Donor-Advised Funds Explained: Your Simple Guide to Smart Charitable Giving

Giving back to causes you care about is a rewarding experience. But navigating the world of charitable donations can sometimes feel complex, especially when you’re thinking about tax benefits, long-term giving strategies, or donating appreciated assets. That’s where Donor-Advised Funds (DAFs) come in.

Often hailed as one of the fastest-growing philanthropic tools, DAFs offer a simple, flexible, and tax-efficient way to manage your charitable giving. If you’ve heard the term but aren’t quite sure what it means or how it works, you’re in the right place. This comprehensive guide will break down Donor-Advised Funds in easy-to-understand language, helping you unlock their potential for your giving journey.

What Exactly Is a Donor-Advised Fund?

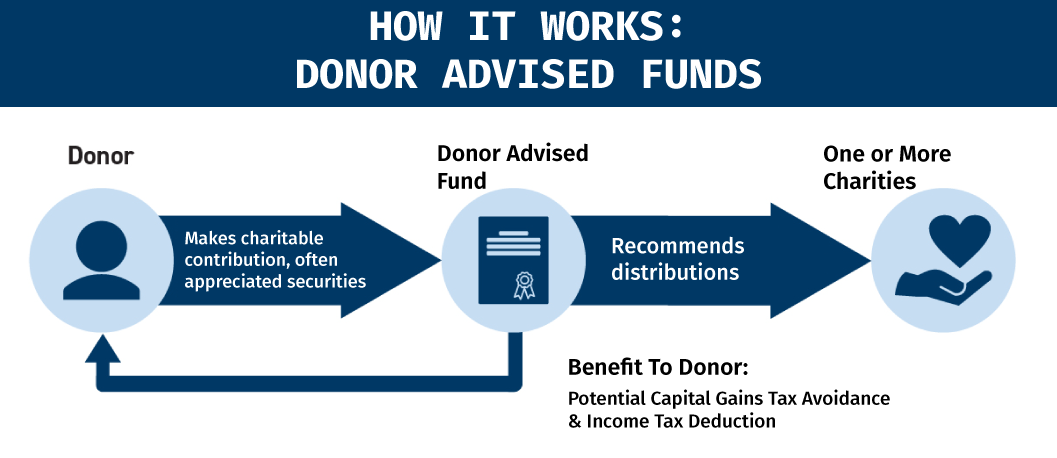

Imagine a charitable savings account. That’s essentially what a Donor-Advised Fund is. It’s a giving vehicle established at a public charity (known as a "sponsoring organization") that allows you, the donor, to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund to your favorite qualified charities over time.

Think of it like this:

- You deposit money (or other assets) into your DAF account.

- You get a tax deduction now for that deposit.

- The money sits in the account, potentially growing tax-free, until you’re ready to decide which charities to support.

- You then recommend grants from your DAF to qualified public charities, whenever you’re ready.

Key Players in a DAF:

- The Donor: That’s you! The individual, family, or even business contributing assets to the fund.

- The Sponsoring Organization: The public charity that legally owns and administers your DAF. Examples include Fidelity Charitable, Schwab Charitable, Vanguard Charitable, and countless community foundations. They handle the investments, compliance, and grant distribution.

- The Grant Recipient: The qualified public charity that receives a grant from your DAF.

How Does a Donor-Advised Fund Work? A Step-by-Step Guide

Understanding the process makes DAFs much clearer. Here’s how it typically unfolds:

Step 1: Open Your DAF and Make a Contribution

The first step is to establish your DAF account with a sponsoring organization. This is usually a straightforward application process.

Once open, you make an irrevocable contribution of cash, securities, or other assets into the fund. This is the point at which you receive your immediate tax deduction.

- Example: You contribute $10,000 in cash or appreciated stock to your DAF in December. You can claim a tax deduction for that $10,000 on your taxes for that year, even if you don’t recommend any grants until the following year or later.

