Real GDP vs. Nominal GDP: Adjusting for Inflation – Understanding True Economic Growth

When you hear news reports about the economy, terms like "GDP growth" are often thrown around. But did you know there are actually two main ways to measure a country’s Gross Domestic Product (GDP), and one tells a much more accurate story about real progress?

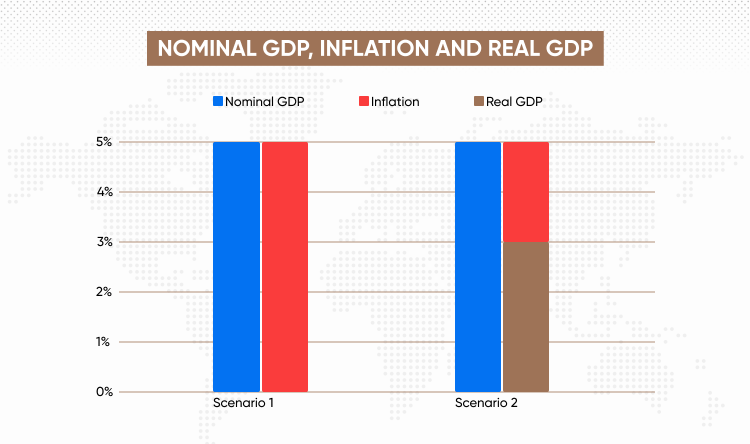

Understanding the difference between Nominal GDP and Real GDP is crucial for anyone trying to grasp the true health of an economy. The key factor that separates them? Inflation.

In this comprehensive guide, we’ll break down these concepts, explain why adjusting for inflation is so important, and show you how to truly understand whether an economy is growing or just getting more expensive.

What Exactly is GDP? The Foundation

Before we dive into the "real" and "nominal," let’s quickly define GDP.

Gross Domestic Product (GDP) is the total monetary value of all finished goods and services produced within a country’s borders in a specific time period, usually a year or a quarter. Think of it as the ultimate economic scorecard for a nation.

Why is GDP important?

- It’s a primary indicator of a country’s economic health and size.

- It helps policymakers make informed decisions about taxes, spending, and interest rates.

- It’s used to compare the economic output of different countries.

- It gives businesses and investors an idea of economic trends and potential opportunities.

In simple terms, a higher GDP generally means a country is producing more, which can lead to more jobs, higher incomes, and better living standards. But this is where the "real" vs. "nominal" distinction becomes critical.

Understanding Nominal GDP: The Price Tag Today

Nominal GDP measures the value of all goods and services produced at current market prices. It’s the most straightforward calculation because it simply adds up the dollar value of everything produced in a given year.

Imagine you’re looking at a price tag in a store today. That’s nominal. If a country produced 100 apples at $1 each last year, its GDP from apples was $100. If this year it produced 100 apples at $1.20 each, its GDP from apples would be $120.

Key Characteristics of Nominal GDP:

- Measured in current dollars: It uses the actual prices from the year the goods and services were produced.

- Simple calculation: No adjustments are made for price changes over time.

- Can be misleading: Its biggest drawback is that it doesn’t account for inflation.

The Problem with Nominal GDP and Inflation:

Let’s use a simple example to illustrate the pitfall:

- Year 1: Country A produces 100 cars, and each car sells for $20,000.

- Nominal GDP = 100 cars * $20,000/car = $2,000,000

- Year 2: Country A still produces 100 cars, but due to inflation, each car now sells for $22,000.

- Nominal GDP = 100 cars * $22,000/car = $2,200,000

Looking at these numbers, Nominal GDP went up from $2 million to $2.2 million – a 10% increase! This might look like strong economic growth. However, the actual number of cars produced (the real output) didn’t change at all. The entire increase in Nominal GDP was purely due to rising prices (inflation), not an increase in production or economic activity.

This is why relying solely on Nominal GDP can give a false impression of economic progress. It doesn’t tell you if people are actually producing more, or if their money is just worth less.

The Sneaky Culprit: Inflation

Before we introduce Real GDP, let’s make sure we’re clear on inflation.

Inflation is the general increase in prices for goods and services over time, which means the purchasing power of currency is falling. In simpler terms, your money buys less today than it did yesterday.

Think of it this way: If a loaf of bread cost $2 last year and costs $2.50 this year, that’s inflation. Your dollar can’t buy as much bread as it used to.

When inflation is high, Nominal GDP can soar even if the economy isn’t actually producing more. It’s like your salary increasing, but if prices are rising faster, you’re not actually getting richer – you might even be getting poorer in terms of what you can buy.

Enter Real GDP: The True Picture of Growth

This is where Real GDP comes to the rescue. Real GDP measures the value of all goods and services produced in an economy, but it adjusts for inflation. It does this by expressing the value of output in constant prices, using a chosen "base year" as a reference point.

Think of Real GDP as comparing apples to apples across different years. It strips away the effect of price changes, allowing you to see if the economy is truly producing more goods and services, or if the increase in GDP is merely due to inflation.

Key Characteristics of Real GDP:

- Adjusted for inflation: It removes the impact of rising prices.

