How Much Should You Save for Retirement? Your Ultimate Guide to Financial Freedom

The idea of retirement – a time of freedom, travel, hobbies, and relaxation – sounds idyllic. But for many, the question "How much should I save for retirement?" looms large, often accompanied by a knot of anxiety. It’s a daunting question, and for good reason: there’s no single, one-size-fits-all answer.

However, don’t let that intimidate you! This comprehensive guide will break down the complexities of retirement savings into easy-to-understand concepts, helping you estimate your personal magic number and build a clear path to financial freedom. We’ll cover everything from simple rules of thumb to personalized calculations, smart saving strategies, and common pitfalls to avoid.

Let’s demystify retirement savings together!

The "Rules of Thumb": A Starting Point, Not the Finish Line

Before we dive into personalized calculations, let’s look at some commonly cited "rules of thumb" from financial experts like Fidelity and Vanguard. These are general guidelines based on multiples of your current salary and provide a quick snapshot of where you might want to be at different ages.

General Benchmarks (Multiples of Your Annual Salary):

- By Age 30: Have 1x your annual salary saved.

- Example: If you earn $60,000, aim to have $60,000 saved.

- By Age 40: Have 3x your annual salary saved.

- By Age 50: Have 6x your annual salary saved.

- By Age 60: Have 8x your annual salary saved.

- By Retirement (e.g., Age 67): Have 10x your annual salary saved.

Why these numbers? They’re designed to help you accumulate enough to replace about 70-80% of your pre-retirement income, assuming you retire around age 67 and live into your 90s, with some help from Social Security.

Important Caveat: These are guidelines. Your personal situation will likely require adjustments. They don’t account for your specific desired lifestyle, health, or other unique circumstances. Think of them as a friendly suggestion to get you started, not a strict mandate.

Factors That Influence YOUR Retirement Savings Number

Your ideal retirement nest egg is highly personal. Several key factors will shape how much you need to save. Understanding these will help you move beyond general rules of thumb and create a realistic plan.

