads to a dream job, or simply enjoying your social life without constant worry.

- Prepares for the Future: Understanding finances now makes the transition to independent adulthood smoother, whether you’re buying a car, renting an apartment, or planning for your career.

The Core Pillars of College Financial Planning

Let’s dive into the practical steps you can take to build a solid financial foundation.

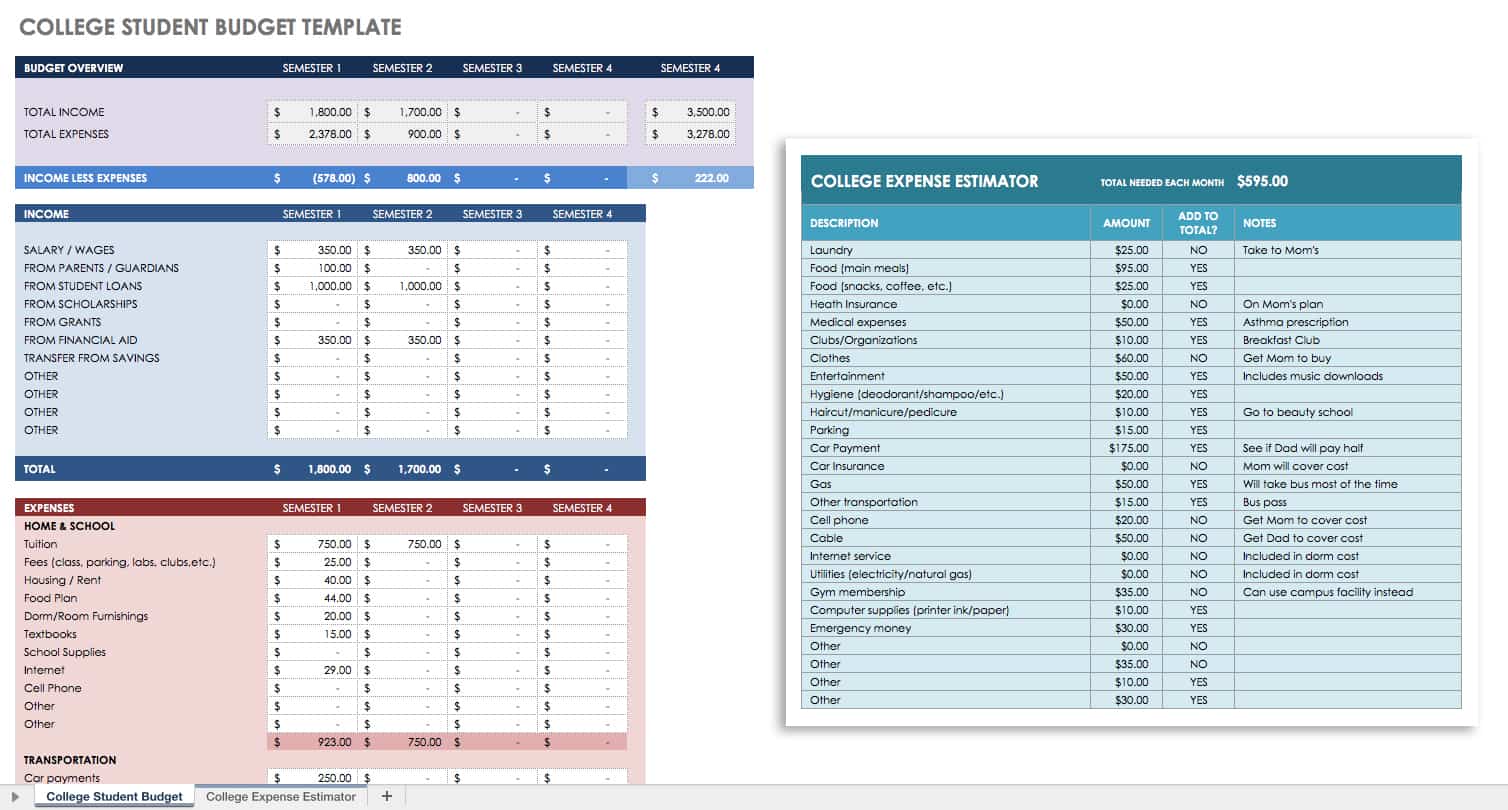

1. Master the Art of Budgeting: Your Financial GPS

A budget isn’t about restricting yourself; it’s about understanding where your money comes from and where it goes. Think of it as a roadmap for your cash.

