How to Calculate Your Investment Returns: A Beginner’s Guide to Understanding Your Money’s Growth

Ever wondered how much your hard-earned money is really growing in your investments? You’re not alone! While checking your bank account balance is straightforward, understanding the performance of your investments can feel like deciphering a secret code. But it doesn’t have to be.

Calculating your investment returns is a crucial skill for any investor, whether you’re just starting out or have been building your portfolio for years. It’s the ultimate report card for your money, telling you how effectively it’s working for you.

In this comprehensive, beginner-friendly guide, we’ll demystify the process of calculating investment returns. We’ll cover everything from the simplest formulas to understanding more complex scenarios, all explained in plain English with clear examples. By the end, you’ll be empowered to track your financial progress with confidence.

What Are Investment Returns?

At its core, an investment return is simply the gain or loss you make on an investment over a specific period, expressed as a percentage of your initial investment.

Think of it like planting a seed. You put in the initial effort (your investment), and the return is how much the plant (your money) has grown – or unfortunately, sometimes shrunk – by the time you check on it.

Returns can come in various forms:

- Capital Gains: The increase in the value of an asset (e.g., buying a stock for $100 and selling it for $120).

- Income: Payments received from the investment (e.g., dividends from stocks, interest from bonds, rent from real estate).

Why Calculate Your Returns? It’s More Than Just a Number!

Understanding how to calculate your investment returns isn’t just about crunching numbers; it’s about gaining insights that can profoundly impact your financial future.

Here’s why it’s so important:

- Track Your Progress: Are you on track to meet your financial goals (retirement, down payment, etc.)? Calculating returns helps you see if your investments are performing as needed.

- Make Informed Decisions: By knowing which investments are performing well (and which aren’t), you can decide whether to adjust your portfolio, rebalance, or even seek new opportunities.

- Compare Investments Fairly: If you’re considering two different investment options, knowing how to calculate their returns allows you to compare them "apples to apples," even if they’ve been held for different periods.

- Stay Motivated: Seeing your money grow can be incredibly motivating and reinforce good financial habits.

- Understand Risk vs. Reward: Higher returns often come with higher risk. Calculating your returns helps you understand if the reward you’re getting is commensurate with the risk you’re taking.

- Accountability: It holds you accountable for your investment choices and helps you learn from successes and mistakes.

