Fixed vs. Variable Costs: A Comprehensive Breakdown for Business Success

The financial heartbeat of any business, big or small, lies in its costs. Understanding where your money goes is not just about balancing the books; it’s about making smart decisions that drive profitability, foster growth, and ensure long-term stability. At the core of cost management lies a fundamental distinction: fixed costs and variable costs.

For beginners navigating the world of business finance, these terms can sometimes seem daunting. But fear not! This comprehensive breakdown will demystify fixed and variable costs, explain why understanding them is crucial, and provide practical insights to help you manage your business more effectively.

Why Understanding Costs is Crucial for Your Business

Imagine you’re steering a ship. To reach your destination safely and efficiently, you need to know how much fuel you consume (variable cost) and how much it costs to keep the ship maintained and the crew paid, regardless of whether you’re sailing or docked (fixed costs).

In business, understanding your costs allows you to:

- Set Profitable Prices: Ensure your selling price covers all expenses and leaves a healthy profit margin.

- Create Accurate Budgets: Forecast expenses more reliably and avoid cash flow surprises.

- Make Informed Decisions: Whether to expand, cut back, launch a new product, or change suppliers.

- Analyze Profitability: Pinpoint exactly where your profits (or losses) are coming from.

- Plan for Growth: Understand how your costs will change as your business scales up or down.

Let’s dive into the two main categories.

