Global Economic Forecasting Models: Accuracy, Limitations, and Why They Still Matter

Have you ever wondered how governments, businesses, and investors make big decisions about the future? They don’t have a crystal ball, but they do have something almost as powerful: global economic forecasting models. These sophisticated tools attempt to predict everything from inflation rates and GDP growth to unemployment figures and stock market trends.

But how accurate are these predictions? And what are their limitations? In a world constantly reshaped by technology, pandemics, and geopolitical shifts, understanding the strengths and weaknesses of these models is more important than ever.

This article will break down the complex world of economic forecasting, making it easy for beginners to understand. We’ll explore the types of models used, discuss their track record of accuracy, and highlight the significant challenges that make perfect predictions impossible.

What is Global Economic Forecasting?

At its core, global economic forecasting is the process of trying to predict the future state of the world’s economy. It involves using various techniques, data, and assumptions to make educated guesses about how economic indicators will change over time.

Why is it so important?

- For Governments: To set interest rates, plan budgets, create jobs, and manage national debt.

- For Businesses: To decide where to invest, whether to expand, how much to produce, and where to hire.

- For Investors: To make informed decisions about buying or selling stocks, bonds, and other assets.

- For Individuals: To understand potential job market changes, inflation’s impact on their savings, or the best time to buy a home.

In essence, forecasting helps us navigate an uncertain future by providing a roadmap, even if that map isn’t always 100% precise.

The Tools of the Trade: Types of Economic Forecasting Models

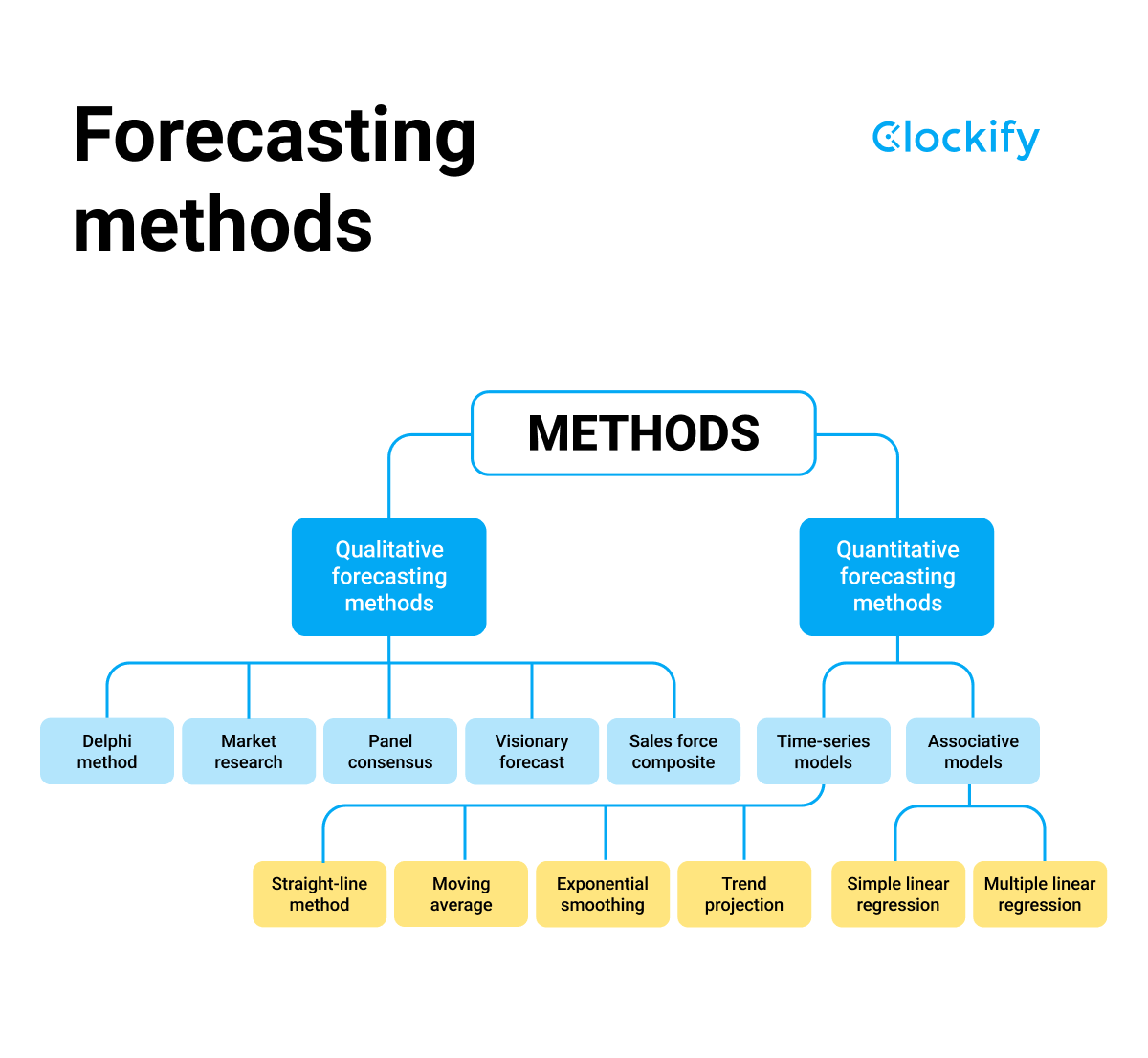

Economic forecasters use a variety of models, often combining different approaches to get the most comprehensive picture. These models can generally be categorized as quantitative (relying on numbers and statistics) or qualitative (relying on expert judgment and surveys).

