Mastering Portfolio Resilience: Your Essential Guide to Diversification Strategies

In the exciting yet often unpredictable world of investing, there’s one golden rule whispered by seasoned professionals and financial advisors alike: diversify. It’s not just a buzzword; it’s a fundamental principle for building a robust and resilient investment portfolio.

Imagine putting all your life savings into a single company’s stock. If that company thrives, you’re in luck! But what if it falters, faces a scandal, or a new competitor emerges? Your entire investment could be at risk. This is precisely why diversification is so crucial – it’s your strategic shield against the inevitable ups and downs of the market.

This comprehensive guide will demystify diversification, explaining what it is, why it’s incredibly important for your financial well-being, and practical strategies you can use to build a well-diversified portfolio, even if you’re just starting your investment journey.

What Exactly Is Diversification in Investing?

At its core, diversification is the strategy of spreading your investments across various assets, industries, and geographies to reduce overall risk. Think of it like this:

The "Don’t Put All Your Eggs in One Basket" Analogy:

If you carry all your eggs in a single basket and you trip, all your eggs will break. But if you divide those eggs into several baskets, and you trip with one, you’ll still have plenty of eggs left in the others.

In the investment world, your "eggs" are your money, and the "baskets" are different types of investments. By not putting all your money into one single investment, you minimize the potential impact of any single investment performing poorly.

