Financial Modeling for Startups: Your Essential Guide to Navigating Growth & Funding

Starting a business is an exhilarating journey, filled with innovative ideas, late nights, and the dream of making a real impact. But amidst the excitement, there’s a crucial, often intimidating, aspect that every successful startup must master: financial modeling.

Feeling overwhelmed by terms like P&L, cash flow, and runway? You’re not alone. Many founders view financial modeling as a complex chore reserved for finance gurus. However, mastering this skill isn’t just about impressing investors; it’s about gaining clarity, making informed decisions, and truly understanding the beating heart of your business.

This comprehensive guide will demystify financial modeling for startups, breaking down complex concepts into easy-to-understand language. By the end, you’ll have a clear roadmap to build robust financial projections that drive your startup’s success.

What Exactly is Financial Modeling for a Startup?

Imagine your startup is a car on a long journey. Financial modeling is like your car’s GPS, dashboard, and fuel gauge all rolled into one. It’s a structured way to represent your business’s past, present, and projected future financial performance, typically using a spreadsheet.

In simpler terms, a financial model is a tool that helps you:

- Predict: How much money you’ll make and spend.

- Analyze: What happens if you change prices, hire more people, or launch a new product.

- Plan: How much cash you’ll need and when.

- Communicate: Your business’s potential to investors, partners, and employees.

It’s not about predicting the future with 100% accuracy (no one can do that!), but about creating a reasoned, data-driven framework to understand your business’s financial trajectory and make smarter decisions.

Why Every Startup Needs a Robust Financial Model

You might be thinking, "I’m too busy building my product! Do I really need this now?" The answer is a resounding YES. Here’s why a strong financial model is non-negotiable for any startup:

-

Informed Decision-Making:

- Pricing Strategy: How much should you charge for your product or service to be profitable?

- Hiring: Can you afford to hire that new developer or sales person? When?

- Product Development: Should you invest in a new feature? What’s the potential return?

- Marketing Spend: How much can you spend on customer acquisition and still be profitable?

-

Successful Fundraising:

- Investor Confidence: Investors demand a solid financial model. It shows them you understand your business, have a clear vision, and have thought through the path to profitability.

- Valuation: It provides the basis for discussions around your startup’s valuation.

- Funding Needs: It clearly outlines how much money you need and what you’ll use it for (your "use of funds").

-

Understanding Your Financial Health:

- Cash Flow Management: The #1 reason startups fail is running out of cash. A model helps you predict your "runway" (how long you can operate before running out of money) and "burn rate" (how quickly you’re spending cash).

- Profitability: It helps you understand when and how you’ll become profitable.

- Break-Even Analysis: When will your revenue cover your costs?

-

Strategic Planning & Goal Setting:

- It helps you set realistic financial goals and track your progress against them.

- It allows you to test different growth scenarios (e.g., what if we grow 10% faster?).

-

Risk Management:

- By modeling different scenarios (e.g., best case, worst case, most likely), you can identify potential risks and develop contingency plans.

Key Components of a Startup Financial Model

A typical startup financial model is built from several interconnected parts. Understanding these building blocks is crucial:

1. Assumptions Sheet

This is the heart of your model. It’s where you list all the variables and educated guesses that drive your projections. Think of it as the "inputs" that feed the rest of your model.

- Examples of Assumptions:

- Customer acquisition cost (CAC)

- Monthly churn rate (customers leaving)

- Average revenue per user (ARPU)

- Employee salaries and benefits

- Marketing spend as a percentage of revenue

- Growth rates (e.g., monthly customer growth)

- Pricing of your product/service

- Cost of goods sold (COGS) per unit

- Payment terms for customers and suppliers

Why it’s important: Transparency and flexibility. If an investor asks "What if your churn is higher?", you can easily adjust it on this sheet and show the impact.

2. Revenue Model

How will your startup make money? This section details your various income streams.

- Common Revenue Models:

- Subscription: Monthly/annual fees (e.g., SaaS, streaming services).

- Transactional: Per-purchase fees (e.g., e-commerce, marketplaces).

- Advertising: Selling ad space (e.g., content sites, social media).

- Service-based: Charging for time or projects (e.g., consulting, agencies).

- Freemium: Basic service free, premium features paid.

Key consideration: Break down your revenue into its core drivers (e.g., number of customers * average price per customer).

3. Cost Structure

This outlines all the expenses your startup incurs. It’s usually divided into:

- Cost of Goods Sold (COGS): Direct costs associated with producing your product or service.

- Examples: Raw materials, manufacturing costs, direct labor (for products), hosting fees (for software), payment processing fees.

- Operating Expenses (OpEx): Costs incurred to run the business that aren’t directly tied to producing your goods/services.

- Examples:

- Salaries & Wages: For employees (sales, marketing, admin, R&D).

- Sales & Marketing: Advertising, commissions, conferences.

- General & Administrative (G&A): Rent, utilities, legal fees, accounting, office supplies.

- Research & Development (R&D): Costs associated with developing new products or improving existing ones.