1. Quantitative Models (Number-Crunching Machines)

These models use mathematical equations and statistical techniques to analyze historical data and predict future trends.

-

Econometric Models (Structural Models):

- How they work: Think of these as a complex set of "if-then" statements. They try to capture the underlying relationships between different economic variables (e.g., if interest rates go up, then consumer spending might go down). They use economic theory to build a "structure" of the economy.

- Example: A model might predict GDP growth based on inputs like consumer confidence, government spending, and export levels.

- Pros: Provide insights into why things are happening, useful for testing the impact of policy changes.

- Cons: Can be very complex, require strong assumptions about economic relationships that might change over time.

-

Time Series Models:

- How they work: These models focus purely on historical patterns of a single economic variable over time, assuming that past trends will continue into the future. They don’t try to explain why the patterns exist, just that they do.

- Example: Predicting next month’s inflation rate purely based on the past 10 years of inflation data. Popular examples include ARIMA (AutoRegressive Integrated Moving Average) models.

- Pros: Relatively simpler to build, good for short-term forecasts, don’t require deep economic theory.

- Cons: Can miss turning points or sudden shifts, don’t explain underlying causes, struggle with "new" situations not seen in historical data.

-

AI and Machine Learning Models:

- How they work: These are the "new kids on the block." AI models, especially machine learning algorithms, can analyze vast amounts of data to find complex patterns that human analysts or traditional models might miss. They "learn" from data rather than being explicitly programmed with economic theories.

- Example: Using a neural network to predict stock prices based on a huge dataset of news articles, social media sentiment, and trading volumes.

- Pros: Can handle massive datasets, identify non-linear relationships, potentially more adaptable.

- Cons: Often act as "black boxes" (hard to understand why they make a certain prediction), require huge amounts of quality data, can perpetuate biases present in the data.

2. Qualitative Models (Expert Insights)

These models rely less on numbers and more on human judgment, surveys, and non-numerical information.

-

Expert Judgment:

- How they work: Gathering opinions and insights from experienced economists, industry leaders, and policymakers. This can involve panels, interviews, or individual assessments.

- Pros: Can incorporate factors that quantitative models can’t (e.g., geopolitical risks, social trends), valuable for interpreting complex situations.

- Cons: Prone to individual biases, can lack transparency, difficult to replicate or systematically test.

-

Surveys and Leading Indicators:

- How they work: Collecting data from surveys of consumer confidence, business sentiment, purchasing managers, etc. These are often called "leading indicators" because they tend to change before the broader economy does.

- Pros: Provide real-time insights into expectations and intentions, useful for spotting shifts in sentiment.

- Cons: Can be subjective, might not always translate directly into economic action.

The Big Question: How Accurate Are Economic Forecasts?

This is where things get tricky. The honest answer is: it varies, and perfect accuracy is extremely rare.

History is full of examples where even the best economic models and forecasters missed major turning points:

- The 2008 Global Financial Crisis: Few, if any, major forecasters predicted the severity and timing of this massive economic meltdown.

- The Dot-Com Bubble Burst (Early 2000s): While some warned of overvaluation, the precise timing and impact were largely unforeseen.

- The COVID-19 Pandemic: An unprecedented event that sent shockwaves through the global economy, rendering most pre-pandemic forecasts instantly obsolete.

Why is it so hard to be accurate?

- Complexity of the Global Economy: Imagine trying to predict the weather across the entire planet, with every tiny local variation impacting every other. The global economy is even more complex, with countless interconnected variables, human behaviors, and external influences.

- Unforeseen Events ("Black Swans"): These are highly improbable, high-impact events that are impossible to predict (like the pandemic, major wars, or sudden technological breakthroughs). They can instantly derail even the most carefully constructed forecasts.

- Data Lags and Quality: Economic data is often collected and released with a delay. Forecasters are often trying to predict the future using slightly outdated information. Data quality can also be an issue, especially in developing economies.

- Human Behavior: People don’t always act rationally. Consumer confidence, business sentiment, and investor panic can shift rapidly and unpredictably, making human behavior one of the hardest factors to model.

While forecasts are rarely perfect, they are often directionally correct over the short term. For example, forecasters might accurately predict a slowdown but miss the exact depth of a recession. The further out a forecast goes, the less accurate it tends to be.

The Roadblocks: Limitations of Economic Forecasting Models

Even the most sophisticated models face inherent limitations that prevent them from being crystal balls. Understanding these limitations is key to using forecasts wisely.

-

1. "Garbage In, Garbage Out" (Data Quality & Availability):

- Models are only as good as the data they’re fed. If the data is incomplete, inaccurate, or outdated, the forecast will suffer.

- For global forecasts, consistent and reliable data across all countries can be a major challenge.

