Mastering Your Money: Understanding Break-Even Analysis for Small Businesses (A Beginner’s Guide)

Starting and growing a small business is an exciting journey, but it’s also one filled with critical financial decisions. One of the most fundamental yet powerful tools at your disposal is Break-Even Analysis. If terms like "fixed costs" and "variable costs" make your head spin, don’t worry! This comprehensive guide will demystify break-even analysis, showing you exactly what it is, why it’s crucial for your small business, and how you can use it to make smarter, more profitable choices.

By the end of this article, you’ll feel confident in calculating your own break-even point and leveraging this knowledge to steer your business towards success.

What Exactly is Break-Even Analysis? The "No Profit, No Loss" Point

Imagine a tightrope walker. To stay balanced, they need to find that perfect middle ground where they neither fall left nor right. In business, the "break-even point" is that perfect middle ground.

In simple terms, Break-Even Analysis is a financial calculation that tells you the point at which your total revenue (money coming in) exactly equals your total costs (money going out). At this point, your business is neither making a profit nor incurring a loss. It’s the moment your business starts to "pay for itself."

Think of it as the minimum sales volume – whether in units sold or total revenue generated – you need to achieve just to cover all your expenses. Anything you sell above this point is pure profit (before taxes, of course!).

Why is Break-Even Analysis Crucial for Small Businesses?

You might be thinking, "Do I really need another financial thing to worry about?" The answer is a resounding YES! For small business owners, understanding your break-even point isn’t just good practice; it’s absolutely vital for:

- 1. Smart Pricing Decisions: Knowing your break-even point helps you set prices that not only attract customers but also ensure you cover your costs and make a profit. Without this, you might price too low and lose money, or too high and lose customers.

- 2. Realistic Sales Targets: Instead of guessing, you’ll know exactly how many units or how much revenue you must generate just to stay afloat. This empowers you to set achievable and meaningful sales goals for your team (or yourself!).

- 3. Effective Cost Control: By breaking down your costs, you gain a clearer picture of where your money is going. This can highlight areas where you might be able to cut expenses without sacrificing quality.

- 4. Business Planning & Forecasting: Whether you’re writing a business plan for a loan, planning for expansion, or simply looking ahead, break-even analysis provides a solid foundation for financial forecasts and strategic decisions.

- 5. Risk Assessment: Understanding your break-even point allows you to assess the financial risk associated with a new product, a price change, or an investment. You’ll know how much "wiggle room" you have.

- 6. Investor Confidence: If you’re seeking funding, investors and lenders will want to see that you understand your business’s financial viability. A well-calculated break-even analysis demonstrates your financial literacy and preparedness.

- 7. "What If" Scenarios: You can easily calculate how changes in costs (e.g., rent increase) or prices (e.g., a sale) would affect your break-even point, helping you plan for different market conditions.

The Key Components: Building Blocks of Your Break-Even Point

Before we jump into the formula, let’s understand the essential ingredients. Don’t worry, these are simpler than they sound!

1. Fixed Costs (FC)

These are expenses that do not change regardless of how many units you produce or sell. They are constant, whether you sell one item or a thousand. Think of them as the "overhead" costs of just keeping your business open.

Examples of Fixed Costs:

- Rent or mortgage payments for your office/storefront

- Salaries of administrative staff (not directly involved in production)

- Insurance premiums

- Loan payments

- Depreciation of equipment

- Utilities (often a mix, but a base amount can be fixed)

- Software subscriptions (e.g., accounting software)

2. Variable Costs (VC)

These are expenses that change directly in proportion to the number of units you produce or sell. The more you produce, the higher your total variable costs will be.

Examples of Variable Costs (per unit):

- Raw materials for your product (e.g., flour for a bakery, fabric for a clothing line)

- Direct labor costs (e.g., hourly wages for production workers)

- Packaging costs

- Shipping costs for each item sold

- Sales commissions

- Transaction fees for online sales

3. Selling Price Per Unit (SP)

This is simply the price at which you sell one single unit of your product or service to a customer.

