Incoterms 2020 Explained: Your Essential Guide to Navigating International Shipping Terms

In the complex world of international trade, clarity is paramount. Misunderstandings about who is responsible for what, when, and where can lead to costly delays, disputes, and even lost shipments. This is where Incoterms® 2020 come into play.

If you’re involved in importing or exporting, or even just curious about how goods move across borders, understanding Incoterms is not just helpful – it’s essential. This comprehensive guide will break down Incoterms 2020, explaining their purpose, the key concepts, and each of the 11 rules in a way that’s easy for beginners to grasp.

What Exactly Are Incoterms?

At their core, Incoterms (International Commercial Terms) are a set of globally recognized rules published by the International Chamber of Commerce (ICC). They define the responsibilities of buyers and sellers for the delivery of goods under sales contracts. Think of them as a universal language for international trade, providing clear guidelines on:

- Who pays for what: Costs related to transport, loading, unloading, customs duties, etc.

- When risk transfers: The point at which the responsibility for loss or damage to goods shifts from the seller to the buyer.

- Where goods are delivered: The specific location where the seller fulfills their delivery obligation.

- Who handles customs formalities: Export and import clearance procedures.

Important Note: Incoterms do not define the price of the goods, the method of payment, or the transfer of ownership (title) of the goods. These aspects are covered in the sales contract itself. Incoterms solely focus on the logistics of delivery and associated costs and risks.

Why Are Incoterms So Crucial for Your Business?

Using Incoterms correctly can save your business time, money, and a lot of headaches. Here’s why they are so vital:

- Prevent Disputes: By clearly defining responsibilities, Incoterms minimize the chances of misunderstandings and costly legal battles between buyers and sellers. Everyone knows what they signed up for.

- Cost Control: They clarify who pays for each leg of the journey, allowing businesses to accurately calculate their landed costs and avoid unexpected expenses.

- Risk Management: Knowing exactly when the risk of loss or damage transfers is critical for insurance purposes and for managing potential liabilities.

- Streamlined Operations: Clear rules lead to smoother logistics, as all parties (shippers, carriers, customs brokers) understand their roles.

- Global Standardization: As an internationally recognized standard, Incoterms facilitate trade across different countries and legal systems.

Key Concepts to Understand in Incoterms

Before diving into the individual Incoterms rules, it’s important to grasp a few fundamental concepts that underpin them:

- Delivery Point: This is the specific place where the seller completes their delivery obligation. It’s the moment the goods are considered "delivered" from the seller’s perspective.

- Risk Transfer: This is the crucial point at which the responsibility for loss or damage to the goods shifts from the seller to the buyer. This point is often, but not always, the same as the delivery point.

- Cost Transfer: This refers to the point at which the responsibility for paying for transport, insurance, and other charges shifts from the seller to the buyer. This point might be different from the risk transfer point.

- Customs Formalities: Incoterms specify who is responsible for handling and paying for export and import customs clearance, duties, and taxes.

- Mode of Transport: Some Incoterms rules are universal and can be used for any mode of transport (air, sea, road, rail), while others are specifically designed for sea and inland waterway transport.

