Minimum Wage Laws by State: Your Easy-to-Understand Guide

Ever wondered why your friend in another state earns a different minimum wage than you, even for the same job? You’re not alone! Minimum wage laws in the United States can seem like a confusing patchwork, varying not just from state to state, but sometimes even from city to city.

This comprehensive guide will break down everything you need to know about minimum wage laws across the U.S. in simple terms. We’ll explore the federal standard, dive into how states set their own rates, explain special rules for tipped employees, and help you understand where to find the most accurate information for your specific location.

What Exactly Is Minimum Wage?

At its core, minimum wage is the lowest hourly pay rate that an employer can legally pay their employees. It’s designed to provide a basic income floor for workers, ensuring they earn enough to cover fundamental living expenses.

The idea of a minimum wage has been around for over a century, evolving to address issues of poverty, worker exploitation, and economic fairness. While the concept is simple, its application in the U.S. is anything but uniform.

Federal vs. State Minimum Wage: Who Sets the Rules?

This is where the journey into understanding minimum wage begins. In the U.S., there are two main levels of minimum wage: federal and state.

The Federal Minimum Wage

The Fair Labor Standards Act (FLSA) is a federal law that establishes a nationwide minimum wage. As of the last update, the federal minimum wage is $7.25 per hour.

- When does it apply? This federal rate applies to most employees across the country. It acts as a safety net, meaning no employer covered by the FLSA can pay less than $7.25 per hour.

State Minimum Wage Laws

Many states have decided that the federal minimum wage isn’t enough to meet the cost of living within their borders. As a result, they’ve passed their own laws setting a higher minimum wage.

- The Golden Rule: When both federal and state minimum wage laws apply, employees are entitled to the higher of the two rates.

- For example, if your state’s minimum wage is $12.00 per hour, your employer must pay you at least $12.00, even though the federal rate is $7.25.

- If your state’s minimum wage is $7.00 per hour (lower than the federal rate), your employer must still pay you at least $7.25 per hour because the federal law takes precedence.

Why Do Minimum Wages Vary So Much by State?

The significant differences in minimum wage rates across states are due to a variety of factors:

- Cost of Living: This is perhaps the biggest driver. States with higher costs of living (e.g., California, New York, Massachusetts) tend to have higher minimum wages to help residents afford housing, food, and other necessities. A dollar simply doesn’t go as far in a big city as it does in a rural area.

- Economic Conditions: A state’s overall economic health, including its unemployment rate, industry makeup, and average wages, can influence legislative decisions on minimum wage.

- Political and Social Priorities: Different states have different political climates and social priorities. Some states prioritize business interests and lower labor costs, while others focus more on worker protections and reducing poverty through higher wages.

- Local Control: Some states allow individual cities or counties to set their own minimum wages, which can be even higher than the state minimum. We’ll cover this more below!