Example: If you sell handmade candles for $25 each, your Selling Price Per Unit is $25.

4. Contribution Margin Per Unit (CM)

This is a super important concept for break-even analysis! The Contribution Margin Per Unit is the amount of money left from each sale after covering its specific variable costs. This "leftover" money then "contributes" towards covering your fixed costs.

Formula for Contribution Margin Per Unit:

Contribution Margin Per Unit = Selling Price Per Unit – Variable Cost Per Unit

Example: If your candle sells for $25 (SP) and the wax, wick, and label (VC) cost $5, then your Contribution Margin Per Unit is $25 – $5 = $20. This means every candle you sell provides $20 to help pay for your rent, salaries, etc.

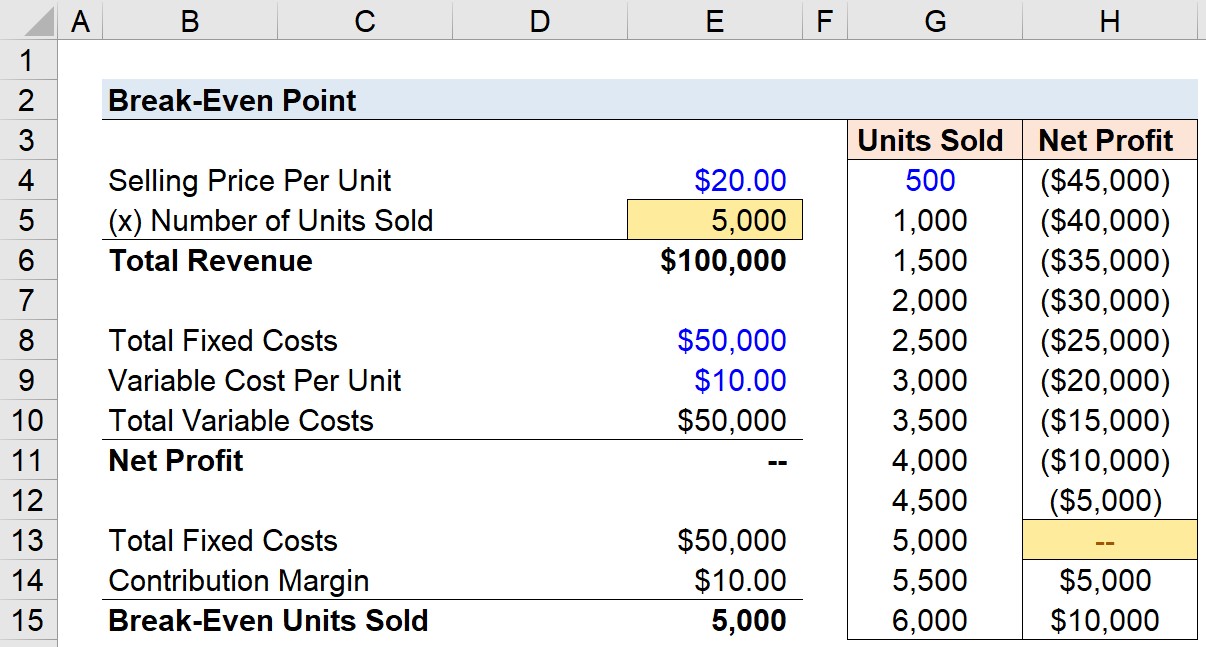

The Break-Even Formula Made Simple

Now that we understand the building blocks, let’s put them together! The break-even point can be calculated in two main ways: in units (how many items you need to sell) or in sales revenue (how much money you need to make).

1. Break-Even Point in Units

This tells you the exact number of products or services you need to sell to cover all your costs.

