Income Elasticity of Demand: What It Means for Businesses – A Beginner’s Guide

In the ever-shifting landscape of consumer spending, understanding why people buy what they buy is paramount for any business. While pricing and marketing play huge roles, there’s another, often overlooked, economic concept that can make or break a product’s success: Income Elasticity of Demand (IED).

Don’t let the fancy name scare you! IED is a powerful, yet simple, tool that helps businesses predict how changes in their customers’ incomes will affect the demand for their products or services. Whether the economy is booming or busting, knowing your product’s IED can be the difference between thriving and just surviving.

This comprehensive guide will demystify Income Elasticity of Demand, explain why it’s crucial for your business strategy, and show you how to apply it to make smarter decisions.

What is Income Elasticity of Demand (IED)?

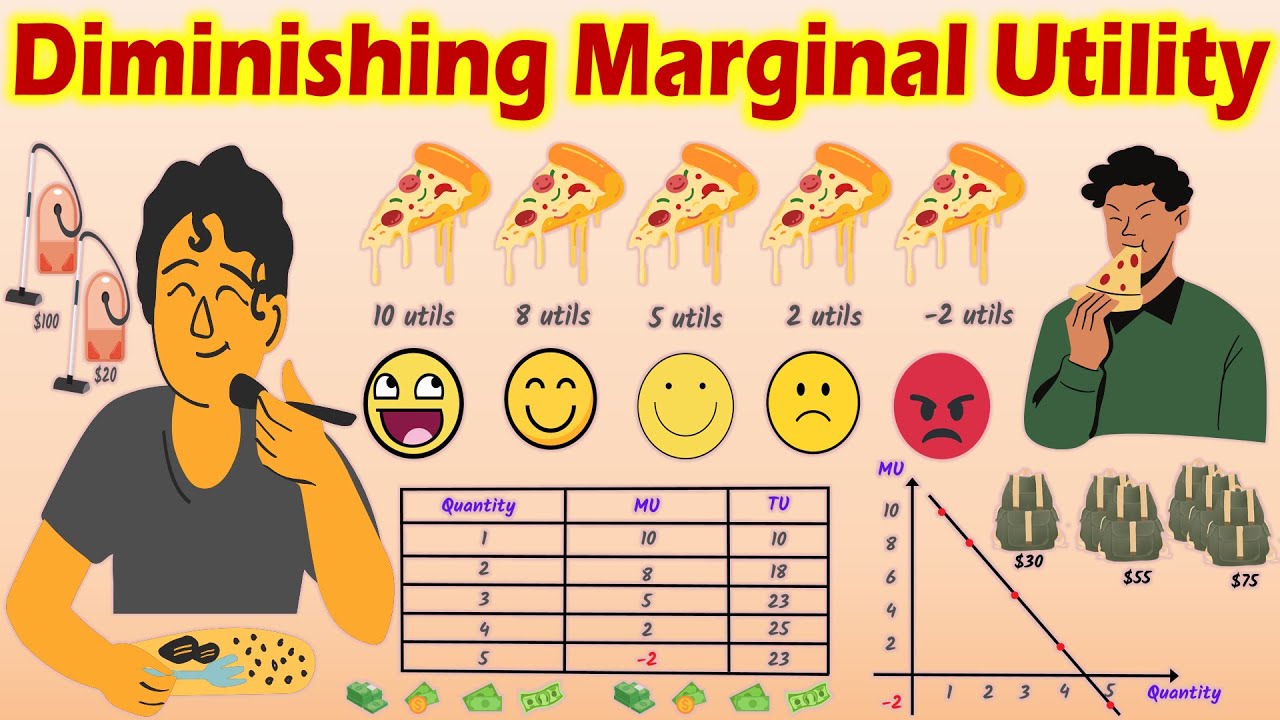

At its core, Income Elasticity of Demand measures how much the quantity demanded of a good or service changes in response to a change in consumers’ incomes.

Think about it: when people get a raise, they might start buying different things or more of the things they already buy. Conversely, if their income drops, they might cut back on certain purchases. IED quantifies this relationship.

In simpler terms:

- Does demand for your product go up when people earn more money?

- Does demand for your product go down when people earn less money?

- Or does it stay relatively stable regardless of income changes?

IED gives you a number that answers these questions, helping you categorize your product and anticipate consumer behavior.

