Financial Independence, Retire Early (FIRE) Explained: Your Beginner’s Guide to Unlocking True Freedom

Have you ever dreamt of a life where work is optional, where you have the freedom to pursue your passions, travel the world, or simply spend more time with loved ones, without the constant pressure of a paycheck? If so, you’ve likely brushed shoulders with the concept of Financial Independence, Retire Early (FIRE).

The FIRE movement has captivated millions, transforming the traditional idea of a 40-year career followed by a modest retirement. It’s not just about saving money; it’s a holistic lifestyle designed to reclaim your most valuable asset: your time.

This comprehensive guide will demystify FIRE, explaining its core principles, various approaches, and how you can start your own journey towards true financial freedom.

What Exactly is FIRE? Deconstructing the Acronym

At its heart, FIRE is a powerful personal finance movement focused on aggressively saving and investing a significant portion of your income with the goal of becoming financially independent – typically much earlier than traditional retirement age.

Let’s break down the two key components:

- Financial Independence (FI): This is the bedrock of the movement. It means having enough passive income (money generated from investments, real estate, etc., without actively working for it) to cover your living expenses. Once you reach FI, you no longer need to work for money. You have the ultimate choice and flexibility.

- Retire Early (RE): This is the outcome of achieving FI. "Retire" in the FIRE context doesn’t necessarily mean sitting on a beach doing nothing. It means retiring from mandatory work. You might choose to pursue a passion project, volunteer, travel extensively, start a less stressful business, or simply enjoy more leisure time. The key is that work becomes a choice, not a necessity.

The generally accepted rule of thumb for achieving financial independence is to accumulate 25 times your annual living expenses in invested assets. This is based on the "4% rule" (also known as the "safe withdrawal rate"), which suggests you can safely withdraw 4% of your portfolio each year without running out of money, historically speaking.

Example: If your annual living expenses are $40,000, your FIRE number would be $40,000 x 25 = $1,000,000.

Why Are People Chasing FIRE? The Allure of Freedom

The appeal of FIRE goes far beyond just stopping work. It addresses a fundamental human desire for autonomy and control over one’s life. Here are some of the compelling reasons why millions are embracing the FIRE lifestyle:

- Ultimate Freedom & Choice: This is the biggest draw. Imagine waking up each day with the freedom to decide how you spend your time, rather than being dictated by a job.

- Reduced Stress: The financial pressure that comes with a traditional career often leads to stress, anxiety, and burnout. FIRE aims to eliminate this by creating a robust financial cushion.

- Time for Passions & Hobbies: Whether it’s learning a new language, mastering an instrument, volunteering, or simply spending more time outdoors, FIRE provides the time to pursue what truly brings you joy.

- More Time with Loved Ones: Many people feel their careers steal precious time away from family and friends. FIRE offers the chance to reconnect and build stronger relationships.

- Geographic Flexibility: With no need for a fixed job, you can live anywhere you desire, whether it’s a lower cost of living area, a different country, or closer to nature.

- Improved Health & Well-being: Less stress, more control, and the ability to focus on physical and mental health often lead to a higher quality of life.

- Leaving a Legacy: Achieving FIRE can free up mental and physical energy to focus on making a greater impact, whether through philanthropy, entrepreneurship, or creative endeavors.

The Core Pillars of the FIRE Movement: How It Works

Achieving FIRE isn’t magic; it’s a disciplined and intentional approach to personal finance built on a few key pillars:

-

Aggressive Savings Rate:

This is the cornerstone of FIRE. Instead of saving the traditional 10-15% of your income, FIRE enthusiasts aim for a much higher percentage, often 50% or even 70%+. The higher your savings rate, the faster you will reach your FIRE number.

- Why it works: A high savings rate has a powerful dual effect:

- It dramatically increases the amount of money you can invest.

- It forces you to live on less, meaning your annual expenses are lower, which in turn means your FIRE number is lower. This creates a powerful feedback loop.

- Why it works: A high savings rate has a powerful dual effect:

-

Mindful Spending & Frugality:

This isn’t about deprivation; it’s about intentionality. FIRE proponents critically examine their spending habits, cutting out expenses that don’t align with their values and focusing on what truly brings them joy.

- Key Strategies:

- Budgeting: Tracking every dollar in and out to understand where your money goes.

