Global Inflation Trends: What’s Driving Price Hikes Worldwide?

Have you noticed your grocery bill getting higher, or the price of gas making your jaw drop? You’re not alone. Around the world, people are feeling the pinch of rising prices – a phenomenon known as inflation. But what exactly is causing this widespread increase in the cost of living? Is it one big problem, or a combination of many smaller ones?

In this comprehensive guide, we’ll break down the complex world of global inflation, explaining in simple terms what it is, what’s driving these price hikes worldwide, and what it all means for your wallet.

What Exactly Is Inflation? (Simplified)

Imagine you have $100 today. If you go to the store, that $100 can buy you a certain amount of groceries, clothes, or services. Inflation is simply when, over time, that same $100 buys you less than it used to. In other words, prices go up, and the purchasing power of your money goes down.

Think of it like this: if a loaf of bread cost $2 last year and now costs $2.50, that’s inflation in action. While a little bit of inflation (around 2-3% per year) is considered healthy for an economy, high and rapid inflation can be a major problem for households and businesses alike.

Now, let’s dive into the major factors that have been fueling these global price hikes.

The Main Culprits: What’s Driving Global Price Hikes?

The current wave of global inflation isn’t due to a single cause but rather a "perfect storm" of interconnected factors, some old, some new.

1. Supply Chain Disruptions: The "Stuck in Transit" Problem

One of the biggest drivers of recent inflation stems from problems in the global supply chain – the complex network that moves products from where they’re made to where they’re sold.

- COVID-19’s Lingering Impact: When the pandemic hit, factories shut down, shipping routes were disrupted, and ports became congested. Even as economies reopened, the system struggled to catch up.

- Labor Shortages: Fewer truck drivers, dockworkers, and factory employees meant goods couldn’t be moved or produced as quickly as before.

- Bottlenecks and Delays: Imagine trying to get through a narrow doorway when everyone tries to go through at once. That’s what happened at ports and warehouses, leading to massive delays and increased shipping costs. These higher costs are then passed on to consumers.

- Example: The shortage of semiconductor chips, crucial for everything from cars to smartphones, severely limited production and drove up prices for these items.

2. Soaring Energy Prices: Fueling Everything Else

Energy is the lifeblood of the global economy. When the cost of oil, natural gas, and electricity goes up, it has a ripple effect on almost everything else we buy.

- Increased Demand Post-Pandemic: As economies reopened and travel resumed, the demand for oil and gas surged.

- Geopolitical Tensions (Especially the Ukraine War): Russia is a major global supplier of oil and natural gas. The conflict in Ukraine and subsequent sanctions against Russia significantly reduced global supply, pushing energy prices to record highs.

- Impact on Production and Transport: Higher fuel costs mean it’s more expensive for farmers to run tractors, for factories to power machinery, and for trucks and ships to transport goods. These added costs inevitably show up in the price of food, clothes, and practically everything else.

3. Food Price Volatility: The Daily Struggle

Food is a basic necessity, and rising food prices hit everyone, but especially lower-income households. Several factors are contributing to this global issue:

- Higher Fertilizer Costs: Natural gas is a key ingredient in many fertilizers. With natural gas prices soaring, so do fertilizer costs, making it more expensive for farmers to grow crops.

- Adverse Weather Events: Climate change is leading to more frequent and intense droughts, floods, and heatwaves in major agricultural regions, reducing crop yields and pushing up prices.

- Ukraine War Impact: Ukraine and Russia are major global suppliers of wheat, corn, and sunflower oil. The conflict disrupted exports from these "breadbasket" regions, sending global grain prices soaring.

- Animal Feed Costs: Higher grain prices also mean higher costs for animal feed, which translates into more expensive meat, dairy, and eggs.

4. Strong Consumer Demand: "Too Much Money Chasing Too Few Goods"

After lockdowns, many people had savings built up (due to less spending on travel, dining out, etc.) and also received government stimulus payments. When economies reopened, there was a surge in consumer spending, often called "revenge spending."

- Pent-Up Demand: People were eager to buy new cars, appliances, or simply go out and spend.

