Debt Financing vs. Equity Financing: Which is Right for Your Business?

Every business, from a budding startup to an established enterprise, eventually faces a crucial question: "How do we fund our growth?" Whether you’re launching a new product, expanding operations, or simply need working capital, securing the necessary funds is paramount.

When it comes to raising money, two primary avenues stand out: Debt Financing and Equity Financing. Understanding the fundamental differences between these two approaches is vital for any entrepreneur or business owner, as each comes with its own set of advantages, disadvantages, and implications for your company’s future.

This comprehensive guide will break down debt financing and equity financing in simple terms, helping you understand which path might be the best fit for your business goals.

What is Debt Financing?

Imagine you need money, and you go to a friend who agrees to lend it to you. You promise to pay them back the original amount, plus a little extra for their trouble, over a set period. That, in essence, is debt financing.

Debt financing involves borrowing money that you promise to repay, typically with interest, over a specific period. When you take on debt, you are creating a liability for your business – an obligation to pay back the borrowed funds.

How Debt Financing Works:

- Lender & Borrower: A financial institution (like a bank) or an individual (a private lender) provides your business with a loan. Your business is the borrower.

- Principal: This is the original amount of money you borrow.

- Interest: This is the cost of borrowing the money, usually expressed as a percentage of the principal. You pay interest on top of the principal repayment.

- Repayment Schedule: You agree to pay back the loan (principal + interest) over a set period, often through regular, fixed payments (e.g., monthly, quarterly).

- Collateral (Often Required): Lenders often require collateral, which is an asset (like real estate, equipment, or inventory) that they can seize if your business fails to repay the loan.

Common Sources of Debt Financing:

- Banks & Credit Unions: Traditional financial institutions offer various business loans (term loans, lines of credit, equipment loans).

- Small Business Administration (SBA) Loans: Government-backed loans (often through banks) that offer favorable terms for small businesses.

- Private Lenders: Individuals or firms that provide loans, sometimes at higher interest rates but with more flexible terms.

- Credit Cards: While easy to access, business credit cards often come with very high interest rates and are generally suitable only for short-term, small amounts.

- Vendor Credit: When suppliers allow you to purchase goods or services on credit, paying later.

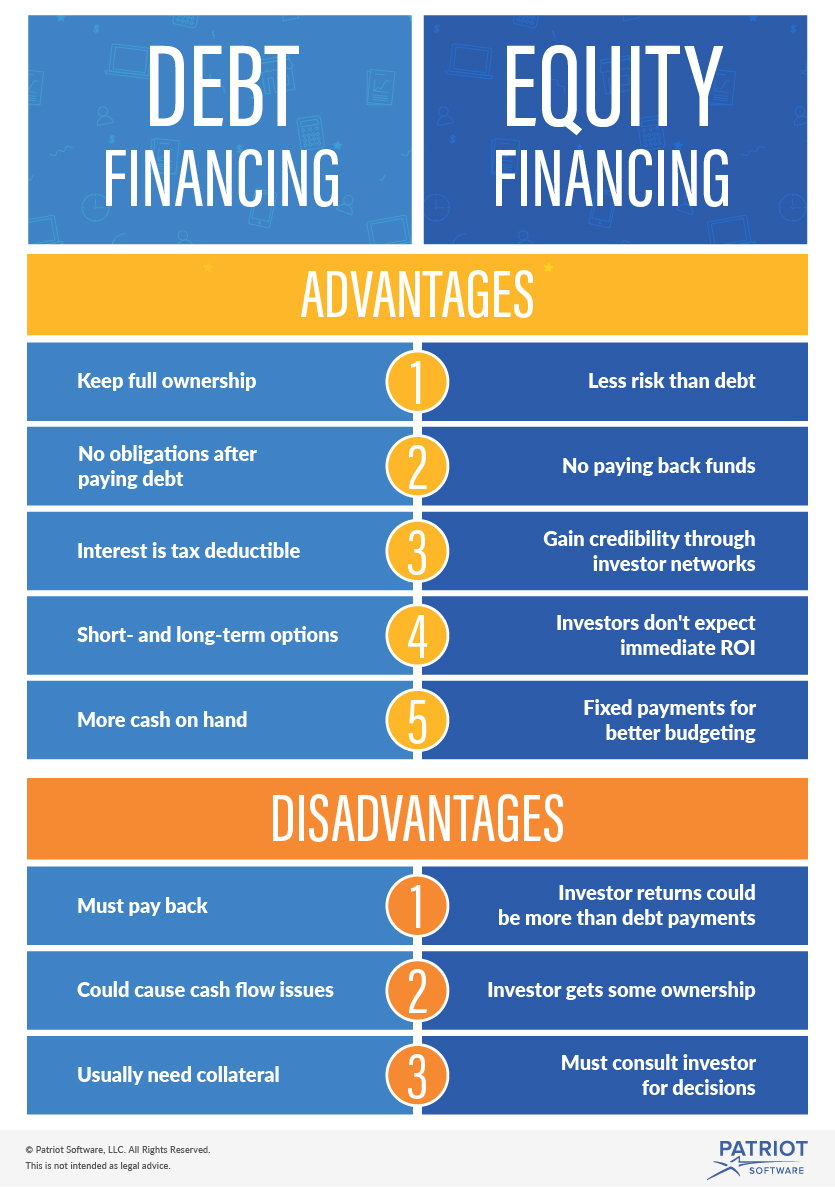

Advantages of Debt Financing:

- Retain Full Ownership: This is the biggest draw. When you borrow money, you don’t give up any part of your company’s ownership or control. You remain the sole decision-maker (or your existing shareholders do).

- Predictable Payments: Loan agreements typically have a fixed repayment schedule, making it easier to forecast your future expenses.

- Interest is Tax-Deductible: In many jurisdictions, the interest you pay on business loans can be deducted from your taxable income, reducing your overall tax burden.

- Leverage for Growth: Debt can act as a powerful tool, allowing you to invest in projects that generate returns higher than the cost of the loan, thus amplifying your profits.

- Finite Obligation: Once the loan is repaid, your obligation to the lender ends.

Disadvantages of Debt Financing:

- Must Repay, Regardless of Profit: Even if your business isn’t doing well, you are still legally obligated to make your loan payments. Failure to do so can lead to default and potentially bankruptcy.

- Fixed Payments Can Strain Cash Flow: If your revenue fluctuates, fixed monthly payments can become a heavy burden during lean periods.

- Collateral Requirements: Many loans require you to pledge assets as collateral, putting them at risk if you can’t repay.

- Debt Covenants: Lenders may impose restrictions on your business operations, such as limits on executive salaries, additional borrowing, or certain investments, to protect their investment.

- Risk of Bankruptcy: Excessive debt can lead to financial distress and, in worst-case scenarios, bankruptcy if you cannot meet your obligations.

What is Equity Financing?

If debt financing is like borrowing money from a friend, equity financing is like inviting that friend to become a co-owner of your business.

Equity financing involves selling a portion of your company’s ownership in exchange for capital. Instead of borrowing money, you are giving investors a stake in your business. These investors then become shareholders, sharing in your company’s profits (and risks).

How Equity Financing Works:

- Selling Shares: You issue new shares of your company’s stock to investors. Each share represents a small percentage of ownership.

- Investors Become Owners: The investors who buy these shares become part-owners of your company. They are now stakeholders in its success.

- No Repayment Obligation: Unlike debt, you do not have to pay back the equity investment. Investors make money if the company grows in value and they can sell their shares for more than they paid, or through dividends (though dividends are less common for growth-focused companies).

- Shared Profits (and Losses): As owners, investors are entitled to a share of the company’s profits (if dividends are paid) and may have a claim on assets if the company is liquidated.

Common Sources of Equity Financing:

- Personal Savings/Bootstrapping: Using your own money is the purest form of equity financing.

- Friends and Family: Often the first external investors for a startup.

- Angel Investors: High-net-worth individuals who invest their own money in early-stage companies, often providing mentorship as well.

- Venture Capital (VC) Firms: Professional investment firms that manage funds from various sources and invest in high-growth potential companies, typically in exchange for significant equity stakes.

- Private Equity Firms: Invest in more mature, established companies, often with the goal of improving operations and selling the company later.

- Crowdfunding: Raising small amounts of capital from a large number of individuals, often through online platforms.

- Initial Public Offering (IPO): Selling shares to the general public on a stock exchange – typically for very large, established companies.

Advantages of Equity Financing:

- No Repayment Obligation: This is the biggest advantage. You don’t have to worry about fixed monthly payments, which greatly eases cash flow pressure, especially for new or volatile businesses.

- Shared Risk: Investors share in the financial risk of the business. If the company fails, they lose their investment, not you personally (unless you provided personal guarantees).

- Access to Expertise and Networks: Equity investors, especially angel investors and VCs, often bring valuable industry knowledge, strategic guidance, and extensive networks that can help your business grow.

- Enhanced Credibility: Securing equity investment from reputable firms or individuals can boost your company’s credibility and attract future funding or partnerships.

- Fuel Rapid Growth: Equity capital is often preferred for high-growth, innovative companies that may not have predictable revenue streams suitable for debt.

Disadvantages of Equity Financing:

- Loss of Ownership & Control (Dilution): The most significant drawback. Every time you sell equity, you give up a piece of your company. This means you own a smaller percentage and may have to consult with or even concede control to investors on major decisions.

- High Cost in the Long Run: While there are no fixed payments, equity can be more "expensive" in the long term if your company becomes very successful. You’re giving away a share of all future profits and potential sale proceeds.