How to Create a Simple College Budget:

- Calculate Your Income:

- Money from parents/guardians

- Financial aid refunds (after tuition/fees)

- Scholarships

- Part-time job earnings

- Savings you brought to college

- List Your Fixed Expenses (The Ones That Stay the Same):

- Tuition & Fees (if not fully covered by aid)

- Rent/Dorm Fees (if not covered)

- Utilities (if applicable: electricity, internet, phone)

- Loan payments (if you have any existing ones)

- Monthly subscriptions (streaming services, gym memberships)

- Estimate Your Variable Expenses (The Ones That Change):

- Food: Groceries, dining out, coffee runs

- Transportation: Gas, public transport, ride-sharing

- Books & Supplies: Textbooks, notebooks, printer ink

- Personal Care: Toiletries, haircuts

- Entertainment/Social: Movies, concerts, going out with friends

- Miscellaneous: Unexpected costs, impulse buys

Putting It Into Practice:

- Track Everything: For a month or two, write down every single dollar you spend. This is eye-opening!

- Compare Income vs. Expenses: Do you have more coming in than going out? If not, it’s time to make adjustments.

- Allocate Funds: Assign a specific amount of money to each spending category for the month.

- Review and Adjust: Life happens! Your budget isn’t set in stone. Review it regularly and tweak it as needed.

Tools to Help You Budget:

- Spreadsheets: Google Sheets or Excel offer free templates.

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), EveryDollar, or PocketGuard link to your bank accounts and categorize spending automatically.

- Pen & Paper: Simple and effective for some – a small notebook dedicated to your money.

2. Understand and Maximize Financial Aid

Financial aid is often the backbone of a college student’s budget. Don’t leave money on the table!

- FAFSA (Free Application for Federal Student Aid): This is your gateway to federal grants, scholarships, work-study, and federal student loans. Fill it out every year as early as possible (it opens October 1st). Even if you think you won’t qualify, apply anyway!

- Grants: This is free money you don’t have to pay back, usually awarded based on financial need.

- Scholarships: Also free money, but often based on merit (academics, athletics, talents), specific demographics, or unique criteria.

- Where to Look: Your college’s financial aid office, departmental scholarships, community organizations, national scholarship search engines (Fastweb, Scholarship.com, Chegg).

- Apply, Apply, Apply! It takes time, but even small scholarships add up.

- Work-Study Programs: If you qualify, this allows you to earn money through part-time jobs, often on campus, with your earnings directly helping with educational costs.

- Federal Student Loans: These are loans from the government with generally better terms (lower interest rates, flexible repayment options) than private loans. Only borrow what you absolutely need.