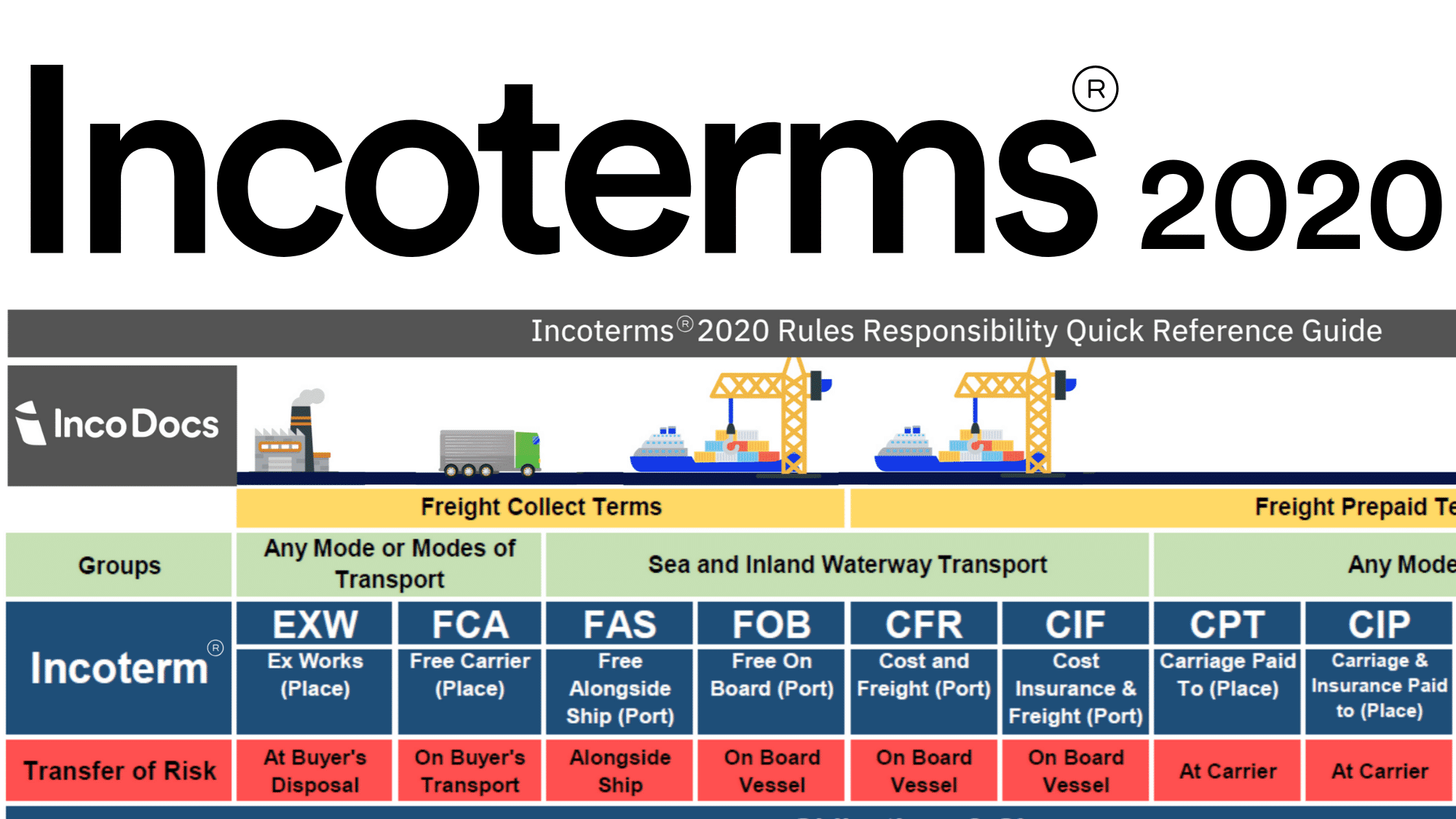

Incoterms 2020 Rules Explained: The 11 Terms

The Incoterms 2020 rules are divided into two main categories based on the mode of transport. Let’s break them down.

Rules for Any Mode of Transport (The "Universal" Terms)

These seven Incoterms can be used regardless of the mode of transport chosen (air, sea, road, rail, or a combination).

1. EXW (Ex Works)

- Meaning: The seller makes the goods available at their own premises (e.g., factory, warehouse).

- Seller’s Responsibility: Minimal. The seller’s only duty is to make the goods available.

- Buyer’s Responsibility: Maximum. The buyer bears all costs and risks involved in taking the goods from the seller’s premises to the final destination, including loading, export clearance, main carriage, import clearance, and unloading.

- Risk Transfer: At the seller’s premises when the goods are made available.

- Best Used When: The buyer has extensive experience in international shipping and wants maximum control over the entire shipping process. Often used for domestic transactions or when the seller is not involved in export procedures.

2. FCA (Free Carrier)

- Meaning: The seller delivers the goods to the buyer’s nominated carrier at a named place. This could be the seller’s own premises, a carrier’s terminal, or another agreed location.

- Seller’s Responsibility: Deliver goods to the agreed place, loaded onto the buyer’s carrier. Handles export customs clearance.

- Buyer’s Responsibility: Arranges and pays for the main carriage, import customs clearance, and all costs and risks from the point of delivery.

- Risk Transfer: When the goods are delivered to the nominated carrier at the named place.

- Best Used When: The seller wants to control the initial leg of the shipment and export procedures, but the buyer wants to control the main carriage. Very flexible and widely used.

3. CPT (Carriage Paid To)

- Meaning: The seller pays for the carriage of the goods to a named destination.

- Seller’s Responsibility: Pays for carriage to the named destination. Handles export customs clearance.

- Buyer’s Responsibility: Bears the risk of loss or damage after the goods are delivered to the first carrier, even though the seller pays for carriage to the destination. Handles import customs clearance and unloading at destination.

