Mastering Your Money: A Beginner’s Guide to Forecasting Revenue and Expenses

Ever feel like running a business or managing your personal finances is a bit like sailing without a map? You’re moving forward, but you’re not quite sure where you’ll land or if you’ll hit a storm. That’s where financial forecasting comes in!

Forecasting revenue and expenses isn’t just for big corporations; it’s a vital tool for anyone wanting to make smart financial decisions, whether you’re a small business owner, a freelancer, or just managing your household budget. In simple terms, it’s about making educated guesses about your future income and costs.

This comprehensive guide will break down financial forecasting into easy-to-understand steps, helping you navigate your financial future with confidence.

What Exactly is Financial Forecasting?

At its core, financial forecasting is the process of estimating your future financial performance. It’s about predicting how much money you expect to make (revenue) and how much you expect to spend (expenses) over a specific period, such as the next quarter, year, or even five years.

Think of it as your financial crystal ball, but instead of magic, it uses data, trends, and informed assumptions to give you a clearer picture of what lies ahead.

Why Is Forecasting Revenue and Expenses So Important?

You might be thinking, "Why bother? I’ll just deal with money as it comes in and goes out." But that approach leaves you vulnerable and reactive. Here’s why proactive financial forecasting is a game-changer:

- 1. Make Smarter Decisions:

- Resource Allocation: Knowing your future cash flow helps you decide where to invest. Should you hire more staff? Launch a new product? Upgrade equipment? Forecasting provides the data for these choices.

- Pricing Strategies: Understand how changes in your pricing will impact your overall revenue.

- 2. Spot Risks Early (and Opportunities!):

- Cash Flow Gaps: Identify potential periods where you might spend more than you earn, allowing you to plan for a line of credit or save up.

- Growth Potential: See where you have room to grow and seize opportunities for expansion or new ventures.

- 3. Set Realistic Goals:

- Achievable Targets: Instead of pulling numbers out of thin air, forecasting helps you set sales targets, expense budgets, and profit goals that are grounded in reality.

- Performance Measurement: Once you have a forecast, you can compare your actual results to your predictions, helping you understand what’s working and what’s not.

- 4. Secure Funding:

- Investor Confidence: Lenders and investors want to see a clear financial roadmap. A well-researched forecast demonstrates your understanding of your business and its potential.

- Loan Applications: Banks require financial projections to assess your ability to repay loans.

- 5. Strategic Planning:

- Long-Term Vision: Forecasting helps you visualize your financial future, enabling you to build long-term strategies for growth, stability, and sustainability.

- Budget Creation: Your forecasts become the foundation for creating realistic and effective budgets.

Forecasting Revenue: Predicting Your Income

Revenue forecasting is all about estimating the money you expect to bring in from your sales, services, or other income streams. It’s often the trickier part, as it depends on external factors like market demand and customer behavior.

Key Methods for Revenue Forecasting:

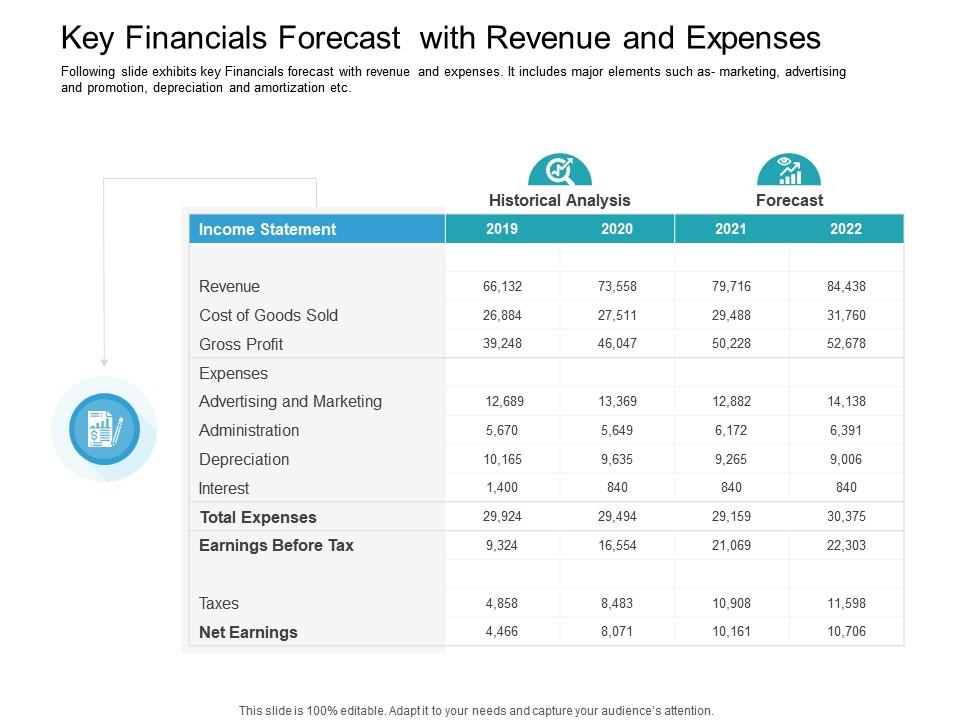

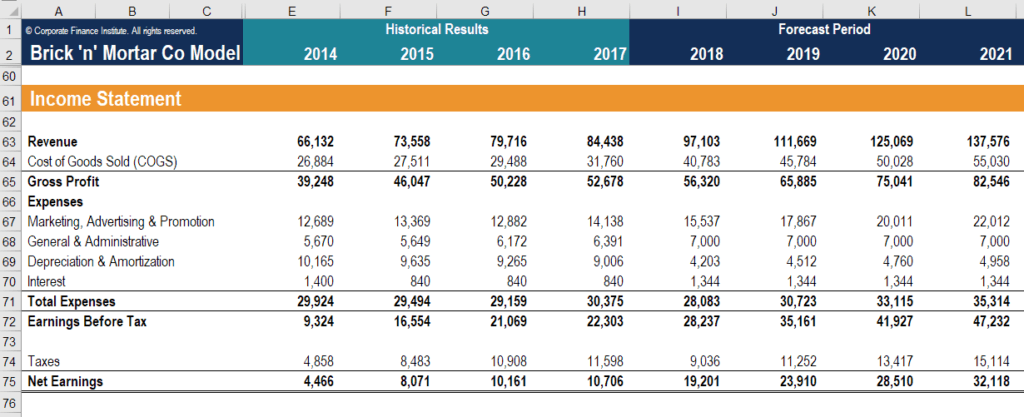

- Historical Data Analysis (Trend Analysis):

- How it works: Look at your past sales figures. Have they been steadily growing? Are there seasonal peaks and valleys? This is the simplest and often most reliable method for established businesses.

- Example: If your online store consistently saw a 10% increase in sales each quarter over the last two years, you might project a similar growth rate for the next quarter. Don’t forget to adjust for seasonality (e.g., higher sales during holidays).

- Sales Pipeline Analysis:

- How it works: If you have a sales team that tracks potential deals (leads, prospects, closed deals), you can use this data. Assign probabilities to each stage of the sales process.

- Example: You have 10 potential deals, each worth $1,000. If 50% of deals typically close, you might forecast $5,000 from these specific opportunities.

- Market Research & Economic Indicators:

- How it works: Look at broader economic trends (e.g., GDP growth, consumer spending habits, interest rates) and industry-specific research. How is your target market growing or shrinking? What are your competitors doing?

- Example: If a major industry report predicts a 5% decline in your sector next year, you might adjust your revenue forecast downwards, even if your historical data was positive.

- Customer Surveys & Feedback:

- How it works: Directly ask your customers about their future purchasing intentions. While not always perfectly accurate, it can provide valuable insights.

- Expert Opinion:

- How it works: Consult with sales managers, industry experts, or consultants who have deep knowledge of your market.

Tips for Revenue Forecasting:

- Be Realistic, Not Optimistic: It’s easy to get excited about potential sales, but it’s safer to err on the side of caution.