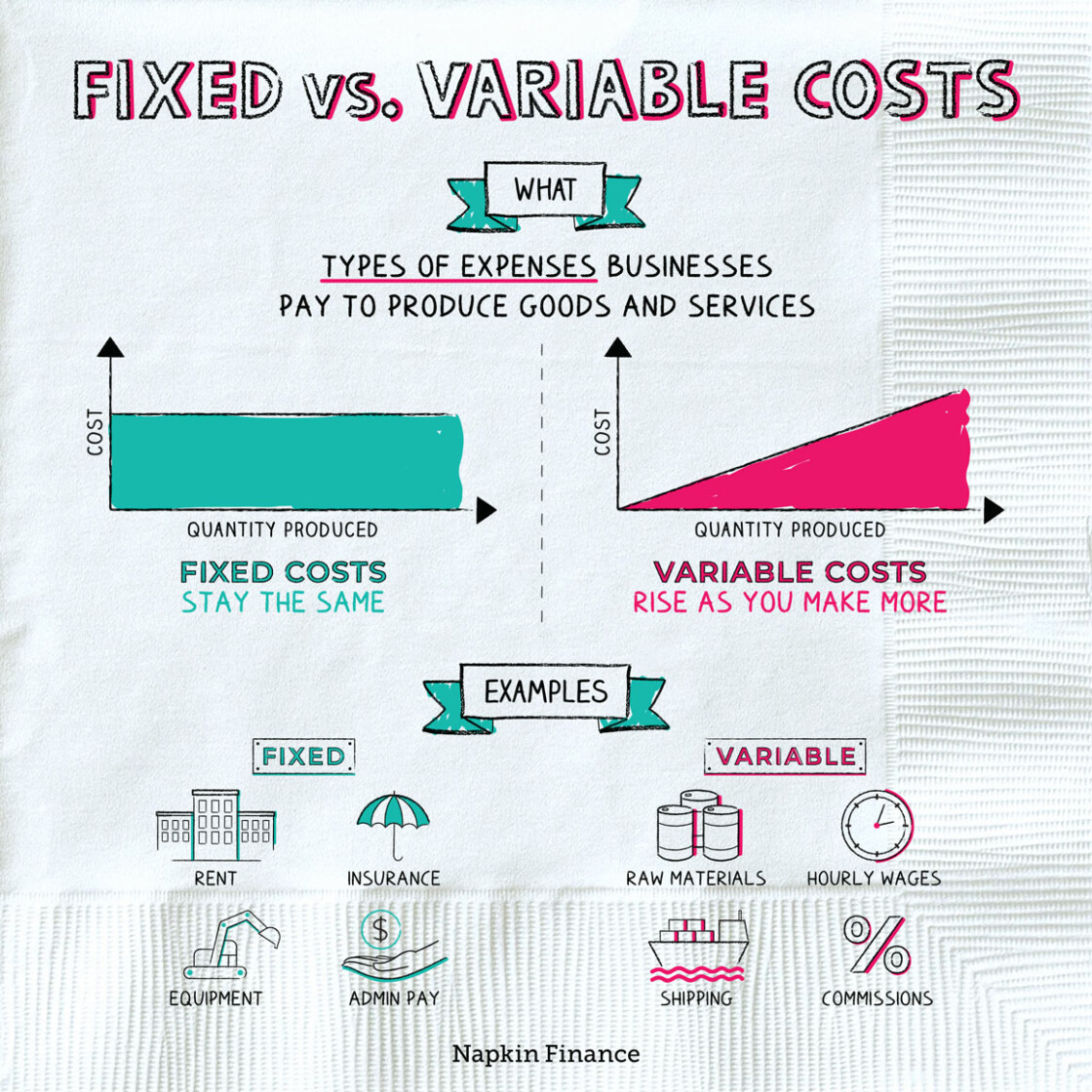

1. What Are Fixed Costs?

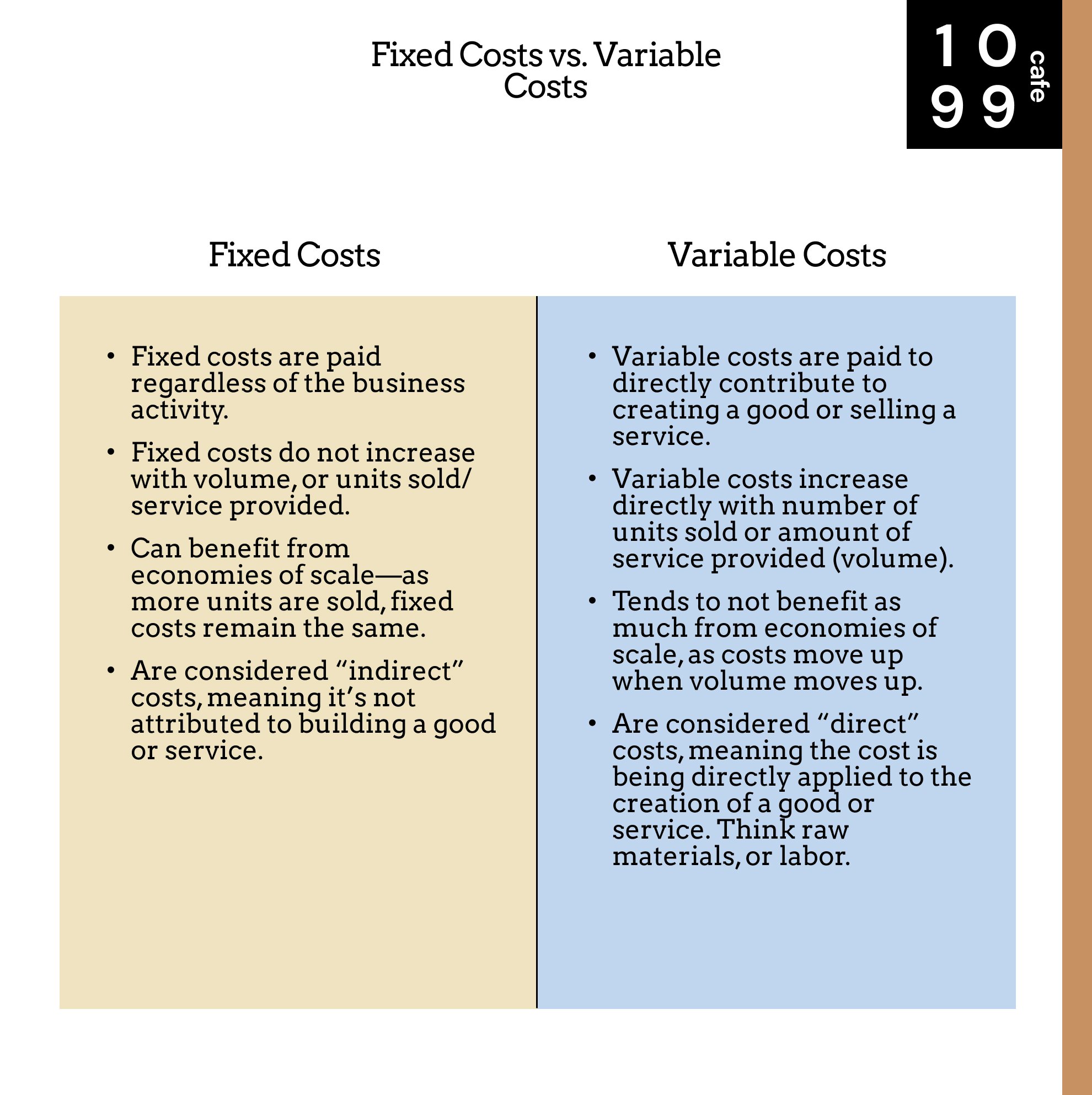

Think of fixed costs as your business’s baseline expenses – the ones you have to pay regularly, regardless of how much you produce or sell. They are constant within a specific period (like a month or a year) and a relevant range of activity.

Definition: Fixed costs are expenses that do not change in total as the volume of goods or services produced increases or decreases. Even if your business produces nothing, you still incur these costs.

Key Characteristics of Fixed Costs:

- Consistent: They remain the same month after month, quarter after quarter.

- Predictable: You can easily forecast these expenses, making budgeting simpler.

- Incurred Even at Zero Production: If your factory shuts down for a month, you still pay rent, insurance, and management salaries.

- Not Directly Tied to Output: Producing one unit or a million units doesn’t change the total amount of these costs.

- Short-Run Concept: While fixed in the short run, almost all costs can become variable in the long run (e.g., you can choose to move to a smaller office or terminate a lease).

Common Examples of Fixed Costs:

- Rent/Lease Payments: For office space, retail store, factory, or warehouse.

- Salaries of Administrative Staff: (e.g., CEO, HR, accounting, administrative assistants – not production workers, who are often variable).

- Insurance Premiums: Business liability, property insurance.

- Depreciation of Equipment: The systematic reduction in value of assets over time.

- Loan Payments: For business loans, equipment financing (the interest portion).

- Property Taxes: For owned real estate.

- Software Subscriptions: For essential business operations (CRM, accounting software).

- Regular Maintenance Contracts: For equipment, even if it’s not heavily used.

Example Scenario: A bakery pays $2,000 per month in rent for its shop. Whether they bake 100 loaves of bread or 10,000 loaves, the rent payment remains $2,000.