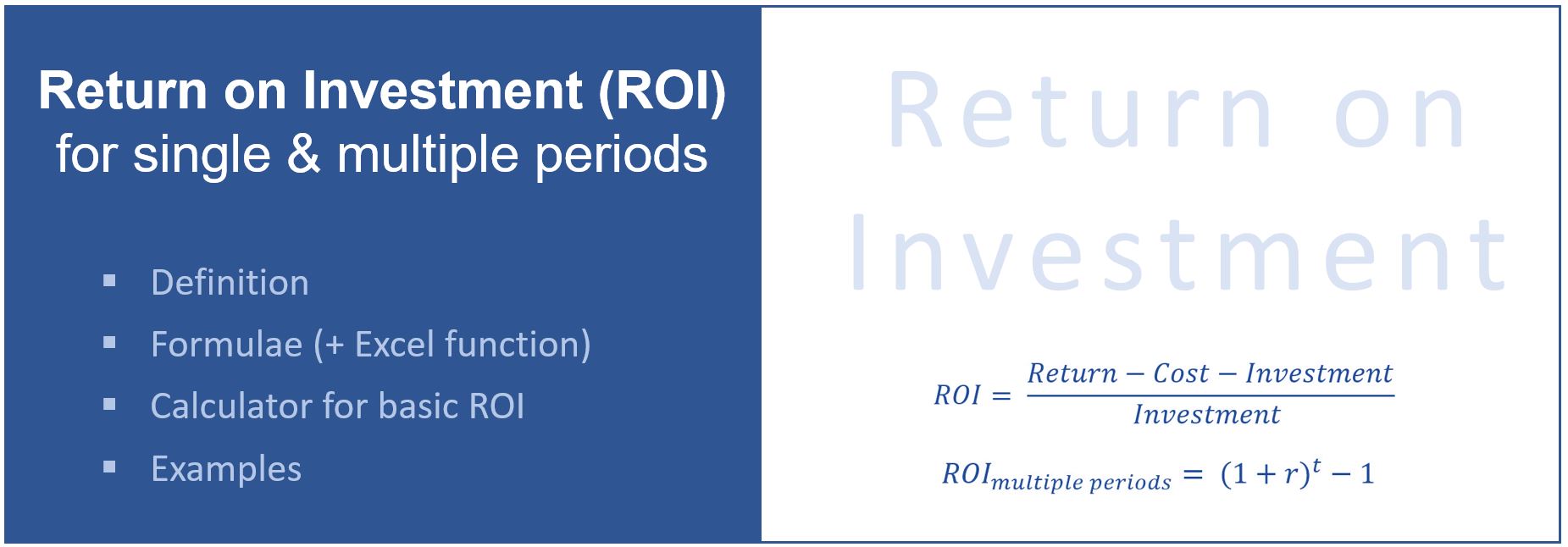

The Simplest Calculation: Basic Return (Absolute Return)

Let’s start with the easiest way to figure out your return. This calculation tells you the total percentage gain or loss from your investment from start to finish.

Formula:

Basic Return = ((Current Value of Investment - Initial Investment) / Initial Investment) * 100- Current Value of Investment: What your investment is worth right now.

- Initial Investment: How much money you originally put into the investment.

- Multiply by 100: To convert the decimal into a percentage.

Example:

Imagine you bought shares of a company for $1,000. A year later, those shares are now worth $1,200.

- Current Value: $1,200

- Initial Investment: $1,000

Let’s plug these numbers into the formula:

Basic Return = (($1,200 - $1,000) / $1,000) * 100

Basic Return = ($200 / $1,000) * 100

Basic Return = 0.20 * 100

Basic Return = 20%Your Basic Return is 20%. This means your investment grew by 20% over that period.

What if it goes down?

If your $1,000 investment dropped to $800:

Basic Return = (($800 - $1,000) / $1,000) * 100

Basic Return = (-$200 / $1,000) * 100

Basic Return = -0.20 * 100

Basic Return = -20%A -20% return means you lost 20% of your initial investment.

Limitations of Basic Return:

While simple, the Basic Return doesn’t tell you how long it took to achieve that return. A 20% return in one year is fantastic, but a 20% return over ten years is less impressive. This leads us to our next calculation…

Beyond the Basics: Annualized Return (Compound Annual Growth Rate – CAGR)

The Basic Return is great for a quick snapshot, but it falls short when you want to compare investments held for different lengths of time. This is where Annualized Return, often called Compound Annual Growth Rate (CAGR), comes in.

Annualized Return tells you the average yearly growth rate of your investment over multiple years, assuming the profits are reinvested (compounded). It allows you to compare different investments on an "apples-to-apples" basis, regardless of how long you’ve held them.

Formula (Simplified for Beginners):

Annualized Return = ((Current Value / Initial Investment)^(1 / Number of Years)) - 1- Current Value: What your investment is worth right now.

- Initial Investment: How much money you originally put into the investment.

- Number of Years: The total duration your investment has been held.

- The "^" symbol: Means "to the power of." If you’re using a calculator, this is often represented by

x^yory^x.

Example:

Let’s say your initial $1,000 investment grew to $1,600 over 3 years.

- Current Value: $1,600

- Initial Investment: $1,000

- Number of Years: 3

Let’s plug these numbers into the formula:

Annualized Return = (($1,600 / $1,000)^(1 / 3)) - 1

Annualized Return = (1.6^(0.3333)) - 1 (Note: 1/3 is approximately 0.3333)

Annualized Return = 1.1696 - 1

Annualized Return = 0.1696To get the percentage, multiply by 100: 0.1696 * 100 = 16.96%

Your Annualized Return is approximately 16.96%. This means, on average, your investment grew by about 16.96% each year over the three-year period.

