Long-Term vs. Short-Term Investing Strategies: Which Path is Right for Your Financial Future?

Embarking on your investment journey can feel like standing at a crossroads. You’ve heard about the potential for growth, the power of compounding, and the importance of securing your financial future. But a fundamental question quickly arises: Should you focus on short-term gains or settle in for the long haul?

This article will demystify the world of long-term and short-term investing, helping beginners understand the core differences, the pros and cons of each, and how to decide which strategy (or combination) is best suited for their unique financial goals and risk tolerance.

Understanding the Basics: What is Investing?

Before diving into strategies, let’s clarify what investing truly means. At its heart, investing is the act of allocating resources (usually money) with the expectation of generating an income or profit. Instead of letting your money sit idle in a low-interest savings account, you’re putting it to work, hoping it grows over time.

Why invest?

- To Grow Your Wealth: The primary reason is to make your money work for you, potentially increasing its value significantly over time.

- To Beat Inflation: Over time, the cost of living tends to rise (inflation). If your money isn’t growing, its purchasing power diminishes. Investing helps your money keep pace or even outpace inflation.

- To Achieve Financial Goals: Whether it’s buying a house, funding retirement, paying for education, or building a safety net, investing can help you reach these milestones faster.

Now, let’s explore the two main roads you can take: the sprint or the marathon.

Short-Term Investing: The Sprint

Imagine a sprinters’ race. It’s fast, intense, and over quickly. That’s a good analogy for short-term investing.

What is it?

Short-term investing involves buying and selling investments with the goal of making a profit within a relatively short period, typically less than one year. Some strategies even aim for profits within hours or days. The focus is on capitalizing on quick price fluctuations.

Characteristics of Short-Term Investing:

- Time Horizon: Days, weeks, or a few months. Rarely exceeds one year.

- Goal: Quick profits from market volatility.

- Risk: Generally much higher due to the unpredictability of short-term market movements.

- Effort: Requires significant time, research, and active management.

Common Short-Term Strategies:

- Day Trading: Buying and selling financial instruments (like stocks, forex, or cryptocurrencies) within the same trading day, often multiple times, to profit from small price movements. Day traders rarely hold positions overnight.

- Swing Trading: Holding assets for a few days or weeks to profit from "swings" in price. Swing traders look for assets that are about to make a significant move up or down, hoping to capture a piece of that movement.

- Event-Driven Trading: Trading based on anticipated events like earnings reports, product launches, or political announcements that could cause rapid price changes.

Pros of Short-Term Investing:

- Potential for Quick Profits: If successful, you can see returns much faster than with long-term strategies.

- Liquidity: Money is tied up for a shorter period, making it easier to access if needed (though frequent trading incurs transaction costs).

- Excitement: For some, the fast pace and active involvement can be thrilling.

Cons of Short-Term Investing:

- High Risk of Loss: Short-term market movements are notoriously difficult to predict. One wrong move can wipe out gains quickly.

- Time-Consuming: Requires constant monitoring of the markets, extensive research, and quick decision-making. It’s often a full-time job.

- High Transaction Costs: Frequent buying and selling leads to more fees and commissions, which eat into profits.

- Emotional Rollercoaster: The rapid ups and downs can be incredibly stressful and lead to impulsive, poor decisions.

- Tax Implications: Short-term capital gains are often taxed at higher rates than long-term capital gains.

Who is Short-Term Investing For?

Short-term investing is generally suited for individuals who:

- Have a very high risk tolerance.

- Possess deep market knowledge and analytical skills.

- Have significant time to dedicate to research and monitoring.

- Are prepared to lose a substantial portion, or even all, of their invested capital.

- It is not recommended for most beginners.

Long-Term Investing: The Marathon

Now, let’s switch to a marathon. It’s a slow, steady, and enduring race, where patience and consistent effort lead to success over a long distance. This is long-term investing.

What is it?

Long-term investing involves holding investments for an extended period, typically five years or more, often decades. The goal is to benefit from the overall growth of the market and the power of compounding, rather than short-term price fluctuations.