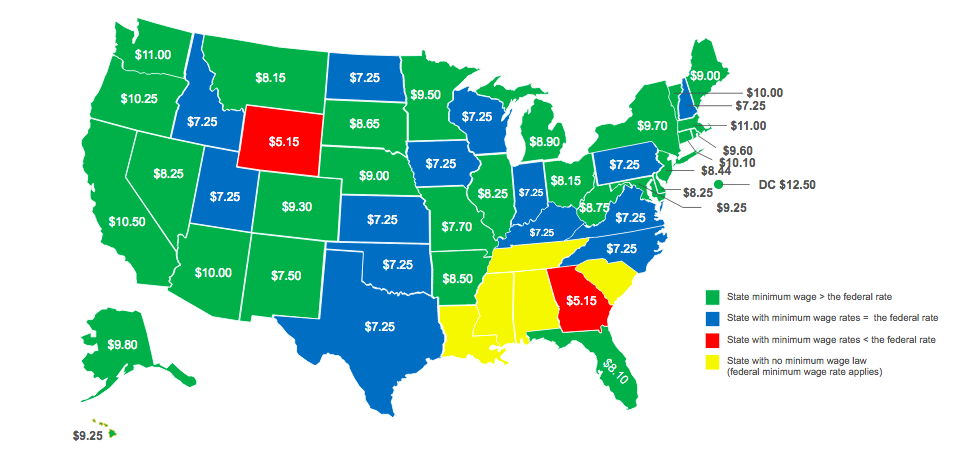

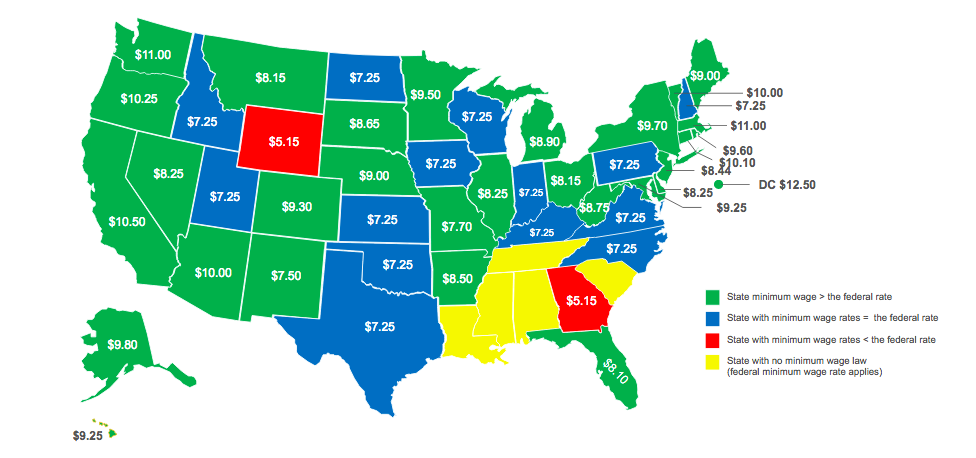

Navigating the State-by-State Landscape

Understanding the exact minimum wage for every state can be tricky because rates change, often annually. However, we can categorize states into general groups to illustrate the different approaches:

1. States with a Minimum Wage Higher Than the Federal Rate

Many states have recognized that $7.25 per hour is insufficient for their residents and have enacted significantly higher minimum wages. These states are often at the forefront of minimum wage increases.

- Examples:

- California: Known for having one of the highest state minimum wages, often adjusted annually.

- New York: Has a complex system with different rates for New York City, Long Island, Westchester, and the rest of the state.

- Washington: Consistently has one of the highest minimum wages in the nation, often indexed to inflation.

- Massachusetts: Another state with a high minimum wage.

- Oregon, Colorado, Arizona, New Jersey, Maine, Vermont, Connecticut, Maryland, Illinois, Michigan, Nevada, Florida, Virginia, Delaware, Rhode Island, New Mexico, Hawaii, Minnesota, Montana, Ohio: All have minimum wages above the federal $7.25, with specific rates and annual adjustment schedules.

2. States That Match the Federal Minimum Wage

A smaller number of states have a state minimum wage rate that is the same as the federal minimum wage ($7.25 per hour). In these states, the federal law primarily dictates the minimum pay.

- Examples:

- Idaho

- Indiana

- Kansas

- Kentucky

- New Hampshire

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- Texas

- Utah

- Wisconsin

- Wyoming

3. States with No State Minimum Wage (or Lower Than Federal)

A few states either have no state minimum wage law or have a minimum wage rate that is lower than the federal rate. In these cases, the federal minimum wage of $7.25 per hour still applies to most workers.

- Examples:

- Alabama: No state minimum wage.

- Louisiana: No state minimum wage.

- Mississippi: No state minimum wage.

- South Carolina: No state minimum wage.

- Tennessee: No state minimum wage.

- Georgia: State minimum wage is $5.15, but the federal $7.25 applies.

- Wyoming: State minimum wage is $5.15, but the federal $7.25 applies.

Important Note: Minimum wage rates are subject to change, often on January 1st of each year, or sometimes on July 1st. Always check the most current information for your specific state and locality.

Special Considerations in Minimum Wage Laws

Beyond the standard hourly rate, there are several nuances that can affect how minimum wage laws apply.

1. Tipped Employees (Servers, Bartenders, etc.)

This is one of the most common areas of confusion. The federal FLSA allows employers to pay a lower direct cash wage to employees who regularly receive tips. This is called a "tip credit."

- Federal Rule: The federal minimum direct cash wage for tipped employees is $2.13 per hour, provided that the employee’s tips, combined with this direct wage, equal at least the full federal minimum wage of $7.25 per hour. If they don’t, the employer must make up the difference.

- State Rules Vary Wildly: Many states have higher direct cash wages for tipped employees, and some even require employers to pay the full state minimum wage before tips.

- Examples of states requiring the full minimum wage for tipped employees (no tip credit): California, Oregon, Washington, Nevada, Montana, Alaska, Minnesota.

- Examples of states with a higher direct cash wage than federal, but still allowing a tip credit: New York, Florida, Texas, Illinois, etc.

It’s crucial for tipped employees to understand their state’s specific rules.

2. Local Minimum Wage Ordinances (City and County Laws)

Even if your state has a minimum wage, your specific city or county might have an even higher one! This often happens in major metropolitan areas with a very high cost of living.

- How it Works: Cities like Seattle, San Francisco, and Flagstaff (AZ) have their own local minimum wage laws that are higher than both the federal and their state’s minimum wage.

- "Preemption" Laws: Some states have passed laws that "preempt" or prevent local governments from setting their own minimum wages. This means that even if a city wants to raise its minimum wage, a state law might forbid it.