Why is this important?

If another investment returned 20% over one year, and yours returned 16.96% annually over three years, you can now directly compare their average yearly performance.

Dealing with Deposits & Withdrawals: Time-Weighted vs. Money-Weighted Returns

The Basic and Annualized Return formulas work best when you make a single initial investment and no further deposits or withdrawals. But what if you’re regularly adding money to your investment account (like a 401k or IRA) or taking money out?

This is where things get a bit more complex, and you’ll typically encounter two types of returns: Time-Weighted Return (TWR) and Money-Weighted Return (MWR).

For Beginners: Don’t panic about manually calculating these! Most brokerage firms (like Fidelity, Vanguard, Schwab, etc.) and investment platforms automatically calculate and display these for you on your statements or online dashboards. Understanding what they mean is more important than knowing the intricate math.

1. Time-Weighted Return (TWR)

- What it is: TWR measures the performance of the investment itself, removing the effects of cash flows (deposits and withdrawals). It’s as if you invested all your money at the beginning and let it ride, without adding or subtracting anything.

- Why it’s useful: This is the standard way fund managers (like mutual fund or ETF managers) report their performance because it shows how well their investment strategy is working, separate from when investors put money in or take it out. It’s great for comparing different funds or managers.

2. Money-Weighted Return (MWR) / Internal Rate of Return (IRR)

- What it is: MWR (often also called the Internal Rate of Return or IRR) measures the performance of your specific money. It takes into account the timing and amount of all your deposits and withdrawals, giving you a truer picture of how your personal investment decisions (when you added or removed money) affected your overall return.

- Why it’s useful: This is often the most relevant return for individual investors because it shows the actual rate of return you experienced on your capital. If you added more money right before a market boom, your MWR would reflect that positive timing. Conversely, if you added money right before a market dip, it would reflect that too.

Key Takeaway for Beginners:

- TWR = How well the investment performed (good for comparing funds).

- MWR = How well your money performed, considering all your actions (good for your personal financial planning).

For most personal investors with ongoing contributions, looking at the MWR/IRR provided by your brokerage is usually the most insightful number.

The Sneaky Thief: Inflation’s Impact (Real Return)

You might calculate a fantastic 10% return on your investment, but what if everything around you got 5% more expensive? Your buying power hasn’t increased by a full 10%. This is where inflation comes in.

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling.

To get a true picture of your investment’s growth, you need to consider Real Return.

- Nominal Return: The return you calculate using the formulas above (the actual percentage gain).

- Real Return: Your return after accounting for inflation. This tells you how much your purchasing power has actually increased.

Simple Formula:

Real Return ≈ Nominal Return - Inflation RateExample:

If your Nominal Return was 8% and the Inflation Rate was 3% for that period:

Real Return = 8% - 3%

Real Return = 5%Your money might have grown by 8% in numbers, but in terms of what it can actually buy, it only grew by 5%. This is why it’s crucial for long-term investors to aim for returns that significantly beat inflation.

Don’t Forget Taxes! (After-Tax Return)

Another critical factor that eats into your returns is taxes. Depending on your investment type (e.g., taxable brokerage account vs. tax-advantaged retirement account like a Roth IRA or 401k), capital gains, dividends, and interest may be subject to various taxes.

Calculating your After-Tax Return gives you the most accurate picture of the money you actually get to keep.

Simple Concept:

After-Tax Return = Nominal Return - (Taxes Paid / Initial Investment) * 100Or, more commonly, you calculate your gain first, then subtract the taxes from that gain, and then divide by your initial investment.

Example:

You made a $200 gain on your $1,000 investment (20% nominal return). If you paid $30 in taxes on that gain:

After-Tax Gain = $200 (gain) - $30 (taxes) = $170

After-Tax Return = ($170 / $1,000) * 100 = 17%Your actual take-home return, after taxes, is 17%, not 20%.

Key Tip: Maximize tax-advantaged accounts like IRAs and 401ks, where your investments can grow tax-deferred or even tax-free, significantly boosting your effective long-term returns.