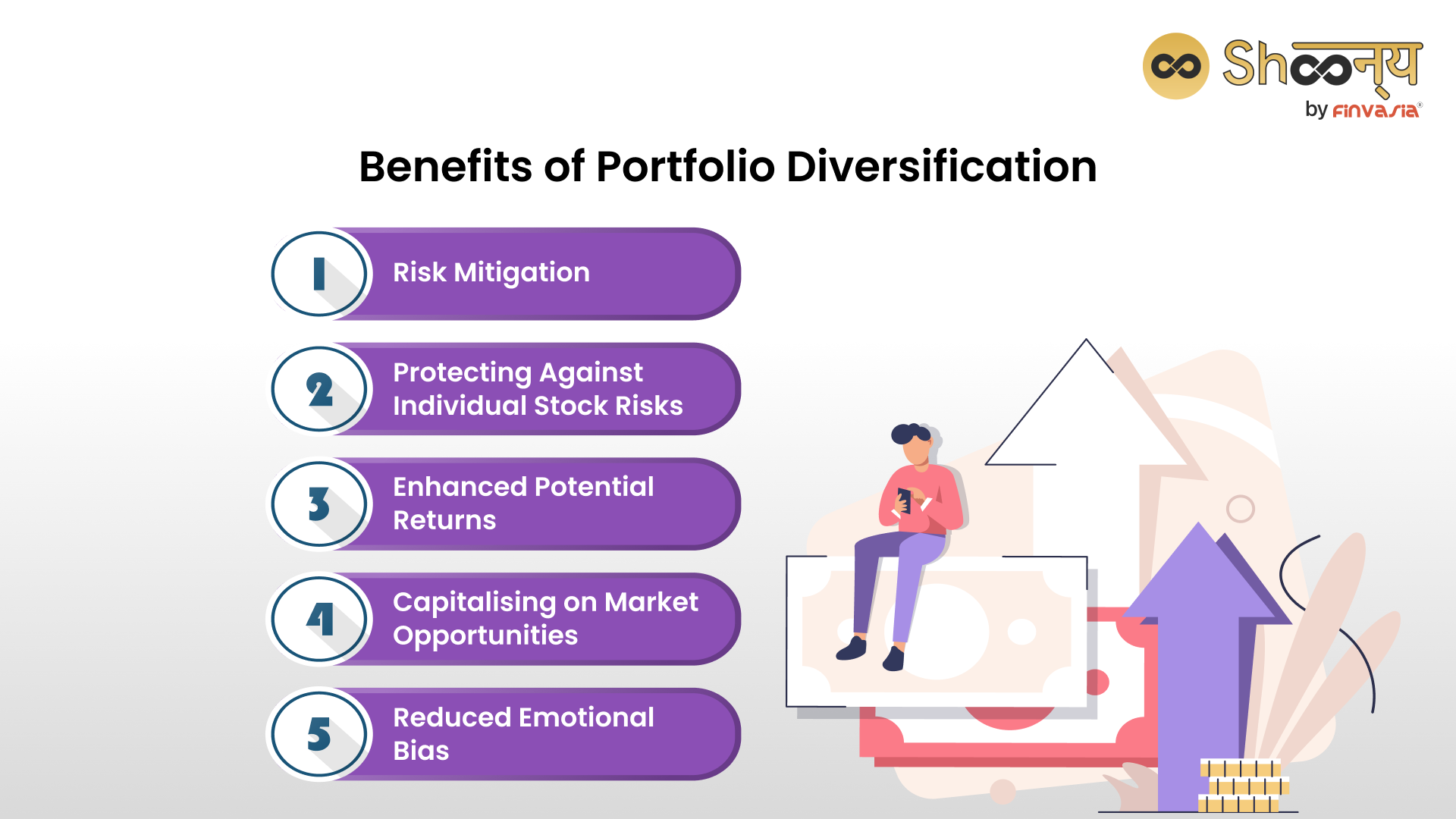

Why Is Diversification So Important for Your Portfolio?

Diversification isn’t just about playing it safe; it’s about smart, long-term wealth building. Here’s why it’s a cornerstone of successful investing:

- 1. Risk Reduction: This is the primary benefit. Different assets react differently to market conditions. When one type of investment is performing poorly (e.g., stocks during a recession), another might be holding steady or even increasing in value (e.g., bonds). This helps cushion the blow and smooth out your overall portfolio returns.

- 2. Smoother Returns: While diversification won’t guarantee profits or eliminate all risk, it can help reduce extreme swings in your portfolio’s value. This means less anxiety for you and a more predictable path towards your financial goals.

- 3. Protection Against Market Volatility: Markets are inherently unpredictable. Wars, pandemics, economic downturns, technological shifts – all can cause market volatility. A diversified portfolio is better equipped to weather these storms because not all your investments will be equally affected.

- 4. Capturing Opportunities: By investing across various sectors and regions, you increase your chances of being invested in the "next big thing," even if you don’t know what it will be. You’re not putting all your hopes on a single growth story.

- 5. Peace of Mind: Knowing your money isn’t entirely dependent on the performance of one company or one industry can significantly reduce investment-related stress.

Key Diversification Strategies for Your Portfolio

Now that you understand the "what" and "why," let’s dive into the "how." Diversification isn’t a one-size-fits-all approach; it involves multiple layers.

1. Diversifying Across Asset Classes

This is the most fundamental level of diversification. An asset class is a group of investments that behave similarly in the market. The most common asset classes are:

- Stocks (Equities):

- What they are: Represent ownership in a company.

- Role in portfolio: Offer potential for high growth over the long term.

- Risk: Higher volatility; can experience significant price swings.

- Example: Owning shares of Apple, Google, or a broad market index fund (like the S&P 500).

- Bonds (Fixed Income):

- What they are: Essentially loans made to governments or corporations. They pay you interest over a set period and return your principal at maturity.

- Role in portfolio: Provide stability, regular income, and often perform well when stocks are struggling.

- Risk: Lower potential returns than stocks; sensitive to interest rate changes.

- Example: U.S. Treasury bonds, corporate bonds, municipal bonds.

- Cash and Cash Equivalents:

- What they are: Highly liquid (easily convertible to cash) investments like savings accounts, money market accounts, or short-term CDs.

- Role in portfolio: Provide safety, liquidity for emergencies, and a place to park funds while waiting for investment opportunities.

- Risk: Very low risk, but also very low returns, often not keeping pace with inflation.

- Real Estate:

- What it is: Tangible property like homes, apartments, or commercial buildings. Can be owned directly or through Real Estate Investment Trusts (REITs).

