How to Create a Budget for Your Business: A Beginner’s Guide to Financial Success

Are you a small business owner, an aspiring entrepreneur, or someone looking to take control of your company’s finances? The idea of creating a budget might sound intimidating, conjuring images of complex spreadsheets and endless numbers. But fear not! A business budget is not a financial straightjacket; it’s your business’s financial roadmap, guiding you towards profitability and sustainable growth.

In this comprehensive guide, we’ll break down the process of creating a business budget into simple, easy-to-understand steps. By the end, you’ll feel empowered to take charge of your financial future, make smarter decisions, and steer your business towards success.

What Exactly is a Business Budget and Why Do You Need One?

Think of a business budget as a detailed financial plan for your company. It’s an estimate of your revenue (money coming in) and expenses (money going out) over a specific period, usually a month, quarter, or year. It’s not just about tracking where your money goes; it’s about making informed decisions about where it should go.

Why is a business budget indispensable?

- Financial Control: It gives you a clear picture of your financial health, helping you understand if you’re making money or losing it.

- Informed Decision-Making: With a budget, you can decide where to invest, where to cut costs, and how to allocate resources effectively.

- Achieve Goals: Whether it’s expanding, launching a new product, or increasing profit margins, a budget helps you set and achieve specific financial goals.

- Identify Problems Early: Spotting cash flow issues or excessive spending before they become major crises.

- Secure Funding: Lenders and investors want to see a well-thought-out financial plan before committing funds.

- Reduce Financial Stress: Knowing where you stand financially brings peace of mind and allows you to focus on growing your business.

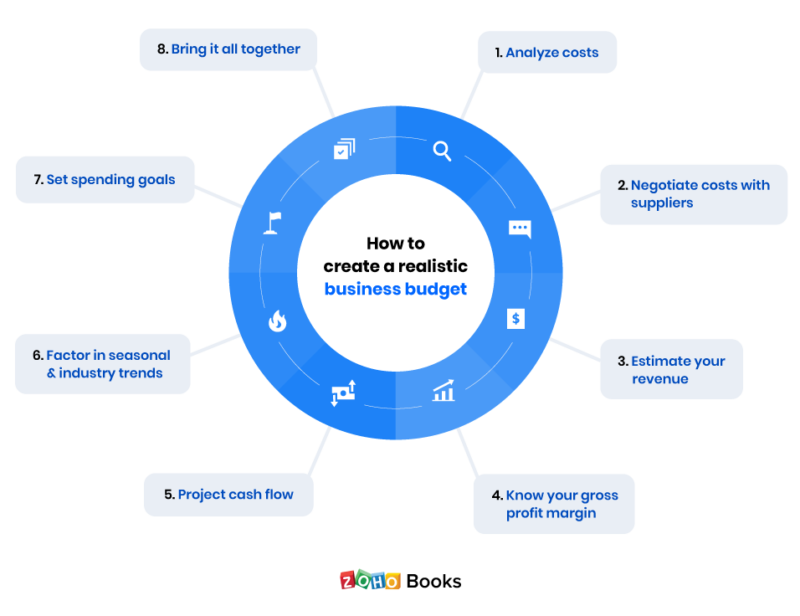

The Essential Steps to Creating Your Business Budget

Creating a budget doesn’t have to be complicated. Let’s walk through the process step-by-step.

Step 1: Gather Your Financial Data

Before you can plan for the future, you need to understand your past and present. This initial step is about collecting all the relevant financial information.

- Past Financial Statements:

- Profit & Loss (P&L) Statements (also called Income Statements): These show your revenues, costs, and profits over a period.

- Balance Sheets: These provide a snapshot of your assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: These detail the actual cash moving in and out of your business.

- Bank Statements: Review your business bank accounts to see actual deposits and withdrawals.

- Invoices & Receipts: Keep records of all money paid to you (invoices issued) and money you’ve paid out (receipts for expenses).

- Payroll Records: Details of salaries, wages, and associated taxes.

- Loan Documents: Information on any business loans, including principal and interest payments.

Tip for Beginners: Don’t get overwhelmed. Even if you’re starting from scratch, you can use personal bank statements and estimates to begin. The goal is to get a realistic baseline.

Step 2: Project Your Revenue (Money Coming In)

This is where you estimate how much money your business expects to generate over the budgeting period. Be realistic, not overly optimistic.

- Analyze Past Sales: Look at your historical sales data. Are there seasonal trends? Have sales been growing steadily?

- Consider Market Conditions: Are there new opportunities or challenges in your industry? Is the economy growing or slowing down?

- Factor in Marketing & Sales Efforts: Are you planning any new marketing campaigns or sales initiatives that could boost revenue?

- New Products/Services: If you’re launching something new, how do you anticipate it will contribute to revenue?

- Pricing Strategy: Are you planning to change your pricing?

How to project:

- If you have a stable business, a simple approach is to take your average monthly revenue from the past year and adjust it based on expected growth or changes.

- For new businesses, research industry benchmarks, talk to mentors, and make educated guesses based on your business plan. It’s better to underestimate slightly than overestimate.