-

2. The "Human Factor" and Irrationality:

- Economic models assume a degree of rational behavior from individuals and businesses. However, human decisions are often driven by emotions, fear, greed, or social trends, making them highly unpredictable.

- Consumer confidence can plummet due to a viral social media post, or investors might panic sell based on rumors, not facts.

-

3. Unpredictable Events ("Black Swans"):

- As mentioned, these are the ultimate forecasting nightmare. By definition, they are unexpected and have massive consequences. No model can predict a pandemic, a major natural disaster, or a sudden geopolitical conflict.

-

4. Model Simplification vs. Real-World Complexity:

- All models are simplifications of reality. They must make assumptions and omit countless minor variables to be manageable.

- Think of it like a map: a map is useful, but it’s not the actual territory. It leaves out many details to be helpful. Economic models do the same.

-

5. Policy Changes & Political Interference:

- Government policies (like tax cuts, new regulations, or trade agreements) can dramatically alter economic trajectories. These changes are often politically driven and not easily predictable by economic models.

- Central banks raising or lowering interest rates can instantly change the economic landscape.

-

6. Lagging Indicators & Real-Time Data Challenges:

- Many key economic indicators (like GDP or unemployment rates) are released with a delay. Forecasters are often looking at the economy in the rearview mirror, making it hard to react to sudden shifts.

- Getting truly real-time, comprehensive global data is an immense challenge.

-

7. The "Self-Fulfilling Prophecy" Paradox:

- Sometimes, a forecast itself can influence the outcome. If everyone believes a recession is coming, they might cut spending, leading to the very recession predicted. This is less common but can occur with widespread public sentiment.

Improving Forecasting: What’s Being Done?

Despite the limitations, forecasters are constantly striving for better accuracy.

- Leveraging Big Data and AI: The ability to process vast datasets and identify complex patterns offers new avenues for improvement.

- Ensemble Forecasting: Combining multiple different models and expert judgments can often yield more robust and accurate predictions than relying on a single approach.

- Focus on Scenarios: Instead of a single "best guess," many forecasters now present a range of possible scenarios (optimistic, pessimistic, base case) to account for uncertainty.

- Greater Transparency: Making models and assumptions more transparent helps others understand and critique forecasts, leading to continuous improvement.

- Behavioral Economics: Integrating insights from psychology into economic models helps better account for irrational human behavior.

Why Forecasts Still Matter (Despite Limitations)

Given all these challenges, one might ask: why bother with economic forecasting at all? The answer is simple: even imperfect guidance is better than no guidance.

- Strategic Planning: Forecasts help governments and businesses plan for different economic conditions, allowing them to prepare for potential downturns or capitalize on opportunities.

- Risk Management: By understanding potential future risks (like inflation or a recession), businesses and investors can adjust their strategies to protect their assets.

- Policy Evaluation: Forecasts provide a baseline against which the effectiveness of economic policies can be measured. Did a tax cut have the predicted impact on growth?

- Communication and Expectations: Forecasts, especially from credible institutions, help manage public and market expectations, preventing panic or irrational exuberance.

Conclusion: Tools, Not Oracles

Global economic forecasting models are powerful tools, not infallible oracles. They represent the best efforts of economists, statisticians, and data scientists to make sense of a highly complex and dynamic world.

While they will never achieve perfect accuracy due to the inherent unpredictability of human behavior and unforeseen events, their value lies in providing a structured framework for understanding potential future scenarios. They help us prepare, adapt, and make more informed decisions in an ever-changing global economy.

As technology advances and our understanding of economic relationships deepens, these models will continue to evolve, offering increasingly sophisticated (though still imperfect) glimpses into our economic future.

Frequently Asked Questions (FAQs)

Q1: Are economic forecasts ever 100% right?

A1: Almost never. The global economy is too complex and influenced by too many unpredictable factors (like human behavior and "black swan" events) for perfect accuracy. Forecasts aim for reasonable accuracy and directional correctness.

Q2: What is a "black swan" event in economics?

A2: A "black swan" event is an extremely rare, unpredictable event that has severe, widespread consequences. Examples include the 9/11 attacks, the 2008 financial crisis, or the COVID-19 pandemic. They are impossible for models to predict and can instantly derail existing forecasts.

Q3: Can AI and Machine Learning predict the economy perfectly?

A3: While AI and Machine Learning models are powerful and can find patterns traditional models miss, they are not perfect predictors. They still rely on historical data, can struggle with unprecedented events, and don’t fully capture the nuances of human behavior or sudden policy shifts. They are a valuable tool but not a magic bullet.

Q4: Who uses economic forecasts the most?

A4: Governments (for policy making), central banks (for monetary policy), large corporations (for strategic planning and investment), and financial institutions (for investment decisions and risk management) are major users of economic forecasts. Individuals also use them indirectly to make personal financial decisions.

Q5: What’s the difference between a short-term and long-term forecast?

A5: Short-term forecasts (e.g., 3-12 months) tend to be more accurate because the immediate future is less uncertain. Long-term forecasts (e.g., 5-10 years) are much more challenging and prone to error, as more variables can change over extended periods.

Post Comment