Forensic Accounting: Unmasking Fraud and Misconduct in the Financial World

In a world increasingly driven by complex financial transactions, the unfortunate reality is that fraud and misconduct are ever-present threats. From sophisticated corporate schemes to individual embezzlement, these deceptive acts can devastate businesses, individuals, and even entire economies. But who are the detectives of the financial world, the specialists who meticulously sift through mountains of data to uncover these hidden truths? Enter the forensic accountant.

This comprehensive guide will demystify forensic accounting, explaining what it is, why it’s crucial, how it operates, and the significant role it plays in ensuring financial integrity and justice. Whether you’re a business owner, an aspiring financial professional, or simply curious about the intricate world of financial crime, you’re about to discover the power of this specialized discipline.

What Exactly is Forensic Accounting? More Than Just Numbers

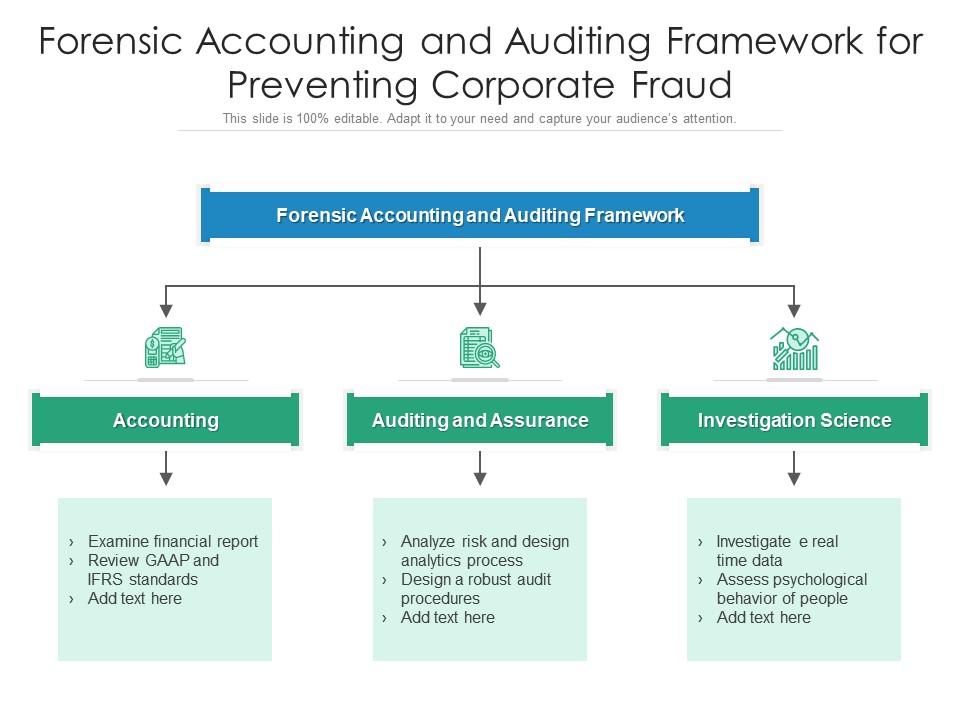

At its core, forensic accounting is the application of accounting, auditing, and investigative skills to uncover financial truths, especially those that might be used in a court of law. The word "forensic" itself comes from the Latin word "forensis," meaning "of the forum," referring to public debate or a legal proceeding.

Think of it this way:

- Traditional accountants are like the general practitioners of the financial world. They prepare financial statements, ensure compliance, and conduct audits to give a "clean bill of health" to a company’s finances.

- Forensic accountants, on the other hand, are the financial detectives or surgeons. They step in when there’s a suspicion of financial foul play, digging deep into records, interviewing individuals, and analyzing data to find evidence of fraud, misconduct, or financial irregularities. Their work often culminates in a report or expert testimony that can stand up to legal scrutiny.

Key Distinction: While traditional auditing aims to provide assurance that financial statements are free from material misstatement, forensic accounting actively seeks out evidence of intentional deception and quantifies its impact.

The Many Hats of a Forensic Accountant: Beyond Fraud Detection

While fraud detection and investigation are primary functions, a forensic accountant’s expertise is far broader. They wear many hats, applying their specialized skills in various scenarios:

1. Fraud Detection & Investigation

This is arguably the most well-known aspect. When a company suspects embezzlement, a government agency detects money laundering, or an individual believes they’ve been defrauded, a forensic accountant is called in. Their mission is to:

- Identify: Pinpoint where and how the fraud occurred.

- Quantify: Determine the financial loss suffered.

- Identify Perpetrators: Find out who was involved.

- Gather Evidence: Collect documentation and data that can be used in legal proceedings.