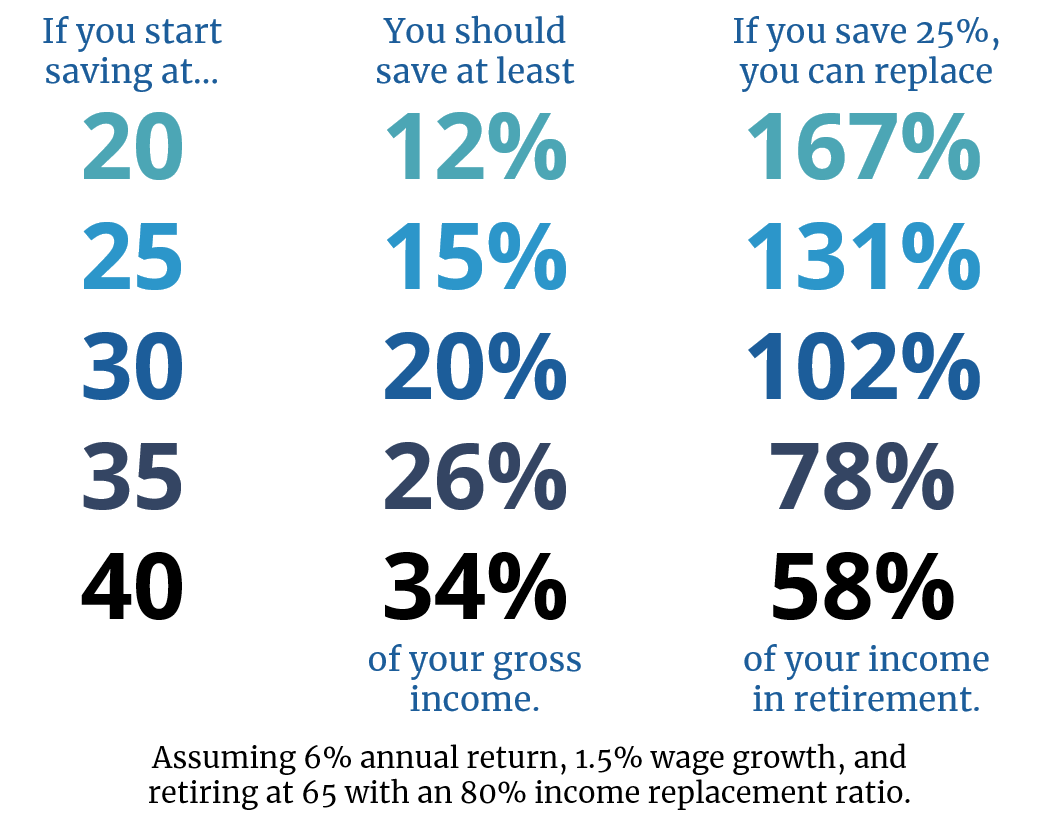

1. Your Current Age and Desired Retirement Age

This is perhaps the most critical factor. The earlier you start saving, the less you need to save each month, thanks to the magic of compound interest.

- Starting Early: If you begin saving in your 20s, your money has decades to grow exponentially. A small amount saved consistently can turn into a substantial sum.

- Starting Later: If you begin saving in your 40s or 50s, you’ll need to save a much larger amount each month to catch up, as you have less time for your money to compound.

2. Your Desired Retirement Lifestyle

Do you dream of globetrotting, fine dining, and lavish hobbies? Or do you envision a quieter life at home, tending to your garden and enjoying local activities? Your desired lifestyle in retirement directly impacts your spending and, consequently, how much you’ll need.

- Modest Lifestyle: You might need to replace 60-70% of your pre-retirement income.

- Comfortable Lifestyle: Aim for 70-80% replacement.

- Luxurious/Travel-Heavy Lifestyle: You might need to replace 90-100% or even more of your pre-retirement income.

3. Expected Expenses in Retirement

Many people assume their expenses will drastically drop in retirement. While some expenses (like commuting costs, work clothes, and perhaps mortgage payments if your home is paid off) might decrease, others could increase, especially healthcare.

Consider these categories of expenses:

- Housing: Mortgage (if any), property taxes, insurance, utilities, maintenance.

- Food: Groceries, dining out.

- Transportation: Car payments, gas, insurance, public transport, travel.

- Healthcare: This is a big one! Medicare premiums, deductibles, co-pays, prescription drugs, long-term care.

- Insurance: Life, long-term care, umbrella policies.

- Discretionary Spending: Hobbies, entertainment, travel, gifts, dining out.

- Taxes: Retirement withdrawals are often taxable.

4. Inflation: The Silent Wealth Eater

Inflation is the gradual increase in prices over time, which reduces the purchasing power of your money. What costs $100 today might cost $200 or more in 20-30 years. Your retirement savings need to grow faster than inflation to maintain their value. Most financial planners use an average inflation rate of 2-3% per year in their calculations.

5. Healthcare Costs

This deserves its own bullet point because it’s one of the biggest unknowns and potential drains on retirement savings. Even with Medicare, you’ll still have out-of-pocket expenses. Fidelity estimates that a couple retiring at age 65 in 2023 would need approximately $315,000 saved just for healthcare expenses in retirement. This doesn’t include long-term care, which can be even more expensive.

6. Social Security and Other Income Sources

Social Security will likely be a component of your retirement income, but it’s rarely enough to live on comfortably by itself.

- Social Security: Think of it as a helpful bonus, not your main act. The average monthly Social Security benefit for retired workers in 2023 was around $1,827. Your benefit depends on your earnings history and when you claim it.

- Pensions: If you’re lucky enough to have one, a pension can significantly reduce your savings burden.

- Part-time Work: Some retirees plan to work part-time to supplement their income and stay active.

- Rental Income, Royalties, etc.: Any other consistent income streams.

How to Calculate YOUR Personal Retirement Number

Ready to get more specific? Here’s a step-by-step approach to estimate how much you might need.

Step 1: Estimate Your Annual Retirement Expenses

- Current Expenses: Start with your current annual spending.

- Adjust for Retirement:

- Subtract: Commuting costs, mortgage (if paid off), saving for retirement (the money you’re currently saving will become your income!), work-related expenses.

