Protectionism Explained: Tariffs, Quotas, and Subsidies – A Beginner’s Guide to Trade Barriers

In our interconnected world, goods and services zip across borders every second. This global exchange, known as international trade, is usually seen as a good thing – bringing diverse products, fostering competition, and driving innovation. But sometimes, countries choose to put up barriers to this free flow. This is where protectionism comes in.

If you’ve ever heard terms like "trade wars," "import duties," or "buy local campaigns," you’ve touched on the concept of protectionism. It’s a fascinating and often controversial economic policy that aims to shield a country’s domestic industries from foreign competition. But how exactly do countries do this?

This comprehensive guide will demystify protectionism, breaking down its core definition, the reasons behind its use, and its most common tools: tariffs, quotas, and subsidies. We’ll explain these complex economic concepts in simple terms, perfect for anyone looking to understand the forces shaping global trade.

What Exactly Is Protectionism?

At its heart, protectionism is an economic policy strategy used by governments to restrict or restrain international trade. The primary goal is to protect and promote domestic industries, jobs, and national security interests from what is perceived as unfair or overwhelming foreign competition.

Think of it like a country trying to give its local businesses a head start or a safety net in a global race. Instead of letting everyone compete freely, the government steps in to tilt the playing field in favor of its own players.

Key Idea: Protectionism stands in stark contrast to free trade, which advocates for minimal government intervention in international trade, allowing market forces to determine the flow of goods and services.

Why Do Countries Use Protectionism? Common Motivations

Governments don’t just implement protectionist policies on a whim. There are several key arguments and motivations behind these decisions, often driven by a mix of economic, social, and political factors:

- Protecting Domestic Jobs: This is perhaps the most common and politically appealing argument. When foreign goods are cheaper, domestic companies might struggle, leading to layoffs. Protectionist measures aim to make foreign goods more expensive or less available, thus theoretically safeguarding local employment.

- National Security: For critical industries like defense, energy, or essential food production, a country might argue that relying too heavily on foreign suppliers is a national security risk. Protectionism ensures domestic capacity in these vital sectors.

- Nurturing "Infant Industries": New industries, especially in developing countries, might not be able to compete with established foreign giants right away. Protectionism can act as a temporary shield, allowing these "infant industries" to grow, become efficient, and eventually compete on a global scale.

- Preventing "Dumping": Dumping occurs when a foreign company sells its products in another country at prices below their production cost, often to gain market share or eliminate competition. Protectionist measures can be used to counteract dumping, ensuring fair competition.

- Generating Government Revenue: Historically, tariffs (taxes on imports) were a significant source of income for governments. While less critical today for developed nations, it can still be a factor, especially for countries with less developed tax systems.

- Addressing Trade Deficits: If a country imports far more than it exports, it has a trade deficit. Some argue that protectionist policies can help reduce this deficit by limiting imports and encouraging domestic production.

- Retaliation: Sometimes, a country implements protectionist measures in response to another country’s similar actions, leading to a "trade war" where multiple countries impose barriers on each other’s goods.

The Main Tools of Protectionism: Tariffs, Quotas, and Subsidies

Now that we understand why countries use protectionism, let’s dive into the "how." Governments primarily employ three main tools to achieve their protectionist goals: tariffs, quotas, and subsidies.

1. Tariffs: The Import Tax

Imagine you want to buy a foreign-made car. If your government imposes a tariff on that car, it means an extra tax is added to its price when it enters the country.

-

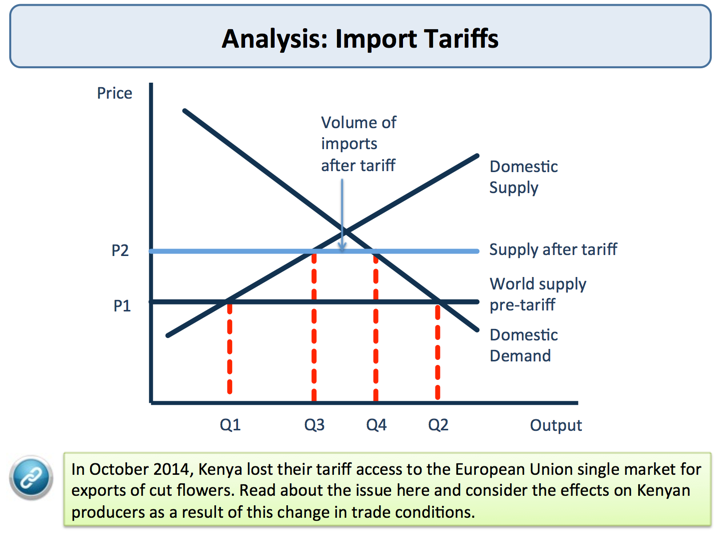

Definition: A tariff is simply a tax or duty imposed on imported goods or services. It makes foreign products more expensive, thereby increasing the price competitiveness of domestically produced goods.