Step 2: Invest and Grow Your Charitable Dollars

After your contribution, the sponsoring organization invests the assets in your DAF account. You typically have several investment options to choose from, ranging from conservative to aggressive portfolios.

The beauty here is that any investment growth within your DAF is tax-free. This means your charitable dollars can grow over time, allowing you to give even more to charity later.

- Example: Your initial $10,000 contribution grows to $12,000 over a few years due to smart investing within the DAF. That extra $2,000 is now available for giving, without you paying capital gains tax on its growth.

Step 3: Recommend Grants to Your Favorite Charities

This is the fun part! Whenever you’re ready, you can recommend grants from your DAF to qualified public charities. You can recommend grants to multiple charities, make one-time gifts, or set up recurring donations.

The sponsoring organization vets the charities to ensure they are qualified 501(c)(3) public charities and then handles the distribution of funds. The grant can often be made in the name of your DAF, anonymously, or in your family’s name.

- Example: A year after funding your DAF, you decide to give $2,000 to your local animal shelter, $1,500 to a national research foundation, and $500 to your alma mater. You simply log into your DAF portal, select the charities, enter the amounts, and the sponsoring organization sends the checks.

The Power of Giving: Key Benefits of a DAF

DAFs offer a compelling set of advantages that make them a popular choice for strategic charitable giving:

- Immediate Tax Deduction, Flexible Giving Timing: You get a tax deduction in the year you make the contribution to your DAF, even if you don’t decide which charities to support until years later. This is incredibly useful for managing your tax liability, especially in high-income years.

- Simplicity & Convenience: No more keeping track of multiple donation receipts! With a DAF, you get one receipt for your contribution to the sponsoring organization. They handle all the paperwork, due diligence on charities, and grant disbursements.

- Tax-Free Investment Growth: Your contributions can be invested and grow over time, allowing you to give more to charity without incurring additional taxes on the gains. It’s like having a dedicated endowment for your personal philanthropy.

- Donate Complex Assets with Ease: DAFs can accept a wide range of assets, including appreciated stocks, mutual funds, real estate, and even private business interests. Donating appreciated assets directly to a DAF allows you to avoid capital gains taxes on those assets while still getting a fair market value deduction.

- Anonymity (If Desired): You can choose to make grants anonymously, which means the recipient charity will only know the grant came from the DAF sponsoring organization, not directly from you.

- Streamlined Record-Keeping: All your giving history is consolidated in one place, making tax time and charitable planning much simpler.

- Family Engagement & Legacy Building: DAFs can be passed down to future generations, allowing families to engage in philanthropy together and instill a tradition of giving. You can name successor advisors who can continue recommending grants after you’re gone.

- Strategic Giving: A DAF allows you to "bunch" your charitable contributions into one year (to maximize itemized deductions) and then distribute the funds to charities over several years. This is especially beneficial with the higher standard deduction.

- No Minimum Annual Grant Requirements: Unlike private foundations, DAFs do not have mandatory annual payout requirements, giving you ultimate flexibility in timing your grants.

Who is a Donor-Advised Fund For? Is It Right for You?

While DAFs offer broad appeal, they are particularly beneficial for certain types of donors:

- Individuals or Families with Appreciated Non-Cash Assets: If you hold highly appreciated stock, real estate, or other assets, donating them to a DAF can help you avoid capital gains taxes and receive a significant tax deduction.

- Donors Who Want to Simplify Their Giving: If you currently make donations to multiple charities throughout the year and want a single point of contact and record for all your giving.

- High-Income Earners or Those with a "Windfall" Year: If you anticipate a year with particularly high income (e.g., from a bonus, sale of a business, or stock options), a DAF allows you to front-load your charitable contributions for a larger deduction in that year, while distributing funds over time.

- People Who Want to Plan Their Giving Strategically: If you have a long-term vision for your philanthropy and want your charitable dollars to grow tax-free before being granted.

