How to Stick to Your Budget Long-Term: Your Ultimate Guide to Lasting Financial Freedom

Ever felt great after setting up a budget, only to find yourself off track a few weeks or months later? You’re not alone. Sticking to a budget long-term can feel like an uphill battle, but it’s the key to achieving your financial goals, reducing stress, and building true financial freedom.

This comprehensive guide will break down the essential strategies, mindset shifts, and practical tips you need to not only create a budget but stick to it consistently for years to come. Whether you’re a complete beginner or looking to get back on track, let’s turn your budgeting attempts into lasting success.

Why Budgets Often Fail (And How to Fix It!)

Before we dive into the "how," let’s quickly understand why so many people struggle to stick with their budget:

- Too Restrictive: Budgets that cut out all fun or "wants" are unsustainable.

- Unrealistic Expectations: Life happens! Unexpected expenses or changes in income can derail even the best-laid plans.

- Lack of Tracking: Without knowing where your money truly goes, it’s impossible to make informed decisions.

- Giving Up Too Soon: One bad week or month can lead to abandoning the entire effort.

- No Clear "Why": Without a strong motivation, it’s easy to lose steam.

- Complexity: Overly complicated budgeting systems can be overwhelming.

The good news? Every one of these challenges can be overcome with the right approach and mindset.

The Foundation: Setting Yourself Up for Long-Term Budgeting Success

Sticking to your budget isn’t just about crunching numbers; it’s about building sustainable habits and a positive financial mindset.

1. Define Your "Why" (Your Financial North Star)

This is the most crucial step. What are you budgeting for? Your "why" is your motivation, your reason to keep going when things get tough.

- Examples of a strong "why":

- Paying off credit card debt to eliminate stress.

- Saving for a down payment on your dream home.

- Building an emergency fund for peace of mind.

- Saving for a memorable family vacation.

- Achieving early retirement or financial independence.

- Having money to invest in your children’s education.

Action Step: Grab a pen and paper. Write down your top 1-3 financial goals. Make them specific and emotionally resonant. Keep them somewhere visible as a constant reminder.

2. Know Where Your Money Truly Goes (Track Everything!)

You can’t manage what you don’t measure. Before you even create a budget, spend a month tracking every single dollar you spend. This isn’t about judgment; it’s about awareness.

- How to Track Your Spending:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), or EveryDollar link to your bank accounts and automatically categorize transactions.

- Spreadsheets: Create a simple spreadsheet in Excel or Google Sheets. Manually enter all your transactions.

- Pen and Paper: Keep a small notebook in your pocket and jot down every purchase.

- Bank Statements: Review your bank and credit card statements at the end of the month to see where your money went.

Action Step: Choose a tracking method and commit to tracking every expense for at least one full month. You’ll be amazed at what you discover about your spending habits.

Building Your Sustainable Budget: Practical Steps

Once you understand your spending, it’s time to build a budget that works for you, not against you.

3. Choose a Budgeting Method That Fits Your Style

There’s no one-size-fits-all budget. Find a method that resonates with your personality and financial situation.

-

The 50/30/20 Rule:

- 50% Needs: Housing, utilities, groceries, transportation, insurance, minimum debt payments.

- 30% Wants: Dining out, entertainment, hobbies, new clothes, vacations.

- 20% Savings & Debt Repayment: Emergency fund, retirement, extra debt payments.

- Why it works: Simple, flexible, and allows for both saving and enjoying life.

-

Zero-Based Budgeting:

- Every dollar has a job. Your income minus your expenses should equal zero.

- How it works: You assign every dollar to a category (spending, saving, debt) until your balance is zero. This ensures no money is "lost" or spent mindlessly.

- Why it works: Gives you complete control over your money and forces intentional spending.

-

The Envelope System (Cash Stuffing):

- How it works: Withdraw cash for variable spending categories (groceries, entertainment, personal care) and put the money into physical envelopes labeled for each category. Once an envelope is empty, you stop spending in that category until the next pay period.

