How to Save for Your First Car: Your Ultimate Beginner’s Guide

Dreaming of hitting the open road in your very own car? It’s an exciting milestone, offering newfound freedom and independence. But before you can cruise into the sunset, there’s a crucial step: saving up! For many, especially first-time car buyers, the idea of saving thousands of dollars can feel overwhelming.

Don’t worry, you’re not alone, and it’s absolutely achievable! This comprehensive guide will break down exactly how to save for your first car, making the process clear, manageable, and even fun. We’ll cover everything from setting realistic goals to smart saving strategies, ensuring you’re well-prepared for this exciting journey.

Why Saving for Your First Car is Smart

You might be thinking, "Why save when I can just get a loan?" While loans are an option, saving a substantial amount (or even the full price) for your first car offers significant advantages:

- Lower Monthly Payments (or None!): The more you save for a down payment, the less you’ll need to borrow, resulting in smaller monthly loan payments. If you save the entire amount, you’ll have no car payments at all!

- Less Debt: Avoiding or minimizing a car loan means less debt hanging over your head. This frees up your money for other important goals, like education, a home, or travel.

- Reduced Interest Paid: Car loans come with interest. The less you borrow, the less interest you pay over time, saving you hundreds or even thousands of dollars.

- Better Negotiation Power: When you’re a cash buyer, you have more leverage to negotiate a better price. Dealerships love cash buyers because it simplifies the transaction.

- Financial Discipline: The process of saving for a big purchase like a car teaches you valuable financial habits that will serve you well for life.

Before You Start Saving: Key Considerations

Before you even think about putting money aside, it’s vital to have a clear picture of what you’re saving for. This isn’t just about the car’s sticker price!

1. What Kind of Car Do You Need (and Can Afford)?

It’s fun to dream, but it’s smarter to be realistic. For a first car, consider:

- Used vs. New: A used car is almost always more affordable, especially for a first vehicle. New cars depreciate (lose value) very quickly.

- Reliability: Look for brands and models known for their durability and low maintenance costs (e.g., Toyota Corolla, Honda Civic, older Mazda 3).

- Size & Type: Do you need a compact car for city driving, an SUV for family trips, or something in between?

- Features: What are your must-haves versus nice-to-haves? Air conditioning, power windows, and safety features are often standard now, but fancy tech might increase the price.

2. The True Cost of Car Ownership (Beyond the Price Tag)

Many first-time buyers forget about the ongoing costs. Factor these into your overall savings goal:

- Purchase Price: The actual cost of the car.

- Sales Tax: Varies by state/province, but typically 5-10% of the car’s price.

- Registration & Title Fees: One-time fees to legally own and register the car.

- Car Insurance: This is a major cost, especially for young or new drivers. Get quotes before you buy to understand your potential monthly or annual expense.

- Fuel (Gas): How much will you drive? Gas prices fluctuate, so budget generously.

- Maintenance & Repairs: Oil changes, tire rotations, unexpected repairs. A general rule of thumb is to set aside $50-$100 per month for maintenance.

- Parking Fees/Tolls: If applicable in your area.

Action Step: Research a few specific car models you’re interested in. Look up their typical used prices, average insurance costs for someone your age, and estimated fuel efficiency. This will help you set a more accurate savings goal.

Your Step-by-Step Car Savings Plan

Now, let’s get down to the practical steps of saving money for your first car.

Step 1: Set a Clear, Specific, and Realistic Goal

This is your target. Don’t just say "I want a car."

- What’s the total amount you need? (Car price + taxes + fees + first few months of insurance + maintenance buffer).

- When do you want to buy it? (Set a realistic timeframe – 6 months, 1 year, 2 years?).

Example: "I want to buy a used Honda Civic for $8,000 (including tax/fees) in 12 months. I’ll also save an extra $1,000 for initial insurance and maintenance, making my total goal $9,000."

Step 2: Create a Realistic Budget

A budget isn’t about restricting yourself; it’s about understanding where your money goes so you can make informed choices.

- Track Your Income: List all money coming in (allowance, job paychecks, gifts, etc.).

- Track Your Expenses: For a month, write down everything you spend money on. Yes, everything – that coffee, the snack, the streaming service, bus fare. Categorize them (e.g., Food, Entertainment, Transportation, Clothes, etc.). There are free budgeting apps (Mint, YNAB, PocketGuard) or simply use a spreadsheet or notebook.

- Identify Fixed vs. Variable Expenses:

- Fixed: Rent, phone bill, subscriptions (usually the same every month).

- Variable: Food, entertainment, shopping (can change based on your choices).

- Calculate Your "Savings Potential":

- Income – Fixed Expenses = Money Left for Variable Expenses & Savings

- Money Left – Average Variable Expenses = Potential Savings

Step 3: Trim the Fat: Cutting Expenses

This is where you make real progress! Look at your variable expenses from Step 2. Where can you cut back without feeling deprived?

