Mastering Foreign Exchange Risk: A Beginner’s Guide to Protecting Your Global Business

In today’s interconnected world, businesses and individuals frequently operate across borders. Whether you’re importing goods from China, exporting services to Europe, or managing investments in different currencies, you’re likely exposed to something called Foreign Exchange Risk, often shortened to FX Risk or Currency Risk.

For beginners, the idea of managing currency fluctuations might seem daunting, filled with complex financial jargon. But fear not! This comprehensive guide will break down foreign exchange risk, explain why it matters, and provide easy-to-understand strategies for managing it, ensuring your global ventures remain profitable and predictable.

What Exactly Is Foreign Exchange Risk?

At its simplest, Foreign Exchange Risk is the potential for financial loss due to changes in the value of one currency relative to another.

Imagine you’re a business in the United States (USD) that agrees to buy goods from a supplier in Japan (JPY). You’ve agreed on a price of 1,000,000 JPY, payable in 90 days.

- Scenario 1 (Good for you): Today, 1 USD = 110 JPY. So, 1,000,000 JPY would cost you about $9,090 USD. If in 90 days, 1 USD = 120 JPY, your cost for 1,000,000 JPY would drop to about $8,333 USD. You save money!

- Scenario 2 (Bad for you – FX Risk): If in 90 days, 1 USD = 100 JPY, your cost for 1,000,000 JPY would rise to $10,000 USD. You lose money compared to your initial expectation!

This potential for the exchange rate to move against you between the time you agree to a price and the time you actually pay (or get paid) is foreign exchange risk. It introduces uncertainty and can eat into your profit margins, even if your core business is performing well.

Types of Foreign Exchange Exposure

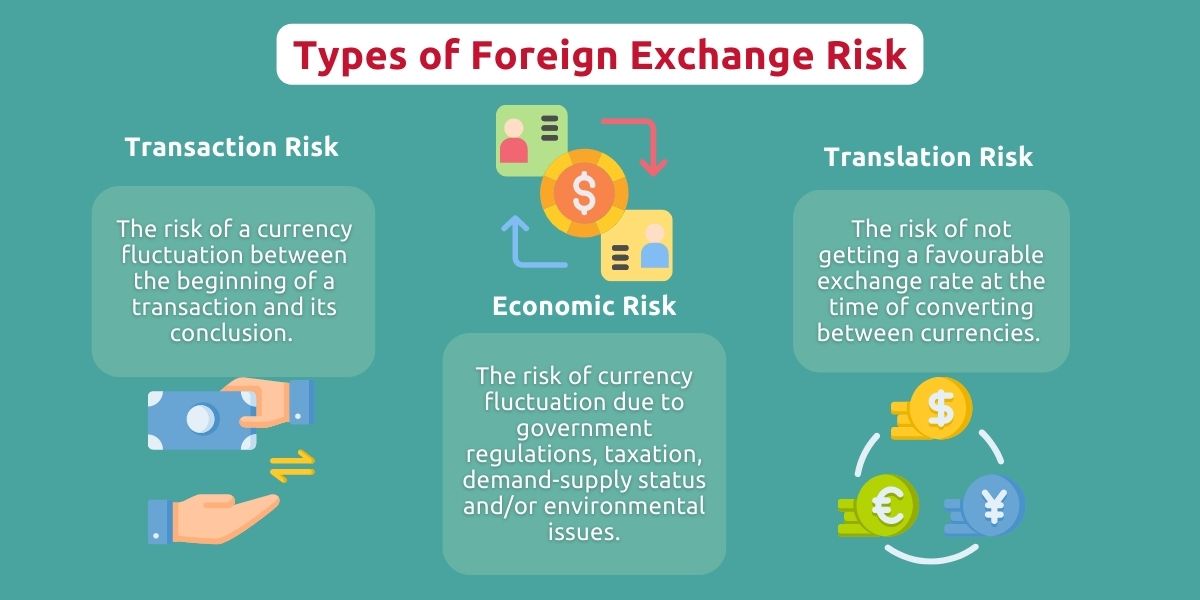

While the core concept is simple, FX risk can manifest in a few ways:

- Transaction Exposure: This is the most common and tangible type for beginners. It refers to the risk that the exchange rate will change between the time a transaction is agreed upon and the time it is settled (i.e., when the money actually changes hands). Our Japanese supplier example above is a perfect illustration of transaction exposure.

