Devaluation vs. Revaluation of Currency: A Beginner’s Guide to Their Profound Impact on Global Trade

Imagine you’re planning a trip abroad, or perhaps you’re a business owner importing goods from another country. The cost of your trip or your goods isn’t just about their listed price; it’s also heavily influenced by something called the "exchange rate." This invisible force determines how much your money is worth compared to another country’s money.

Governments and central banks often step in to influence this exchange rate, either making their currency weaker or stronger on purpose. These deliberate actions are known as devaluation and revaluation. While they might sound like technical economic terms, their effects ripple through every aspect of international commerce, from the price of your imported coffee to the competitiveness of a nation’s car exports.

This article will break down what devaluation and revaluation mean in simple terms, explore why countries choose these paths, and most importantly, explain their significant impacts on global trade for businesses and consumers alike.

Understanding Currency Value: The Basics

Before diving into devaluation and revaluation, let’s quickly grasp what "currency value" means.

Think of an exchange rate like a price tag. If 1 US Dollar (USD) equals 0.90 Euros (EUR), it means you need 0.90 Euros to buy one US Dollar, or conversely, one US Dollar can buy you 0.90 Euros.

- Appreciation: When a currency strengthens against another. For example, if 1 USD used to buy 0.90 EUR and now buys 0.95 EUR, the USD has appreciated (it’s worth more).

- Depreciation: When a currency weakens against another. If 1 USD used to buy 0.90 EUR and now only buys 0.85 EUR, the USD has depreciated (it’s worth less).

These natural fluctuations (appreciation and depreciation) happen constantly due to market forces like supply and demand, interest rates, and economic news. However, devaluation and revaluation are different because they are deliberate policy choices made by a country’s government or central bank, usually in countries that maintain a "fixed" or "pegged" exchange rate system, or those that intervene heavily in a "managed float" system.

What is Devaluation? Making Your Currency Weaker on Purpose

Devaluation occurs when a country’s government or central bank deliberately reduces the official value of its currency relative to other currencies, or to a standard like gold. It’s like a shop deciding to sell its products for less to attract more buyers.

Why do countries devalue their currency?

Countries typically choose to devalue their currency to achieve specific economic goals, primarily related to boosting their international trade and improving their economic competitiveness.

- To Boost Exports: This is often the primary reason. When a country’s currency is cheaper, its goods and services become less expensive for foreign buyers.

- Example: If 1 USD used to buy 10 units of "Country X" currency, and now it buys 12 units, then an item costing 120 units in Country X now only costs 10 USD (instead of 12 USD previously). This makes Country X’s products more appealing to American buyers.

- To Discourage Imports: Conversely, devaluation makes foreign goods and services more expensive for domestic buyers.

- Example: If an imported car costs 20,000 USD, and your local currency has been devalued, you’ll need more of your local currency to buy those 20,000 USD. This makes imports less attractive and encourages people to buy domestically produced goods instead.

- To Reduce a Trade Deficit: A trade deficit means a country imports more than it exports. By boosting exports and curbing imports, devaluation can help reduce this imbalance.

- To Boost Tourism: When a country’s currency is cheaper, it becomes a more affordable destination for foreign tourists, attracting more visitors and their foreign currency.

- To Service Foreign Debt (in some cases): If a country has debt denominated in its own currency, devaluation can effectively reduce the real burden of that debt, although this is a complex and often risky strategy.

Impacts of Devaluation on Trade:

Devaluation has a direct and significant impact on a country’s trade balance:

- For Exporters (Domestic Businesses Selling Abroad):

- Increased Competitiveness: Their products become cheaper and more attractive in international markets.

- Higher Sales Volume: This can lead to increased demand for their goods and services.

- Higher Profits (in local currency): Even if they sell at the same foreign currency price, they receive more local currency for each sale.

- For Importers (Domestic Businesses Buying from Abroad):

- Increased Costs: Imported raw materials, components, and finished goods become more expensive.

- Reduced Profit Margins: Importers might have to absorb some of these higher costs or pass them on to consumers.

- Shift to Domestic Suppliers: Businesses might seek local alternatives if imports become too costly.

- For Consumers:

- Higher Prices for Imported Goods: Your favorite foreign brands, electronics, or even certain foods will likely become more expensive.

- Potential for Inflation: If a country relies heavily on imports (especially essential goods), the increased cost of imports can lead to a general rise in prices within the country. This is known as "imported inflation."

- Reduced Purchasing Power Abroad: Your money doesn’t go as far when you travel to other countries or try to buy foreign assets.