- Coffee & Takeout: Brewing coffee at home and packing lunches can save hundreds over a year.

- Subscriptions: Do you really use all those streaming services, apps, or gym memberships? Cancel or downgrade unused ones.

- Shopping: Before buying something, ask yourself: "Do I need this, or do I just want it?" Can you find it used? Can you wait?

- Entertainment: Look for free or low-cost activities (parks, libraries, free events). Have friends over instead of going out.

- Transportation: Walk, bike, or use public transport more often if possible.

- DIY: Learn to do simple tasks yourself instead of paying others (e.g., basic cooking, cleaning).

Tip: Try the "No-Spend Challenge" for a week or even a month, where you only spend on absolute necessities. It’s an eye-opening exercise!

Step 4: Boost Your Income: Earning More Money

Cutting expenses is great, but increasing your income can accelerate your savings dramatically.

- Get a Part-Time Job: If you don’t have one, this is the most direct way to earn money. Look for something flexible that fits your schedule.

- Do Odd Jobs: Offer services to neighbors, friends, or family:

- Babysitting or pet-sitting

- Lawn care/gardening

- Car washing/detailing

- Tutoring

- Running errands

- Sell Unused Items: Declutter your home and sell clothes, electronics, books, or furniture you no longer need on platforms like eBay, Depop, Facebook Marketplace, or local consignment shops.

- Freelance/Gig Work: If you have a specific skill (writing, graphic design, social media, web design), explore online freelance platforms.

- Ask for Raises (if applicable): If you’re already employed, and you’ve taken on more responsibility or improved your skills, consider asking for a pay bump.

- Save Gift Money: Birthdays, holidays – put all or a significant portion of monetary gifts directly into your car fund.

Step 5: Open a Dedicated Savings Account

This is crucial for keeping your car money separate and avoiding accidental spending.

- High-Yield Savings Account: Look for an online savings account that offers a higher interest rate than traditional banks. While the interest won’t make you rich, every little bit helps!

- Automate Transfers: Set up automatic transfers from your checking account to your car savings account every time you get paid. Even $25 or $50 a week adds up quickly! "Pay yourself first" is a golden rule of saving.

Step 6: Track Your Progress and Celebrate Milestones

Seeing your savings grow is incredibly motivating.

- Visual Tracker: Use a progress bar, a thermometer chart, or even a simple spreadsheet. Color in sections as you reach financial milestones.

- Savings Apps: Many budgeting apps also allow you to set goals and track progress.

- Reward Yourself (Small, Non-Financial): When you hit a certain percentage of your goal (e.g., 25%, 50%), treat yourself to something small and free or very low-cost, like a movie night at home or a walk in your favorite park.

Staying Motivated on Your Savings Journey

Saving for a big goal takes time and discipline. Here’s how to keep your spirits high:

- Visualize Your Goal: Picture yourself driving your car. Imagine the places you’ll go, the freedom you’ll have. Keep a picture of your dream car (or a realistic target car) in your saving space.

- Stay Positive: There might be setbacks or times you feel like giving up. Remind yourself why you started.

- Learn from Setbacks: If you overspent one month, don’t dwell on it. Analyze what happened, adjust your budget for the next month, and get back on track.

- Share Your Goal (Carefully): Tell supportive friends or family about your goal. They can offer encouragement, but be mindful of unsolicited advice or peer pressure.

- Remember the "Why": Why do you want this car? Is it for a job, school, independence, or just fun? Keep that reason front and center.

You’ve Saved It! Now What?

Congratulations! Reaching your savings goal is a huge accomplishment. Here are quick next steps:

- Final Research: Re-confirm your chosen car model and current market prices.

- Vehicle Inspection: If buying used, always get a pre-purchase inspection from an independent mechanic. This can save you from buying a lemon.

- Insurance: Secure your car insurance before you drive the car off the lot.

- Negotiate: Don’t be afraid to negotiate the price, especially if paying cash.

Frequently Asked Questions (FAQs) About Saving for Your First Car

Q1: How much money should I save for my first car?

A: This depends on the car, but aim for the full purchase price if possible, plus an extra 15-20% to cover sales tax, registration, initial insurance, and a small maintenance fund. For a used car costing $5,000, you might aim for $6,000-$6,500 total.

Q2: How long will it take me to save for a car?

A: This varies greatly based on your income, expenses, and savings goal.

- Small Goal ($3,000 – $5,000): 6 months to 1 year (saving $250-$400/month)

- Medium Goal ($6,000 – $10,000): 1-2 years (saving $400-$800/month)

- Larger Goal ($10,000+): 2+ years

The more you can cut expenses and increase income, the faster you’ll reach your goal.

