How to Save for a Down Payment on a House: Your Ultimate Beginner’s Guide

The dream of owning a home is a powerful one – a place to call your own, build equity, and create lasting memories. But for many, the biggest hurdle to turning that dream into a reality is the down payment. It can seem like a daunting sum, but with the right strategy, dedication, and a clear understanding of the process, saving for a down payment is entirely achievable.

This comprehensive guide will break down everything you need to know about saving for your first home, making the journey clear, manageable, and even exciting!

Table of Contents:

- Understanding the Down Payment: What Is It, Really?

- How Much Do You Really Need? Setting Realistic Goals

- Getting Started: Laying Your Financial Foundation

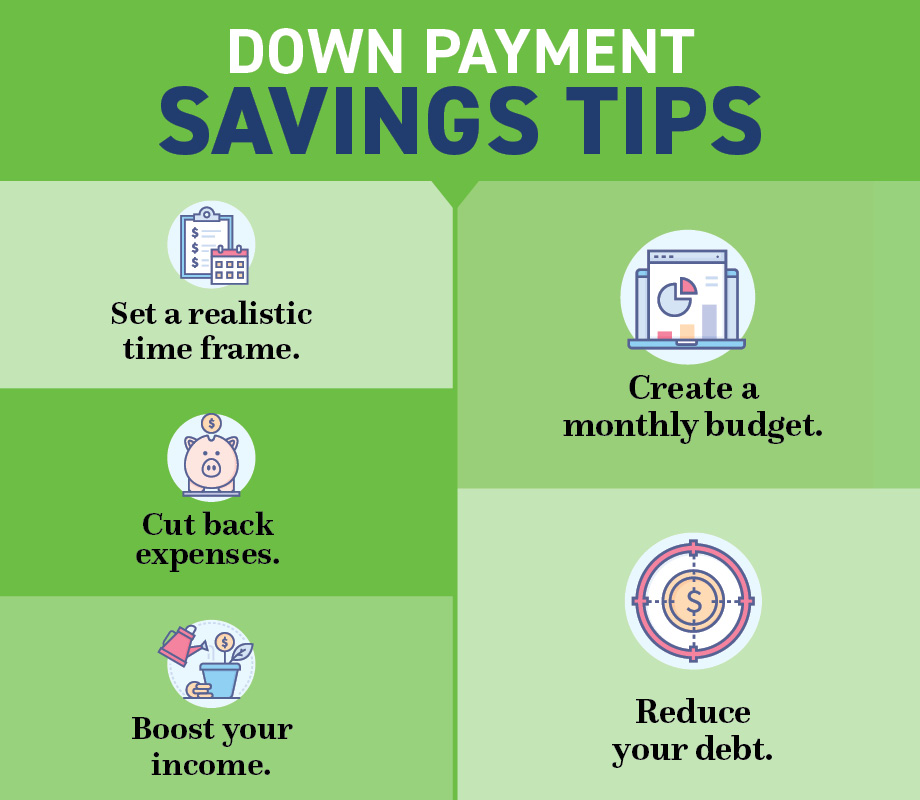

- Define Your Goal & Timeline

- Create a Detailed Budget (and Stick to It!)

- Open a Dedicated Savings Account

- Proven Strategies to Boost Your Savings

- Cut Expenses Ruthlessly (Initially!)

- Increase Your Income

- Automate Your Savings

- Apply the "Windfall" Rule

- Embrace Frugal Habits

- Accelerating Your Down Payment Savings

- Explore Down Payment Assistance Programs

- Understand Gift Funds

- Consider Borrowing from Retirement (with Caution!)

- Sell Unused Assets

- Avoiding Common Pitfalls

- Maintaining Momentum & Staying Motivated

- Conclusion: Your Homeownership Journey Begins Now!

1. Understanding the Down Payment: What Is It, Really?

Before you start saving, it’s essential to understand what a down payment is and why it’s so important.

A down payment is the initial cash amount you pay upfront when purchasing a house. It’s a percentage of the home’s total purchase price, and it reduces the amount you need to borrow from a lender (your mortgage).

Why is it important?

- Reduces Your Loan Amount: A larger down payment means a smaller mortgage, which translates to lower monthly mortgage payments and less interest paid over the life of the loan.

- Builds Instant Equity: The down payment immediately gives you a stake in the property.

- Avoids Private Mortgage Insurance (PMI): If you put down less than 20% of the home’s purchase price on a conventional loan, lenders typically require you to pay for Private Mortgage Insurance (PMI). This is an extra monthly fee that protects the lender if you default on your loan. By putting down 20% or more, you can avoid this added cost.

- Better Loan Terms: A larger down payment often makes you a more attractive borrower to lenders, potentially qualifying you for better interest rates and loan terms.