- Government Stimulus: In many countries, governments injected money directly into the economy through stimulus checks or enhanced unemployment benefits. While helpful during the crisis, this increased the amount of money people had to spend.

- The Problem: When a lot of people want to buy a limited number of goods, sellers can raise prices. This is known as "demand-pull" inflation.

5. Labor Shortages and Wage Growth: The Cost of Doing Business

Businesses need workers, and in many sectors, there aren’t enough people to fill the available jobs. This has led to an interesting dynamic:

- "The Great Resignation": Many workers reassessed their careers during the pandemic, leading to significant job changes and sometimes a reluctance to return to certain industries.

- Rising Wages: To attract and retain employees, businesses are often forced to offer higher wages and better benefits. While this is good for workers, it increases the operating costs for businesses.

- Passing Costs On: To cover these higher labor costs, businesses often raise the prices of their products or services, contributing to inflation. This can sometimes create a "wage-price spiral" where rising wages lead to higher prices, which then prompts demands for even higher wages.

6. Government Spending and Monetary Policy: The Role of Central Banks

Governments and central banks (like the Federal Reserve in the US or the European Central Bank) play a crucial role in managing an economy. Their actions can also influence inflation.

- Fiscal Stimulus: During the pandemic, many governments spent vast sums to support businesses and individuals. While necessary, this massive injection of money into the economy, combined with supply constraints, can fuel inflation.

- Low Interest Rates & Quantitative Easing (QE): For years, central banks kept interest rates very low and engaged in "quantitative easing" (effectively injecting more money into the financial system by buying bonds). The idea was to stimulate economic growth. However, when there’s "too much money" flowing in the economy and not enough goods to buy, it can lead to higher prices.

Who Gets Hit Hardest by Inflation?

While inflation affects everyone, some groups feel the pinch more acutely:

- Low-Income Households: They spend a larger portion of their income on necessities like food, housing, and energy, which are often the first prices to jump. Their wages might not keep pace with rising costs.

- Savers and Retirees: If your savings are sitting in a bank account earning very low interest, inflation erodes their value. What could buy you a certain lifestyle in retirement might buy significantly less if prices keep rising.

- Businesses (especially small ones): They face higher costs for raw materials, energy, and labor, making it harder to maintain profits without raising prices, which can deter customers.

- People with Fixed Incomes: Individuals on pensions or other fixed incomes find their purchasing power diminishing rapidly as prices climb.

What Are Governments and Central Banks Doing About It?

Governments and central banks are actively working to bring inflation under control, primarily through:

- Raising Interest Rates: This is the primary tool used by central banks. When interest rates go up, borrowing money becomes more expensive (for homes, cars, business loans). This slows down spending, cools demand, and helps to bring prices down.

- Tightening Monetary Policy: This involves reducing the amount of money flowing in the economy, often by reversing quantitative easing.

- Fiscal Measures: Governments might implement targeted aid programs for low-income households, or invest in infrastructure to improve supply chains in the long run.

However, these measures come with their own risks, like slowing down economic growth too much and potentially leading to a recession. It’s a delicate balancing act.