- Consider Seasonality: If your business has busy and slow periods (e.g., retail during holidays, landscaping in summer), factor these into your monthly or quarterly projections.

- Account for External Factors: Economic downturns, new competitors, changes in consumer trends, or even global events can all impact your sales.

- Break It Down: Instead of one big revenue number, forecast by product line, service, or customer segment. This makes it more manageable and accurate.

Forecasting Expenses: Predicting Your Outflow

Expense forecasting is about estimating how much money you expect to spend. This is often more straightforward than revenue, as many costs are predictable. However, it’s crucial to be thorough so you don’t miss anything!

Key Categories of Expenses:

- Fixed Costs:

- These costs generally stay the same, regardless of how much you sell or produce.

- Examples: Rent, insurance premiums, salaries (for administrative staff), software subscriptions, loan payments.

- Variable Costs:

- These costs change in direct proportion to your sales or production volume.

- Examples: Cost of Goods Sold (COGS – materials, labor for products), shipping costs, sales commissions, utility bills (if they fluctuate with usage), marketing expenses per sale.

- Semi-Variable Costs:

- These have both a fixed and a variable component.

- Example: A phone bill might have a fixed monthly charge plus a variable charge per minute used.

- One-Time or Project-Based Costs:

- These are expenses for specific projects or infrequent purchases.

- Examples: Website redesign, new equipment purchase, major renovation, legal fees for a specific case.

Key Methods for Expense Forecasting:

- Historical Data Analysis:

- How it works: Look at your past spending. What were your average utility bills? How much did you spend on marketing last quarter?

- Example: If your electricity bill averages $200/month, you’d project that for the future, perhaps adjusting slightly for expected changes in usage or rates.

- Vendor Quotes & Contracts:

- How it works: For services or supplies you use regularly, get quotes from suppliers or check existing contracts.

- Example: If your software subscription is $50/month, that’s a clear fixed expense.

- Future Plans & Growth:

- How it works: If you plan to expand, hire new staff, or launch a new product, these decisions will directly impact your expenses.

- Example: Planning to hire two new employees? Factor in their salaries, benefits, and related payroll taxes.

- Industry Benchmarks:

- How it works: See what similar businesses in your industry spend on certain categories. This is especially useful for new businesses.

Tips for Expense Forecasting:

- Don’t Forget the Small Stuff: Lots of small expenses can add up quickly (e.g., office supplies, bank fees, software licenses).

- Plan for Contingencies: Always build in a buffer for unexpected costs. A good rule of thumb is 5-10% of your total expenses.

- Separate Fixed from Variable: This is crucial for understanding your break-even point (the sales volume needed to cover all costs).

- Review and Update Regularly: Prices change, contracts expire, and new needs arise. Your expense forecast should be a living document.

The Forecasting Process: A Step-by-Step Guide for Beginners

Ready to start forecasting? Here’s a simple process to follow:

Step 1: Gather Your Data

- Past Financial Records: Income statements, balance sheets, cash flow statements, sales reports, bank statements, and credit card statements from previous months or years.

- Business Plans & Goals: What are your strategic objectives for the next period?

- Market Information: Industry trends, economic forecasts, competitor analysis.

- Operational Plans: Hiring plans, new product launches, marketing campaigns.

Step 2: Choose Your Timeframe

- Short-Term: Monthly or quarterly forecasts (e.g., for the next 3-12 months) are great for managing cash flow and making immediate operational decisions.

- Long-Term: Annual or multi-year forecasts (e.g., 3-5 years) are useful for strategic planning, investment decisions, and securing funding.

- Recommendation for Beginners: Start with a monthly forecast for the next 6-12 months.

Step 3: Select Your Forecasting Methods

- Based on your data availability and business type, choose the methods discussed above (e.g., historical data for established businesses, market research for startups).

- Often, a combination of methods yields the most accurate results.

Step 4: Make Assumptions (and Write Them Down!)

