Inflationary Crises: Causes, Consequences, and How to Navigate Economic Turmoil

Have you ever noticed that your weekly grocery bill keeps climbing, or that the price of your favorite coffee seems to jump every few months? That feeling is often due to inflation, the general increase in prices and the fall in the purchasing value of money. While a little bit of inflation is normal and even healthy for an economy, when it spirals out of control, it can trigger an inflationary crisis.

An inflationary crisis isn’t just about things getting a little more expensive; it’s about money rapidly losing its value, leading to widespread economic instability and hardship. Understanding these crises is crucial for everyone, from individuals planning their finances to governments managing their economies.

In this comprehensive guide, we’ll break down what inflationary crises are, explore the main reasons they happen, examine their devastating effects, and discuss how societies and individuals can try to weather the storm.

What is Inflation, Anyway? The Shrinking Candy Bar Analogy

Before we dive into the crisis, let’s make sure we understand inflation itself.

Imagine you could buy a large chocolate bar for $1 a few years ago. Today, that same chocolate bar costs $1.50, or maybe it’s even shrunk in size but still costs $1. That’s inflation in action. Inflation means that your money buys less than it used to. In simpler terms, the cost of living goes up.

Economists usually measure inflation using something called the Consumer Price Index (CPI), which tracks the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

When Inflation Becomes a Crisis: Beyond Just "Expensive"

A little inflation (say, 2-3% per year) is often seen as a sign of a growing economy. It encourages people to spend and businesses to invest, rather than just hoarding cash.

However, an inflationary crisis (sometimes leading to hyperinflation in extreme cases) occurs when prices rise at an incredibly rapid, uncontrollable rate. We’re talking about prices doubling or tripling in a matter of months, weeks, or even days. This rapid devaluation of money can shatter an economy and lead to severe social unrest.

Think of countries like post-World War I Germany, Zimbabwe in the 2000s, or Venezuela more recently. In these situations, people needed wheelbarrows full of cash just to buy basic groceries, and their life savings could become worthless overnight.

Causes of Inflationary Crises: Why Prices Explode

Inflationary crises don’t just happen out of nowhere. They are usually the result of several powerful economic forces acting together, often exacerbated by poor policy decisions. Here are the main culprits:

1. Demand-Pull Inflation: Too Much Money Chasing Too Few Goods

Imagine everyone suddenly got a massive pay raise and wanted to buy the newest smartphone. If there aren’t enough smartphones to go around, sellers will naturally raise prices because they know people are willing to pay more.

- Explanation: This happens when there’s an overwhelming demand for goods and services that the economy can’t keep up with. People have more money to spend (or they think they do), and they’re eager to buy.

- Common Triggers:

- Excessive Government Spending: When governments pump too much money into the economy through stimulus packages or large projects without a corresponding increase in production.

- Rapid Money Supply Growth: When the central bank prints too much money or makes it too easy to borrow, flooding the economy with cash.

- Strong Consumer Confidence: When people feel secure about their jobs and future, they tend to spend more.

2. Cost-Push Inflation: Rising Production Costs

Think about baking a cake. If the price of flour, sugar, and eggs suddenly skyrockets, the baker has no choice but to charge more for the cake to cover their costs.

- Explanation: This type of inflation occurs when the cost of producing goods and services increases significantly. Businesses then pass these higher costs onto consumers in the form of higher prices.

- Common Triggers:

- Supply Shocks: Sudden, unexpected events that disrupt the supply of crucial goods or raw materials. Examples include natural disasters, wars (like the impact on energy prices after the Ukraine invasion), or pandemics (like the COVID-19 impact on global supply chains).

- Rising Wages: If workers demand and receive significantly higher wages without a corresponding increase in productivity, businesses will raise prices to maintain profit margins.

- Increased Raw Material Costs: A surge in the price of essential commodities like oil, gas, metals, or agricultural products.

- New Taxes/Regulations: Government policies that increase the cost of doing business.