- Role in portfolio: Can offer income (rent), potential for appreciation, and often acts as a hedge against inflation.

- Risk: Less liquid than stocks/bonds; property values can fluctuate; maintenance costs.

- Commodities:

- What they are: Raw materials like gold, silver, oil, natural gas, or agricultural products.

- Role in portfolio: Can act as an inflation hedge and perform well during specific economic cycles. Gold, in particular, is often seen as a "safe haven" during times of uncertainty.

- Risk: Volatile prices; can be influenced by global supply and demand.

The Strategy: The key is to combine these asset classes in a way that aligns with your risk tolerance (how much risk you’re comfortable taking) and your financial goals (when you need the money). A younger investor with a long time horizon might have more stocks, while someone nearing retirement might favor more bonds.

2. Diversifying Within Asset Classes

Once you’ve decided on your mix of stocks, bonds, etc., you need to diversify within each of those categories.

- Industry/Sector Diversification:

- What it means: Don’t put all your stock investments into just one industry (e.g., only tech stocks).

- Why it’s important: If a particular industry faces a downturn (e.g., new regulations for pharmaceutical companies, a shift away from fossil fuels), your entire stock portfolio won’t be devastated.

- Example: Instead of only Apple and Microsoft, also invest in companies from healthcare, consumer goods, finance, and energy sectors.

- Geographic Diversification:

- What it means: Invest in companies from different countries and regions, not just your home country.

- Why it’s important: Different economies grow at different rates and face different political or economic risks. If your home country’s economy struggles, your international investments might still thrive.

- Example: Include investments in U.S. companies, European companies, emerging markets (like China or India), and developed markets (like Japan or Canada).

- Company Size Diversification (for Stocks):

- What it means: Invest in companies of various sizes.

- Why it’s important:

- Large-Cap Stocks: (e.g., Apple, Amazon) Tend to be more stable, established companies with a long track record.

- Mid-Cap Stocks: (e.g., companies valued between $2 billion and $10 billion) Offer a balance of growth potential and stability.

- Small-Cap Stocks: (e.g., companies valued under $2 billion) Can offer higher growth potential but also carry higher risk and volatility.

- Growth vs. Value Stocks (for Stocks):

- Growth Stocks: Companies expected to grow faster than the overall market (e.g., many tech companies). Often reinvest profits back into the company.

- Value Stocks: Companies that appear to be undervalued by the market, often with stable earnings and dividends.

- Why it’s important: These two styles often perform differently during various market cycles.

3. Diversifying by Investment Vehicle

You don’t have to pick individual stocks and bonds yourself. There are excellent tools that offer instant diversification:

- Mutual Funds:

- How they work: A pool of money from many investors managed by a professional fund manager. The fund invests in a diversified portfolio of stocks, bonds, or other assets based on its stated objective.

- Benefit: Professional management and instant diversification across many securities.

- Exchange-Traded Funds (ETFs):

- How they work: Similar to mutual funds, but they trade like individual stocks on an exchange throughout the day. Many ETFs track specific market indexes (e.g., an S&P 500 ETF holds stocks of the 500 largest U.S. companies).

- Benefit: Low costs, tax efficiency, and broad diversification. Great for beginners!

- Robo-Advisors:

- How they work: Online platforms that use algorithms to build and manage diversified portfolios based on your risk tolerance and goals.

- Benefit: Very low fees, automated rebalancing, and easy to use for beginners.

4. Time Diversification (Dollar-Cost Averaging)

This strategy isn’t about what you invest in, but how and when you invest.

- What it means: Investing a fixed amount of money at regular intervals (e.g., $100 every month) regardless of market conditions.

- Why it’s important:

- Reduces market timing risk: You avoid the temptation to guess when the market will be at its lowest or highest.

- Averages out your purchase price: When prices are high, your fixed amount buys fewer shares. When prices are low, it buys more shares. Over time, this averages out your cost per share.

- Builds discipline: Encourages consistent investing, which is key for long-term wealth accumulation.