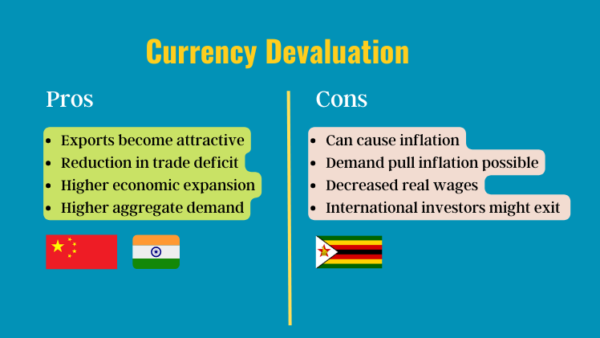

Potential Downsides of Devaluation:

While devaluation can stimulate exports, it’s not without risks:

- Inflation: As mentioned, imported goods become more expensive, potentially leading to widespread price increases.

- Reduced Purchasing Power: Citizens can buy less with their money, both domestically (due to inflation) and internationally.

- Loss of Confidence: Repeated or aggressive devaluations can signal economic instability and deter foreign investment.

- Retaliation: Other countries might react by devaluing their own currencies, leading to a "currency war" where no one truly benefits.

What is Revaluation? Making Your Currency Stronger on Purpose

Revaluation is the opposite of devaluation. It occurs when a country’s government or central bank deliberately increases the official value of its currency relative to other currencies or a fixed standard. It’s like a shop deciding to increase its prices because its products are in high demand or are considered premium.

Why do countries revalue their currency?

Revaluation is less common than devaluation, but countries may choose this path for specific reasons, often to manage domestic economic conditions or respond to international pressure.

- To Combat Inflation: A stronger currency makes imports cheaper, which can help bring down the overall price level within the country, especially for goods that are heavily imported.

- To Increase Purchasing Power: Citizens can buy more foreign goods and services, and their money goes further when traveling abroad.

- To Signal Economic Strength: A strong currency can be a sign of a robust economy, attracting foreign investment.

- To Reduce a Trade Surplus: If a country is exporting much more than it imports, a revaluation can help balance trade by making exports more expensive and imports cheaper.

- Under International Pressure: Countries with large and persistent trade surpluses (like China has historically faced) might be pressured by trading partners to revalue their currency to make trade fairer.

Impacts of Revaluation on Trade:

Revaluation also has a direct and significant impact on a country’s trade balance:

- For Exporters (Domestic Businesses Selling Abroad):

- Reduced Competitiveness: Their products become more expensive for foreign buyers, potentially leading to lower sales volumes.

- Lower Profits: Exporters might have to lower their prices in foreign currency to remain competitive, resulting in less local currency per sale.

- Pressure on Domestic Industries: Export-oriented industries might face challenges, potentially leading to job losses if they cannot adapt.

- For Importers (Domestic Businesses Buying from Abroad):

- Reduced Costs: Imported raw materials, components, and finished goods become cheaper.

- Increased Profit Margins: Importers can sell foreign goods at lower prices or enjoy higher profit margins.

- Increased Consumer Choice: A wider range of affordable imported goods becomes available.

- For Consumers:

- Lower Prices for Imported Goods: Your favorite foreign brands, electronics, or even certain foods will likely become cheaper.

- Increased Purchasing Power Abroad: Your money goes further when you travel to other countries or try to buy foreign assets.

- Potential for Deflation: If imports become significantly cheaper, it can put downward pressure on overall prices, potentially leading to deflation (a general fall in prices), which can be harmful if persistent.

Potential Downsides of Revaluation:

While revaluation can offer benefits, it also carries risks:

- Damage to Export Industries: Industries heavily reliant on exports can suffer significantly, leading to job losses and economic slowdown in those sectors.

- Increased Imports: While good for consumers, a surge in cheap imports can hurt domestic industries that produce similar goods.

- Economic Slowdown: If export industries are a major part of the economy, a strong currency can contribute to an overall economic slowdown.