- Complex and Lengthy Process: Raising equity, especially from VCs, can be a time-consuming, rigorous, and often frustrating process involving due diligence, negotiations, and legal agreements.

- Investor Expectations & Pressure: Investors will expect a return on their investment, which can lead to pressure to grow quickly, make specific strategic decisions, or even sell the company earlier than you might have planned.

- No Tax Deduction: Unlike interest on debt, dividends paid to shareholders are not tax-deductible for the company.

Debt vs. Equity: A Direct Comparison

Let’s put them side-by-side to highlight the core differences:

| Feature | Debt Financing | Equity Financing |

|---|---|---|

| Ownership | No change in ownership. | Dilutes ownership; investors become part-owners. |

| Repayment | Required (principal + interest) over time. | Not required (no direct repayment). |

| Cost | Interest payments; often fixed. | Giving up a percentage of future profits/value; can be very high if company succeeds. |

| Control | Retain full control (barring covenants). | Shared control; investors may have board seats or veto power. |

| Risk to Business | High risk of default/bankruptcy if payments missed. | No default risk on the capital itself; risk of losing control. |

| Tax Implications | Interest is tax-deductible. | Dividends are not tax-deductible. |

| Investor Input | Minimal (focused on repayment ability). | Significant (strategic advice, network, oversight). |

| Suitability | Established, predictable cash flow, lower risk. | High-growth, uncertain revenue, high potential. |

How to Choose: Factors to Consider

Deciding between debt and equity financing isn’t a one-size-fits-all answer. The best choice depends heavily on your specific business, its stage of development, your goals, and your personal preferences.

Here are key factors to consider:

-

Stage of Your Business:

- Early-Stage Startups: Often gravitate towards equity. They typically have little to no revenue, no assets for collateral, and highly uncertain cash flows, making them unattractive to debt lenders. Equity investors are more willing to take on high risk for high potential reward.

- Established Businesses: More likely to qualify for and benefit from debt. They have a proven track record, assets, and predictable cash flow to service debt payments.

-

Your Desire for Control:

- High Control Preference: If you want to maintain complete decision-making authority and don’t want external voices on your board, debt financing is generally the better option.

- Willingness to Share: If you’re open to collaboration, strategic input, and potentially giving up some control in exchange for capital and expertise, equity might be suitable.

-

Your Risk Tolerance:

- Comfort with Fixed Payments: If your business has stable, predictable cash flow and you’re confident in meeting regular payments, debt can be less risky in terms of dilution.

- Need for Flexibility: If your revenue is highly variable or your business model is unproven, the flexibility of equity (no fixed payments) can be a lifeline, even if it means giving up ownership.

-

Cost of Capital:

- Interest Rates vs. Future Value: Compare the current interest rates on debt to the potential future value of the equity you’d give up. A highly successful company might find equity "more expensive" in the long run.

- Tax Benefits: Remember the tax deductibility of interest on debt.

-

Growth Potential and Business Model:

- Slow, Steady Growth: Businesses with steady, predictable growth and strong margins (e.g., service businesses, manufacturing) often do well with debt.

- Rapid, High-Scale Growth: Tech startups, biotech companies, or businesses aiming for rapid market disruption often require significant capital to scale quickly. Equity financing is typically better suited for this, as investors are betting on a massive future payoff.

-

Market Conditions:

- Interest Rates: When interest rates are low, debt becomes more attractive.

- Investor Appetite: The availability and terms of equity funding can vary significantly based on the economic climate and investor interest in your industry.

Hybrid Approaches: Blending Debt and Equity

It’s also common for businesses to use a combination of debt and equity over their lifecycle. In fact, many companies start with equity (personal savings, friends & family, angels) and then, once they have a proven model and some revenue, layer on debt (bank loans, lines of credit) to fuel further growth without further dilution.

Some specific hybrid financing options include:

- Convertible Notes: A type of debt that converts into equity at a later date, typically at a discount to a future equity round. Popular for early-stage startups as it defers valuation discussions.

- Venture Debt: A form of debt financing specifically for venture-backed companies. It provides capital without further equity dilution but often comes with warrants (options to buy equity) as a sweetener for the lender.

Conclusion

Both debt financing and equity financing are powerful tools for raising capital, but they serve different purposes and come with distinct trade-offs.

- Debt financing allows you to retain full ownership and control, offers predictable payments, and provides tax benefits on interest. However, it comes with a fixed repayment obligation and the risk of default.

- Equity financing provides capital without the burden of repayment, often brings valuable expertise, and shares the risk. But it means giving up a piece of your company, diluting your ownership and potentially your control.

There is no universally "better" option. The ideal choice depends on your company’s stage, financial health, growth trajectory, and your personal philosophy as a business owner. Carefully weigh the pros and cons, assess your specific needs, and don’t hesitate to consult with financial advisors or experienced mentors to make the most informed decision for your business’s future.

Post Comment