The IED Formula Explained

To calculate Income Elasticity of Demand, economists use a straightforward formula:

IED = (% Change in Quantity Demanded) / (% Change in Income)

Let’s break down each part:

- % Change in Quantity Demanded: This is calculated as

[(New Quantity Demanded - Old Quantity Demanded) / Old Quantity Demanded] * 100. It tells you how much the sales of your product have increased or decreased. - % Change in Income: This is calculated as

[(New Income - Old Income) / Old Income] * 100. It tells you how much the average income of your target customers has changed.

Example:

Imagine a store that sells designer handbags.

- Last year, the average customer income was $50,000, and they sold 1,000 handbags.

- This year, the average customer income increased to $55,000, and they sold 1,200 handbags.

Let’s calculate the IED:

- % Change in Quantity Demanded:

[(1200 - 1000) / 1000] * 100 = (200 / 1000) * 100 = 0.20 * 100 = 20% - % Change in Income:

[(55,000 - 50,000) / 50,000] * 100 = (5,000 / 50,000) * 100 = 0.10 * 100 = 10% - IED:

20% / 10% = 2

An IED of 2 for designer handbags tells us something very important about this product.

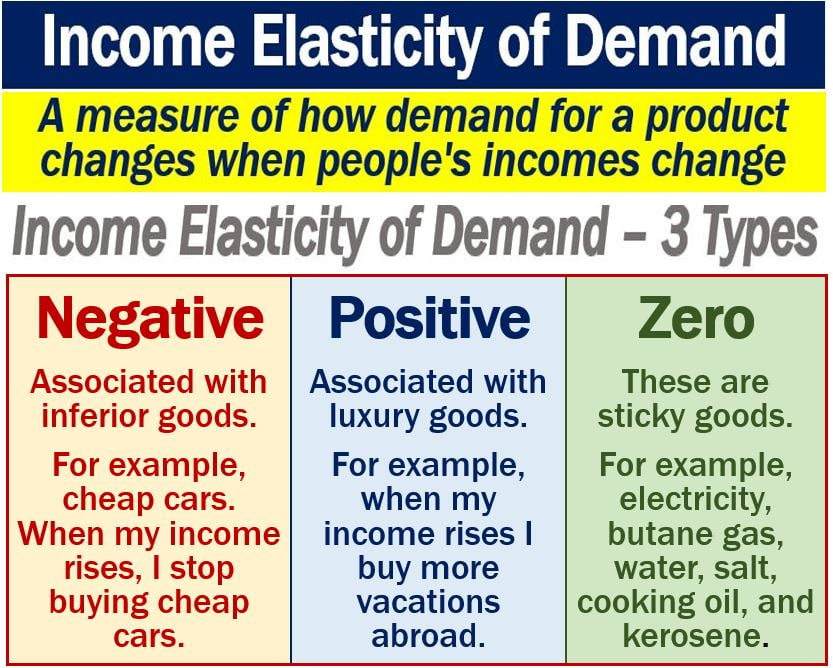

Types of Goods & Their Income Elasticity

The value you get from the IED formula categorizes your product into one of three main types, each with unique implications for your business:

1. Normal Goods (IED > 0)

Normal goods are those for which demand increases as consumer income increases. Most products fall into this category. However, within normal goods, there are two important sub-categories:

-

Necessities (0 < IED < 1):

- Meaning: Demand for these goods increases with income, but at a slower rate. Even if incomes rise significantly, people won’t buy that much more of these items. They are considered essential.

- Examples: Basic groceries (bread, milk), utilities (electricity, water), basic clothing, public transportation, affordable healthcare.

- Business Implication: These products tend to be more recession-proof. While sales might dip during an economic downturn, they usually don’t plummet as drastically as luxury items. Their demand is relatively stable, making them a safe bet for consistent revenue.

-

Luxury Goods (IED > 1):

- Meaning: Demand for these goods increases more than proportionally as consumer income increases. When people have more disposable income, they tend to spend a much larger percentage of that extra income on these items.

- Examples: High-end electronics, designer clothing, luxury cars, fine dining, international travel, second homes, premium subscriptions. (Our designer handbags example with an IED of 2 falls here).

- Business Implication: These products thrive during economic booms but are highly vulnerable during recessions or periods of income stagnation. They are often the first things consumers cut back on when tightening their belts. Businesses selling luxury goods need to be very agile and prepared for significant swings in demand.

2. Inferior Goods (IED < 0)

- Meaning: Demand for these goods actually decreases as consumer income increases. As people earn more, they tend to switch from these cheaper, lower-quality options to more expensive, higher-quality alternatives.