- Translation Exposure (or Accounting Exposure): This type affects companies with international subsidiaries. When a parent company converts the financial statements of its foreign subsidiaries into its home currency for reporting purposes, changes in exchange rates can impact the reported value of assets, liabilities, and equity, even if no cash has moved. It’s an accounting risk, not a cash flow risk, but it can affect a company’s reported financial health.

- Economic Exposure (or Operating Exposure): This is the broadest and most long-term type of FX risk. It refers to the risk that a company’s future cash flows, competitive position, and market value will be affected by unexpected currency fluctuations, even if it doesn’t have direct foreign currency transactions. For example, a purely domestic company might still face economic exposure if its foreign competitors become more or less competitive due to currency shifts.

For the purpose of this beginner’s guide, we will primarily focus on transaction exposure, as it’s the most immediate and common concern for businesses just starting to navigate international trade.

Why Bother Managing Foreign Exchange Risk?

You might be thinking, "Can’t I just hope for the best?" While you could, actively managing FX risk offers significant benefits that can make or break your international business ventures:

- Protecting Profit Margins: The most obvious reason. Unfavorable currency movements can quickly erase expected profits, turning a successful deal into a loss. Hedging helps lock in your desired profit.

- Ensuring Budget Certainty: For businesses, planning and budgeting are crucial. FX risk introduces a huge variable. By managing it, you can predict your costs and revenues more accurately, making financial planning much easier.

- Enhancing Competitive Advantage: Companies that effectively manage FX risk can offer more stable pricing to their customers or negotiate better terms with suppliers, giving them an edge over competitors who are vulnerable to currency swings.

- Improving Cash Flow Stability: Unexpected costs or reduced revenues due to currency changes can strain your cash flow. Managing FX risk helps stabilize your cash flow, ensuring you have the funds when you need them.

- Facilitating Growth and Expansion: With FX risk under control, businesses can confidently explore new international markets and opportunities without the constant worry of currency volatility.

- Meeting Investor Expectations: For larger businesses, demonstrating a robust risk management strategy, including FX risk, is crucial for attracting and retaining investors.

Key Steps to Managing Foreign Exchange Risk

Managing FX risk isn’t a one-time fix; it’s an ongoing process. Here are the fundamental steps:

1. Identify Your Exposure

Before you can manage risk, you need to know where it exists.

- Who are your international customers and suppliers?

- What currencies do you transact in (both receiving and paying)?

- What is the timing of these payments and receipts? (e.g., Are payments due in 30, 60, or 90 days?)

- Are there any future planned transactions that will involve foreign currency?

List out all your foreign currency receivables (money you expect to get) and payables (money you expect to pay).

2. Measure Your Exposure

Once identified, quantify it.

- What is the specific amount of foreign currency involved in each transaction? (e.g., 50,000 EUR payable, 100,000 CAD receivable).

- What is the specific due date for each transaction?

- What is your current exposure to each currency? (e.g., Net 50,000 EUR payable, net 100,000 CAD receivable).

This step helps you understand the scale of your risk and prioritize which exposures to manage.

3. Choose Your Strategy (Mitigation)

This is where you decide how you will deal with the identified and measured risk. There are various strategies, ranging from simple operational adjustments to more complex financial instruments. We’ll dive into these in detail in the next section.

4. Monitor and Review

Currency markets are constantly moving. What worked last month might not be the best strategy next month.

- Regularly review your exposures: Are there new transactions? Have existing ones changed?

- Monitor market conditions: Keep an eye on economic news and political events that can influence currency rates.

- Assess the effectiveness of your chosen strategies: Are they working as expected? Are they cost-effective?

- Adjust as needed: Be prepared to change your approach if market conditions or your business needs evolve.

Common Strategies for Managing Foreign Exchange Risk

Now, let’s explore the practical tools and techniques you can use to manage your FX risk. These can generally be grouped into two categories: Financial Hedging Instruments and Operational/Natural Hedging Strategies.

A. Financial Hedging Instruments (Using Financial Contracts)

These involve using specialized financial products to lock in an exchange rate or limit your exposure.

1. Forward Contracts

- What it is: A customized agreement between two parties (usually you and a bank) to exchange a specific amount of one currency for another at a pre-agreed exchange rate on a specific future date.