- Examples:

Key consideration: Distinguish between fixed costs (don’t change with sales volume, like rent) and variable costs (change with sales volume, like COGS).

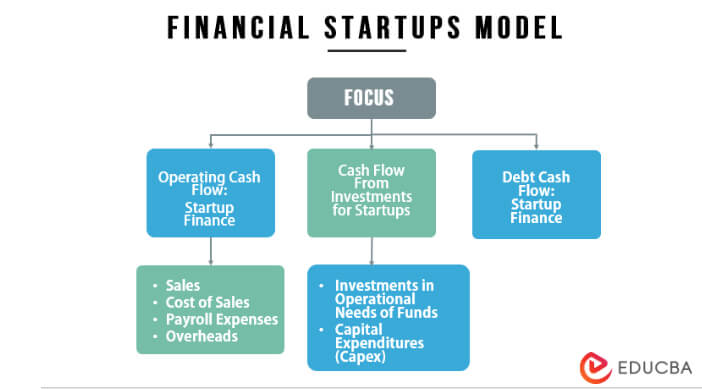

4. Capital Expenditures (CapEx)

These are investments in long-term assets that benefit the business for more than one year.

- Examples: Buying computers, office furniture, specialized equipment, building improvements.

5. Working Capital

This refers to the money needed for your day-to-day operations. It’s the difference between your current assets (cash, accounts receivable, inventory) and current liabilities (accounts payable).

Why it’s important: To ensure you have enough liquidity to cover immediate expenses. Startups often face working capital challenges due to delayed customer payments or needing to pay suppliers upfront.

6. The Three Core Financial Statements

These are the outputs of your model, providing a standardized view of your financial health.

-

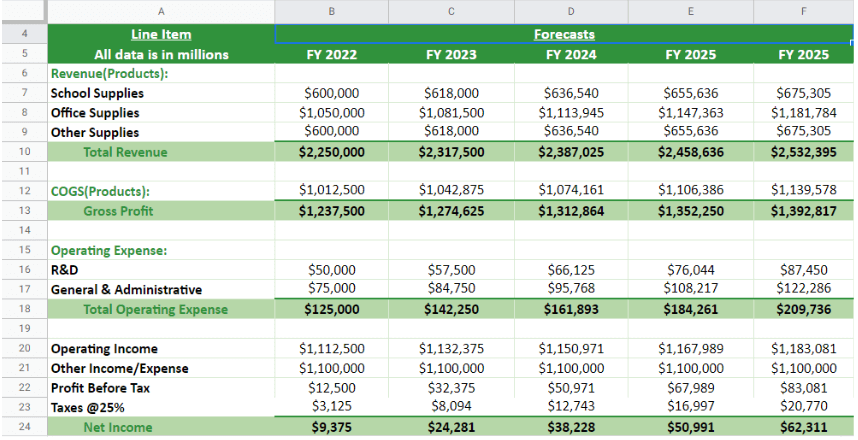

a. Income Statement (Profit & Loss / P&L):

- What it shows: Your company’s profitability over a period (e.g., month, quarter, year).

- Key line items: Revenue – COGS = Gross Profit – Operating Expenses = Net Income (Profit/Loss).

- Think of it as: Your report card on how much profit you’re making.

-

b. Cash Flow Statement:

- What it shows: The actual movement of cash into and out of your business over a period. This is often the most critical statement for startups.

- Key sections: Cash from Operations, Cash from Investing, Cash from Financing.

- Think of it as: Your bank statement, showing where all your money went and came from. You can be profitable on paper but still run out of cash!

-

c. Balance Sheet:

- What it shows: A snapshot of your company’s assets, liabilities, and equity at a specific point in time.

- Key equation: Assets = Liabilities + Equity.

- Think of it as: Your company’s financial photograph at a given moment.

Building Your Startup Financial Model: A Step-by-Step Guide

Ready to get hands-on? Here’s a simplified approach to building your first financial model. Most founders use spreadsheets like Microsoft Excel or Google Sheets.

Step 1: Lay the Foundation with Assumptions

- Start here. Seriously. Don’t jump straight to revenue.

- Create a dedicated "Assumptions" tab in your spreadsheet.

- List every key variable that will influence your financial future (e.g., customer acquisition cost, conversion rates, average contract value, employee salaries, monthly rent, software subscriptions).

- Be realistic and try to back up your assumptions with market research, industry benchmarks, or early traction data.

Step 2: Project Your Revenue

- Based on your assumptions, build out your revenue streams.

- Example (SaaS):

- New Customers per Month (from marketing spend assumptions)

- Minus Churned Customers (from churn rate assumption)

- Equals Net New Customers

- Times Average Revenue Per User (ARPU)

- Equals Monthly Recurring Revenue (MRR)

- Break down each revenue stream into its core drivers.

Step 3: Estimate Your Costs (COGS & Operating Expenses)

- COGS: Link these directly to your revenue drivers. If you sell more products, your COGS should increase proportionally.

- Operating Expenses:

- Fixed Costs: Enter your monthly rent, standard software subscriptions, etc.