- Why it works: Excellent for visual learners and those who tend to overspend with cards. It makes spending feel "real."

Action Step: Research these methods briefly and pick one to try. Don’t be afraid to experiment if the first one doesn’t click.

4. Create Your Budget (Be Realistic, Not Restrictive)

Now, use your spending data from Step 2 to fill in your chosen budgeting method.

- List Your Income: All take-home pay from all sources.

- List Your Fixed Expenses: Rent/mortgage, loan payments, insurance, subscriptions. These are generally the same each month.

- List Your Variable Expenses: Groceries, dining out, entertainment, gas, utilities (these fluctuate). Use your tracking data to estimate realistic amounts.

- Allocate to Savings & Debt: Don’t forget your "pay yourself first" money! This includes your emergency fund, retirement, and any extra debt payments.

- Include a "Fun Money" or "Buffer" Category: This is crucial for long-term success. Give yourself a small allowance for guilt-free spending on whatever you want. Also, include a small "miscellaneous" or "buffer" category for unexpected small expenses.

Action Step: Draft your first budget. Be honest with yourself about your spending habits. It’s better to overestimate slightly than to create a budget that’s impossible to stick to.

5. Build in Flexibility (The Secret Sauce for Sticking to It)

Rigid budgets break. Flexible budgets bend and adapt.

- The "Miscellaneous" or "Buffer" Category: Set aside a small amount (e.g., $50-$100) for things you didn’t plan for. This prevents small unexpected costs from derailing your entire budget.

- Sinking Funds: These are mini-savings accounts for anticipated but irregular expenses.

- Examples: Car maintenance, holiday gifts, annual subscriptions, medical co-pays, vacation.

- How it works: Instead of being hit with a $500 car repair bill out of nowhere, you save $40 a month into a "Car Maintenance" sinking fund. When the expense comes, the money is already there.

Action Step: Identify 2-3 common irregular expenses you face and start a small sinking fund for each.

6. Automate Your Savings and Bill Payments

This is where you make your budget work for you without constant willpower.

- "Pay Yourself First": Set up automatic transfers from your checking account to your savings, investment, and debt repayment accounts immediately after you get paid. Even $25 a week adds up.

- Automate Bills: Set up automatic payments for all your fixed expenses (rent, utilities, loans, subscriptions) to avoid late fees and stress.

Action Step: Go into your online banking and set up at least one automatic transfer to your savings or investment account today.

Maintaining Momentum: Long-Term Strategies

Once your budget is set up, the real work (and reward) comes from consistently applying and adjusting it.

7. Review and Adjust Your Budget Regularly

Your budget isn’t set in stone. Life changes, and so should your budget.

- Weekly Check-ins (5-10 minutes):

- Review recent transactions.

- Update your spending categories.

- See where you stand for the week/month.

- Monthly Review (30-60 minutes):

- Compare your actual spending to your budget.

- Identify categories where you overspent or underspent.

- Adjust category amounts for the next month based on what you learned.

- Update income or fixed expenses if anything has changed.

- Revisit your financial goals.

- Quarterly/Annual Deep Dive:

- Review progress towards major goals.

- Adjust for seasonal spending (holidays, summer travel).

- Consider new financial goals or changes in your life (new job, family changes).

Action Step: Schedule a recurring "Budget Review" appointment in your calendar for a specific time each week and month. Treat it like an important meeting.

8. Find Your Budgeting Tools (Apps, Spreadsheets, Software)

The right tool can make budgeting easier and more engaging.

- Popular Budgeting Apps:

- Mint: Free, tracks spending, categorizes transactions, sets budgets, bill reminders.

- YNAB (You Need A Budget): Paid, excellent for zero-based budgeting, focuses on giving every dollar a job.

- EveryDollar: Free/Paid, simple interface, great for beginners, uses a zero-based approach.