- How it works: Let’s say you’re a US company expecting to receive 100,000 EUR in 3 months. You’re worried the EUR might weaken against the USD. You can enter into a forward contract today to sell 100,000 EUR for USD at a rate of, say, 1.10 USD/EUR, payable in 3 months. Regardless of what the actual spot rate is in 3 months, you are guaranteed to receive $110,000 USD.

- Pros:

- Certainty: Eliminates exchange rate uncertainty. You know exactly what you’ll pay or receive.

- Customizable: Tailored to your specific amount and date.

- Cons:

- Obligation: You are obligated to complete the transaction at the agreed rate, even if the market moves in your favor (meaning you would have made more money if you hadn’t hedged).

- Less Flexible: Hard to change once agreed upon.

2. Futures Contracts

- What it is: Similar to a forward contract, but it’s a standardized agreement traded on an organized exchange (like the Chicago Mercantile Exchange – CME). They have set contract sizes, maturity dates, and terms.

- How it works: Instead of directly with a bank, you buy or sell a futures contract through a broker. Because they are standardized and exchange-traded, they are often more liquid (easier to buy and sell) than forwards.

- Pros:

- Liquidity: Easy to enter and exit positions.

- Transparency: Prices are publicly available.

- Cons:

- Standardized: May not perfectly match your exact exposure in terms of amount or date.

- Margin Requirements: You typically need to deposit an initial amount (margin) and maintain it, which can tie up capital.

- Daily Settlement: Gains and losses are typically settled daily, leading to cash flow fluctuations.

3. Currency Options

- What it is: A financial contract that gives the buyer the right, but not the obligation, to buy or sell a specific amount of one currency for another at a pre-agreed exchange rate (called the "strike price") on or before a specific future date.

- How it works: You pay a premium (like an insurance policy) for this right.

- Call Option: Gives you the right to buy a currency. (e.g., you buy a call option to buy EUR with USD if you expect to pay in EUR in the future and worry EUR will strengthen).

- Put Option: Gives you the right to sell a currency. (e.g., you buy a put option to sell EUR for USD if you expect to receive EUR in the future and worry EUR will weaken).

- Pros:

- Flexibility (Upside Potential): If the market moves in your favor, you can simply let the option expire and benefit from the favorable spot rate. Your only loss is the premium paid.

- Limited Downside: Your maximum loss is limited to the premium you paid.

- Cons:

- Cost: You pay a premium, which can be significant, especially for longer maturities or volatile currencies.

- Complexity: More complex than forwards or futures, requiring a better understanding of how they work.

4. Currency Swaps

- What it is: An agreement between two parties to exchange principal and/or interest payments in different currencies. These are typically long-term arrangements.

- How it works: For example, two companies might swap principal amounts and future interest payments in different currencies to take advantage of better borrowing rates in a foreign market or to hedge long-term debt exposure.

- Pros:

- Long-Term Hedging: Ideal for hedging long-term foreign currency debt or investments.

- Access to Different Markets: Can allow companies to borrow more cheaply in a foreign currency and then swap it back to their home currency.

- Cons:

- Complexity: Usually only for larger, more sophisticated transactions.

- Illiquid: Harder to exit early compared to other instruments.

B. Operational & Natural Hedging Strategies (Business Practices)

These methods involve making changes to your business operations to reduce or eliminate FX risk without using complex financial instruments.

1. Natural Hedging (Matching Inflows and Outflows)

- What it is: The most effective and often cheapest way to manage FX risk. It involves structuring your business so that you naturally have foreign currency receivables and payables in the same currency.

- How it works: If you regularly receive revenue in EUR from your exports to Germany, try to pay your suppliers in EUR as well. Or, if you need to borrow money, consider borrowing in the same currency you receive your primary revenues.

- Pros:

- No Cost: Doesn’t involve transaction fees or premiums for financial instruments.

- Simple: Easy to understand and implement if your business structure allows.

- Comprehensive: Can reduce both transaction and economic exposure.

- Cons:

- Not Always Possible: Your business operations might not naturally align in this way.

- Limited Scope: May only cover a portion of your overall exposure.

2. Diversification

- What it is: Spreading your business activities (sales, sourcing, investments) across multiple countries and currencies.

- How it works: Instead of selling all your products to one country (e.g., only in Europe), diversify your sales to include markets in Asia, North America, etc. This way, if one currency weakens, others might strengthen or remain stable, balancing out your overall exposure.