Formula:

Break-Even Point (Units) = Total Fixed Costs / (Selling Price Per Unit – Variable Cost Per Unit)

Remember: (Selling Price Per Unit – Variable Cost Per Unit) is your Contribution Margin Per Unit!

So, it can also be written as:

Break-Even Point (Units) = Total Fixed Costs / Contribution Margin Per Unit

2. Break-Even Point in Sales Revenue

This tells you the total dollar amount of sales you need to generate to cover all your costs.

Formula:

Break-Even Point (Sales Revenue) = Total Fixed Costs / ((Selling Price Per Unit – Variable Cost Per Unit) / Selling Price Per Unit)

The part in the double parentheses is called the "Contribution Margin Ratio." It tells you what percentage of each sales dollar is available to cover fixed costs.

So, it can also be written as:

Break-Even Point (Sales Revenue) = Total Fixed Costs / Contribution Margin Ratio

Let’s Do the Math: A Step-by-Step Example

Meet Sarah. She owns a small business called "Cozy Glow Candles," selling handmade scented candles online. Let’s help Sarah find her break-even point.

Sarah’s Monthly Costs and Prices:

-

Fixed Costs (FC):

- Website hosting & e-commerce platform: $50

- Marketing software subscription: $30

- Rent for small workshop space: $300

- Business insurance: $20

- Total Fixed Costs = $50 + $30 + $300 + $20 = $400 per month

-

Variable Costs (VC) per Candle:

- Wax, wick, fragrance oil: $3.00

- Jar and lid: $1.50

- Label and packaging: $0.50

- Total Variable Cost Per Unit = $3.00 + $1.50 + $0.50 = $5.00 per candle

-

Selling Price Per Unit (SP):

- Sarah sells each candle for $20.00

Step 1: Calculate Contribution Margin Per Unit

Contribution Margin Per Unit = Selling Price Per Unit – Variable Cost Per Unit

Contribution Margin Per Unit = $20.00 – $5.00 = $15.00

This means for every candle Sarah sells, $15 is available to cover her fixed costs.

Step 2: Calculate Break-Even Point in Units

Break-Even Point (Units) = Total Fixed Costs / Contribution Margin Per Unit

Break-Even Point (Units) = $400 / $15.00 = 26.67 units

Since Sarah can’t sell 0.67 of a candle, she needs to sell 27 candles to break even. If she sells 26, she’ll still be at a small loss.

Step 3: Calculate Break-Even Point in Sales Revenue

First, let’s find the Contribution Margin Ratio:

Contribution Margin Ratio = Contribution Margin Per Unit / Selling Price Per Unit

Contribution Margin Ratio = $15.00 / $20.00 = 0.75 or 75%

This means 75% of every sales dollar Sarah earns contributes to covering her fixed costs.

Now, calculate Break-Even Point in Sales Revenue:

Break-Even Point (Sales Revenue) = Total Fixed Costs / Contribution Margin Ratio

Break-Even Point (Sales Revenue) = $400 / 0.75 = $533.33

So, Sarah needs to generate $533.33 in sales revenue to cover all her monthly costs.

Putting it to the Test:

If Sarah sells 27 candles at $20 each:

Total Revenue = 27 candles $20/candle = $540

Total Variable Costs = 27 candles $5/candle = $135

Total Costs = Fixed Costs + Total Variable Costs = $400 + $135 = $535

Profit = Total Revenue – Total Costs = $540 – $535 = $5

(The slight difference is due to rounding up from 26.67 to 27 units. At exactly 26.67 units, she’d be at zero profit/loss.)

This small profit shows that by selling 27 candles, Sarah has successfully covered all her expenses and is now operating in the profit zone!

Beyond the Numbers: How to Use Your Break-Even Point

Calculating your break-even point is just the first step. The real power comes from using this information to make informed business decisions.

1. Optimize Your Pricing Strategy

- Too High: If your break-even point is too high given your current price, you might need to reconsider your pricing. Can you justify a higher price to customers?