2. How Much Do You Really Need? Setting Realistic Goals

This is often the first question aspiring homeowners ask, and the answer can vary.

The "Ideal" 20% Down Payment:

Historically, the 20% down payment has been considered the gold standard because it allows you to avoid PMI and typically secures the best interest rates. For a $300,000 home, a 20% down payment would be $60,000.

The Reality: Less Than 20% is Common!

Many first-time homebuyers put down significantly less than 20%. In fact, the average down payment for first-time buyers is often closer to 6-7%. There are many loan programs designed to help:

- FHA Loans: Backed by the Federal Housing Administration, these loans often require as little as 3.5% down. They have more flexible credit requirements but do require Mortgage Insurance Premium (MIP) for the life of the loan in most cases.

- VA Loans: For eligible veterans, service members, and surviving spouses, VA loans are an incredible benefit, often requiring 0% down payment! They also have no PMI.

- USDA Loans: For properties in eligible rural areas, USDA loans also offer 0% down payment for qualifying low-to-moderate-income buyers.

- Conventional Loans with Low Down Payments: Some conventional loan programs now offer options for as little as 3% or 5% down, though these will usually require PMI until you build enough equity.

Don’t Forget Closing Costs!

On top of your down payment, you’ll also need to budget for closing costs. These are fees associated with finalizing your mortgage and home purchase, including things like appraisal fees, loan origination fees, title insurance, and more. They typically range from 2% to 5% of the loan amount. So, for a $300,000 home, expect an additional $6,000 to $15,000 in closing costs.

Your Action Step:

Research average home prices in your desired area and then calculate what a 3.5%, 5%, 10%, or 20% down payment would look like. Add an estimated 3-5% for closing costs. This will give you a concrete savings goal!

3. Getting Started: Laying Your Financial Foundation

Once you have a target amount, it’s time to build the framework for your savings success.

Define Your Goal & Timeline

- Be Specific: Instead of "save for a down payment," aim for "save $40,000 for a down payment and closing costs in 3 years."

- Break It Down: Divide your total goal by the number of months in your timeline to get a monthly savings target. (e.g., $40,000 / 36 months = ~$1,111 per month). This makes a large number feel much more manageable.

- Be Realistic: Don’t set yourself up for failure with an impossible target. It’s better to extend your timeline slightly than to get discouraged and give up.

Create a Detailed Budget (and Stick to It!)

This is the cornerstone of any successful savings plan.

- Track Your Spending: For at least a month, meticulously track every dollar you spend. Use an app (Mint, YNAB), a spreadsheet, or even a notebook. This reveals where your money is really going.

- Categorize Expenses: Group your spending into categories like housing, food, transportation, entertainment, utilities, etc.

- Identify Needs vs. Wants:

- Needs: Rent, groceries, essential utilities, transportation to work, debt payments.

- Wants: Eating out, subscriptions, new clothes, vacations, daily lattes.

- Find Areas to Cut: Once you see where your money is going, you can identify areas to reduce spending. Even small cuts add up significantly over time.

- Allocate Funds: Assign a specific amount for each category for the upcoming month, ensuring your savings goal is prioritized.

Open a Dedicated Savings Account

- Separate Your Funds: Open a separate savings account specifically for your down payment. This makes it feel real and helps you avoid dipping into it for other expenses.

- High-Yield Savings Account (HYSA): Look for an online bank that offers a high-yield savings account. These accounts typically offer significantly higher interest rates than traditional brick-and-mortar banks, allowing your money to grow faster (even if only slightly).

- Make it Difficult to Access: Consider an account that isn’t instantly linked to your checking account for easy transfers. The slight friction can prevent impulse spending.

4. Proven Strategies to Boost Your Savings

Now for the actionable steps that will fill your down payment fund!

Cut Expenses Ruthlessly (Initially!)

Think of this as a temporary "down payment diet." Every dollar saved is a dollar closer to your home.

- Review Subscriptions: Cancel unused streaming services, gym memberships, or apps.

- Cook at Home More: Eating out, even fast food, adds up quickly. Meal prep can save a fortune.

- Reduce Entertainment Costs: Look for free or low-cost activities (parks, libraries, board games).

- Limit Impulse Buys: Unsubscribe from marketing emails. Think before you buy.

- Negotiate Bills: Call your internet, cable, or insurance providers and ask for a lower rate.

- Reduce Transportation Costs: Carpool, use public transport, bike, or walk more.

- Cut Back on Vices: Smoking, excessive drinking, or gambling can be huge money drains.

Increase Your Income

Saving isn’t just about spending less; it’s also about earning more!

- Side Hustle: Deliver food, drive for a ride-share service, freelance your skills (writing, graphic design, web design), pet-sit, tutor, or create and sell crafts online.

- Ask for a Raise: If you’ve been excelling at work, build a case for a raise.