- Reducing Big Expenses: Housing, transportation, and food are typically the largest budget categories. Optimizing these (e.g., smaller home, efficient car, cooking at home) can have a massive impact.

- Avoiding Lifestyle Creep: As income increases, resist the urge to immediately upgrade your lifestyle. Maintain your current spending habits to boost your savings rate.

- Key Strategies:

-

Aggressive Investing:

Saving money is only half the equation. To truly build wealth and generate passive income, you need to invest your savings wisely.

- Common Investment Vehicles:

- Low-Cost Index Funds & ETFs: These are popular because they offer broad market diversification (you own a tiny piece of many companies) at very low fees, making them ideal for long-term growth.

- Tax-Advantaged Accounts: Maximizing contributions to accounts like 401(k)s, IRAs (Roth or Traditional), and HSAs allows your investments to grow tax-free or tax-deferred.

- Real Estate: Some choose to invest in rental properties for additional passive income and asset appreciation.

- The Power of Compound Interest: This is your best friend on the FIRE journey. It’s the concept of earning returns on your initial investment and on the accumulated interest from previous periods. The earlier you start, the more time compound interest has to work its magic.

- Common Investment Vehicles:

-

Increasing Income (Optional, but Powerful):

While cutting expenses is crucial, increasing your income can significantly accelerate your journey.

- Strategies:

- Career Advancement: Negotiating raises, seeking promotions, or changing jobs for higher pay.

- Side Hustles: Starting a part-time business, freelancing, or gig work to earn extra money outside of your primary job.

- Skill Development: Investing in new skills that command higher wages.

- Strategies:

Different Flavors of FIRE: It’s Not One-Size-Fits-All

The FIRE movement is incredibly diverse, recognizing that everyone’s ideal "retirement" looks different. Here are some of the most popular variations:

-

Traditional FIRE:

This is the classic approach: save aggressively (50-70% of income) to reach your 25x annual expenses number, then stop working entirely or mostly.

-

Lean FIRE:

For those who desire to retire with a very minimalist lifestyle, often living on less than $40,000 per year (or even less, depending on location). This requires a smaller FIRE number but also a commitment to extreme frugality.

-

Fat FIRE:

The opposite of Lean FIRE. These individuals aim for a much larger portfolio to support a more luxurious or comfortable lifestyle in retirement, often well over $100,000+ per year in expenses. This naturally requires a significantly higher FIRE number and often a higher income during the accumulation phase.

-

Barista FIRE:

You’ve reached a substantial portion of your FIRE number, but not quite 100%. To bridge the gap and cover health insurance or some expenses, you work part-time at a low-stress job (like a barista, hence the name). This allows for a semi-retired lifestyle while your investments continue to grow.

-

Coast FIRE:

You’ve saved and invested enough money early in your career that, if left to grow untouched in your investment accounts, it will naturally compound to your full FIRE number by traditional retirement age (or even earlier) without any further contributions. You can then work a less demanding job, or just cover your current expenses, knowing your future is secured.

-

Slow FIRE:

A more gradual approach to FIRE, where individuals still prioritize financial independence but don’t aim for the super-aggressive savings rates of Traditional FIRE. They might take a longer time (e.g., 20-30 years) to reach FI, enjoying their journey more along the way.

Your Step-by-Step Guide to Starting Your FIRE Journey

Ready to light your own FIRE? Here’s a practical roadmap to get started:

-

Assess Your Current Financial Situation:

- Track Your Spending: For at least a month, record every dollar you spend. Use a budgeting app, spreadsheet, or pen and paper. This is critical for understanding where your money goes.

- Calculate Your Net Worth: Sum up all your assets (cash, investments, property value) and subtract all your liabilities (debts like mortgages, student loans, credit card debt). This gives you your starting point.

- Understand Your Income: How much are you bringing in after taxes and deductions?

-

Define Your "Why" and Your "What":

- Why FIRE? What does financial freedom truly mean to you? What would you do with your time? This motivation will keep you going during challenging times.

- What’s Your Ideal FI Lifestyle? Do you want to travel extensively, volunteer, or live a simple life? This will help determine your ideal annual expenses in retirement.

-

Calculate Your FIRE Number:

- Based on your ideal annual expenses (from step 2), multiply that by 25. This is your target wealth accumulation.

- Example: If you estimate needing $50,000 per year, your FIRE number is $1,250,000.