- Measured in constant dollars: Uses prices from a specific "base year" to value output from all years.

- Accurate measure of economic growth: Provides a much clearer picture of changes in production volume.

- Essential for comparisons: Allows for meaningful comparisons of economic output over time.

How is Real GDP Calculated? The GDP Deflator

To convert Nominal GDP into Real GDP, economists use a tool called the GDP Deflator.

The GDP Deflator is a price index that measures the average level of prices of all new, domestically produced, final goods and services in an economy. It’s essentially a ratio that shows how much prices have changed relative to a base year.

The formula for Real GDP is:

*Real GDP = (Nominal GDP / GDP Deflator) 100**

Let’s revisit our car example to see Real GDP in action:

-

Year 1 (Base Year):

- Nominal GDP = $2,000,000

- GDP Deflator (always 100 in the base year) = 100

- Real GDP = ($2,000,000 / 100) * 100 = $2,000,000 (In the base year, Nominal GDP = Real GDP)

-

Year 2:

- Nominal GDP = $2,200,000 (as calculated before)

- Let’s say the GDP Deflator for Year 2 is 110 (meaning prices have increased by 10% since the base year).

- Real GDP = ($2,200,000 / 110) * 100 = $2,000,000

Notice what happened? Even though Nominal GDP increased, Real GDP remained flat at $2,000,000. This accurately reflects that the actual quantity of cars produced did not change from Year 1 to Year 2. The economy didn’t grow in terms of output; it just experienced inflation.

If Country A had produced 110 cars in Year 2 (and the deflator was still 110), then:

- Nominal GDP = 110 cars * $22,000/car = $2,420,000

- Real GDP = ($2,420,000 / 110) * 100 = $2,200,000

This would show true economic growth from $2,000,000 to $2,200,000, reflecting the increase in car production.

Why is This Distinction Crucial for Everyone?

Understanding the difference between Real and Nominal GDP isn’t just for economists. It affects how we interpret economic news, make personal financial decisions, and understand the bigger picture.

Here’s why it’s so important:

- Accurate Measure of Economic Growth: Real GDP is the only reliable way to know if an economy is truly expanding or if the reported growth is just an illusion created by rising prices. Governments and central banks primarily focus on Real GDP to gauge the health of the economy.

- Informing Policy Decisions:

- Monetary Policy: Central banks (like the Federal Reserve in the U.S.) use Real GDP growth to decide whether to raise or lower interest rates to control inflation or stimulate growth.

- Fiscal Policy: Governments use it to plan budgets, assess the need for stimulus packages, or determine if tax revenues will increase naturally.

- International Comparisons: When comparing the economic performance of different countries, especially over time, Real GDP allows for fair comparisons, as it removes the distortion of varying inflation rates.

- Investment Decisions: Businesses and investors look at Real GDP growth to determine if there’s increasing demand for goods and services, which influences decisions about expansion, hiring, and stock market outlook.

- Understanding Living Standards: While not a perfect measure, Real GDP per capita (Real GDP divided by population) gives a better indication of the average material well-being of a country’s citizens than Nominal GDP per capita. If Real GDP is growing faster than the population, it suggests that, on average, people have access to more goods and services.

Real vs. Nominal GDP: Key Differences at a Glance

| Feature | Nominal GDP | Real GDP |

|---|---|---|

| Price Basis | Current market prices | Constant prices (adjusted for inflation) |

| Inflation | Includes the effect of inflation | Excludes the effect of inflation |

| Purpose | Measures total output in current dollar terms | Measures true change in output volume |

| Comparability | Poor for comparing output over time | Excellent for comparing output over time |

| Indicator of | Economic size in current dollars | True economic growth and production capacity |

| Calculation | Sum of (Quantity * Current Price) | (Nominal GDP / GDP Deflator) * 100 |

Common Misconceptions and FAQs

-

"Is higher Nominal GDP always good?"

Not necessarily. As we’ve seen, high Nominal GDP growth could simply mean high inflation, not an increase in actual goods and services produced. It’s the Real GDP growth that indicates true economic expansion. -

"Does GDP measure everything?"

No. GDP has limitations. It doesn’t account for unpaid work (like volunteering or housework), the quality of goods, environmental degradation, income inequality, or the "black market" economy. It’s a measure of economic output, not overall well-being. -

"Which one should I pay attention to?"

For understanding economic growth, changes in productivity, and improvements in living standards, Real GDP is the figure you should focus on. When you hear economists or policymakers talk about "economic growth rates," they are almost always referring to the growth rate of Real GDP.

Conclusion

In the world of economics, distinguishing between Nominal GDP and Real GDP is fundamental. While Nominal GDP offers a snapshot of an economy’s total output at current prices, it’s often a misleading indicator of true progress due to the distorting effects of inflation.

Real GDP, by adjusting for inflation, provides the clearest and most accurate measure of a nation’s actual economic growth. It tells us whether an economy is truly producing more goods and services, which is what ultimately leads to higher living standards and greater prosperity.

So, the next time you hear about GDP figures, remember to ask: "Is that Real GDP, or just Nominal GDP?" Your understanding of the economy will be much clearer for it.

Post Comment