- Sell Unused Items: Declutter your home and sell clothes, electronics, furniture, or collectibles on platforms like eBay, Facebook Marketplace, or local consignment shops.

- Take on Extra Shifts: If your job allows, pick up more hours.

Automate Your Savings

This is arguably the most powerful savings strategy.

- Set Up Automatic Transfers: On payday, have a set amount automatically transfer from your checking account to your dedicated down payment savings account. "Pay yourself first!"

- Treat it Like a Bill: Don’t think of it as "extra money to save." Think of it as a non-negotiable bill you must pay every month.

Apply the "Windfall" Rule

- Bonus Checks: Got a work bonus? Deposit 100% of it into your down payment fund.

- Tax Refunds: Direct your entire tax refund to your savings.

- Gifts: Birthday money, holiday gifts – if you don’t need them for essentials, save them.

- Unexpected Income: If you receive money from selling something, a legal settlement, or any other unexpected source, commit to saving a large portion of it.

Embrace Frugal Habits

- "No-Spend" Days/Weeks: Challenge yourself to spend no money for a day or even a week, buying only absolute necessities.

- Pack Your Lunch: A small daily savings that adds up.

- Make Your Own Coffee: Your daily $5 coffee is $1,825 a year!

- Buy Generic Brands: Often just as good as name brands for less.

- Borrow, Don’t Buy: Need a tool? Check if a friend has one before heading to the store. Use your local library for books and movies.

5. Accelerating Your Down Payment Savings

Once you’ve got the basics down, explore these options to supercharge your fund.

Explore Down Payment Assistance Programs (DAPs)

Many states, counties, and cities offer programs to help first-time homebuyers with down payments and closing costs. These can come in various forms:

- Grants: Money you don’t have to pay back.

- Second Mortgages: Low-interest loans that are deferred or forgivable after a certain period (e.g., 5-10 years of living in the home).

- Matched Savings Programs: Some programs match a certain amount you save.

Where to Look:

- Your state’s housing finance agency (HFA) website.

- Local city or county housing departments.

- Non-profit organizations focused on housing.

- Ask a local lender or real estate agent – they often have up-to-date information.

Understand Gift Funds

Family members (or even close friends) can sometimes "gift" you money towards your down payment.

- IRS Rules: The IRS has specific rules for gift funds. The money must truly be a gift (not a loan) and must be documented with a "gift letter" signed by the giver and borrower, stating the money doesn’t need to be repaid.

- Lender Requirements: Your lender will require proof of funds and may "season" the money (meaning it needs to sit in your account for a certain period, usually 60 days, before closing) to ensure it’s not a new loan you haven’t disclosed.

Consider Borrowing from Retirement (with Caution!)

This should generally be a last resort and only after careful consideration, as it can have long-term impacts on your retirement security.

- 401(k) Loan: Some plans allow you to borrow from your 401(k) and pay yourself back with interest. The interest goes back into your account. However, if you leave your job, the loan often becomes due immediately. Defaulting can lead to taxes and penalties.

- IRA Withdrawal: You can withdraw up to $10,000 from an IRA penalty-free for a first-time home purchase (though income taxes will still apply). For Roth IRAs, qualified distributions are both tax and penalty-free.

Warning: Pulling money from retirement accounts reduces your future nest egg and the power of compound interest. Consult a financial advisor before taking this step.

Sell Unused Assets

Beyond small items, consider larger assets if they’re not essential:

- Extra Car: If you have two cars but only need one, selling the second can provide a substantial boost.

- Collectibles/Investments: Review any non-retirement investments or valuable collections you might be willing to part with.

6. Avoiding Common Pitfalls

While saving, be mindful of these common mistakes that can derail your progress:

- Don’t Touch Your Savings: Once money goes into your down payment fund, it’s sacred. Resist the urge to use it for emergencies (build a separate emergency fund first!).