Characteristics of Long-Term Investing:

- Time Horizon: 5+ years, often 10, 20, or even 30+ years.

- Goal: Significant wealth accumulation, financial independence, retirement planning.

- Risk: Generally lower over the long run, as market downturns tend to recover over time.

- Effort: Less active management; often a "set it and forget it" approach.

Key Concepts in Long-Term Investing:

- Compounding: Often called the "eighth wonder of the world." This is when your investment earnings themselves start earning returns. For example, if you invest $100 and earn 10%, you have $110. The next year, you earn 10% on $110, not just the original $100. This creates a snowball effect that can lead to exponential growth over time.

- Diversification: The practice of spreading your investments across different asset classes (e.g., stocks, bonds, real estate), industries, and geographic regions. This helps reduce risk because if one investment performs poorly, others might perform well, balancing out your portfolio.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals (e.g., $100 every month), regardless of the asset’s price. This strategy helps reduce the impact of market volatility because you buy more shares when prices are low and fewer when prices are high, averaging out your purchase price over time.

Pros of Long-Term Investing:

- Lower Risk: While markets fluctuate, historically, they have always trended upwards over long periods. This reduces the risk of permanent capital loss.

- Power of Compounding: Your money grows exponentially over time, creating substantial wealth with less effort.

- Less Time-Consuming: Once your portfolio is set up, it requires minimal monitoring and adjustments.

- Reduced Stress: You’re less affected by daily market news and short-term volatility, leading to a calmer investment experience.

- Tax Efficiency: Long-term capital gains are often taxed at a lower rate than short-term gains.

- Less Emotional Decision-Making: The "set it and forget it" approach helps avoid impulsive buying or selling based on fear or greed.

Cons of Long-Term Investing:

- Patience Required: You won’t see quick profits. It takes years, even decades, to see significant returns.

- Money is Tied Up: Your capital is committed for a long period, making it less accessible for immediate needs.

- Initial Setup: Requires some initial research to choose suitable investments (e.g., index funds, ETFs, quality stocks).

Who is Long-Term Investing For?

Long-term investing is ideal for most people, especially beginners, as it aligns with common financial goals like:

- Retirement planning

- Saving for a down payment on a house

- Funding a child’s education

- Building generational wealth

It is suited for individuals who: - Have a moderate to low risk tolerance.

- Prefer a less hands-on approach.

- Are comfortable waiting for returns.

- Are focused on building substantial wealth over time.

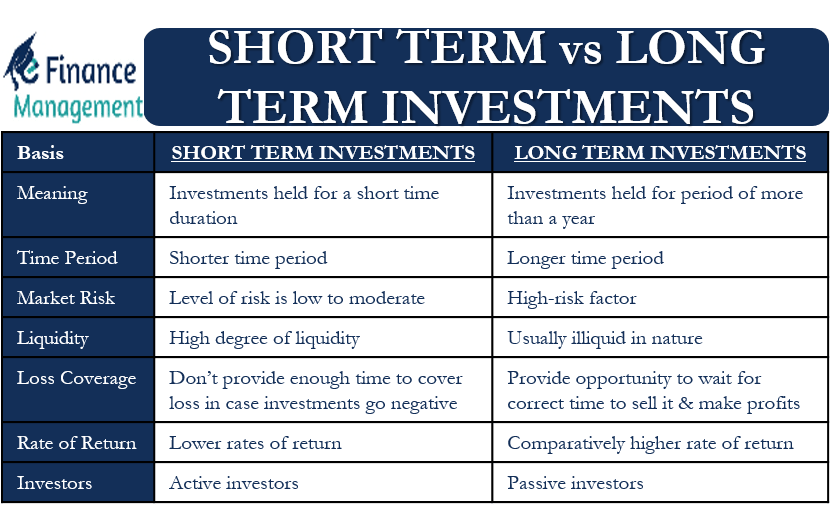

Key Differences at a Glance

Let’s quickly summarize the main distinctions between these two strategies:

- Time Horizon:

- Short-Term: Days, weeks, months (under 1 year)

- Long-Term: Years, decades (5+ years)

- Primary Goal:

- Short-Term: Quick profits from market fluctuations

- Long-Term: Significant wealth accumulation over time

- Risk Level:

- Short-Term: Very High

- Long-Term: Generally Lower (over time)

- Required Effort:

- Short-Term: Very high (active trading, constant monitoring)

- Long-Term: Low (passive, "set it and forget it")

- Emotional Impact:

- Short-Term: High stress, prone to impulsive decisions

- Long-Term: Lower stress, less reactive

- Taxation:

- Short-Term: Higher capital gains tax rates

- Long-Term: Lower capital gains tax rates

How to Choose Your Strategy: It’s Personal!

There’s no one-size-fits-all answer. The best strategy depends entirely on your personal circumstances. Ask yourself these questions:

- What are your financial goals?

- Are you saving for a down payment in 2 years? (Leans short-term, but still risky for stocks; safer in high-yield savings or short-term bonds).

- Are you saving for retirement in 30 years? (Definitely long-term).

- What is your time horizon?

- When do you need the money? The longer your horizon, the more suitable long-term investing becomes.

- What is your risk tolerance?

- How comfortable are you with the possibility of losing money? Can you sleep at night if your portfolio drops by 20% in a week? If not, short-term investing is likely not for you.

- How much time and effort can you commit?

- Do you have hours every day to research, monitor, and trade? Or do you prefer a more hands-off approach?

- How much knowledge and experience do you have?

- Beginners are usually better off starting with long-term, diversified strategies before considering the complexities of short-term trading.

Can You Do Both? Blending Strategies

Yes, absolutely! Many investors adopt a blended approach, especially as their wealth grows and their financial goals diversify.

- You might have a core long-term portfolio dedicated to retirement and significant wealth growth, invested in diversified index funds or ETFs.

- At the same time, you might allocate a small percentage (e.g., 5-10%) of your portfolio to more speculative or short-term investments if you have the risk tolerance, time, and knowledge to do so. This portion is often referred to as "play money" – money you can afford to lose without impacting your core financial security.

This blended approach allows you to pursue long-term growth while satisfying an interest in more active trading, without jeopardizing your overall financial future.

Getting Started: Tips for Beginner Investors

Regardless of your chosen path (but especially if you’re leaning long-term, which is highly recommended for beginners), here are some essential tips:

- Educate Yourself: Learn the basics of investing. Read books, follow reputable financial news, and take online courses.

- Define Your Goals: Clearly outline what you’re investing for and when you need the money. This will guide your strategy.

- Start Small, Start Now: You don’t need a lot of money to begin. Even $50 a month can make a difference thanks to compounding. The most important thing is to start.

- Diversify Your Investments: Don’t put all your eggs in one basket. Invest across different companies, industries, and asset types (e.g., stocks, bonds, real estate). For beginners, investing in broad market index funds or ETFs is an excellent way to achieve instant diversification.

- Automate Your Investments: Set up automatic transfers from your bank account to your investment account. This ensures consistency and helps with dollar-cost averaging.

- Be Patient (for Long-Term Investors): Don’t panic during market downturns. History shows that markets recover. Stay invested and focus on your long-term goals.

- Consider Professional Advice: If you feel overwhelmed, a qualified financial advisor can help you create a personalized investment plan based on your goals and risk tolerance.

Conclusion

Both long-term and short-term investing strategies have their place in the financial world. Short-term investing offers the allure of rapid gains but comes with significant risk, high effort, and a steep learning curve, making it generally unsuitable for most beginners.

Long-term investing, on the other hand, is a proven, less stressful path to wealth accumulation. It harnesses the incredible power of compounding and market resilience over time, making it the recommended strategy for the vast majority of individuals looking to build a secure financial future.

Understand your goals, assess your risk tolerance, and be honest about your time commitment. For many, a disciplined, long-term approach will be the most effective and least stressful way to reach their financial dreams. Start today, stay patient, and watch your money work for you.

Post Comment