- Add: Increased healthcare costs, travel, new hobbies, long-term care insurance (if desired).

- Inflation Adjustment: Add 2-3% for inflation for every 10 years until retirement. For example, if you’re 30 and plan to retire at 60 (30 years), multiply your current estimated expenses by roughly 1.8 (1.025^30).

- Target: Let’s say, after all adjustments, you estimate you’ll need $70,000 per year in today’s dollars, which inflates to $150,000 per year by the time you retire.

Step 2: Factor in Social Security and Other Income

- Social Security: Get an estimate of your future Social Security benefits by creating an account at ssa.gov/myaccount.

- Other Income: Include any pensions, rental income, or planned part-time work income.

- Subtract from Expenses: Deduct these guaranteed income sources from your estimated annual retirement expenses.

- Example: $150,000 (estimated annual expenses) – $40,000 (Social Security + pension) = $110,000. This is the income gap your savings need to cover each year.

Step 3: Use the "4% Rule" (or a similar withdrawal rate)

The 4% rule is a common guideline suggesting you can safely withdraw about 4% of your savings in your first year of retirement, adjusting for inflation in subsequent years, without running out of money for at least 30 years.

- Calculate Your Nest Egg: Divide your annual income gap (from Step 2) by 0.04 (or 4%).

- Example: $110,000 / 0.04 = $2,750,000. This is your estimated target retirement nest egg.

Important Note on the 4% Rule: While widely used, the 4% rule is a guideline and not a guarantee. Some financial advisors suggest a more conservative 3.5% or even 3% withdrawal rate, especially in periods of low market returns or if you plan for a very long retirement.

Step 4: Utilize a Retirement Calculator

This is where things get easier! Online retirement calculators are invaluable tools that do all the complex math for you. They factor in your current savings, contributions, expected returns, inflation, and retirement age to tell you if you’re on track and how much you need to save monthly.

Recommended Calculators:

- NerdWallet Retirement Calculator: Easy to use and visually clear.

- Fidelity Retirement Calculator: Comprehensive, with various assumptions.

- Vanguard Retirement Nest Egg Calculator: Simple and straightforward.

- Your Employer’s 401(k) Provider: Most offer their own calculators.

Action Item: Spend some time playing with one or more of these calculators. Input different scenarios (e.g., saving more, retiring later) to see how it impacts your outcome.

Smart Strategies to Maximize Your Retirement Savings

Now that you have a better idea of your target number, let’s talk about the "how." These strategies are designed to make your savings journey efficient and effective.

1. Start Early, Save Consistently

We can’t emphasize this enough: time is your greatest asset. Thanks to compound interest, money saved in your 20s is far more valuable than money saved in your 40s.

- The Power of Compounding: Imagine a tiny snowball rolling down a hill. The longer it rolls, the more snow it picks up, growing exponentially. Your investments work the same way.

- Consistency is Key: Even small, regular contributions add up significantly over time.

2. Utilize Employer-Sponsored Retirement Plans (401(k), 403(b), TSP)

These are often the best vehicles for retirement savings, especially if your employer offers a match.

- Employer Match: It’s FREE Money! If your company offers to match a percentage of your contributions (e.g., they match 50% of the first 6% you contribute), contribute at least enough to get the full match. Missing out on this is like turning down a raise.

- Pre-Tax vs. Roth Options:

- Traditional (Pre-Tax) 401(k): Your contributions lower your taxable income now, and your money grows tax-deferred. You pay taxes when you withdraw in retirement. Good if you expect to be in a lower tax bracket in retirement.

- Roth 401(k): Your contributions are made with after-tax money, but your qualified withdrawals in retirement are completely tax-free. Good if you expect to be in a higher tax bracket in retirement. Many plans offer both options; consider diversifying!

- Max Out Contributions: If possible, aim to contribute the maximum allowed by the IRS each year ($23,000 in 2024, plus an additional $7,500 catch-up contribution for those age 50 and over).

3. Open and Max Out an Individual Retirement Account (IRA)

If you don’t have a 401(k) or want to save even more, an IRA is an excellent option.

- Traditional IRA: Contributions might be tax-deductible now (depending on your income and if you have a 401(k)), and money grows tax-deferred. Withdrawals are taxed in retirement.