2. What Are Variable Costs?

In contrast to fixed costs, variable costs are directly tied to your business’s activity level. The more you produce or sell, the higher your total variable costs will be. The less you produce, the lower they become.

Definition: Variable costs are expenses that change in total in direct proportion to changes in the volume of goods or services produced. While the total variable cost fluctuates, the per-unit variable cost typically remains constant.

Key Characteristics of Variable Costs:

- Fluctuating: They go up when production increases and go down when production decreases.

- Directly Tied to Output: If you don’t produce anything, you incur zero variable costs.

- Per-Unit Cost Remains Constant: If it costs $1 to produce one widget in terms of raw materials, it will cost $100 to produce 100 widgets, but the cost per widget is still $1.

- Easier to Control in the Short Term: You can directly influence these costs by adjusting production levels.

Common Examples of Variable Costs:

- Raw Materials: Ingredients for a bakery, steel for a manufacturer, fabric for a clothing line.

- Direct Labor Wages: Wages paid to employees directly involved in production (e.g., assembly line workers paid per unit, hourly production workers).

- Production Supplies: Packaging materials, labels, cleaning supplies used in production.

- Sales Commissions: Paid to sales staff based on sales volume.

- Shipping & Freight Costs: Costs to deliver products to customers, which increase with more sales.

- Utilities Directly Related to Production: Electricity for machinery that runs only when producing, water used in a manufacturing process.

- Transaction Fees: Credit card processing fees that increase with sales volume.

Example Scenario: That same bakery uses $0.50 worth of flour, sugar, and yeast for each loaf of bread. If they bake 100 loaves, their variable cost for ingredients is $50 (100 x $0.50). If they bake 10,000 loaves, this cost jumps to $5,000 (10,000 x $0.50).