Building Your Diversified Portfolio: Practical Steps for Beginners

Don’t feel overwhelmed! Building a diversified portfolio is simpler than you might think.

-

Assess Your Risk Tolerance: How comfortable are you with your investments going up and down?

- Conservative: Prioritize safety; more bonds, cash.

- Moderate: Balanced approach; mix of stocks and bonds.

- Aggressive: Willing to take on more risk for higher potential returns; more stocks.

- Tip: Many online questionnaires can help you determine your risk tolerance.

-

Define Your Financial Goals: What are you saving for?

- Retirement (long-term, perhaps 20+ years away)

- Down payment for a house (mid-term, 5-10 years)

- Child’s education (mid to long-term)

- Your goals will influence your timeline and, therefore, your asset allocation.

-

Choose Your Asset Allocation: Based on your risk tolerance and goals, decide on the percentage breakdown of your asset classes (e.g., 60% stocks, 30% bonds, 10% cash).

- General Rule of Thumb (not financial advice): Subtract your age from 110 or 120 to get a rough percentage of stocks you might consider. (e.g., 30-year-old: 110 – 30 = 80% stocks).

- Remember: This is just a starting point; adjust based on your personal comfort.

-

Implement with Diversified Vehicles: For most beginners, using broad-market ETFs or low-cost mutual funds is the easiest way to achieve diversification.

- Example Portfolio (for a moderate investor):

- 30% U.S. Total Stock Market ETF (covers thousands of U.S. companies)

- 20% International Stock Market ETF (covers thousands of companies globally)

- 40% U.S. Total Bond Market ETF (covers various U.S. bonds)

- 10% Cash/Emergency Fund

- Example Portfolio (for a moderate investor):

-

Rebalance Regularly: Over time, your initial percentages will shift as some investments perform better than others.

- What it means: Adjusting your portfolio periodically (e.g., once a year) to bring it back to your target asset allocation. If stocks have soared and now represent 70% of your portfolio instead of 60%, you might sell some stocks and buy more bonds to get back to your target.

- Why it’s important: Keeps your portfolio aligned with your risk tolerance and prevents you from becoming unintentionally overexposed to a single asset class.

-

Start Small and Be Consistent: You don’t need a lot of money to start. Even $50 or $100 a month consistently invested can grow significantly over time thanks to the power of compounding and dollar-cost averaging.

Common Diversification Mistakes to Avoid

Even with good intentions, investors can make errors. Be aware of these pitfalls:

- 1. "Di-worsification" (Over-Diversification): While diversification is good, you can have too much of a good thing. Owning too many different funds or individual stocks can dilute your returns, make your portfolio overly complex, and lead to high fees without adding significant risk reduction.

- 2. Ignoring Rebalancing: As mentioned, neglecting to rebalance can cause your portfolio to drift away from your intended risk level.

- 3. Panicking During Downturns: Selling all your investments when the market drops (and buying when it’s high) is a common, costly mistake. A diversified portfolio is designed to weather these downturns. Stick to your plan.

- 4. Chasing "Hot" Trends: Investing solely in the latest popular stock or sector (e.g., meme stocks, specific tech fads) is the opposite of diversification and can lead to significant losses.

- 5. Not Understanding Your Investments: Don’t just buy something because someone told you to. Understand what you own and how it fits into your overall strategy.

Conclusion: Your Path to a Resilient Financial Future

Diversification isn’t a guarantee against losses, but it is the single most powerful strategy to manage risk and enhance the long-term stability and growth of your investment portfolio. It allows you to participate in the market’s upside potential while protecting you from the inevitable downturns.

By spreading your investments across different asset classes, industries, geographies, and using smart investment vehicles like ETFs, you’re building a fortress for your financial future. Remember to regularly review and rebalance your portfolio to ensure it always aligns with your evolving goals and risk tolerance. Start today, stay consistent, and watch your diversified portfolio become a powerful engine for your wealth creation journey.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Always consult with a qualified financial advisor before making any investment decisions.

Post Comment