Economic Profit vs. Accounting Profit: What’s the Difference? A Beginner’s Guide to Business Profitability

When you hear the word "profit," what comes to mind? For most people, it’s simply the money a business has left over after paying all its bills. While that’s true in a general sense, the world of business finance actually has two distinct ways of looking at profit: Accounting Profit and Economic Profit.

Understanding the difference between these two isn’t just an academic exercise for economists; it’s a crucial concept for anyone running a business, considering an investment, or simply trying to make smart financial decisions. While accounting profit tells you if your business is financially viable on paper, economic profit reveals the true opportunity cost of your choices, guiding you toward optimal resource allocation.

Let’s dive into these two fundamental concepts, breaking them down into easy-to-understand terms.

The Profit You Usually See: What is Accounting Profit?

Accounting profit is the most common and straightforward measure of a company’s financial performance. It’s the number you’ll typically find on a company’s income statement, often referred to as "net income" or "net profit."

Simply put, accounting profit is the total revenue a business earns minus its explicit costs.

Think of it as the money that actually flows in and out of the business’s bank account.

Breaking Down Accounting Profit:

- Total Revenue: This is all the money a business brings in from selling its goods or services. If you sell 100 widgets at $10 each, your total revenue is $1,000.

- Explicit Costs: These are the clear, tangible, out-of-pocket expenses that a business pays. They are easily identifiable, quantifiable, and recorded in a company’s financial records.

Common Examples of Explicit Costs:

- Wages and Salaries: Money paid to employees.

- Rent: Payments for office space, factory, or retail location.

- Utilities: Electricity, water, internet bills.

- Raw Materials: Costs of ingredients, components, or supplies needed for production.

- Marketing and Advertising: Money spent on promotions, ads, etc.

- Loan Interest: Payments on borrowed money.

- Depreciation: The accounting expense of assets losing value over time.

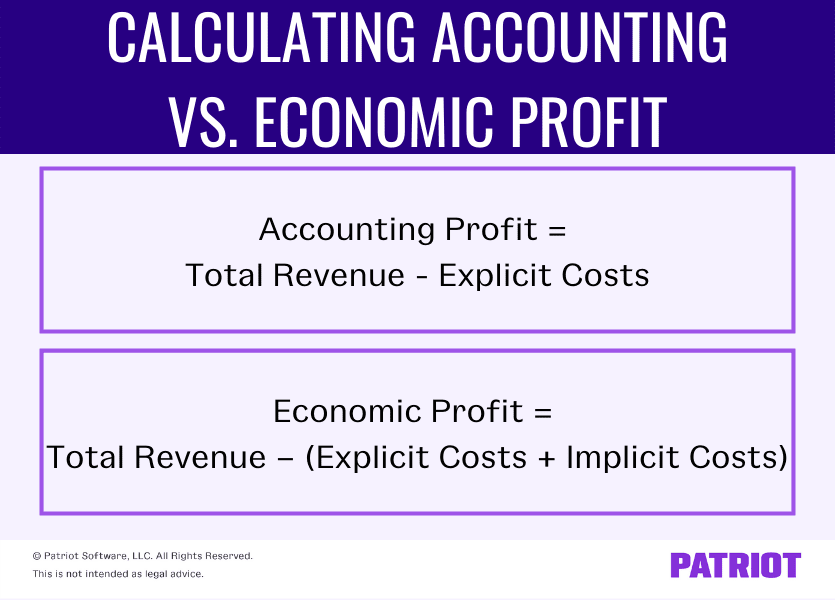

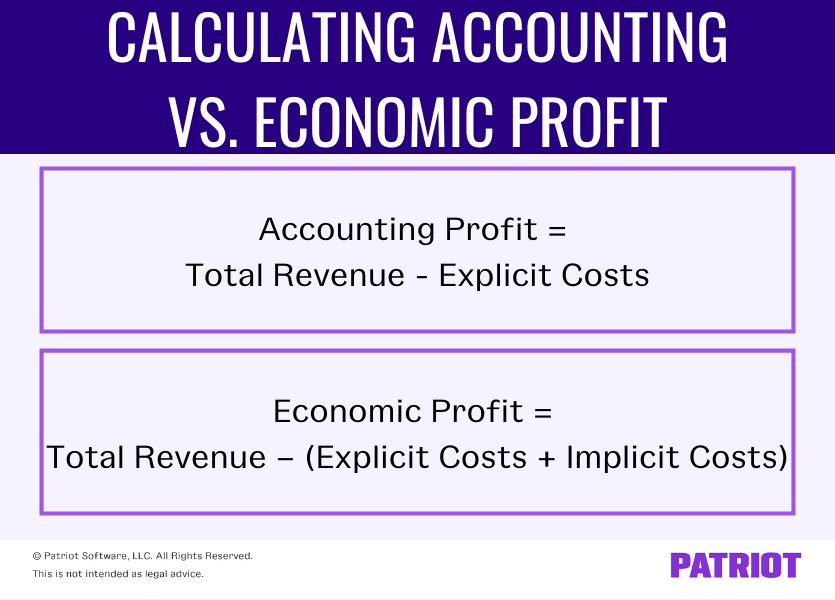

The Accounting Profit Formula:

Accounting Profit = Total Revenue – Explicit Costs

Example:

Imagine you start a small t-shirt printing business.