Devaluation vs. Revaluation: A Side-by-Side Comparison

To summarize the core differences and their impacts, here’s a quick comparison:

| Feature | Devaluation (Weaker Currency) | Revaluation (Stronger Currency) |

|---|---|---|

| Definition | Deliberate reduction in currency’s value. | Deliberate increase in currency’s value. |

| Goal (Primary) | Boost exports, curb imports, reduce trade deficit. | Combat inflation, increase purchasing power, reduce trade surplus. |

| Impact on Exports | Cheaper for foreign buyers; more competitive. | More expensive for foreign buyers; less competitive. |

| Impact on Imports | More expensive for domestic buyers; less attractive. | Cheaper for domestic buyers; more attractive. |

| Trade Balance | Tends to improve (exports up, imports down). | Tends to worsen (exports down, imports up). |

| Tourism | Cheaper for foreign tourists; boosts inbound tourism. | More expensive for foreign tourists; curbs inbound tourism. |

| Domestic Inflation | Potential for imported inflation (prices rise). | Potential for deflationary pressure (prices fall). |

| Purchasing Power | Reduced (less can be bought domestically & abroad). | Increased (more can be bought domestically & abroad). |

| Foreign Debt (Local Currency) | Can make debt burden appear smaller (but complex). | Can make debt burden appear larger (but complex). |

Real-World Context: Why It Matters

The decisions to devalue or revalue a currency are complex and involve significant political and economic considerations. There’s no "one-size-fits-all" answer, and the outcomes are not always predictable.

- China’s Yuan (Renminbi): For many years, China was accused by some countries (notably the US) of keeping its currency artificially undervalued (a form of de facto devaluation) to boost its exports and maintain a massive trade surplus. Over time, China has allowed its currency to gradually appreciate, often in response to internal economic needs and external pressure.

- Switzerland’s Franc: The Swiss National Bank has at times intervened to prevent the Swiss Franc from strengthening too much, as its strong currency makes its exports very expensive and hurts its export-oriented economy. This is an example of a central bank trying to avoid an appreciation (which is like trying to avoid an involuntary revaluation).

These actions are powerful tools in a government’s economic arsenal, directly influencing the flow of goods, services, and money across borders. They can determine whether a country’s industries thrive or struggle, whether consumers pay more or less for goods, and ultimately, a nation’s economic health.

The Delicate Balance: Why Policy Matters

The choice between devaluation and revaluation is a tightrope walk for policymakers.

- Devaluation can offer a quick boost to exports and employment in export sectors, but it risks inflation, reduces the purchasing power of citizens, and can harm industries reliant on imports.

- Revaluation can combat inflation and increase purchasing power, but it risks hurting export industries, increasing unemployment in those sectors, and making domestic industries less competitive against cheaper imports.

Governments must weigh the immediate benefits against the potential long-term risks and consider their specific economic conditions, global trade relationships, and the welfare of their citizens. The impact on trade is just one piece of a much larger and intricate economic puzzle.

Conclusion

Devaluation and revaluation are deliberate policy decisions that profoundly reshape the landscape of international trade. By making a currency weaker or stronger, governments directly influence the price of exports and imports, impacting businesses, consumers, and the overall economic health of a nation.

For beginners, understanding these concepts is crucial because they explain why the price of goods might change, why some countries are more competitive in global markets, and how governments try to steer their economies. While complex, the core idea is simple: the value of a currency is a powerful lever that can open or close doors for trade, creating both opportunities and challenges on the global stage.

Frequently Asked Questions (FAQs)

Q1: Who decides to devalue or revalue a currency?

A1: This decision is typically made by a country’s central bank or its government, especially in countries that manage their exchange rates or have a fixed exchange rate system.

Q2: Is devaluation always bad, and revaluation always good?

A2: No. Both have pros and cons, depending on a country’s specific economic situation and goals. Devaluation can boost exports but cause inflation. Revaluation can combat inflation but hurt export industries. The "good" or "bad" depends on what problem the country is trying to solve.

Q3: What’s the difference between "devaluation" and "depreciation"?

A3: This is a crucial distinction!

- Devaluation: A deliberate policy action by a government or central bank to lower its currency’s value. It happens in fixed or managed exchange rate systems.

- Depreciation: A market-driven decline in a currency’s value due to forces like supply and demand, interest rates, or economic news. It happens in floating exchange rate systems.

The same applies to "revaluation" (deliberate) and "appreciation" (market-driven).

Q4: How does devaluation affect my foreign travel plans?

A4: If your home currency is devalued, your money will buy less foreign currency. This means your trip abroad will become more expensive because hotels, food, and activities in the foreign country will cost more in terms of your devalued home currency.

Q5: Can countries devalue their currency too much?

A5: Yes. Excessive or repeated devaluation can lead to hyperinflation, a drastic loss of purchasing power for citizens, and a severe loss of confidence in the economy, potentially deterring foreign investment and causing social unrest.

Post Comment