- Examples: Store-brand (generic) products, instant noodles, second-hand clothing, public transportation (when people can afford cars or taxis), budget airlines.

- Business Implication: These products perform well during economic downturns when consumers are looking for cheaper alternatives. However, they face challenges during economic booms as their target market upgrades to better options. Businesses selling inferior goods might consider focusing on cost-efficiency, targeting lower-income segments, or finding ways to improve perceived value without drastically increasing prices.

3. Zero Income Elasticity (IED = 0)

- Meaning: Demand for these goods does not change at all, regardless of income changes. These are extremely rare and apply to absolute necessities where consumption is already at its maximum practical level.

- Examples: Salt (you only need so much, regardless of income), life-saving medication (if universally accessible).

- Business Implication: For all practical purposes, most businesses won’t encounter products with a true IED of zero.

Why Income Elasticity Matters for Your Business: Strategic Applications

Understanding your product’s IED isn’t just an academic exercise; it’s a powerful strategic tool that can inform decisions across every department of your business.

1. Product Development & Portfolio Diversification

- Necessities: Consider developing new, slightly improved versions or complementary services for your core necessities. Focus on consistent quality and reliability.

- Luxuries: When the economy is strong, innovate and introduce new, higher-end luxury lines. During downturns, you might consider offering slightly more affordable "entry-level" luxury items or focus on experiences over pure product.

- Inferior Goods: If your product is inferior, think about how to create a "normal good" version or brand to offer customers as their income rises. This can involve improving quality, branding, or packaging.

- Diversification: A smart business often diversifies its product portfolio to include a mix of necessities and luxuries. This provides stability during downturns (necessities) and growth potential during booms (luxuries).

2. Pricing Strategy

- Necessities: Pricing is often competitive. Small price increases may not significantly impact demand, but large ones could drive customers to competitors. Focus on volume and operational efficiency.

- Luxuries: You have more leeway to charge premium prices, especially during economic upswings. Customers are paying for status, quality, and experience. However, be prepared to adjust pricing or offer value-added bundles during downturns to maintain sales.

- Inferior Goods: Price sensitivity is extremely high. Even small price increases can cause customers to switch to a competitor’s cheaper alternative or a superior normal good. Focus on being the most cost-effective option.

3. Marketing & Promotion

- Necessities: Marketing should emphasize reliability, value, everyday convenience, and perhaps health or safety benefits. Focus on broad reach and consistent messaging. Promotions might involve bulk discounts or loyalty programs.

- Luxuries: Marketing should evoke aspiration, exclusivity, status, and emotional connection. Highlight craftsmanship, unique features, and the lifestyle associated with the product. Promotions might be exclusive events or limited editions rather than simple discounts.

- Inferior Goods: Marketing should focus on extreme affordability, practicality, and meeting basic needs. Highlight cost savings and efficiency. Promotions will likely involve aggressive price cuts or multi-buy deals.

4. Inventory & Supply Chain Management

- Necessities: Maintain stable inventory levels, as demand is relatively predictable. Focus on efficient logistics to keep costs down.

- Luxuries: Adjust inventory levels dynamically. Stock up more during anticipated economic growth, and be prepared to reduce stock or clear inventory (through sales) quickly during downturns to avoid holding costly unsold goods.

- Inferior Goods: Anticipate increased demand during recessions. Ensure you have the capacity to meet this surge while maintaining low production costs.

5. Economic Forecasting & Recession Planning

- Knowing your IED allows you to better predict how economic cycles will impact your sales.

- Recession Prep: If you primarily sell luxury goods, you know a recession means significant challenges. You can prepare by:

- Building cash reserves.

- Developing contingency plans (e.g., temporary layoffs, production cuts).

- Exploring new, more affordable product lines.

- Shifting marketing spend to brand building rather than direct sales.

- Boom Prep: If you sell necessities, you might not see massive growth, but you can focus on efficiency and market share. If you sell luxuries, prepare to scale up production, marketing, and sales efforts to capitalize on increased consumer spending.

6. Market Research & Segmentation

- IED analysis helps you understand your target customer’s income bracket and how sensitive they are to income changes.

- You might discover new segments. For example, if your product is a "normal good" for one income group, it might be an "inferior good" for a higher-income group (who’d prefer a premium alternative) or a "luxury good" for a lower-income group (who can barely afford it).