2. Litigation Support

Forensic accountants frequently work alongside legal teams, providing the financial expertise necessary for various legal disputes. This can include:

- Calculating Damages: Determining the financial loss suffered by a party in a breach of contract, personal injury, or intellectual property infringement case.

- Business Valuation: Assessing the worth of a business for divorce settlements, shareholder disputes, or acquisition disagreements.

- Marital & Divorce Disputes: Tracing hidden assets, evaluating income for spousal or child support, and dividing marital property fairly.

- Bankruptcy & Insolvency: Investigating the financial health of bankrupt entities, identifying preferential payments, or fraudulent conveyances.

3. Dispute Resolution

Beyond formal litigation, forensic accountants help parties resolve financial disagreements through:

- Mediation & Arbitration: Providing objective financial analysis to help parties reach an amicable settlement without going to court.

- Shareholder Disputes: Analyzing financial records to resolve conflicts between business partners or shareholders.

4. Insurance Claims

They investigate complex insurance claims, such as:

- Business Interruption Claims: Calculating lost profits due to a disaster or unexpected event.

- Personal Injury Claims: Assessing lost earnings capacity.

5. Anti-Money Laundering (AML)

Forensic accountants play a critical role in identifying and investigating suspicious financial activities that might indicate money laundering, helping financial institutions and law enforcement agencies comply with regulations and combat financial crime.

Why is Forensic Accounting So Important Today?

The demand for forensic accounting is on a significant rise, driven by several key factors:

- Increasing Sophistication of Fraud: Criminals are becoming more adept at hiding their tracks, utilizing complex financial instruments, digital currencies, and international networks. Forensic accountants possess the tools and knowledge to unravel these intricate schemes.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations (e.g., Sarbanes-Oxley Act, AML laws) to combat financial crime, making forensic expertise essential for compliance and investigation.

- Globalization: Cross-border transactions add layers of complexity, requiring forensic accountants to navigate different legal systems and financial practices.

- Digitalization: While technology aids fraud, it also provides new avenues for detection. Forensic accountants are adept at digital forensics, analyzing electronic data to find clues.

- Cost of Fraud: Fraud costs businesses and individuals billions globally each year. Investing in forensic accounting can help recover losses, prevent future occurrences, and deter potential fraudsters.

- Public Trust: Uncovering and prosecuting financial misconduct helps maintain public trust in financial markets and corporate governance.

The Forensic Accounting Process: A Step-by-Step Investigation

While every case is unique, forensic accountants typically follow a structured approach to their investigations:

-

Engagement & Planning:

- Defining the Scope: What is the specific objective? Is it to find fraud, calculate damages, or value a business?

- Understanding the Environment: Learning about the company, industry, and individuals involved.

- Developing a Plan: Outlining the methodology, resources needed, and timeline. This phase is crucial for efficiency and effectiveness.

-

Data Collection & Preservation:

- Gathering Documents: Meticulously collecting all relevant financial records – bank statements, invoices, contracts, emails, payroll records, expense reports, digital files, etc.

- Ensuring Integrity: Maintaining a strict chain of custody for all evidence to ensure its admissibility in court. This means documenting exactly where each piece of evidence came from and how it was handled.

- Interviewing Key Individuals: Speaking with employees, management, and other relevant parties to gather qualitative information and understand processes.

-

Analysis & Reconstruction:

- Tracing Transactions: Following the flow of money to identify unusual patterns, unauthorized payments, or missing funds.

- Financial Modeling: Creating models to quantify losses, project future damages, or value assets.

- Data Analytics: Utilizing specialized software to analyze large datasets, identify anomalies, and uncover hidden relationships.

- Reconstructing Events: Piecing together fragmented information to create a clear picture of what happened. This is where their investigative skills truly shine.

-

Reporting:

- Clear & Concise: Preparing a detailed, objective report that presents the findings in an easy-to-understand manner.

- Evidentiary Support: The report must be backed by solid evidence and analysis, strong enough to withstand scrutiny.

- Recommendations: Often, the report will include recommendations for internal control improvements to prevent future incidents.

-

Testimony (Expert Witness):

- Explaining Complexities: If the case goes to court, the forensic accountant may be called to testify as an expert witness. Their role is to explain complex financial concepts and their findings clearly to a judge and jury.

- Defending Findings: They must be prepared to defend their methodologies and conclusions under cross-examination.

Common Types of Fraud Forensic Accountants Uncover

While the methods of fraud are constantly evolving, they generally fall into a few broad categories:

-

1. Asset Misappropriation: This is the most common type of fraud, involving the theft or misuse of an organization’s assets.

- Examples:

- Embezzlement: An employee stealing cash or company funds.

- Skimming: Taking cash before it’s recorded in the accounting system.

- Larceny: Stealing cash after it’s been recorded.

- Payroll Fraud: Fictitious employees or inflated hours.