- This is crucial! Every forecast relies on assumptions. Be clear about them.

- Examples of Assumptions:

- "Sales will grow by 5% per month."

- "We will hire 2 new employees in Q3."

- "Raw material costs will remain stable."

- "Marketing spend will be 10% of revenue."

- Why document them? If your forecast is off, you can review your assumptions to see what changed or what was incorrect.

Step 5: Create Your Forecast

- Use a Spreadsheet: Excel or Google Sheets are your best friends here. Create separate tabs or sections for revenue and expenses.

- Start with Revenue: Project your income month-by-month.

- Then Expenses: Project your fixed and variable costs month-by-month.

- Calculate Profit/Loss: Subtract total expenses from total revenue to see your projected profit or loss for each period.

- Project Cash Flow: This is different from profit! It shows the actual money coming in and going out of your bank account. Make sure to account for when money is received and paid, not just when it’s earned or incurred.

Step 6: Create Multiple Scenarios (Good, Bad, & Most Likely)

- Best-Case Scenario: What if everything goes perfectly? Higher sales, lower costs.

- Worst-Case Scenario: What if things go wrong? Lower sales, unexpected costs. This helps you plan for tough times.

- Most Likely Scenario: Your most realistic and probable outcome.

- This prepares you for various possibilities and helps manage risk.

Step 7: Review and Adjust Regularly

- This is not a one-and-done task! Your forecast is a living document.

- Monthly Review: At the end of each month, compare your actual results to your forecast.

- Identify Variances: Where were you accurate? Where were you off?

- Learn and Adapt: Use these insights to refine your assumptions and improve the accuracy of future forecasts. Markets change, customer behavior shifts, and new opportunities or challenges arise.

Common Challenges in Financial Forecasting (and How to Overcome Them)

Even with the best intentions, forecasting can be tricky. Here are some common hurdles and solutions:

- 1. Lack of Historical Data (Especially for New Businesses):

- Solution: Rely more heavily on market research, industry benchmarks, competitor analysis, and expert opinions. Start tracking everything from day one so you build your own data.

- 2. Unexpected Events & Market Volatility:

- Solution: Embrace scenario planning (best, worst, most likely). Build in contingency funds. Stay agile and be prepared to adjust your forecast quickly.

- 3. Over-Optimism or Pessimism:

- Solution: Base your forecasts on data and realistic assumptions, not just hopes or fears. Get input from others to balance your perspective.

- 4. Forgetting Small Expenses:

- Solution: Be meticulously thorough when listing expenses. Review past bank statements line by line to ensure nothing is missed. Categorize expenses to make them easier to track.

- 5. Not Reviewing & Adjusting:

- Solution: Schedule regular forecast reviews. Make it a non-negotiable part of your monthly or quarterly financial routine.

Tools and Resources for Financial Forecasting

You don’t need expensive software to get started.

- 1. Spreadsheets (Excel, Google Sheets):

- Best for Beginners: Powerful, flexible, and free (Google Sheets). You can create custom templates tailored to your specific needs. There are many free templates available online.

- 2. Accounting Software (QuickBooks, Xero, FreshBooks):

- While primarily for bookkeeping, many of these platforms offer basic reporting features that can help you pull historical data and sometimes even generate simple forecasts.

- 3. Specialized Forecasting Software:

- As your business grows, you might explore dedicated financial planning and analysis (FP&A) software, but this is usually for more advanced users.

Conclusion: Your Financial Map to Success

Forecasting revenue and expenses might seem daunting at first, but it’s one of the most empowering financial exercises you can undertake. It transforms your financial journey from a blind stumble into a strategic voyage.

By consistently predicting your income and outflow, you’ll gain:

- Clarity: A clear picture of your financial future.

- Control: The ability to make informed decisions and steer your finances.

- Confidence: Knowing you’re prepared for what’s ahead.

Start small, stay consistent, and remember that even an imperfect forecast is far better than no forecast at all. Embrace the process, learn from your predictions, and watch your financial management skills – and your financial health – flourish!

Post Comment