- Total Revenue: You sell 1,000 t-shirts at $20 each = $20,000

- Explicit Costs:

- Blank t-shirts: $5,000

- Printing equipment rental: $1,000

- Utilities: $500

- Marketing: $500

- Employee wages: $3,000

- Total Explicit Costs: $5,000 + $1,000 + $500 + $500 + $3,000 = $10,000

Accounting Profit = $20,000 (Revenue) – $10,000 (Explicit Costs) = $10,000

From an accounting perspective, your business is doing great! You made $10,000. This is the profit figure that most investors, banks, and tax authorities focus on.

The "True" Profit Story: What is Economic Profit?

While accounting profit gives you a good snapshot of your financial performance, it doesn’t tell the whole story, especially when it comes to making long-term strategic decisions. This is where economic profit comes in.

Economic profit takes into account not just the explicit costs, but also the implicit costs – the often-overlooked costs of choosing one course of action over another.

Simply put, economic profit is the total revenue a business earns minus both its explicit costs AND its implicit costs.

It’s a more comprehensive measure of profitability because it considers the "opportunity cost" of using resources in a particular way.

Breaking Down Economic Profit:

- Total Revenue: (Same as accounting profit) All the money a business brings in.

- Explicit Costs: (Same as accounting profit) The tangible, out-of-pocket expenses.

- Implicit Costs: These are the hidden, non-monetary costs associated with the use of a company’s own resources. They represent the value of the best alternative that was given up when a particular choice was made. This is also known as opportunity cost.

Common Examples of Implicit Costs (Opportunity Costs):

- Foregone Wages/Salary: If the business owner could have earned a salary working for someone else, that potential salary is an implicit cost.

- Foregone Interest/Returns: If the owner invested their own money into the business instead of putting it in a savings account or other investment, the interest or returns they could have earned are an implicit cost.

- Use of Owner’s Property: If the business operates out of the owner’s home or uses their personal equipment without paying rent or a usage fee, the market value of that rent or fee is an implicit cost.

- Owner’s Time and Effort: The value of the owner’s time and expertise that could have been used in another profitable venture.

The Economic Profit Formula:

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

OR

Economic Profit = Accounting Profit – Implicit Costs

Example (Continuing the T-shirt Business):

We know your Accounting Profit was $10,000. Now, let’s consider the implicit costs:

-

Foregone Salary: Before starting the t-shirt business, you had a job where you earned $8,000 during the same period. This is an implicit cost.

-

Foregone Interest: You invested $2,000 of your personal savings into the business. If you had kept it in a high-yield savings account, it could have earned $200 in interest. This is an implicit cost.

-

Total Implicit Costs: $8,000 (Foregone Salary) + $200 (Foregone Interest) = $8,200

Now, let’s calculate the Economic Profit:

Economic Profit = $10,000 (Accounting Profit) – $8,200 (Implicit Costs) = $1,800

In this scenario, your economic profit is $1,800. This number tells a much different story than the $10,000 accounting profit. It shows that after considering the true cost of your time and capital, your business is still profitable, but not as wildly successful as the accounting profit might suggest.

Explicit vs. Implicit Costs: The Core Difference Maker

The distinction between explicit and implicit costs is the cornerstone of understanding the difference between accounting and economic profit.

Explicit Costs: The "Out-of-Pocket" Expenses

- Definition: Tangible, monetary payments made to external parties for resources or services.

- Visibility: Easily recorded, appear on financial statements (e.g., income statement, balance sheet).

- Nature: Direct, measurable, and involve a clear exchange of money.

- Examples: Wages, rent, utilities, raw materials, advertising, insurance premiums.

Implicit Costs: The "Opportunity" Expenses

- Definition: The value of the best alternative foregone when a choice is made. They do not involve a direct monetary payment.

- Visibility: Not recorded in traditional financial statements; they are "hidden" costs.

- Nature: Indirect, estimated, and represent the lost potential benefit from an alternative use of resources.

- Examples: The salary an owner could have earned elsewhere, interest on owner’s invested capital, rent from owner’s property used for the business.

Why Does the Difference Matter? The Importance of Economic Profit

While accounting profit is vital for reporting and tax purposes, economic profit is arguably more important for internal decision-making and long-term strategic planning. Here’s why:

-

Making Smarter Business Decisions:

- Entry/Exit Decisions: Economic profit helps a business owner decide whether it’s truly worth staying in a particular industry or pursuing a new venture. If economic profit is zero or negative, it means your resources could be better utilized elsewhere, even if accounting profit is positive.

- Resource Allocation: It guides decisions on where to invest time, money, and effort. Should you expand your current business, or would you be better off pursuing a completely different opportunity?