Step 3: Identify and Categorize Your Expenses (Money Going Out)

This is often the most detailed part of budgeting. You need to list every single cost your business incurs. It’s helpful to break expenses into two main categories:

A. Fixed Costs: These are expenses that generally stay the same, regardless of your sales volume or activity.

- Examples:

- Rent/Lease payments

- Insurance premiums

- Loan payments (principal + interest)

- Salaries of administrative staff (not tied to production)

- Software subscriptions (e.g., accounting software, CRM)

- Website hosting fees

B. Variable Costs: These expenses fluctuate directly with your business activity. The more you produce or sell, the higher these costs will be.

- Examples:

- Raw materials/Cost of Goods Sold (COGS)

- Production labor wages (e.g., per-unit pay)

- Shipping and packaging costs

- Sales commissions

- Marketing and advertising spend (can be variable if tied to campaigns)

- Utilities (can have a variable component based on usage)

C. One-Time/Startup Costs (for new businesses):

- Legal fees (business registration, permits)

- Equipment purchases

- Initial inventory

- Website development

- Branding/Logo design

How to track expenses:

- Go through your bank statements, credit card statements, and past receipts.

- Create a detailed list, assigning each expense to a category (e.g., "Office Supplies," "Utilities," "Marketing," "Salaries," "Rent").

- Don’t forget small, recurring expenses! They add up quickly.

Step 4: Calculate Your Profit or Loss (The Bottom Line)

Once you have your projected revenue and estimated expenses, it’s time to see where you stand.

Simple Formula:

Projected Revenue – Total Projected Expenses = Projected Profit (or Loss)

- If the number is positive: Congratulations! You’re projecting a profit. This means your business is expected to bring in more money than it spends.

- If the number is negative: Don’t panic! This indicates a projected loss. It’s a signal that you need to make adjustments.

- Strategies for a Projected Loss:

- Increase Revenue: Can you raise prices? Increase sales volume? Offer new services?

- Decrease Expenses: Can you cut back on non-essential spending? Negotiate better deals with suppliers? Find cheaper alternatives?

- Revisit Projections: Are your revenue estimates too low or your expense estimates too high? Be realistic.

- Strategies for a Projected Loss:

Step 5: Allocate Funds and Set Financial Goals

Now that you have a clear picture, it’s time to strategically allocate your funds.

- Prioritize Spending: Ensure essential expenses are covered first.

- Build an Emergency Fund: Aim to set aside at least 3-6 months of operating expenses. This acts as a safety net for unexpected downturns or opportunities.

- Allocate for Growth: If you have a projected profit, decide how much to reinvest in the business (e.g., new equipment, marketing, research & development) and how much to save or distribute.

- Set Specific Financial Goals:

- "Increase profit margin by 10% in the next quarter."

- "Reduce operating costs by 5% annually."

- "Save $X for a new piece of equipment by year-end."

- "Achieve $Y in monthly recurring revenue."

Step 6: Monitor and Adjust Your Budget Regularly

A budget is not a "set it and forget it" tool. It’s a living document that needs regular attention.

- Regular Review:

- Monthly: Compare your actual revenue and expenses against your budgeted figures.

- Quarterly/Annually: Conduct a more in-depth review to see if major adjustments are needed.

- Identify Variances: Where did your actual numbers differ from your budget?

- Positive Variances: Did you make more money than expected? Did you spend less? Why?

- Negative Variances: Did you make less money? Did you overspend? Why?

- Adjust as Needed: Your business environment changes. New opportunities arise, unexpected costs occur. Be prepared to adapt your budget. This isn’t a failure; it’s smart financial management.

Tips for Successful Business Budgeting

- Be Realistic: Overly optimistic revenue projections or underestimating expenses will lead to a useless budget.

- Track Everything: Use accounting software (like QuickBooks, Xero, or even simple spreadsheets) to meticulously record all income and expenses.

- Automate Where Possible: Set up automatic payments for fixed expenses to ensure they’re paid on time.

- Build a Buffer: Always include a small contingency fund for unexpected costs.

- Don’t Be Afraid to Cut: If you identify unnecessary expenses, be decisive in eliminating them.

- Involve Your Team: If applicable, involve key team members in the budgeting process, especially those responsible for specific departments or projects.

- Seek Professional Advice: For complex situations, a financial advisor or accountant can provide invaluable guidance.

Common Budgeting Mistakes to Avoid

- Ignoring Cash Flow: A profitable business can still run out of cash if income doesn’t arrive before expenses are due. Understand your cash flow cycle.

- Not Tracking Small Expenses: Those "little" purchases (coffee, office supplies, subscriptions) add up quickly. Track every penny.

- Being Overly Optimistic: This is the biggest pitfall. Always err on the side of caution with revenue and expense estimates.

- Setting It and Forgetting It: A budget is useless if you don’t regularly review and adjust it.

- Fear of Budgeting: Don’t let the numbers intimidate you. Start simple, and you’ll build confidence over time.

- Not Categorizing Expenses Properly: Haphazard expense tracking makes it impossible to analyze where your money is going.

Conclusion: Take Control of Your Business’s Financial Future

Creating a budget for your business might seem like a daunting task initially, but it is one of the most powerful tools you have for achieving financial stability and growth. It transforms guesswork into informed decision-making, allowing you to proactively manage your resources, identify opportunities, and mitigate risks.

By following these steps – gathering your data, projecting revenue, categorizing expenses, calculating profit, setting goals, and consistently monitoring – you’ll gain clarity and confidence in your business’s financial health. Start today, even if it’s just a simple spreadsheet. Your future self, and your business, will thank you for it. Take control, budget smart, and watch your business thrive!

Post Comment