- Risk Transfer: When the goods are delivered to the first carrier nominated by the seller.

- Best Used When: The seller wants to arrange and pay for the main carriage but wants the risk to transfer early. Often used for multimodal transport.

4. CIP (Carriage and Insurance Paid To)

- Meaning: Similar to CPT, the seller pays for carriage to a named destination and also obtains minimum insurance coverage against the buyer’s risk of loss or damage during transit.

- Seller’s Responsibility: Pays for carriage to the named destination. Provides minimum insurance coverage (ICC Clause C). Handles export customs clearance.

- Buyer’s Responsibility: Bears the risk of loss or damage after the goods are delivered to the first carrier. Handles import customs clearance and unloading at destination. If higher insurance coverage is desired, the buyer is responsible for arranging it.

- Risk Transfer: When the goods are delivered to the first carrier nominated by the seller.

- Best Used When: Similar to CPT, but the buyer requires the seller to provide basic insurance. Suitable for high-value goods or when the buyer wants minimal hassle.

5. DAP (Delivered At Place)

- Meaning: The seller delivers the goods to a named place of destination, ready for unloading, but not unloaded.

- Seller’s Responsibility: Bears all costs and risks involved in bringing the goods to the named destination, ready for unloading. Handles export customs clearance.

- Buyer’s Responsibility: Handles import customs clearance, pays import duties/taxes, and is responsible for unloading the goods at the destination.

- Risk Transfer: At the named place of destination, when the goods are available for unloading.

- Best Used When: The seller wants to manage most of the logistics chain up to the final destination, but the buyer is capable of handling import formalities and final unloading.

6. DPU (Delivered At Place Unloaded)

- Meaning: This is a new term in Incoterms 2020, replacing DAT (Delivered At Terminal). The seller delivers the goods, unloaded, at a named place of destination.

- Seller’s Responsibility: Bears all costs and risks involved in bringing the goods to the named destination and unloading them. Handles export customs clearance.

- Buyer’s Responsibility: Handles import customs clearance and pays import duties/taxes.

- Risk Transfer: At the named place of destination, after the goods have been unloaded.

- Best Used When: The seller has the capability and desire to manage the entire delivery process, including unloading, at the destination. This is suitable for situations where the seller has control over the equipment and personnel required for unloading.

7. DDP (Delivered Duty Paid)

- Meaning: The seller delivers the goods to the named place of destination, cleared for import, and ready for unloading. This is the maximum obligation for the seller.

- Seller’s Responsibility: Bears all costs and risks to the final destination, including export customs, main carriage, import customs, and all duties and taxes.

- Buyer’s Responsibility: Minimal. The buyer’s only responsibility is to unload the goods at the destination.

- Risk Transfer: At the named place of destination, when the goods are available for unloading.

- Best Used When: The buyer wants a completely hassle-free experience, and the seller has a strong understanding and capability to handle all aspects of international shipping, including import formalities in the buyer’s country.

Rules for Sea and Inland Waterway Transport Only

These four Incoterms are specifically designed for situations where goods are transported by sea or inland waterways, and the goods are delivered to the buyer at the ship’s side or on board the vessel.

8. FAS (Free Alongside Ship)

- Meaning: The seller delivers the goods alongside the vessel at the named port of shipment.

- Seller’s Responsibility: Delivers goods alongside the vessel, ready for loading. Handles export customs clearance.

- Buyer’s Responsibility: Bears all costs and risks from the moment the goods are alongside the vessel. This includes loading onto the ship, main carriage, insurance, unloading, and import formalities.

- Risk Transfer: When the goods are placed alongside the vessel at the named port of shipment.

- Best Used When: The buyer has the expertise and desire to manage the main carriage and loading, often for bulk cargo or non-containerized goods.

9. FOB (Free On Board)

- Meaning: The seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment.

- Seller’s Responsibility: Delivers goods on board the vessel. Handles export customs clearance.

- Buyer’s Responsibility: Bears all costs and risks once the goods are on board the vessel. This includes main carriage, insurance, unloading, and import formalities.

- Risk Transfer: When the goods are on board the vessel at the named port of shipment.

- Best Used When: One of the most common terms for sea transport. The seller loads the goods onto the ship, and the buyer takes over from there. Suitable for containerized cargo.

10. CFR (Cost and Freight)

- Meaning: The seller pays for the costs and freight to bring the goods to the named port of destination.