3. Exemptions and Special Circumstances

Not everyone is automatically covered by standard minimum wage laws. Some common exemptions include:

- Certain Student Workers: Full-time students in specific programs may be paid a sub-minimum wage.

- Workers with Disabilities: Under certain circumstances, workers with disabilities may be paid a sub-minimum wage with a special certificate.

- Youth Minimum Wage: The FLSA allows employers to pay workers under 20 years old a "youth minimum wage" of $4.25 per hour for their first 90 calendar days of employment. After 90 days or when the employee turns 20 (whichever comes first), they must receive the full minimum wage.

- Trainees/Apprentices: In some cases, specific training programs may have different wage rules.

- Certain Farmworkers: Some agricultural workers may be exempt from federal minimum wage requirements.

- Outside Sales Employees: Typically exempt from minimum wage and overtime rules.

4. Annual Adjustments and Indexing

Many states have laws that automatically increase their minimum wage each year. This is often done in one of two ways:

- Indexing to Inflation: The wage is tied to the Consumer Price Index (CPI) or another measure of inflation, meaning it goes up as the cost of living rises.

- Scheduled Increases: The state law outlines specific annual increases for several years into the future until it reaches a certain target.

How to Find Your State’s (and City’s) Current Minimum Wage

Given how often rates change and the complexities of local laws, it’s essential to find the most up-to-date and accurate information for your specific location.

Here are the best resources:

- Your State’s Department of Labor Website: This is the most reliable source. Every state has a Department of Labor (or similar agency) that publishes official minimum wage information. A quick search for "[Your State Name] Department of Labor Minimum Wage" will usually get you there.

- U.S. Department of Labor (DOL): The federal DOL website provides a wealth of information, including links to state labor departments and general overviews of federal laws.

- Local City or County Websites: If you live in a major city or county, check their official government website for any local minimum wage ordinances that might apply.

- Employer Information: Your employer should be able to provide you with information about the minimum wage applicable to your job.

The Impact of Minimum Wage Laws

Minimum wage laws are a topic of ongoing debate, with passionate arguments from various perspectives.

Arguments for Higher Minimum Wage:

- Poverty Reduction: Helps lift workers out of poverty and reduces income inequality.

- Increased Consumer Spending: Low-wage workers are more likely to spend any extra income, boosting local economies.

- Improved Worker Morale and Productivity: Fairer wages can lead to happier, more motivated employees, reducing turnover.

- Economic Stimulus: Puts more money into the hands of those who need it most, stimulating demand.

Arguments Against Higher Minimum Wage (or for keeping it low):

- Job Losses: Businesses, especially small ones, may reduce staff or slow hiring to offset increased labor costs.

- Increased Prices (Inflation): Businesses might pass increased labor costs onto consumers through higher prices for goods and services.

- Reduced Competitiveness: Companies in states with higher minimum wages might be at a disadvantage compared to those in states with lower wages.

- Impact on Small Businesses: Small businesses often operate on tighter margins and may struggle more than large corporations to absorb wage increases.

Frequently Asked Questions (FAQs) About Minimum Wage

Q1: What if my state doesn’t have a minimum wage, or it’s lower than the federal rate?

A1: In these cases, the federal minimum wage of $7.25 per hour still applies to most workers. Employers must pay the higher of the two rates.

Q2: Can my city or county pay more than my state’s minimum wage?

A2: Yes, if your state allows it (meaning there’s no "preemption" law). Many major cities have higher minimum wages than their surrounding states. Always check local ordinances.

Q3: Does minimum wage apply to everyone?

A3: No, there are some exemptions, such as certain student workers, workers with disabilities, and specific types of employees (e.g., some outside sales employees). Always verify if an exemption applies to your specific situation.

Q4: Is the minimum wage enough to live on?

A4: This is a complex question. While minimum wage provides a basic floor, for many individuals and families, especially in high-cost-of-living areas, it is often not enough to cover all essential expenses. This is why the concept of a "living wage" (the income needed to meet basic needs in a specific area) is often discussed as a separate measure.

Q5: How often does the minimum wage change?

A5: The federal minimum wage changes infrequently (it hasn’t changed since 2009). However, many state and local minimum wages are adjusted annually, often on January 1st, due to scheduled increases or indexing to inflation.

Conclusion

Understanding minimum wage laws is crucial for both employees and employers. While the federal minimum wage provides a baseline, the real story lies in the diverse landscape of state and local laws. These varying rates reflect different economic realities and policy choices across the country.

Always remember the "golden rule": you are entitled to the highest applicable minimum wage, whether it’s federal, state, or local. By staying informed and knowing where to find accurate information, you can ensure you’re paid fairly according to the law.

Post Comment