- Pros:

- Reduces Overall Volatility: Less dependent on the performance of a single currency.

- Growth Opportunities: Opens up new markets for your business.

- Cons:

- Requires Significant Effort: Expanding into new markets is a major undertaking.

- Not a Direct Hedge: Doesn’t eliminate specific transaction risk, but reduces overall portfolio risk.

3. Invoicing in Your Home Currency

- What it is: Whenever possible, insist on invoicing your international customers in your home currency (e.g., USD for a US company) or demand that your foreign suppliers invoice you in your home currency.

- How it works: If a US company invoices a German customer in USD, the currency risk shifts entirely to the German customer. The US company knows exactly how much USD they will receive.

- Pros:

- Eliminates Your Risk: Transfers the FX risk to the other party.

- Simple: No complex financial instruments needed.

- Cons:

- Customer/Supplier Resistance: Your trading partners may not agree, as it shifts the risk to them.

- Competitive Disadvantage: May make your prices less attractive if competitors are willing to absorb the FX risk.

4. Multi-Currency Bank Accounts

- What it is: Holding bank accounts in various foreign currencies.

- How it works: If you receive EUR from customers and also have EUR expenses (e.g., paying a European supplier), you can keep the EUR in a dedicated account and use it directly for payments, avoiding conversion fees and FX risk for those specific transactions.

- Pros:

- Reduces Conversion Fees: Saves money on repeated currency conversions.

- Convenient: Simplifies international cash management.

- Natural Hedge (within the same currency): If you collect and pay in the same foreign currency, you mitigate that specific currency’s risk.

- Cons:

- Still Exposed to Overall FX Risk: The value of the foreign currency balance itself can still fluctuate against your home currency.

- Interest Rates: Foreign currency accounts may offer lower or different interest rates than your home currency accounts.

5. Leading and Lagging

- What it is: Adjusting the timing of foreign currency payments or receipts based on your expectations of currency movements.

- How it works:

- Leading: If you expect a foreign currency you are owed to weaken, you might try to collect payment earlier than the due date. If you expect a foreign currency you owe to strengthen, you might try to pay earlier.

- Lagging: If you expect a foreign currency you are owed to strengthen, you might delay collecting payment. If you expect a foreign currency you owe to weaken, you might delay paying.

- Pros:

- Simple: Doesn’t involve external financial contracts.

- Potentially Beneficial: Can improve your cash flow if your predictions are correct.

- Cons:

- Speculative: Relies on predicting currency movements, which is risky and difficult.

- Relationship Risk: Can strain relationships with customers or suppliers if you constantly try to adjust payment terms.

- Interest Cost/Benefit: Affects the timing of cash flow and potentially interest earned or paid.

Best Practices and Considerations for Beginners

- Start Simple: Don’t jump into complex derivatives if you’re just beginning. Forward contracts are usually the easiest to understand and implement for specific transactions.

- Develop an FX Risk Policy: Even for small businesses, having a clear policy outlines how you identify, measure, and manage FX risk. This brings structure and consistency.

- Don’t Speculate: The goal of FX risk management is to reduce uncertainty, not to make money by predicting currency movements. Hedging is about protecting your existing profit margins, not creating new ones.

- Understand the Costs: All hedging strategies have costs, whether it’s a premium for an option, a spread on a forward contract, or the opportunity cost of not benefiting from a favorable currency move. Factor these costs into your business decisions.

- Seek Expert Advice: Consult with your bank or a financial advisor specializing in foreign exchange. They can help you understand the instruments, assess your specific exposure, and recommend tailored solutions.

- Regularly Review and Adjust: The global economic landscape is constantly changing. What worked yesterday might not work tomorrow. Regularly review your hedging strategies and adjust them as your business evolves and market conditions shift.

Conclusion: Take Control of Your Global Future

Foreign exchange risk is an inherent part of doing business internationally. While it might seem intimidating at first, understanding its fundamentals and implementing appropriate management strategies can transform it from a threat into a manageable variable.

By proactively identifying your exposures, utilizing suitable hedging instruments like forward contracts, and adopting smart operational practices like natural hedging, you can protect your hard-earned profits, ensure financial stability, and confidently expand your global footprint. Don’t let currency fluctuations dictate your success; empower yourself with the knowledge and tools to manage them effectively. Your global business ventures deserve the best chance to thrive.

Post Comment