- Seller’s Responsibility: Pays for costs and freight to the named port of destination. Handles export customs clearance.

- Buyer’s Responsibility: Bears the risk of loss or damage once the goods are on board the vessel at the port of shipment. Handles unloading costs at destination, insurance, and import formalities.

- Risk Transfer: When the goods are on board the vessel at the port of shipment (same as FOB).

- Best Used When: The seller wants to arrange and pay for the main sea freight, but the buyer takes on the risk once the goods are loaded.

11. CIF (Cost, Insurance and Freight)

- Meaning: Similar to CFR, the seller pays for costs and freight to the named port of destination and also obtains minimum insurance coverage against the buyer’s risk of loss or damage during transit.

- Seller’s Responsibility: Pays for costs and freight to the named port of destination. Provides minimum insurance coverage (ICC Clause C). Handles export customs clearance.

- Buyer’s Responsibility: Bears the risk of loss or damage once the goods are on board the vessel at the port of shipment. Handles unloading costs at destination, and import formalities. If higher insurance coverage is desired, the buyer is responsible for arranging it.

- Risk Transfer: When the goods are on board the vessel at the port of shipment (same as FOB).

- Best Used When: Common for sea shipments, especially for bulk or general cargo, where the seller wants to provide basic insurance coverage up to the destination port.

Choosing the Right Incoterm: A Practical Guide

Selecting the appropriate Incoterm is a critical decision that impacts your costs, risks, and responsibilities. Here’s what to consider:

- Your Expertise & Resources:

- Buyer: Are you experienced in international logistics and customs? Do you have reliable freight forwarders and customs brokers? If yes, terms like EXW or FCA might be suitable. If you prefer minimal involvement, look for DAP, DPU, or DDP.

- Seller: Do you have the infrastructure and knowledge to manage complex logistics, including import clearance in another country? If not, stick to terms where your responsibility ends earlier (EXW, FCA, FOB).

- Nature of the Goods:

- Perishable or Fragile Goods: You might want a term that ensures a quicker transfer of risk or more direct control over the journey.

- Bulk vs. Containerized: Some terms are better suited for specific cargo types (e.g., FAS for bulk, FOB/CFR/CIF for containerized).

- Cost vs. Control:

- More Seller Responsibility (DDP): Higher cost for the seller, but more control. Easier for the buyer.

- More Buyer Responsibility (EXW): Lower cost for the seller, but less control. More effort for the buyer.

- Relationship with Your Partner:

- New Partner: Starting with a clearly defined term like FOB or CIF can provide a good balance.

- Long-Term Partner: You might be more flexible and adjust terms based on evolving needs.

- Insurance Requirements:

- CIP and CIF require the seller to provide minimum insurance. If higher coverage is needed, ensure it’s specified in the sales contract or arranged by the party bearing the risk.

Common Mistakes to Avoid

Even with the best intentions, Incoterms can be misused. Here are some common pitfalls:

- Not Specifying "Incoterms 2020": Always include the version (e.g., "FOB Shanghai, China Incoterms® 2020"). Without the year, older versions might apply, leading to confusion.

- Misunderstanding Risk vs. Cost Transfer: Remember that the point where costs transfer isn’t always the same as where risk transfers (e.g., CPT, CIP, CFR, CIF).

- Using Sea-Only Terms for Non-Sea Shipments: Don’t use FOB, CFR, CIF, or FAS for air or land transport. Use FCA, CPT, or CIP instead.

- Ignoring Insurance: Even if an Incoterm doesn’t require the seller to provide insurance, the party bearing the risk should always consider it.

- Not Naming the Specific Place: "FOB Port" is not enough. It must be "FOB Port of Shanghai, China." Specificity is key.

- Assuming DDP is Always Best: While convenient for the buyer, DDP places a huge burden on the seller, who must understand and comply with import regulations in a foreign country. This can be complex and risky.

Conclusion

Incoterms 2020 are more than just a set of acronyms; they are the backbone of clear and efficient international trade. By understanding these 11 rules, both buyers and sellers can precisely define their responsibilities, manage risks, control costs, and avoid potential disputes.

Whether you’re a seasoned logistics professional or just starting your journey in global trade, mastering Incoterms 2020 is a powerful asset. Always choose the Incoterm that best suits your capabilities, the nature of your goods, and your relationship with your trading partner. When in doubt, consult with a freight forwarder, customs broker, or legal expert to ensure your contracts are perfectly aligned with your operational realities. Happy shipping!

Post Comment