-

How They Work:

- A foreign product arrives at the border.

- The government levies a specific percentage (e.g., 10%) or a fixed amount (e.g., $5 per unit) as a tax.

- This tax is paid by the importer, who then typically passes the cost onto the consumer through a higher retail price.

-

Types of Tariffs:

- Specific Tariff: A fixed fee levied on each unit of an imported good (e.g., $2 per imported shirt).

- Ad Valorem Tariff: A percentage of the imported good’s value (e.g., 5% of the car’s declared value).

- Compound Tariff: A combination of both specific and ad valorem tariffs.

-

Pros of Tariffs (from a protectionist viewpoint):

- Boosts Domestic Sales: By making foreign goods pricier, domestic alternatives become more attractive.

- Increases Government Revenue: The collected tax goes into government coffers.

- Reduces Imports: The higher cost can discourage consumers and businesses from buying foreign goods.

- Leverage in Negotiations: Tariffs can be used as bargaining chips in trade negotiations.

-

Cons of Tariffs:

- Higher Consumer Prices: Consumers end up paying more for both imported and, potentially, domestic goods (as domestic producers face less competition).

- Reduced Consumer Choice: Fewer affordable imported options might be available.

- Retaliation: Other countries might impose their own tariffs in response, leading to a "trade war" that harms all involved.

- Inefficiency: Protected domestic industries may become less efficient and innovative without the pressure of foreign competition.

- Harm to Export Industries: If other countries retaliate, a nation’s own export industries could suffer.

2. Quotas: The Quantity Limit

Instead of making foreign goods more expensive, a quota directly limits how much of a particular foreign product can enter the country.

-

Definition: A quota is a physical limit on the quantity or value of certain goods that can be imported into a country during a specific period.

-

How They Work:

- The government sets a maximum number or value for imports of a specific product (e.g., only 100,000 foreign cars can be imported per year).

- Once that limit is reached, no more of that product can be imported until the next period.

-

Types of Quotas:

- Absolute Quota: A strict limit that cannot be exceeded.

- Tariff-Rate Quota: A certain quantity of imports is allowed in at a lower (or zero) tariff rate, but any imports above that quantity face a much higher tariff.

-

Pros of Quotas (from a protectionist viewpoint):

- Direct Protection: Quotas offer a more direct and certain way to limit imports compared to tariffs, whose effectiveness depends on how consumers react to price changes.

- Guaranteed Market Share: Domestic producers are guaranteed a certain share of the market that foreign competitors cannot penetrate beyond the quota.

- Less Revenue Loss for Foreign Firms: Unlike tariffs, which collect revenue for the importing government, quotas often mean that the "quota rent" (the extra profit due to scarcity) goes to the foreign firms lucky enough to get quota allocations.

-

Cons of Quotas:

- Higher Consumer Prices: By limiting supply, quotas drive up prices for consumers, even more directly than tariffs.

- Reduced Consumer Choice: Fewer options are available once the quota is met.

- Potential for Smuggling: Strict limits can incentivize illegal trade.

- Bureaucracy and Corruption: Managing quotas can be complex and prone to corruption as firms vie for limited import licenses.

- Lack of Government Revenue: Unlike tariffs, quotas do not directly generate revenue for the government.

3. Subsidies: The Helping Hand

While tariffs and quotas focus on making foreign goods less appealing, subsidies work by making domestic goods more appealing, usually by making them cheaper to produce.

-

Definition: A subsidy is a form of financial aid or support extended by the government to a domestic industry or business. The goal is to reduce production costs, making domestic goods more competitive both at home and abroad.

-

How They Work:

- The government provides money directly to domestic producers, offers tax breaks, low-interest loans, or covers a portion of their production costs (e.g., for research and development, specific raw materials, or export activities).

- This financial assistance allows domestic firms to sell their products at lower prices than they otherwise could, or to invest more in technology and marketing.

-

Types of Subsidies:

- Direct Subsidies: Cash payments to producers (e.g., to farmers for specific crops).

- Indirect Subsidies: Tax breaks, low-interest loans, government-funded research, infrastructure improvements benefiting specific industries, or even export credit guarantees.

-

Pros of Subsidies (from a protectionist viewpoint):

- Boosts Domestic Production and Employment: By lowering costs, subsidies can encourage domestic firms to produce more and hire more workers.

- Enhances Competitiveness: Domestic firms can compete more effectively on price, both in the domestic market and when exporting.

- Promotes Specific Industries: Governments can use subsidies to foster the growth of industries deemed strategically important (e.g., renewable energy, high-tech manufacturing).

- No Direct Price Increase for Consumers: Unlike tariffs and quotas, subsidies don’t directly raise consumer prices for goods.

-

Cons of Subsidies:

- Cost to Taxpayers: Subsidies are paid for by public funds, meaning taxpayers bear the burden.