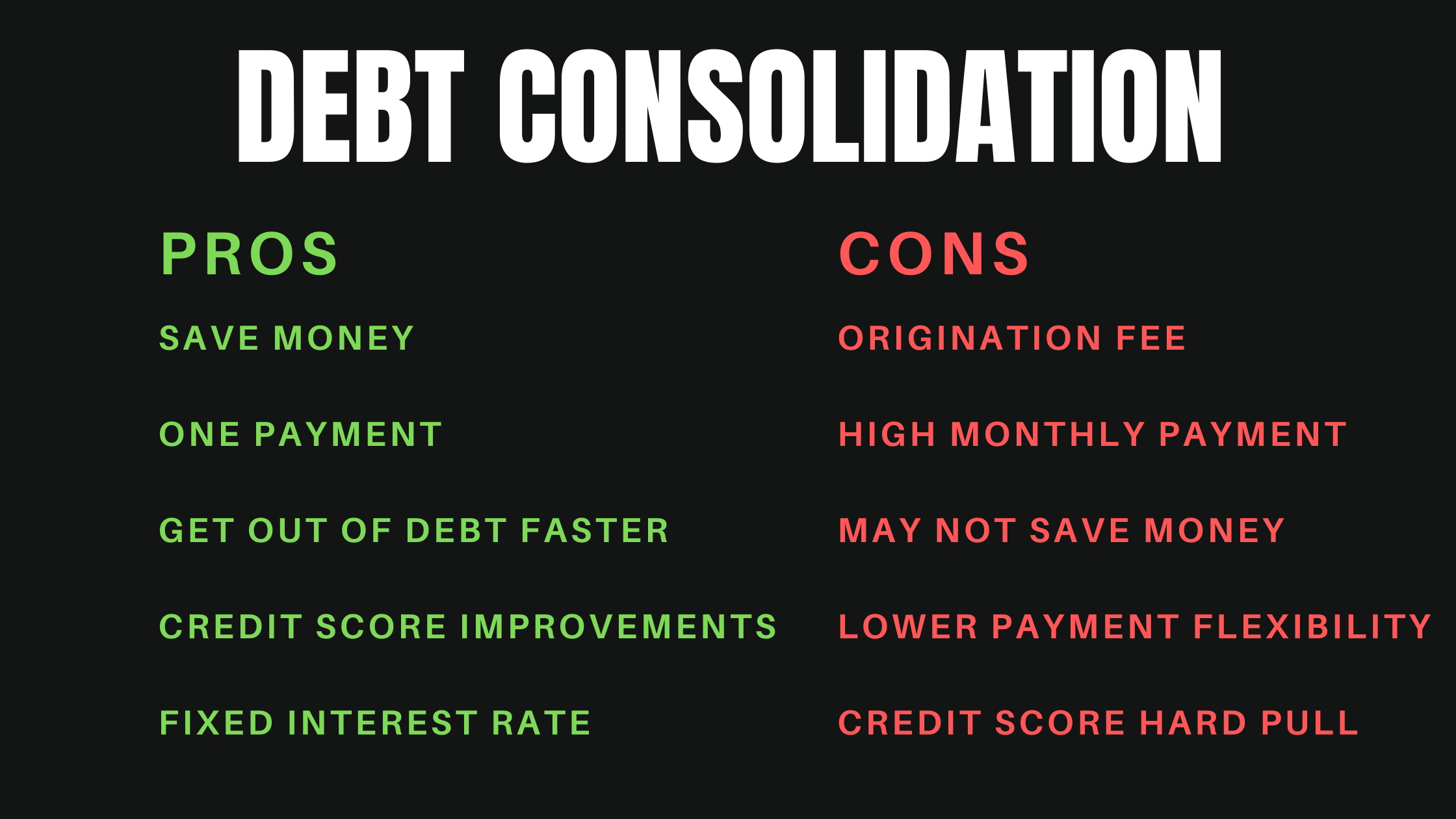

3. Borrow Smart (If You Must)

Sometimes, loans are necessary. But how you borrow makes a huge difference.

- Prioritize Federal Loans: Always max out your federal loan eligibility before considering private loans.

- Subsidized vs. Unsubsidized: Subsidized loans don’t accrue interest while you’re in school, during grace periods, or deferment. Unsubsidized loans start accruing interest immediately.

- Avoid Private Loans if Possible: These are offered by banks and credit unions, often have higher, variable interest rates, and fewer borrower protections. If you must take one, shop around for the best rates and terms.

- Borrow Only What You Need: It’s tempting to take the full amount offered, but remember, every dollar borrowed must be paid back with interest. Think of your future self.

4. Earn Money While You Learn

Supplementing your income can significantly reduce financial stress and your reliance on loans.

- Part-Time Jobs:

- On-Campus: Often flexible with your class schedule and provide convenience. Check with your university’s career services or student employment office.

- Off-Campus: Retail, food service, tutoring, administrative roles.

- Freelancing/Gig Economy: Use your skills (writing, graphic design, social media, web development) for freelance work, or join ride-sharing/delivery services if you have a car.

- Paid Internships: Gain valuable experience and earn money. Look for opportunities through your career services or department.

- Sell Unused Items: Textbooks, old electronics, clothes – declutter and make some cash!

5. Build an Emergency Fund (Even a Small One!)

Life is unpredictable. An emergency fund is money set aside for unexpected expenses.

- What it’s for: A sudden medical bill, an unexpected trip home, a laptop breakdown, car repair, or a lost wallet.

- How much: Start small. Even $200-$500 can prevent a minor crisis from becoming a major one. As you build more financial stability, aim for a larger fund.

- Where to keep it: In a separate savings account, so you’re not tempted to spend it on everyday items.

6. Start Your Credit Journey Wisely

Your credit score is like a financial report card. A good score makes it easier to rent an apartment, get a car loan, or even secure a job in the future.