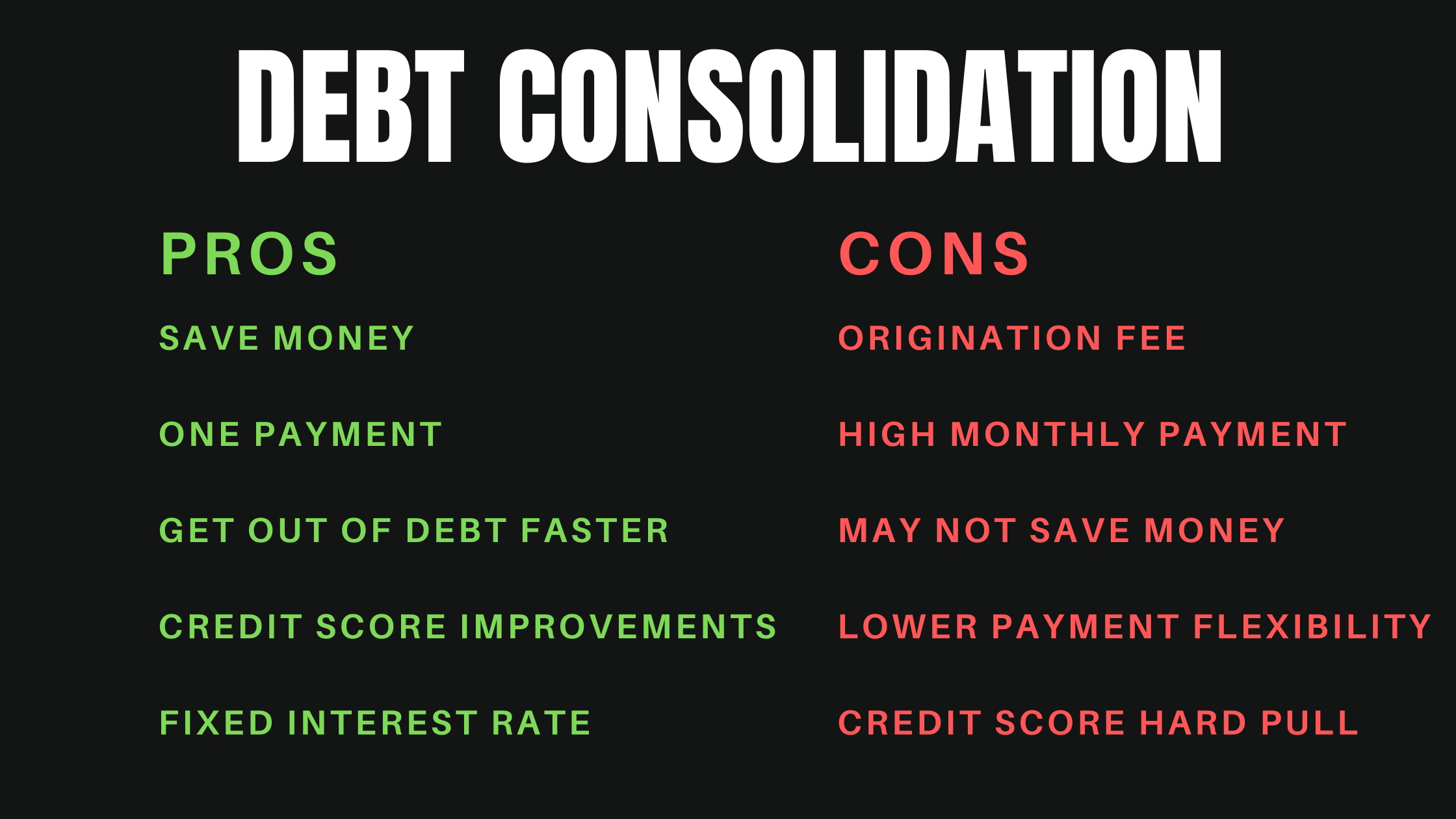

Q3: Should I get a car loan for my first car?

A: While saving cash is ideal, a small, manageable loan for a portion of the car’s price can be an option if you have a stable income and a good credit history (or a co-signer). However, always prioritize saving as much as possible for a down payment to minimize the loan amount and interest paid.

Q4: What about car insurance for a first-time driver?

A: Car insurance can be expensive for young or new drivers. Always get quotes before you buy a car. Factors like the car’s make/model, your age, driving record, and location all impact the price. Look into discounts for good grades, safe driving courses, or bundling with family policies.

Q5: Is it better to save for a used car or a new car as a first car?

A: For your first car, a reliable used car is almost always the better financial choice. New cars lose a significant portion of their value the moment they leave the dealership, making them a less efficient investment for a beginner. Used cars are more budget-friendly and still offer excellent performance and safety.

Saving for your first car is a significant financial undertaking, but by following these steps, you’ll be well on your way to achieving your goal. It requires discipline, planning, and smart choices, but the reward of driving your own car, knowing you saved for it, is truly priceless. Start today – even small steps lead to big destinations!

Post Comment