- Roth IRA: Contributions are made with after-tax money, but qualified withdrawals in retirement are 100% tax-free. There are income limits for direct contributions to a Roth IRA.

- Contribution Limits: The maximum you can contribute to an IRA is $7,000 in 2024 ($8,000 if you’re age 50 or older).

4. Consider a Health Savings Account (HSA)

If you have a high-deductible health plan (HDHP), you might be eligible for an HSA. These accounts offer a powerful "triple tax advantage":

- Tax-deductible contributions: Lower your taxable income.

- Tax-free growth: Your investments grow without being taxed.

- Tax-free withdrawals: If used for qualified medical expenses.

Many people use HSAs as a supplemental retirement account, especially for future healthcare costs, letting the money grow until retirement.

5. Automate Your Savings

The easiest way to stick to your savings plan is to make it automatic. Set up direct deposits from your paycheck or automatic transfers from your checking account to your retirement accounts.

- "Pay Yourself First": Treat your retirement savings like a non-negotiable bill.

- Increase Annually: Aim to increase your contribution percentage by 1% each year, especially when you get a raise. You’ll barely notice the difference, but your savings will grow much faster.

6. Diversify Your Investments

Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds, real estate) and geographies to manage risk. For beginners, target-date funds (available in most 401(k)s and IRAs) are a great option as they automatically adjust your asset allocation as you get closer to retirement.

7. Review and Adjust Regularly

Life changes – your income, expenses, family situation, and financial goals will evolve. Review your retirement plan annually, especially after major life events (marriage, children, new job, home purchase). Adjust your contributions and investment strategy as needed.

Common Retirement Savings Questions & Misconceptions

"What if I start late? Is it too late to save for retirement?"

No, it’s never too late to start! While starting early is ideal, the most important thing is to start now. You’ll need to save more aggressively, but every dollar you save counts. Focus on maximizing catch-up contributions if you’re over 50.

"Is Social Security enough to live on?"

For most people, absolutely not. Social Security is designed to be a safety net, replacing only a portion of your pre-retirement income (around 40% for the average earner). It’s meant to supplement your savings, not replace them.

"How does inflation affect my savings?"

Inflation erodes the purchasing power of your money over time. That $1 million saved today might feel like $500,000 in 20-30 years due to inflation. This is why it’s crucial for your investments to grow at a rate higher than inflation. This is also why we factored it into our calculation steps.

"Do I need a financial advisor?"

While you can manage your retirement savings yourself, a qualified financial advisor can provide personalized guidance, help you create a comprehensive plan, choose appropriate investments, and keep you on track. It’s especially beneficial if your situation is complex or if you feel overwhelmed. Look for a fee-only fiduciary advisor.

"Should I pay off debt before saving for retirement?"

It depends on the type of debt.

- High-interest debt (credit cards, payday loans): Pay these off aggressively first. The interest rates are usually higher than what you can reasonably expect to earn on investments, making it a guaranteed return.

- Low-interest debt (mortgage, student loans): It’s often a good idea to save for retirement while paying off these debts. Especially if your employer offers a 401(k) match – don’t miss out on that free money!

Key Takeaways and Your Action Plan

Saving for retirement doesn’t have to be overwhelming. Break it down into manageable steps:

- Don’t Panic: Even if you feel behind, every step forward counts.

- Estimate Your Number: Use the factors and calculators mentioned to get a personalized goal.

- Start Now, Even Small: The power of compound interest is real.

- Automate Your Savings: Make it effortless.

- Utilize All Available Accounts: 401(k), IRA, HSA – maximize their benefits.

- Get the Employer Match: It’s free money you can’t afford to miss.

- Increase Contributions Gradually: Aim to boost your savings rate each year.

- Review and Adjust: Your plan isn’t set in stone; adapt it as life changes.

- Seek Professional Help: If you’re unsure, a financial advisor can be a great resource.

Your retirement future is in your hands. By understanding how much you need to save and implementing smart strategies, you can build the financial security and freedom you deserve. Start planning today, and enjoy the peace of mind that comes with a well-prepared future!

Post Comment