- Expense Reimbursement Fraud: Submitting false or inflated expense reports.

- Examples:

-

2. Corruption: Involves the misuse of influence in a business transaction to gain a direct or indirect benefit.

- Examples:

- Bribery: Offering, giving, receiving, or soliciting anything of value to influence an official act.

- Kickbacks: Undisclosed payments made by a vendor to an employee of the purchasing company in exchange for favorable treatment.

- Conflicts of Interest: An employee or executive making decisions that benefit themselves or a related party, rather than the organization.

- Examples:

-

3. Financial Statement Fraud: Less common but often the most costly, involving the intentional misrepresentation of financial information to deceive investors or creditors.

- Examples:

- Fictitious Revenues: Recording sales that never occurred.

- Concealed Liabilities/Expenses: Hiding debts or overstating assets.

- Improper Asset Valuation: Inflating the value of assets on the balance sheet.

- Timing Differences: Recording revenues or expenses in the wrong accounting period to meet targets.

- Examples:

-

4. Other Emerging Frauds:

- Cyber Fraud: Phishing scams, ransomware, data breaches leading to financial loss.

- Insurance Fraud: False claims for damages or injuries.

- Consumer Fraud: Identity theft, investment scams, pyramid schemes.

Red Flags: Signs You Might Need a Forensic Accountant

While not every red flag indicates fraud, a cluster of these signs should prompt a deeper look and potentially, the involvement of a forensic accountant:

-

Unusual or Unexpected Financial Activity:

- Sudden, unexplained wealth or lifestyle changes in an employee.

- Significant, unexplained variances in budget vs. actual results.

- Unusual or excessive payments to vendors or individuals.

- A high volume of voided transactions or credit memos.

- Missing or altered financial documents.

-

Weak Internal Controls:

- Lack of segregation of duties (one person handling too many financial responsibilities).

- Poor record-keeping or disorganized financial files.

- Absence of regular reconciliation of bank accounts or other financial records.

- Lack of oversight or independent review of financial transactions.

-

Behavioral Red Flags:

- An employee who never takes vacation or insists on working alone.

- Reluctance to share financial information or provide explanations.

- High pressure from management to meet aggressive financial targets.

- Employees living beyond their apparent means.

- Frequent complaints from vendors or customers about billing discrepancies.

-

Operational Issues:

- Declining profits despite increasing sales.

- Inventory shortages or discrepancies.

- Unusual or rapid turnover in financial staff.

- Frequent related-party transactions without clear business justification.

Beyond Detection: Prevention is Key

While forensic accountants are crucial for detecting and investigating fraud after it has occurred, their insights are also invaluable in preventing future incidents. They can help organizations implement robust anti-fraud programs, which typically include:

- Strong Internal Controls: Implementing policies and procedures to safeguard assets and ensure accuracy of financial data (e.g., segregation of duties, regular reconciliations, approval limits).

- Ethical Culture: Fostering a workplace environment where honesty and integrity are highly valued and misconduct is not tolerated.

- Whistleblower Hotlines: Providing anonymous channels for employees to report suspicious activities without fear of retaliation.

- Regular Risk Assessments: Identifying and evaluating potential fraud risks specific to the organization.

- Employee Training: Educating employees on fraud awareness, ethical conduct, and reporting mechanisms.

- Data Analytics Tools: Proactively monitoring transactions for anomalies and suspicious patterns.

Who Needs a Forensic Accountant?

The need for forensic accounting services extends across a wide spectrum of clients:

- Businesses of All Sizes: From small businesses suspecting employee theft to large corporations dealing with complex financial statement fraud.

- Legal Firms: Requiring expert financial analysis and testimony for litigation, dispute resolution, and divorce cases.

- Government Agencies: Investigating public corruption, money laundering, and tax evasion.

- Insurance Companies: Assessing the validity and value of complex claims.

- Individuals: Victims of investment scams, identity theft, or those going through a high-asset divorce.

- Non-Profit Organizations: Ensuring donor funds are used appropriately and combating embezzlement.

Conclusion: The Guardians of Financial Integrity

Forensic accounting is a specialized, vital discipline in today’s intricate financial landscape. Forensic accountants are more than just number crunchers; they are meticulous investigators, strategic analysts, and articulate communicators who bridge the gap between financial complexities and legal realities.

By skillfully applying their expertise, they not only uncover the truth behind financial deception but also play a critical role in recovering losses, ensuring justice, and strengthening the integrity of our financial systems. As fraud continues to evolve, the demand for these financial detectives will only grow, solidifying their position as indispensable guardians of financial integrity. If you suspect financial misconduct or are embroiled in a complex financial dispute, remember that the specialized skills of a forensic accountant can be your most valuable asset in navigating the path to truth and resolution.

Post Comment