3. Excessive Money Printing (Monetary Inflation)

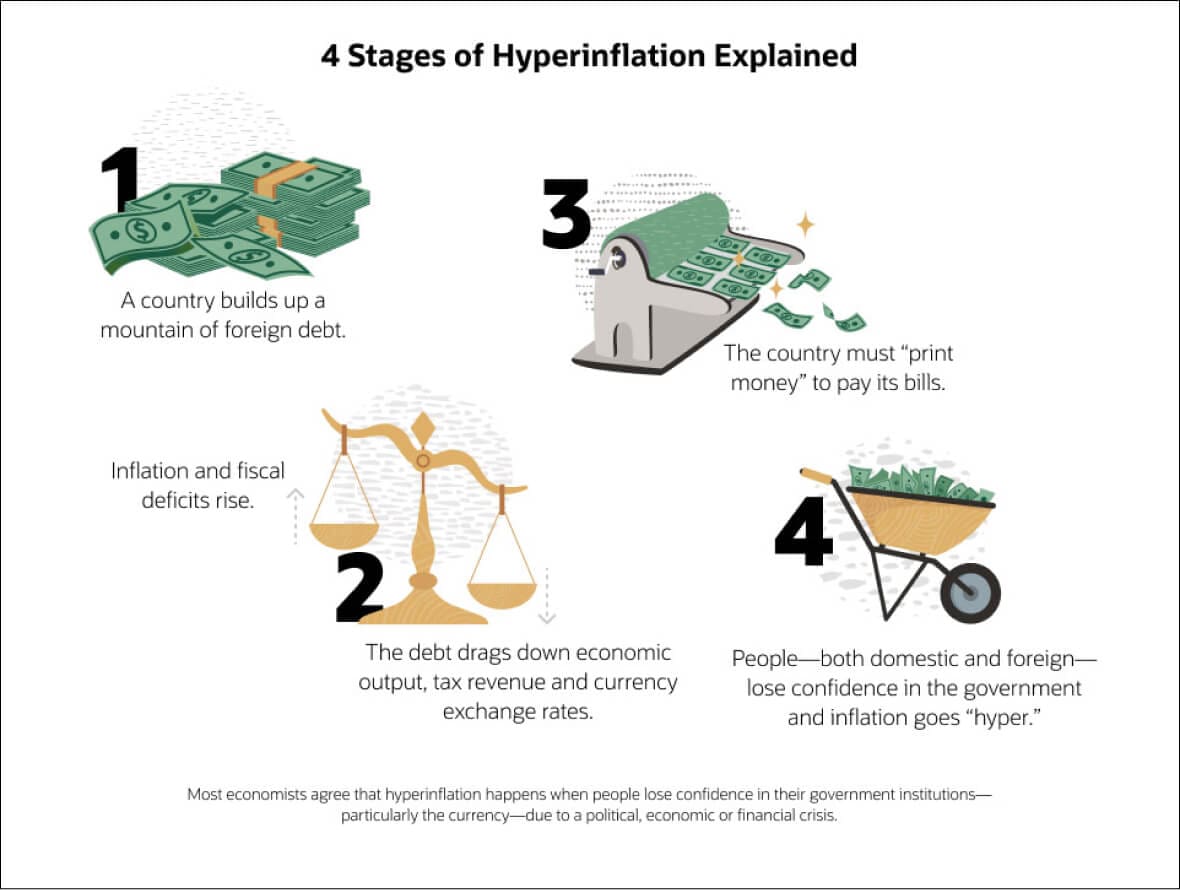

This is perhaps the most direct and dangerous cause of hyperinflation. If a government simply prints more and more money to pay its debts or fund its operations without a corresponding increase in goods and services, the value of each unit of currency plummets.

- Explanation: When the amount of money in circulation grows much faster than the amount of goods and services available, money becomes less valuable. It’s like adding too much water to a soup – it becomes diluted and tasteless.

- Historical Examples: Weimar Republic Germany in the 1920s, Zimbabwe in the 2000s, and Venezuela in the 2010s are classic examples where governments resorted to printing vast amounts of money, leading to hyperinflation where prices rose by millions or even billions of percent.

4. Inflationary Expectations: The Self-Fulfilling Prophecy

If people expect prices to rise significantly in the future, they start behaving in ways that make that expectation a reality.

- Explanation:

- Consumers: Might buy more now to avoid paying higher prices later, increasing demand.

- Businesses: Might raise prices proactively, anticipating higher costs for their own inputs. They might also demand higher prices for their goods and services.

- Workers: Will demand higher wages to compensate for the expected increase in the cost of living, leading to a "wage-price spiral" (see consequences below).

5. Global Factors and Currency Devaluation

In our interconnected world, what happens in one country can affect others.

- Explanation:

- Weakening Currency: If a country’s currency loses value against other major currencies, imports become more expensive. This "imported inflation" can contribute to a domestic crisis.

- International Commodity Prices: A global surge in the price of oil, food, or other key commodities can hit countries that rely on imports particularly hard.

- Capital Flight: If investors lose confidence in a country’s economy, they might pull their money out, further weakening the currency and reducing investment.

Consequences of Inflationary Crises: The Ripple Effect

An inflationary crisis sends shockwaves through an economy and society, affecting almost everyone. The consequences can be devastating and long-lasting.

1. Erosion of Purchasing Power and Savings

- Impact: This is the most immediate and painful effect. Your hard-earned money loses its value rapidly. Savings accounts, pensions, and fixed incomes (like retirement benefits) are decimated as they can buy less and less.

- Example: A retirement fund that seemed sufficient to live comfortably might suddenly barely cover basic necessities.

2. Economic Uncertainty and Instability

- Impact: Businesses become hesitant to invest or expand because they can’t predict future costs or revenues. Consumers delay big purchases due to uncertainty. This leads to reduced economic activity, job losses, and a general slowdown.