-

Optimal Resource Allocation:

- Economic profit encourages businesses to use their resources (capital, labor, time) in the most efficient and productive way possible. If your economic profit is low, it signals that your resources might be generating more value in an alternative activity.

-

Investor and Entrepreneurial Perspective:

- For Entrepreneurs: Economic profit is a reality check. It helps them understand if their venture is truly adding value above and beyond what they could achieve by simply working for someone else or investing their capital elsewhere. A positive economic profit means the entrepreneur is earning more than just a "normal" return on their investment and effort.

- For Investors: While investors primarily look at accounting profit for financial stability, savvy investors might also consider the economic factors that influence a company’s long-term sustainability and competitive advantage.

-

Understanding "Normal Profit":

- When a business earns zero economic profit, it means it is covering all its explicit costs and all its implicit costs. In other words, the entrepreneur is making just enough to cover their opportunity costs – they are doing just as well as they would in their next best alternative. This is known as normal profit. A business earning normal profit is considered to be covering its true costs and is viable in the long run, as its resources are earning competitive returns.

Real-World Examples & Scenarios

Let’s look at a couple more scenarios to solidify your understanding:

Scenario 1: The Coffee Shop Dream

-

Background: Sarah quits her $60,000/year corporate job to open a coffee shop. She invests $100,000 of her savings (which could have earned 5% interest in a bond).

-

Year 1 Financials:

- Revenue: $200,000

- Explicit Costs:

- Rent: $30,000

- Coffee beans & supplies: $40,000

- Employee wages: $50,000

- Utilities & marketing: $10,000

- Total Explicit Costs: $130,000

-

Accounting Profit: $200,000 (Revenue) – $130,000 (Explicit Costs) = $70,000

- Looks great on paper! Sarah made $70,000.

-

Implicit Costs:

- Foregone Salary: $60,000

- Foregone Interest (on $100,000 at 5%): $5,000

- Total Implicit Costs: $65,000

-

Economic Profit: $70,000 (Accounting Profit) – $65,000 (Implicit Costs) = $5,000

- The true picture: After accounting for what she gave up, Sarah’s coffee shop is still slightly profitable, but only by $5,000. This tells Sarah that her business is generating a return just slightly above her best alternative use of her time and capital.

Scenario 2: The Tech Startup with High Potential

-

Background: Alex, a brilliant software engineer, leaves a comfortable $150,000/year job at Google to start his own AI startup. He uses his garage as an office (market rent for similar space: $1,000/month or $12,000/year).

-

Year 1 Financials (Pre-Revenue, Development Phase):

- Revenue: $0 (still developing the product)

- Explicit Costs:

- Servers & software licenses: $20,000

- Freelance developer support: $30,000

- Legal fees: $5,000

- Total Explicit Costs: $55,000

-

Accounting Profit: $0 (Revenue) – $55,000 (Explicit Costs) = -$55,000

- A significant accounting loss. This would look bad to a traditional lender.

-

Implicit Costs:

- Foregone Salary: $150,000

- Foregone Rent (garage): $12,000

- Total Implicit Costs: $162,000

-

Economic Profit: -$55,000 (Accounting Profit) – $162,000 (Implicit Costs) = -$217,000

- A massive economic loss. However, this doesn’t necessarily mean Alex’s decision was bad. For a startup, initial economic losses are often expected due to high implicit costs and zero revenue, with the expectation of massive future economic profits. This highlights that economic profit is about long-term sustainability and strategic choice, not just short-term numbers.

Quick Comparison Table: Accounting vs. Economic Profit

| Feature | Accounting Profit | Economic Profit |

|---|---|---|

| Focus | Financial reporting & tax compliance | Business decision-making & resource allocation |

| Costs Included | Only Explicit Costs (out-of-pocket) | Explicit Costs AND Implicit Costs (opportunity costs) |

| Formula | Total Revenue – Explicit Costs | Total Revenue – (Explicit Costs + Implicit Costs) |

| Purpose | Shows historical financial performance | Guides future choices, assesses true viability |

| Visibility | Appears on financial statements | Not typically on financial statements; internal analysis |

| Outcome | Can be positive even if resources are not used optimally | True profitability, reflects opportunity cost |

| Zero Result | Means revenue equals explicit costs | Means all explicit and implicit costs are covered (Normal Profit) |

Conclusion

Understanding the distinction between accounting profit and economic profit is fundamental to truly grasping how businesses operate and make decisions. While accounting profit provides a necessary and easily quantifiable measure for external stakeholders and tax purposes, economic profit offers a deeper, more insightful view into a business’s true efficiency and sustainability.

By considering both explicit and implicit costs, business owners and entrepreneurs can make more informed choices about where to allocate their precious resources, ensuring that their ventures are not just profitable on paper, but also yield a return that truly justifies the opportunity costs involved. So, the next time you hear "profit," remember that there’s often more to the story than meets the eye!

Post Comment