- Too Low: If your break-even point is easily achievable but your profit margins are thin, raising your price slightly could significantly increase your profitability.

- Competitor Analysis: Compare your break-even point with competitors’ pricing. Are you competitive while still covering your costs?

2. Implement Effective Cost Control

- Target Fixed Costs: If your fixed costs are making your break-even point too high, explore ways to reduce them. Can you negotiate rent, switch to cheaper software, or find more affordable insurance?

- Negotiate Variable Costs: Can you get a better deal on raw materials by buying in bulk, or find a more cost-effective supplier? Even small reductions in variable costs per unit can have a big impact on your overall profitability.

3. Set Realistic Sales Targets

- Minimum Goal: Your break-even point is your absolute minimum sales target. Share this with your sales team so everyone understands the baseline.

- Profit Goals: Once you know your break-even, you can set clear profit targets. For example, "We need to sell 27 units to break even, but we want to sell 50 units to achieve a profit of X dollars."

4. Evaluate New Products or Services

- Before launching a new offering, calculate its separate break-even point. This will help you decide if it’s a viable addition to your business and what sales volume it needs to achieve to be successful.

5. Plan for Growth and Expansion

- If you’re considering expanding (e.g., opening a new location, hiring more staff), calculate how these increased fixed costs will affect your new break-even point. Can you realistically achieve the higher sales volume needed?

6. Assess Risk and Make Strategic Decisions

- If a supplier raises prices, or if you plan a marketing campaign that increases fixed costs, use break-even analysis to see the impact. This allows you to plan counter-measures or adjust your strategy proactively.

Common Mistakes to Avoid When Using Break-Even Analysis

While powerful, break-even analysis isn’t a magic bullet. Be aware of these common pitfalls:

- 1. Inaccurate Data: Garbage in, garbage out! Ensure your cost data (fixed and variable) and selling prices are as accurate as possible. Don’t guess.

- 2. Ignoring Changes: Your costs and prices aren’t static. Review and recalculate your break-even point regularly (monthly, quarterly, or whenever significant changes occur).

- 3. Overlooking Other Factors: Break-even analysis focuses purely on costs and sales volume. It doesn’t account for market demand, competition, economic conditions, or marketing efforts. It’s one tool among many.

- 4. Treating All Costs as Purely Fixed or Variable: In reality, some costs are "semi-variable" (e.g., electricity might have a fixed base charge plus a variable usage charge). For simplicity, you often categorize them as primarily one or the other, but be aware of this nuance.

- 5. One-Time Calculation: Don’t calculate it once and forget it. Your business environment is dynamic, and your break-even point will shift.

Practical Tips for Small Business Owners

- Start Simple: Don’t get overwhelmed by perfect accuracy initially. Get a good estimate of your costs to begin. You can refine it later.

- Categorize Carefully: Take the time to accurately separate your fixed and variable costs. This is the most crucial step.

- Use Spreadsheets: Excel or Google Sheets are your best friends here. Create a simple template to plug in your numbers and see the results instantly.

- Focus on Contribution: Always think about the Contribution Margin Per Unit. It’s the engine that drives your business towards profitability after covering fixed costs.

- Seek Advice: If you’re struggling, don’t hesitate to consult with an accountant, a business advisor, or use online resources and tools.

- Don’t Just Break Even, Aim for Profit! Your break-even point is the floor, not the ceiling. Once you know it, you can strategize how to sell well above it to achieve your profit goals.

Conclusion: Empower Your Business with Break-Even Knowledge

Understanding and regularly calculating your break-even point is an indispensable skill for any small business owner. It transforms uncertainty into clarity, allowing you to make proactive, data-driven decisions about pricing, cost management, and sales targets.

By knowing precisely how many sales you need to cover your expenses, you gain a powerful sense of control over your financial destiny. So, take the time, gather your numbers, and calculate your break-even point today. It’s the first crucial step on your journey from just surviving to truly thriving!

Post Comment