- Those Who Value Privacy in Giving: If you prefer to support charities without revealing your personal identity.

- Individuals Considering a Private Foundation (But Want Simplicity): DAFs offer many of the benefits of a private foundation without the significant setup costs, administrative burdens, or ongoing compliance requirements.

DAF vs. Private Foundation: What’s the Difference?

While both Donor-Advised Funds and Private Foundations are powerful tools for philanthropy, they serve different needs and come with different levels of complexity and control.

| Feature | Donor-Advised Fund (DAF) | Private Foundation |

|---|---|---|

| Setup Cost | Low (often no direct setup fee) | High (legal fees, filing fees, ongoing compliance) |

| Administration | Managed by sponsoring organization (low burden on donor) | Managed by donor/board (high administrative burden) |

| Control | Advisory role (recommend grants) | Full control over investments, grants, operations |

| Tax Deduction | Higher deduction limits (public charity status) | Lower deduction limits (private charity status) |

| Payout Rule | No minimum annual payout requirement | Required 5% annual payout of assets |

| Investment | Options provided by sponsoring organization | Full control over investment decisions |

| Anonymity | Easily available | Publicly disclosed (Form 990-PF) |

| Complexity | Simple and convenient | Complex, ongoing legal and accounting requirements |

| Succession | Name successor advisors within the DAF | Establish bylaws and board for perpetual existence |

For most donors, the simplicity, flexibility, and cost-effectiveness of a DAF make it the preferred choice over establishing a private foundation.

Important Considerations & Things to Know

While DAFs are incredibly beneficial, there are a few key points to be aware of:

- Irrevocable Gift: Once you contribute assets to a DAF, they are permanently committed to charity. You cannot get them back, nor can they directly benefit you, your family, or your business.

- Minimum Contribution Requirements: Most sponsoring organizations have a minimum initial contribution amount (e.g., $5,000, $10,000, or $25,000), though some are lower.

- Fees: Sponsoring organizations charge administrative fees (a small percentage of assets under management) and investment management fees. These fees are typically much lower than the cost of running a private foundation.

- No Goods or Services in Return: You cannot recommend a grant to a charity if you or any related party will receive a direct benefit in return (e.g., paying for a school tuition or a gala ticket).

- Not All Organizations Qualify: Grants can only be made to qualified 501(c)(3) public charities, as determined by the IRS.

Ready to Get Started? How to Open a DAF

If a Donor-Advised Fund sounds like the right tool for your charitable giving, here are the general steps to open one:

-

Choose a Sponsoring Organization: Research different DAF providers. Consider factors like:

- Minimum contribution requirements

- Investment options

- Fees

- Customer service and online tools

- Any specific programs or focuses (e.g., community foundations specializing in local giving).

- Popular national providers include Fidelity Charitable, Schwab Charitable, and Vanguard Charitable. Many local community foundations also offer DAFs.

-

Complete the Application: Fill out the necessary paperwork, which can often be done online. You’ll provide personal information, name your fund (e.g., "The [Your Last Name] Family Charitable Fund"), and designate any successor advisors.

-

Fund Your DAF: Make your initial contribution. This is the step that secures your immediate tax deduction. You can transfer cash, securities, or other eligible assets.

-

Start Recommending Grants: Once your fund is established and funded, you can begin recommending grants to your favorite qualified charities through the sponsoring organization’s online portal or by contacting them directly.

Conclusion

Donor-Advised Funds have democratized philanthropy, making sophisticated charitable giving strategies accessible to a wider range of donors. They offer an unparalleled combination of tax efficiency, flexibility, and administrative ease, allowing you to maximize your impact on the causes you care about most.

By understanding how DAFs work, their numerous benefits, and who they are best suited for, you can make an informed decision about whether this powerful giving vehicle is the right choice for your philanthropic journey. As always, consulting with a qualified financial advisor or tax professional is recommended to ensure a DAF aligns perfectly with your overall financial and charitable planning goals.

Post Comment