- How to Start (Safely):

- Secured Credit Card: You put down a deposit (e.g., $200), and that becomes your credit limit. It acts like a regular credit card but uses your deposit as collateral.

- Authorized User: Ask a trusted family member (with good credit) to add you as an authorized user on their credit card. Their good habits can positively impact your score.

- The Golden Rules of Credit:

- Pay Your Bill ON TIME, EVERY TIME: This is the most critical factor.

- Keep Your Balance Low: Don’t max out your card. Aim to use less than 30% of your credit limit.

- Don’t Apply for Too Many Cards: Each application can temporarily ding your score.

- Warning: Credit cards are not free money. They are tools. If you can’t pay off your balance in full each month, avoid using them. High-interest debt can quickly spiral out of control.

7. Protect Your Money: Beware of Scams!

College students are often targets for scammers. Be vigilant!

- Common Scams: Fake job offers, lottery winnings you never entered, imposter scams (someone pretending to be the IRS, police, or university staff demanding immediate payment), tech support scams.

- Red Flags: Demands for gift cards or wire transfers, threats, unsolicited offers that seem too good to be true, requests for personal information (Social Security Number, bank details) via email or phone.

- What to Do: If something feels off, it probably is. Never share personal or financial information unless you initiated the contact and are certain of the recipient’s identity. Verify requests by contacting the organization directly using a number from their official website, not one provided by the caller/emailer.

8. Plan for Post-Graduation (It’s Closer Than You Think!)

While the primary focus is current college finances, having an eye on the future can motivate good habits.

- Student Loan Repayment: Understand your loan types, interest rates, and repayment options. Federal loans offer income-driven repayment plans that can be helpful.

- Career Goals: Think about how your degree will translate into income and what your post-graduation expenses might look like.

Practical Tips for Everyday Financial Success

Beyond the big picture, small daily choices add up.

- Cook More, Eat Out Less: Eating at the dining hall or cooking your own meals is almost always cheaper than ordering takeout or going to restaurants. Learn a few simple, cheap recipes!

- Utilize Student Discounts: Always ask if a store, restaurant, or service offers a student discount. Many do!

- Use Campus Resources: Your university likely offers free or low-cost counseling, health services, gym access, and career guidance. Take advantage of them!

- Avoid Impulse Buys: Give yourself a "cooling off" period before making non-essential purchases. If you still want it tomorrow, then consider it.

- Walk, Bike, or Use Public Transport: Save money on gas, parking, and car maintenance.

- Buy Used Textbooks: Check online marketplaces, campus bookstores, or library reserves before buying new.

- Track Subscriptions: Review your monthly subscriptions (streaming, apps, gym) and cancel any you don’t actively use.

- Set Financial Goals: Whether it’s saving for spring break, a new laptop, or an emergency fund, having a target keeps you motivated.

Common Financial Mistakes College Students Make (And How to Avoid Them)

- Ignoring Their Budget (Or Not Having One): Without a budget, you’re flying blind. Start one today, even a simple one!

- Overspending on Non-Essentials: That daily coffee or frequent takeout adds up faster than you think. Prioritize needs over wants.

- Taking Out Too Many Student Loans: Borrow only what’s absolutely necessary. Every dollar borrowed is a dollar you’ll owe later.

- Not Applying for Financial Aid & Scholarships: Don’t assume you won’t qualify. Always apply for FAFSA and actively search for scholarships.

- Mismanaging Credit Cards: Using them for everyday expenses you can’t pay off, leading to high-interest debt. Use credit cards wisely to build credit, not fund a lifestyle.

- Falling for Scams: Being too trusting or desperate can make you vulnerable. If it sounds too good to be true, it probably is.

- Not Building an Emergency Fund: Relying on credit cards or loans for unexpected expenses. Start saving, even small amounts.

Conclusion: Your Financial Journey Starts Now

Financial planning for college students isn’t about deprivation; it’s about empowerment. It’s about taking control of your money so your money doesn’t control you. By implementing these strategies, you’ll not only navigate your college years with less stress but also build crucial habits that will serve you throughout your entire life.

Remember, every small step counts. Start with one thing – maybe creating a basic budget or researching scholarships – and build from there. Your future self will thank you for the financial wisdom you gain today. Start your smart money journey now, and build a brighter future!

Post Comment