Real-World Examples in Action

Let’s look at a few practical scenarios:

-

The Coffee Shop:

- Basic drip coffee (Necessity/Low IED Normal Good): Even if incomes dip, people will likely still buy their daily coffee, perhaps just a standard brew instead of a fancy latte. Sales are relatively stable.

- Specialty lattes and artisanal blends (Luxury/High IED Normal Good): During a boom, people splurge on these. During a downturn, they might cut back, making their coffee at home or opting for the basic drip.

- Strategy: The coffee shop should ensure a reliable supply of basic coffee and efficient service, while also being ready to promote and innovate with premium drinks when the economy is good.

-

The Automotive Industry:

- Used compact cars (Inferior Good): Demand for these often rises during recessions as people downsize or avoid new car debt.

- New mid-range sedans (Necessity/Low IED Normal Good): Stable demand, people replace them periodically.

- Luxury SUVs (Luxury/High IED Normal Good): Sales soar during good times, but plummet during economic uncertainty.

- Strategy: Car manufacturers often have diverse portfolios. They might ramp up used car offerings or cheaper models during downturns, while focusing on luxury and high-tech features during booms.

-

The Restaurant Sector:

- Fast-food value menus (Inferior Good): See increased traffic when incomes are tight.

- Casual dining (Necessity/Low IED Normal Good): Relatively stable, people still enjoy eating out, perhaps just less frequently.

- Fine dining (Luxury/High IED Normal Good): Heavily impacted by economic conditions; people cut back on expensive nights out first.

- Strategy: A restaurant group might own different brands catering to different IEDs, allowing them to hedge against economic fluctuations.

How to Calculate and Apply IED in Your Business (Practical Steps)

While economists use complex models, you can start with a simpler approach:

-

Gather Data:

- Sales Data: Track the quantity of your product sold over time (e.g., quarterly, annually).

- Income Data: This is trickier. You’ll need data on the average income of your target customer base. Sources can include:

- Government statistics (e.g., Census Bureau, Bureau of Economic Analysis for national/regional income trends).

- Market research reports.

- Internal customer surveys (if you collect income data responsibly and ethically).

- Industry reports.

- Proxy data like unemployment rates or consumer confidence indices (though these are indirect).

- Choose a Time Period: Compare sales and income changes over a specific period (e.g., year-over-year, or comparing a boom period to a bust period).

-

Perform the Calculation:

- Plug your % change in quantity demanded and % change in income into the IED formula.

-

Interpret the Results:

- Is the IED positive or negative? (Normal vs. Inferior)

- If positive, is it between 0 and 1 (Necessity) or greater than 1 (Luxury)?

-

Formulate Strategic Actions:

- Based on your IED, revisit your:

- Product roadmap: Are you developing the right products for future economic scenarios?

- Pricing strategy: How flexible should your prices be?

- Marketing messages: What resonates most with your income-sensitive customers?

- Inventory plans: How much buffer do you need?

- Financial projections: Are your revenue forecasts realistic given potential income shifts?

- Based on your IED, revisit your:

Challenges and Considerations

- Data Accuracy: Obtaining precise income data for your specific customer segment can be challenging. Proxies might be necessary but introduce some inaccuracy.

- Other Factors: IED doesn’t account for other influences on demand, such as price changes, competitor actions, advertising effectiveness, or shifts in consumer tastes. It’s one piece of a larger puzzle.

- Dynamic Nature: IED is not static. A product that was once a luxury might become a necessity over time (e.g., smartphones). Consumer preferences and market conditions constantly evolve.

- Segmentation: IED can vary significantly across different customer segments. A product might be a necessity for high-income earners but a luxury for low-income earners.

Conclusion: Don’t Just Sell, Strategize!

Income Elasticity of Demand is more than just an economic theory; it’s a vital framework for understanding how economic tides can impact your business. By taking the time to assess your products’ IED, you gain a significant competitive advantage.

You can:

- Anticipate shifts in consumer behavior.

- Optimize your product portfolio for resilience and growth.

- Tailor your marketing and pricing for maximum impact.

- Prepare your business for both economic booms and challenging downturns.

In a world where consumer incomes are constantly fluctuating, businesses that understand and adapt to Income Elasticity of Demand are the ones best positioned to not just survive, but truly thrive. Start analyzing your numbers today – your bottom line will thank you!

:max_bytes(150000):strip_icc()/IncomeElasticityDemand_Final_4194762-d43e702e8a384ec6beaddae86ac6a0e8.jpg)

Post Comment