- Result: A decline in economic growth and potential recession.

3. Redistribution of Wealth (Often Unfairly)

- Impact:

- Debtors Benefit: People who owe money (e.g., on a mortgage) might find their debt easier to repay in real terms, as the value of the money they owe decreases.

- Creditors Suffer: Those who lent money (banks, bondholders) are repaid with money that is worth less than what they lent, effectively losing out.

- Fixed Income Earners Suffer Most: Retirees, people on disability, and those with stagnant wages are hit hardest as their income doesn’t keep pace with rising prices.

4. The Wage-Price Spiral

- Impact: This is a vicious cycle. As prices rise, workers demand higher wages to maintain their living standards. Businesses, facing higher labor costs, then raise their prices further, leading to more wage demands, and so on.

- Result: An accelerating spiral of inflation that is very difficult to break.

5. Social and Political Unrest

- Impact: When people’s basic needs become unaffordable, frustration and anger can boil over. Shortages of essential goods, food riots, and widespread protests are common during severe inflationary crises.

- Result: Can lead to political instability, government collapses, and even revolutions.

6. Risk of Recession or Stagflation

- Impact: Governments and central banks often respond to high inflation by raising interest rates to cool down the economy. While necessary, this can slow economic growth significantly, potentially leading to a recession (a significant decline in economic activity).

- Stagflation: A particularly nasty scenario where the economy experiences high inflation and high unemployment and slow economic growth simultaneously. This is very difficult for policymakers to fix because traditional solutions for inflation (raising rates) can worsen unemployment, and solutions for unemployment (stimulating the economy) can worsen inflation.

7. Hyperinflation: The Extreme End

- Impact: This is inflation run wild, where prices double or more in a very short period (sometimes daily). Money loses almost all its value, becoming practically worthless. People resort to bartering or using foreign currencies. The economy grinds to a halt.

- Example: In hyperinflationary environments, workers might demand to be paid multiple times a day so they can spend their wages before they lose too much value.

How Governments and Central Banks Fight Inflation

Facing an inflationary crisis, governments and central banks have powerful tools at their disposal, though using them effectively is a delicate balancing act.

-

Monetary Policy (Central Banks):

- Raising Interest Rates: The most common tool. When the central bank (like the Federal Reserve in the US or the European Central Bank) raises its key interest rate, it becomes more expensive for banks to borrow money. This, in turn, makes loans for businesses and consumers more expensive, discouraging borrowing and spending, which cools down demand.

- Reducing Money Supply: The central bank can also reduce the amount of money circulating in the economy.

-

Fiscal Policy (Governments):

- Reducing Government Spending: Cutting back on government projects or social programs can reduce overall demand in the economy.

- Raising Taxes: Higher taxes leave people with less disposable income, reducing their spending power.

-

Supply-Side Policies:

- Investing in Infrastructure: Improving roads, ports, and communication networks can make it easier and cheaper for businesses to produce and transport goods, increasing supply.

- Reducing Regulations: Less red tape can lower costs for businesses.

- Promoting Competition: Breaking up monopolies or encouraging new businesses can lead to lower prices.

Navigating an Inflationary Crisis: Tips for Individuals

While governments and central banks work on the big picture, there are steps you can take to protect your personal finances during times of high inflation:

- Budget Wisely: Track your spending meticulously. Identify areas where you can cut back.

- Prioritize Debt Repayment (Especially Variable-Rate Debt): As interest rates rise to combat inflation, variable-rate debts (like some credit cards or adjustable-rate mortgages) become more expensive.

- Negotiate Your Income: If possible, ask for a raise that at least keeps pace with inflation to protect your purchasing power.

- Invest in Inflation-Resistant Assets:

- Real Estate: Property values often rise with inflation.

- Commodities: Gold, silver, oil, and other raw materials can be good hedges.

- Treasury Inflation-Protected Securities (TIPS): Government bonds designed to protect against inflation.

- Stocks of Companies with Pricing Power: Companies that can easily pass on higher costs to their customers tend to do better.

- Avoid Holding Too Much Cash: Cash loses value quickly during high inflation.

- Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes.

- Focus on Essential Needs: During a crisis, distinguish between needs and wants.

Conclusion: Understanding is Your Best Defense

Inflationary crises are complex economic phenomena with far-reaching and often painful consequences. From the erosion of savings to social unrest, their impact can reshape societies. While they are often triggered by a combination of factors – from excessive money printing to supply shocks and soaring demand – understanding their causes is the first step toward mitigating their effects.

By knowing how inflation works, recognizing the signs of a looming crisis, and understanding the tools used to combat it, we can all be better prepared to navigate economic turbulence and make informed decisions to protect our financial well-being. Economic stability is a shared goal, and an informed populace is its strongest advocate.

Post Comment