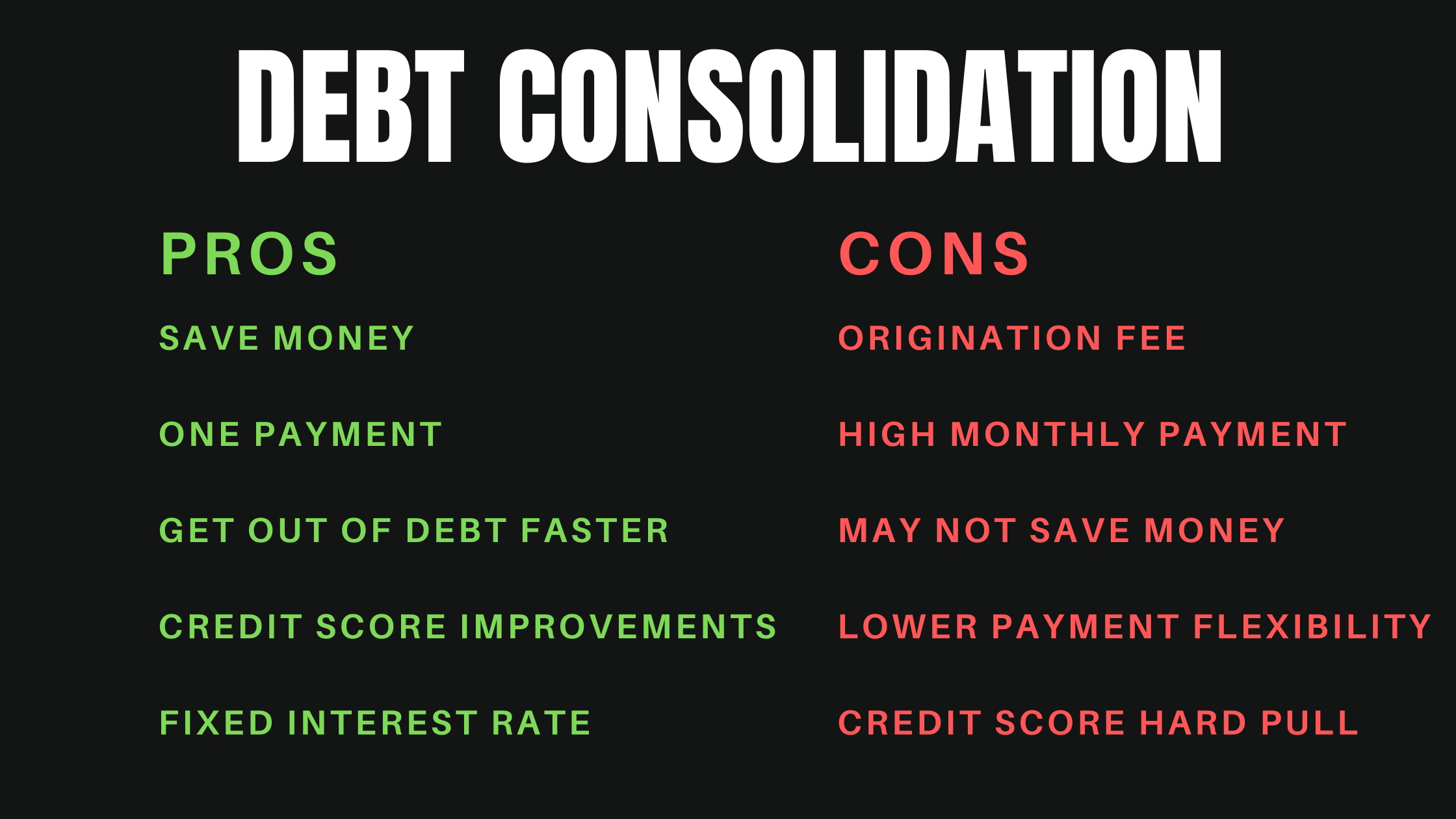

- Beware of New Debt: Taking on new credit card debt, car loans, or personal loans while saving for a down payment can significantly hurt your debt-to-income ratio (DTI), making it harder to qualify for a mortgage.

- Don’t Forget About Your Credit Score: Keep paying all your bills on time and avoid opening new credit accounts. A good credit score is crucial for getting favorable mortgage rates.

- Underestimating Total Costs: Remember to budget for closing costs, potential repairs, and moving expenses in addition to your down payment.

- Getting Discouraged: Saving a large sum takes time. Don’t let setbacks or slow progress demotivate you.

7. Maintaining Momentum & Staying Motivated

The journey to homeownership is a marathon, not a sprint. Keep your spirits high!

- Track Your Progress Visually: Use a thermometer chart, a spreadsheet, or an app to see how far you’ve come and how much further you need to go. Visual progress is incredibly motivating.

- Celebrate Milestones: When you hit 25%, 50%, or 75% of your goal, treat yourself to a small, non-budget-breaking reward (e.g., a nice dinner at home, a new book, a movie night).

- Stay Positive: Focus on the "why" – the homeownership dream. Remind yourself of the benefits and the feeling of accomplishment.

- Connect with Fellow Savers: Share your journey with friends or family who are also saving, or join online communities for support and tips.

- Educate Yourself: Continue learning about the home-buying process, mortgages, and real estate. The more you know, the more confident you’ll feel.

8. Conclusion: Your Homeownership Journey Begins Now!

Saving for a down payment is a significant financial undertaking, but it’s one of the most rewarding. By setting clear goals, creating a smart budget, automating your savings, and staying disciplined, you can systematically build the foundation for your future home.

Remember, every dollar saved is a step closer to unlocking your own front door. Start today, stay consistent, and before you know it, you’ll be holding the keys to your very own home. Happy saving!

Post Comment