- Inefficiency and "Moral Hazard": Protected industries might become less efficient, relying on government handouts rather than market innovation. It can also create a "moral hazard" where firms take more risks knowing the government will bail them out.

- Distortion of Trade: Subsidies can give domestic firms an unfair advantage, leading to international disputes and potential retaliation from other countries (who might view them as unfair trade practices).

- Difficulty in Removal: Once an industry becomes reliant on subsidies, it can be politically very difficult to remove them.

The Great Debate: Protectionism vs. Free Trade

The use of protectionist policies is one of the most hotly debated topics in economics.

Arguments for Protectionism often emphasize:

- Protecting domestic jobs and industries.

- Ensuring national security.

- Allowing infant industries to grow.

- Correcting unfair trade practices (like dumping).

Arguments against Protectionism (and for Free Trade) often highlight:

- Lower Consumer Prices: Competition from imports drives down prices for consumers.

- Increased Choice and Quality: Consumers have access to a wider variety of goods and services, often of higher quality due to global competition.

- Greater Efficiency and Innovation: Companies are forced to be more efficient and innovative to compete globally.

- Economic Growth: Specialization and trade allow countries to focus on what they do best, leading to overall economic growth.

- Reduced Risk of Trade Wars: Open trade fosters cooperation and reduces the likelihood of retaliatory measures.

While protectionism might offer short-term benefits to specific industries, economists generally agree that in the long run, it often leads to higher prices for consumers, less innovation, and can spark damaging trade wars that hurt everyone. However, the political appeal of "protecting our own" remains strong in many nations.

Real-World Examples of Protectionism

- Agricultural Subsidies: Many developed countries, including the United States and the European Union, heavily subsidize their farmers. This allows them to sell their produce at lower prices, making it difficult for farmers in developing countries to compete without similar support.

- Steel Tariffs: Governments sometimes impose tariffs on imported steel to protect their domestic steel industries from cheaper foreign alternatives, as seen in recent trade disputes between the US, China, and the EU.

- Textile Quotas: Historically, many developed nations used quotas to limit the import of textiles and apparel from developing countries to protect their own manufacturing sectors. While many of these quotas have been phased out under international agreements, they were a significant feature of global trade for decades.

Conclusion: Understanding the Global Economic Landscape

Protectionism, through its tools like tariffs, quotas, and subsidies, represents a deliberate government intervention in the free flow of international trade. While its proponents argue it’s essential for safeguarding domestic interests, critics point to its potential for higher consumer costs, reduced choice, inefficiency, and the risk of triggering retaliatory trade wars.

Understanding these concepts is crucial for anyone trying to make sense of global economic news, trade negotiations, and the policies that shape our daily lives. Whether a country leans towards protectionism or free trade, its choices have profound impacts on businesses, workers, and consumers worldwide. The ongoing debate about balancing domestic protection with the benefits of open markets continues to be a central challenge in the global economy.

Frequently Asked Questions (FAQs) About Protectionism

Q1: Is protectionism always bad for the economy?

A1: It’s a complex issue. Most economists agree that widespread protectionism generally leads to higher prices, less innovation, and reduced overall economic efficiency in the long run. However, specific, targeted protectionist measures might be argued for in certain situations, like nurturing a vital infant industry or for national security. The consensus is that its costs often outweigh its benefits.

Q2: Who ultimately pays for tariffs and quotas?

A2: While the immediate cost of a tariff is paid by the importer, these costs are almost always passed on to the consumer in the form of higher prices for both imported goods and, often, domestic goods (as domestic producers face less competition and can raise their prices). For quotas, the limited supply directly drives up prices, again impacting consumers.

Q3: What is a "trade war"?

A3: A trade war occurs when one country imposes tariffs or other trade barriers on another, and the second country retaliates with its own barriers. This escalating cycle of protectionism can severely disrupt global supply chains, reduce international trade, and harm economic growth in all involved countries.

Q4: Does the World Trade Organization (WTO) promote protectionism or free trade?

A4: The World Trade Organization (WTO) primarily advocates for and works towards reducing trade barriers and promoting free, fair, and predictable international trade. Its agreements aim to lower tariffs, eliminate quotas, and regulate subsidies to prevent unfair competition. While it allows for some exceptions (like for national security), its overall mission is to foster a more open global trading system.

Q5: Can protectionism help create jobs?

A5: Protectionism can protect jobs in specific domestic industries that face foreign competition. However, this often comes at the cost of job losses in other sectors (e.g., export industries hit by retaliation) or in industries that rely on imported inputs. Overall, the impact on total employment is debated and often found to be negative in the long run due to reduced efficiency and trade.

:max_bytes(150000):strip_icc():gifv()/what-is-trade-protectionism-3305896-v6-3f85cde89bce41fd89f4f31ca713b241.png)

Post Comment