- Personal Capital: Free, great for tracking investments and net worth alongside spending.

- Spreadsheets: Google Sheets or Excel templates can be customized to your needs. Search for "budget template" online.

Action Step: If you haven’t already, explore a few budgeting apps or find a good spreadsheet template to help you visualize and manage your money.

9. Deal with Budget Blips and Mistakes Gracefully

You will go over budget sometimes. You will make impulsive purchases. It’s okay! The key is how you respond.

- Don’t Give Up: One "bad" day or week doesn’t ruin your entire financial journey. Think of it like a diet – one slice of cake doesn’t mean you abandon healthy eating forever.

- Learn from It: What triggered the overspending? Was it an emotional purchase, an unexpected event, or an unrealistic budget category? Adjust your plan for next time.

- "Roll with the Punches": If you overspend in one category, try to find the money from another non-essential category for the current month.

- Forgive Yourself: Financial progress is a marathon, not a sprint. Every setback is an opportunity to learn and refine your approach.

Action Step: When you inevitably slip up, take a deep breath. Analyze why it happened, make a small adjustment, and get right back on track.

10. Celebrate Your Wins (Big and Small!)

Budgeting can feel like a chore if it’s all about restriction. Acknowledge your progress!

- Small Wins: Paid off a credit card, stayed within budget for groceries, saved an extra $50, hit a savings goal.

- Big Wins: Paid off a major debt, reached your emergency fund goal, made a down payment.

How to Celebrate (Budget-Friendly!):

- Treat yourself to a nice coffee.

- Have a movie night at home.

- Enjoy a picnic in the park.

- Buy that book you’ve been wanting.

- Share your success with a supportive friend or family member.

Action Step: Set small, achievable milestones and plan a non-spending reward for each.

11. Continuously Educate Yourself

The world of personal finance is vast and always evolving. The more you learn, the more confident and capable you’ll become.

- Read Books: "The Total Money Makeover" by Dave Ramsey, "The Richest Man in Babylon" by George S. Clason, "I Will Teach You To Be Rich" by Ramit Sethi are great starting points.

- Listen to Podcasts: "BiggerPockets Money," "Stacking Benjamins," "Afford Anything."

- Follow Reputable Blogs/Websites: NerdWallet, Investopedia, The Balance, personal finance blogs.

- Join Online Communities: Find supportive groups where you can ask questions and share experiences.

Action Step: Commit to learning one new financial concept or reading one financial article/chapter each week.

The Long-Term Benefits of Sticking to Your Budget

Consistently managing your money isn’t just about avoiding debt; it’s about transforming your entire life.

- Reduced Financial Stress: Knowing where your money is going and having a plan creates immense peace of mind.

- Achieve Your Financial Goals Faster: Your "why" becomes a reality when you’re intentional with your money.

- Increased Savings & Investments: You’ll build wealth and secure your future.