- Variable/Scalable Costs: Model employee salaries, marketing spend (often a percentage of revenue or based on customer acquisition goals), travel, etc.

- Don’t forget CapEx if you plan significant asset purchases.

Step 4: Construct Your Financial Statements (The Outputs)

- Income Statement: Use formulas to pull data from your revenue and expense sections. Calculate Gross Profit, Operating Income, and Net Income.

- Cash Flow Statement: This is where things get a bit trickier, as it adjusts for non-cash items (like depreciation) and changes in working capital. For beginners, focus on the operational cash flow (cash from sales minus cash paid for expenses).

- Balance Sheet: This is often the most complex to build from scratch. Many founders get professional help for this or use simplified templates initially. The key is to ensure it balances!

Step 5: Calculate Key Metrics & Insights

Once your statements are built, derive critical insights:

- Burn Rate: How much cash you’re losing per month.

- Calculation: (Total Cash Outflows – Total Cash Inflows) / Number of Months

- Runway: How many months until you run out of cash.

- Calculation: Current Cash Balance / Monthly Burn Rate

- Break-Even Point: When your total revenue equals your total costs.

- Customer Lifetime Value (CLTV): The total revenue you expect from a customer over their relationship with your company.

- Customer Acquisition Cost (CAC): How much it costs to acquire one new customer.

- Unit Economics: The revenues and costs associated with a single unit of your product or service.

Step 6: Perform Scenario Planning & Sensitivity Analysis

This is where your model truly becomes powerful.

- Scenario Planning: Create different versions of your model based on varying assumptions:

- Best Case: Optimistic growth, lower costs.

- Most Likely Case: Your primary projection.

- Worst Case: Slower growth, higher costs.

- This shows investors you’ve thought about potential challenges.

- Sensitivity Analysis: See how sensitive your outcomes (e.g., profitability, runway) are to changes in single key assumptions. What if your customer acquisition cost doubles? What if your churn rate increases by 2%?

Step 7: Iterate and Refine

- Your model is a living document. It’s never "done."

- As your business evolves, as you get more data, and as market conditions change, update your assumptions and projections.

- Regularly compare your actual performance against your model to identify discrepancies and refine your forecasting.

Common Mistakes Startups Make in Financial Modeling (and How to Avoid Them)

- Overly Optimistic Projections: "Hockey stick" growth charts without realistic justification.

- Fix: Base assumptions on market research, industry averages, and your actual early traction. Be conservative and build in a "worst case" scenario.

- Ignoring Cash Flow: Focusing only on profitability (P&L) and forgetting that "cash is king."

- Fix: Prioritize building and understanding your Cash Flow Statement. Monitor your burn rate and runway religiously.

- Lack of Detailed Assumptions: "Magic numbers" without any basis.

- Fix: Create a comprehensive assumptions sheet. Explain why you chose each number. Use percentages, drivers, and clear logic.

- Setting It and Forgetting It: Building a model once for fundraising and never updating it.

- Fix: Treat your model as a dynamic tool. Update it monthly or quarterly with actuals and revise future projections.

- Over-Complicating the Model: Adding too many intricate details or unnecessary features early on.

- Fix: Start simple. Focus on the core drivers of your business. You can always add complexity later as needed.

- Not Understanding the Model You Built: Relying on a template or someone else to build it without truly grasping the underlying logic.

- Fix: Get involved in the building process. Ask questions, understand the formulas, and be able to explain every part of your model to an investor.

Tools for Financial Modeling

You don’t need fancy software to get started.

- Spreadsheets (Excel, Google Sheets): Your best friends. Powerful, flexible, and free (Google Sheets).

- Financial Modeling Templates: Many free or paid templates are available online specifically for startups (e.g., from venture capital firms, startup accelerators, or financial modeling blogs). These can provide a great starting point.

- Specialized Software: As your company grows, you might explore dedicated financial planning & analysis (FP&A) software, but for early-stage startups, spreadsheets are more than sufficient.

When to Seek Professional Help

While it’s crucial for founders to understand their model, sometimes a little professional help can go a long way:

- Complex Business Models: If your revenue streams or cost structures are unusually intricate.

- Major Fundraising Rounds: For significant seed, Series A, or later rounds, investors expect a highly polished and robust model.

- Lack of Internal Expertise: If no one on your team has a strong finance background and you’re struggling to grasp the concepts.

- Time Constraints: Building a detailed model takes time. If you’re stretched thin, a fractional CFO or financial consultant can expedite the process.

Conclusion: Empower Your Startup with Financial Clarity

Financial modeling might seem daunting at first, but it’s an indispensable skill for any startup founder. It’s not just about numbers; it’s about translating your vision into a tangible plan, understanding your true potential, and making smart, data-driven decisions that pave the way for sustainable growth.

By embracing financial modeling, you’ll not only be better equipped to attract investment but, more importantly, you’ll gain the clarity and control needed to navigate the exciting, challenging, and ultimately rewarding journey of building your startup. Start small, iterate often, and empower your entrepreneurial dream with financial intelligence.

Post Comment