-

Create a Budget and Slash Expenses:

- Based on your spending tracker, identify areas where you can cut back. Prioritize the "big three": housing, transportation, and food.

- Automate your savings! Treat savings like a non-negotiable bill.

-

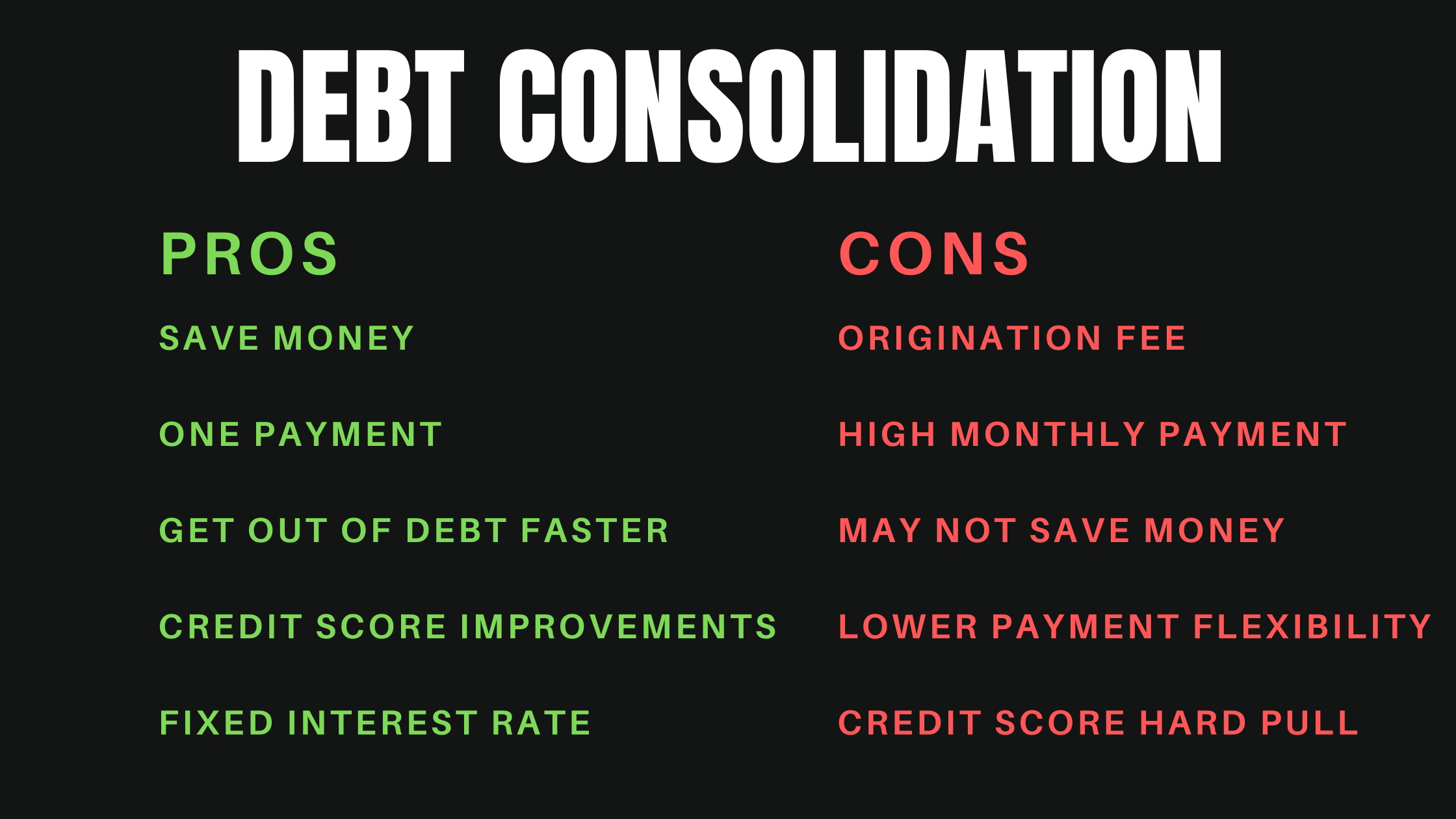

Eliminate High-Interest Debt:

- Credit card debt and personal loans are like financial anchors. Pay these off aggressively before focusing heavily on investments, as their interest rates often outpace investment returns.