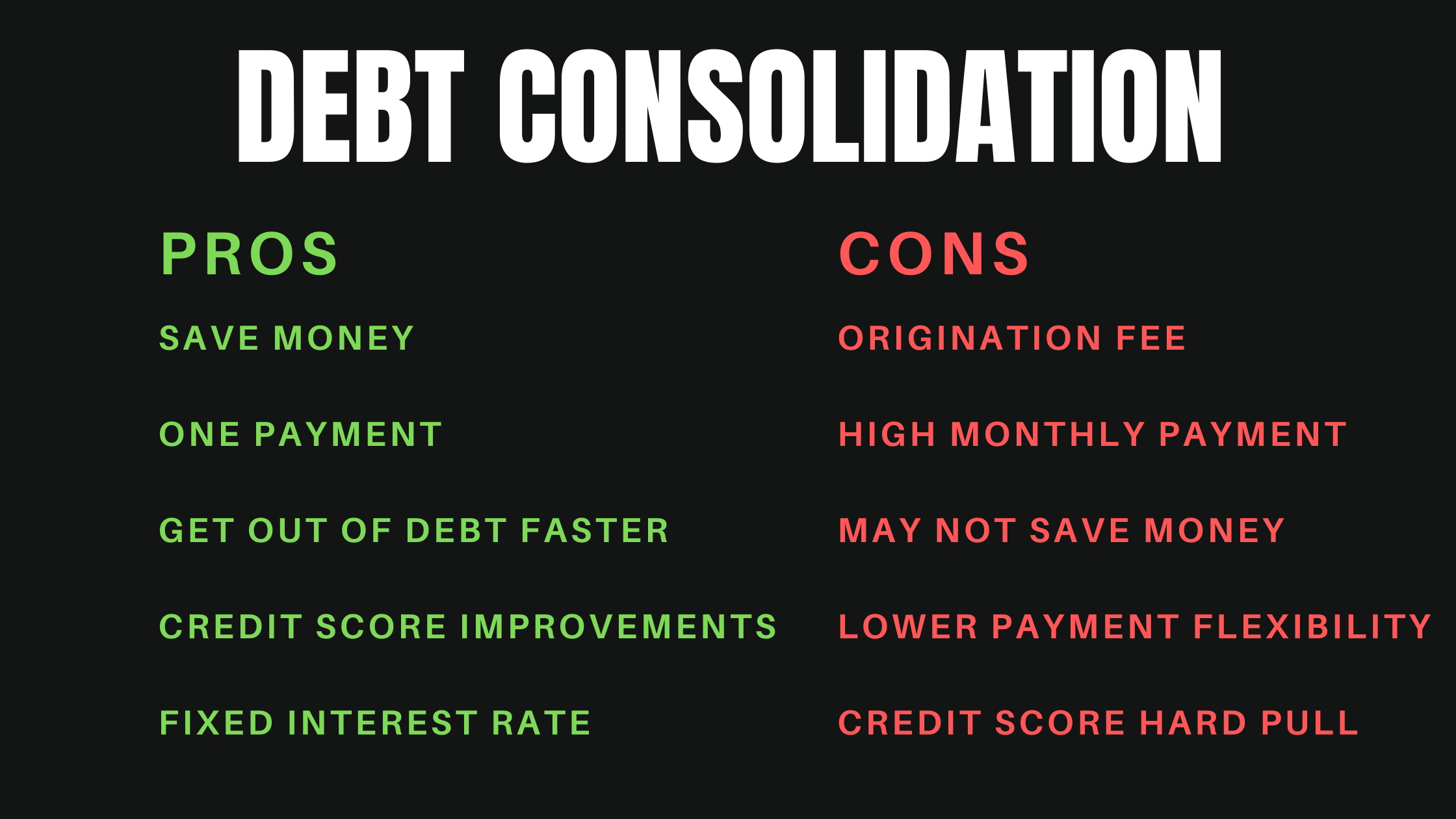

- Debt Reduction: Get out of debt faster and stay out of it.

- More Freedom & Choices: Financial stability opens up opportunities – whether it’s career changes, travel, or giving back.

- Improved Relationships: Money arguments are a leading cause of relationship stress. A shared budget can foster teamwork.

- Emergency Preparedness: An emergency fund provides a crucial safety net for life’s unexpected challenges.

Conclusion: Your Journey to Lasting Financial Freedom Starts Now

Sticking to your budget long-term isn’t a one-time fix; it’s an ongoing journey of learning, adapting, and growing. It requires discipline, yes, but also self-compassion and a willingness to adjust.

By understanding your "why," tracking your spending, choosing a realistic budgeting method, building in flexibility, automating your savings, and regularly reviewing your progress, you’ll transform your relationship with money.

Don’t wait for the "perfect" time. Start today. Pick one small action step from this guide and implement it. Every consistent step, no matter how small, builds momentum towards lasting financial freedom. You have the power to take control of your money and create the life you desire.

Post Comment