3. Fixed vs. Variable Costs: The Key Differences

Here’s a quick comparison to highlight the main distinctions between these two crucial cost categories:

| Feature | Fixed Costs | Variable Costs |

|---|---|---|

| Behavior with Output | Remain constant in total | Change in total with output |

| Per Unit Cost | Decreases as output increases (spreads out) | Remains constant per unit |

| Predictability | Highly predictable | Less predictable (depends on sales/production) |

| Incurred at Zero Output | Yes | No |

| Impact on Break-Even | Higher fixed costs mean higher break-even point | Directly impact marginal profit per unit |

| Management Focus | Long-term strategy, cost structure optimization | Short-term efficiency, production volume control |

| Examples | Rent, insurance, administrative salaries | Raw materials, direct labor, sales commissions |

4. Why Understanding Fixed and Variable Costs Matters for Your Business

Knowing the difference between fixed and variable costs is not just academic – it’s fundamental to sound business management.

a) Budgeting and Financial Planning

- Accurate Forecasting: Fixed costs are easy to budget for, providing a stable baseline. Variable costs require more careful forecasting based on sales projections, but knowing their per-unit rate helps.

- Cash Flow Management: Predicting when and how much cash you’ll need is vital. Fixed costs represent regular outflows, while variable costs fluctuate with sales, impacting your short-term cash needs.

b) Pricing Strategies

- Covering Your Costs: You must set prices that cover both your fixed and variable costs, plus leave a profit.

- Minimum Price Point: Variable costs define the absolute minimum price you can charge for a product or service and still contribute to covering fixed costs. Selling below your variable cost per unit means losing money on every single sale.

- Contribution Margin: Understanding variable costs allows you to calculate your contribution margin (Sales Revenue – Variable Costs). This is the amount of money each sale contributes towards covering your fixed costs and generating profit.

c) Break-Even Analysis

- The "Magic Number": Break-even analysis is the point at which your total revenues equal your total costs (both fixed and variable), meaning you are neither making a profit nor incurring a loss.

- Calculating Break-Even: You need to know your total fixed costs and your per-unit variable costs to calculate how many units you need to sell to break even. This is a critical metric for any business.

- Formula: Break-Even Point (in units) = Total Fixed Costs / (Selling Price Per Unit – Variable Cost Per Unit)

d) Scalability and Growth

- Impact of Growth: As your business grows, your total variable costs will increase. However, your fixed costs might remain the same for a while, meaning your per-unit fixed cost decreases, leading to higher profit margins per unit. This is known as economies of scale.

- Strategic Expansion: Understanding your cost structure helps you decide whether to expand. If you have high fixed costs, you need a high volume of sales to be profitable. If you have low fixed costs and high variable costs, you might be more flexible during downturns but might not benefit as much from economies of scale.

e) Decision-Making

- Outsourcing vs. In-House: Should you outsource a function (making it a variable cost, paid per service) or hire employees and invest in equipment (creating fixed costs)?

- Production Levels: How many units should you produce? This decision is heavily influenced by your variable costs per unit.

- Cost-Cutting Measures: Knowing which costs are fixed and which are variable helps you identify the most effective areas for cost reduction. Cutting variable costs often has a more immediate impact on profitability.

5. Practical Tips for Managing Your Business Costs

Now that you understand the difference, here’s how to put that knowledge into action:

- Categorize Everything: When reviewing your expenses, clearly label each as fixed or variable. This is the first and most crucial step. Use accounting software to help you do this.

- Monitor Variable Costs Closely: Since they fluctuate, track them regularly. Look for opportunities to reduce per-unit variable costs (e.g., negotiate better deals with suppliers, optimize production processes).

- Review Fixed Costs Periodically: While fixed, they aren’t set in stone forever. Can you negotiate lower rent? Are you over-insured? Can you switch to a more affordable software subscription?

- Understand Your Break-Even Point: Calculate it regularly, especially after any significant changes in your cost structure or pricing.

- Build a Cash Reserve: Having a buffer helps cover your fixed costs during slow periods when variable cost-generating sales might be low.

- Consider Outsourcing: For some functions, outsourcing can convert a fixed cost (e.g., an employee’s salary, office space for that employee) into a variable cost (paying a contractor only when you need their service).

- Invest in Efficiency: Automation, better machinery, and streamlined processes can often reduce variable costs per unit, increasing your profit margins.

Conclusion

Fixed and variable costs are the bedrock of financial understanding for any business owner. By clearly distinguishing between these two types of expenses, you gain unparalleled insight into your cost structure, empowering you to make more informed decisions about pricing, budgeting, growth, and overall profitability.

Don’t just track your money – understand how it behaves. This knowledge is your compass, guiding your business toward sustained success and financial resilience. Start categorizing, analyzing, and strategizing today, and watch your business thrive!

Post Comment