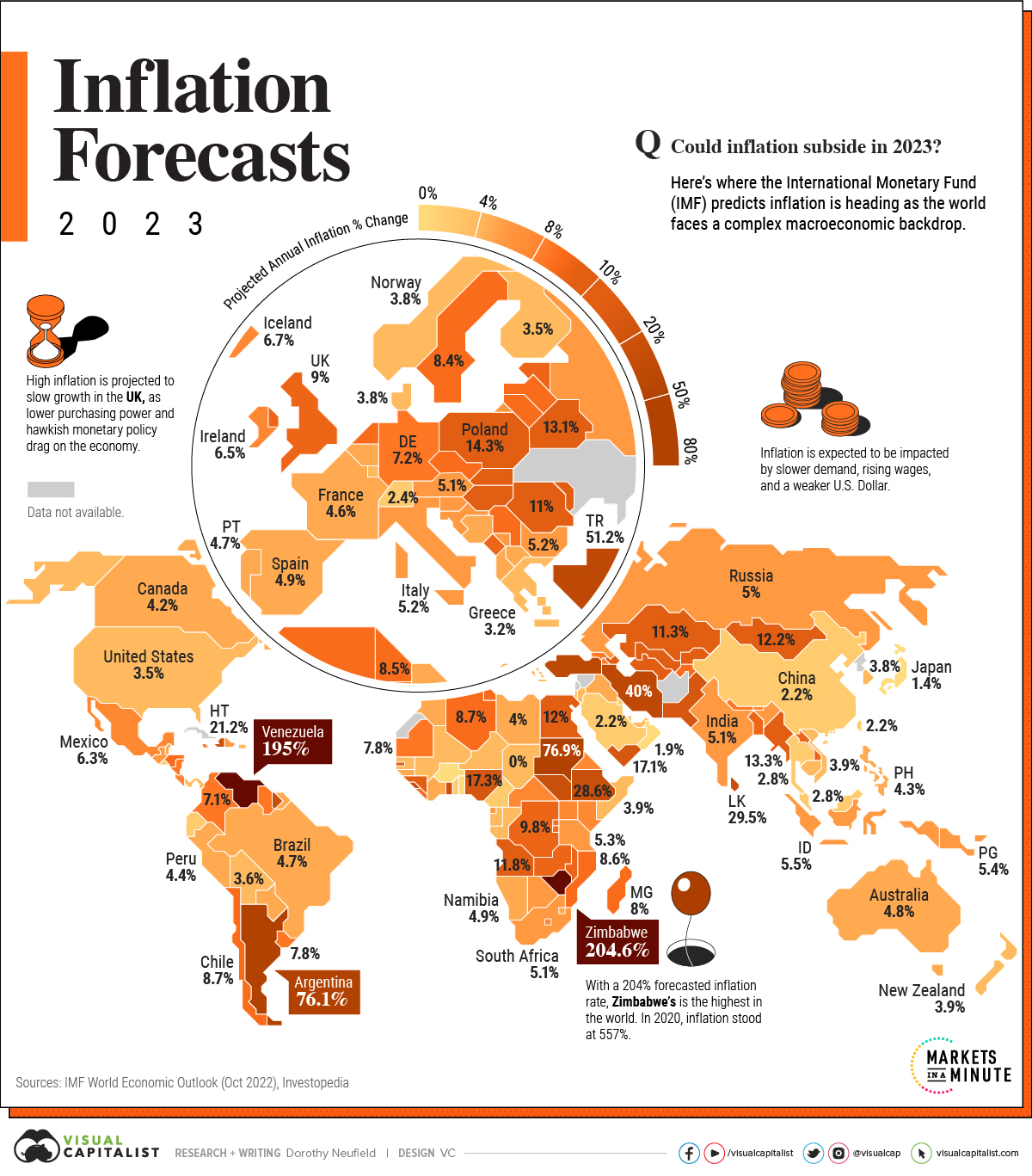

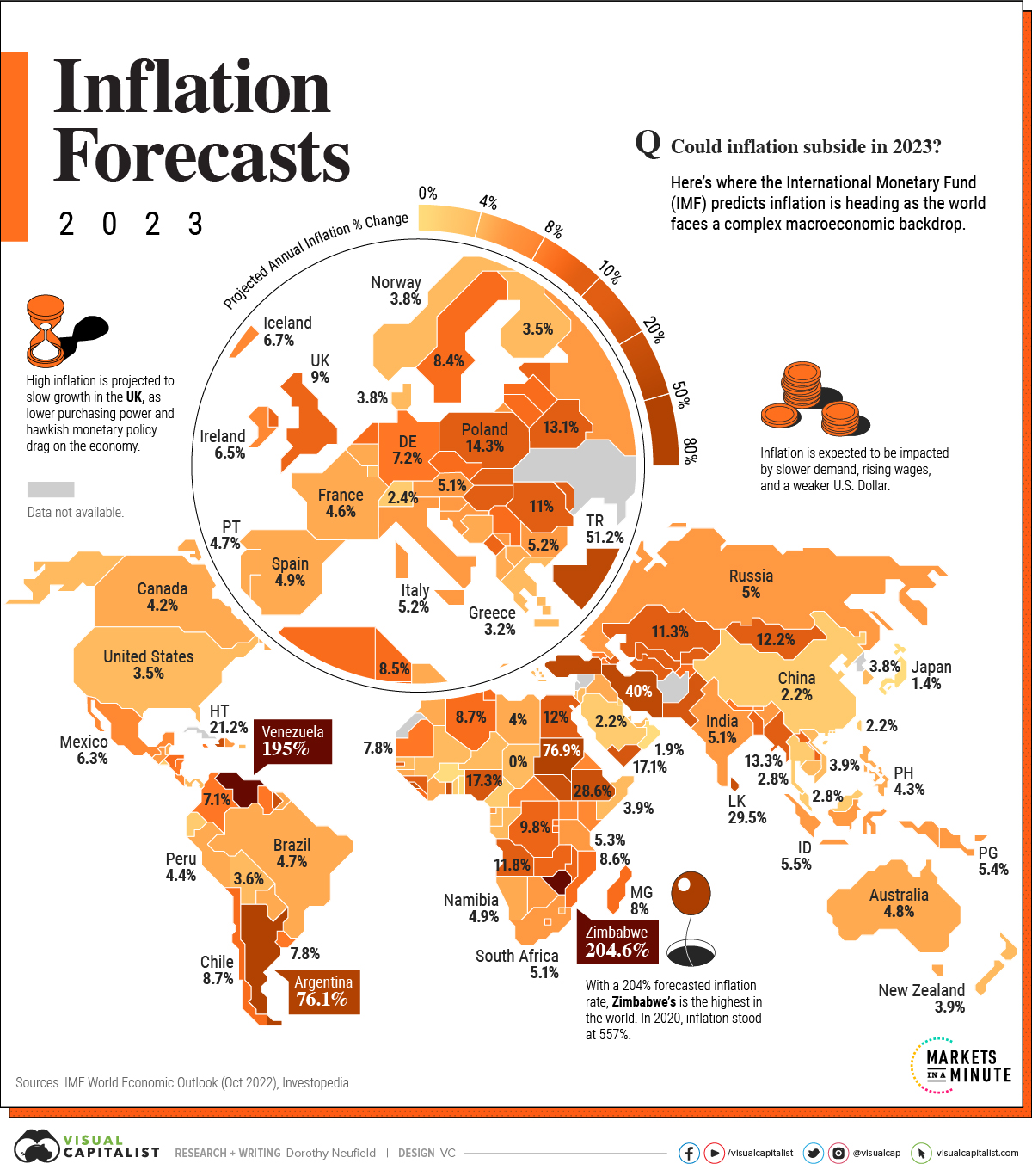

The Road Ahead: What Can We Expect?

Predicting the future of global inflation is challenging, but here are some general expectations:

- Gradual Easing (Hopefully): Many economists expect inflation to gradually ease as supply chains untangle, energy markets stabilize, and central bank actions take effect.

- Volatility: However, geopolitical events, further supply shocks, or unexpected surges in demand could still cause prices to fluctuate.

- Higher Interest Rates: Consumers and businesses should be prepared for a period of higher interest rates as central banks prioritize bringing inflation under control.

- New Normals: Some price changes, especially those driven by long-term shifts in supply chains or energy transitions, might become more permanent.

Conclusion: A Complex Global Challenge

Global inflation is a multifaceted challenge, driven by a complex interplay of supply chain issues, energy and food price shocks, strong consumer demand, labor dynamics, and the lingering effects of pandemic-era economic policies. It’s not just a problem for one country but a global phenomenon that impacts everyone.

While central banks and governments are working to stabilize prices, the path forward is uncertain. Understanding these drivers is the first step in navigating the current economic climate and preparing for what lies ahead. By keeping an eye on these global trends, we can better understand the forces shaping our daily lives and our wallets.

Post Comment