Tools to Help You Calculate Your Returns

While knowing the formulas is empowering, you don’t always have to pull out a calculator or spreadsheet.

- Your Brokerage Statements/Online Dashboards: This is your number one resource! Most reputable brokerage firms provide detailed performance reports that include your Time-Weighted Return, Money-Weighted Return (IRR), and often compare your returns to relevant benchmarks. Look for sections like "Performance," "Returns," or "Account Activity."

- Spreadsheets (Excel, Google Sheets): For those who like to get hands-on, spreadsheets are incredibly powerful. You can set up simple formulas for Basic and Annualized Returns. For MWR/IRR, Excel and Google Sheets have built-in functions like

IRRorXIRRthat can calculate this if you meticulously log all your cash flows (deposits/withdrawals) and their dates. - Online Investment Calculators: A quick search for "investment return calculator" will yield many free online tools. These can be great for quick estimates or for seeing the impact of different growth rates.

Important Considerations When Looking at Returns

Calculating your returns is a fantastic start, but remember that a single number doesn’t tell the whole story. Here are a few things to keep in mind:

- Returns and Risk Go Hand-in-Hand: Generally, higher potential returns come with higher risk. Don’t chase unrealistic returns without understanding the potential for loss.

- Investment Goals Matter: A "good" return depends on your financial goals and timeline. A conservative investor saving for a down payment in 2 years will have different return expectations than a young investor saving for retirement in 40 years.

- Consistency Over Short-Term Volatility: Markets go up and down. Focus on your long-term average returns rather than getting caught up in daily or monthly fluctuations. A single year’s spectacular return doesn’t guarantee future performance.

- Compare "Apples to Apples": When comparing your returns to a benchmark or another investment, make sure they are similar. Don’t compare a stock portfolio’s return to a savings account interest rate, or a small-cap stock fund to a bond fund. Use relevant benchmarks (e.g., S&P 500 for a diversified U.S. stock portfolio).

- Don’t Forget Dividends/Interest: Ensure your return calculations include any income generated by your investments (dividends from stocks, interest from bonds, etc.) as these contribute significantly to total returns, especially over the long term.

- Fees and Expenses: Just like taxes, investment fees (management fees, expense ratios, trading commissions) eat into your returns. Factor these in, as even small percentages can make a big difference over decades.

Conclusion: Empower Yourself with Knowledge

Learning how to calculate your investment returns might seem daunting at first, but by understanding the basic concepts and knowing which tools to use, you’ve gained a powerful skill.

Monitoring your investment returns isn’t just about satisfying curiosity; it’s about making informed decisions, staying on track with your financial goals, and ultimately, ensuring your money is working as hard as possible for you. Start simple, use the resources available to you, and watch your confidence as an investor grow!

Frequently Asked Questions (FAQs)

Q1: What is considered a "good" investment return?

A1: There’s no single answer, as it depends on your risk tolerance, investment timeline, and the type of asset. Historically, diversified stock market portfolios have averaged around 7-10% annually over long periods (decades), including inflation. For more conservative investments like bonds or savings accounts, returns will be lower. The most important thing is that your real (inflation-adjusted) return is positive and helps you meet your financial goals.

Q2: Can investment returns be negative?

A2: Absolutely, yes. Investments carry risk, and it’s possible to lose money. Markets fluctuate, and the value of your investments can go down. This is why diversification and a long-term perspective are often recommended to weather short-term downturns.

Q3: How often should I calculate my investment returns?

A3: For most long-term investors, reviewing your returns quarterly or annually is sufficient. Checking too frequently can lead to emotional decisions based on short-term market noise. Your brokerage statements will typically provide monthly or quarterly updates.

Q4: Should I include fees and taxes when calculating my returns?

A4: Yes, always! Fees and taxes are real costs that reduce your take-home return. Your brokerage statement’s reported returns usually account for internal fund fees (expense ratios), but you’ll need to consider trading commissions and personal tax liabilities separately to get your true after-cost, after-tax return.

Post Comment