-

Build an Emergency Fund:

- Before investing heavily, ensure you have 3-6 months (or even 12 months, if you’re risk-averse) of living expenses saved in an easily accessible, high-yield savings account. This protects you from unexpected job loss or major expenses.

-

Start Investing Aggressively:

- Automate Investments: Set up automatic transfers from your checking account to your investment accounts.

- Max Out Tax-Advantaged Accounts: Contribute as much as you can to your 401(k), IRA, and HSA.

- Invest in Low-Cost Index Funds/ETFs: These are excellent choices for beginners due to their diversification and low fees.

- Stay Consistent: The key is to keep investing regularly, regardless of market fluctuations.

-

Increase Your Income (If Possible):

- Negotiate raises, seek promotions, or explore side hustles. Every extra dollar you earn and save accelerates your journey.

-

Educate Yourself Continuously:

- Read books, listen to podcasts, follow reputable personal finance blogs. The more you learn, the more confident you’ll become in your decisions.

-

Stay Consistent and Be Patient:

- FIRE is a marathon, not a sprint. There will be ups and downs. Celebrate small victories, learn from setbacks, and stay focused on your long-term goal.

Common Misconceptions About FIRE

Despite its growing popularity, the FIRE movement is often misunderstood. Let’s debunk some common myths:

-

"FIRE is about extreme deprivation."

- Reality: While it involves intentional spending and often frugality, it’s not about never enjoying life. It’s about aligning spending with values and cutting out waste, so you have more to invest in your freedom. Many FIRE enthusiasts find they live more fulfilling lives because they’re spending on experiences, not just things.

-

"You stop working entirely and do nothing."

- Reality: "Retire Early" often means retiring from mandatory work. Many FIRE individuals transition to less stressful, passion-driven work, volunteer, start businesses, or engage in creative pursuits. It’s about having the choice.

-

"It’s only for high-income earners."

- Reality: While a higher income can accelerate the journey, a high savings rate is more crucial than a high income. People with average incomes have achieved FIRE by meticulously controlling expenses and investing wisely. It’s about the gap between what you earn and what you spend.

-

"It’s too risky; the stock market might crash."

- Reality: The FIRE strategy typically relies on long-term investing in diversified assets like index funds, which historically recover from downturns. The 4% rule (or similar safe withdrawal rates) is designed to account for market fluctuations and ensure portfolio longevity. Plus, many FIRE individuals have contingency plans (e.g., ability to pick up part-time work).

-

"You’ll be bored once you stop working."

- Reality: People who achieve FIRE are generally highly motivated and driven. They often have a long list of projects, hobbies, and interests they’ve been waiting to pursue. Boredom is rarely an issue; instead, it’s about channeling their energy into meaningful activities.

Is FIRE For Everyone?

While the principles of FIRE can benefit almost anyone, the full "Retire Early" component isn’t necessarily for everyone, and that’s perfectly okay.

- It requires discipline: A high savings rate and consistent investing demand self-control and commitment.

- It requires a mindset shift: Moving away from consumerism and prioritizing financial freedom takes a fundamental change in perspective.

- Life happens: Unexpected events can derail plans, but having a solid financial foundation provides resilience.

However, even if you don’t aim for early retirement, adopting the principles of FIRE – budgeting, aggressive saving, mindful spending, and smart investing – can dramatically improve your financial well-being and offer more options in life. You might not retire at 40, but you could gain significant financial security, reduce stress, and have more choices throughout your career.

Conclusion: Ignite Your Journey to Freedom

The Financial Independence, Retire Early (FIRE) movement offers a compelling alternative to the traditional career path. It’s a testament to the power of intentional living, aggressive saving, and smart investing. It’s about designing a life on your own terms, where work is a choice, not a necessity.

Whether you’re aiming for full early retirement or simply seeking greater financial security and flexibility, understanding and applying the core tenets of FIRE can be transformative. It empowers you to take control of your financial future, reduce stress, and unlock the freedom to pursue a life filled with purpose and passion.

The journey may require effort and patience, but the destination – a life lived on your own terms – is profoundly rewarding. So, why not take the first step today? Start tracking your expenses, set your FIRE number, and begin building the financial foundation for the life you truly desire. The power to design your future is in your hands.

Post Comment