Cross-Price Elasticity of Demand: Unveiling the Secrets of Substitutes and Complements for Smart Decisions

In the bustling marketplace, prices are constantly shifting, and consumer choices are influenced by a myriad of factors. But have you ever wondered how the price change of one product can directly impact the demand for another product? This isn’t magic; it’s a fundamental economic principle known as Cross-Price Elasticity of Demand (CPED).

Understanding CPED is a cornerstone for businesses, economists, and even savvy consumers. It reveals the hidden relationships between different goods and services, categorizing them as either substitutes (alternatives) or complements (items used together). This article will demystify Cross-Price Elasticity of Demand, explaining its types, how to interpret it, and why it’s a powerful tool for making smarter decisions.

What is Cross-Price Elasticity of Demand? (CPED Explained Simply)

Imagine you’re craving a soda. You walk into a store, and suddenly your favorite brand, "Cola-X," has doubled its price. What do you do? Most likely, you’ll switch to "Cola-Y," a competing brand that still has a reasonable price. This everyday scenario perfectly illustrates the concept of Cross-Price Elasticity of Demand.

Cross-Price Elasticity of Demand (CPED) measures how sensitive the demand for one product (let’s call it Product B) is to a change in the price of another product (Product A). In simpler terms, it tells us:

- If the price of Product A goes up or down, how much does the quantity demanded for Product B change?

Unlike regular Price Elasticity of Demand, which looks at how a product’s own price affects its own demand, CPED focuses on the interconnection between two different products.

The Basic Idea:

- Product A’s Price Changes $rightarrow$ Product B’s Demand Reacts

This reaction can be positive, negative, or even non-existent, and the direction of that reaction is key to identifying the relationship between the two products.

The Formula Behind the Concept

While understanding the concept is paramount, it’s helpful to see the formula that economists use to calculate CPED:

$$ textCPED = fractext% Change in Quantity Demanded of Product Btext% Change in Price of Product A $$

- % Change in Quantity Demanded of Product B: This measures how much the demand for Product B went up or down, expressed as a percentage.

- % Change in Price of Product A: This measures how much the price of Product A went up or down, expressed as a percentage.

Don’t worry too much about the math right now! The most important part of this formula isn’t the number itself, but the SIGN of the number (positive, negative, or zero). The sign tells us everything we need to know about the relationship between the two products.

The Three Relationships: Substitutes, Complements, and Unrelated Goods

The sign of the Cross-Price Elasticity of Demand number reveals one of three fundamental relationships between products:

1. Positive Cross-Price Elasticity: Substitutes

- The Sign: The CPED value is positive (+).

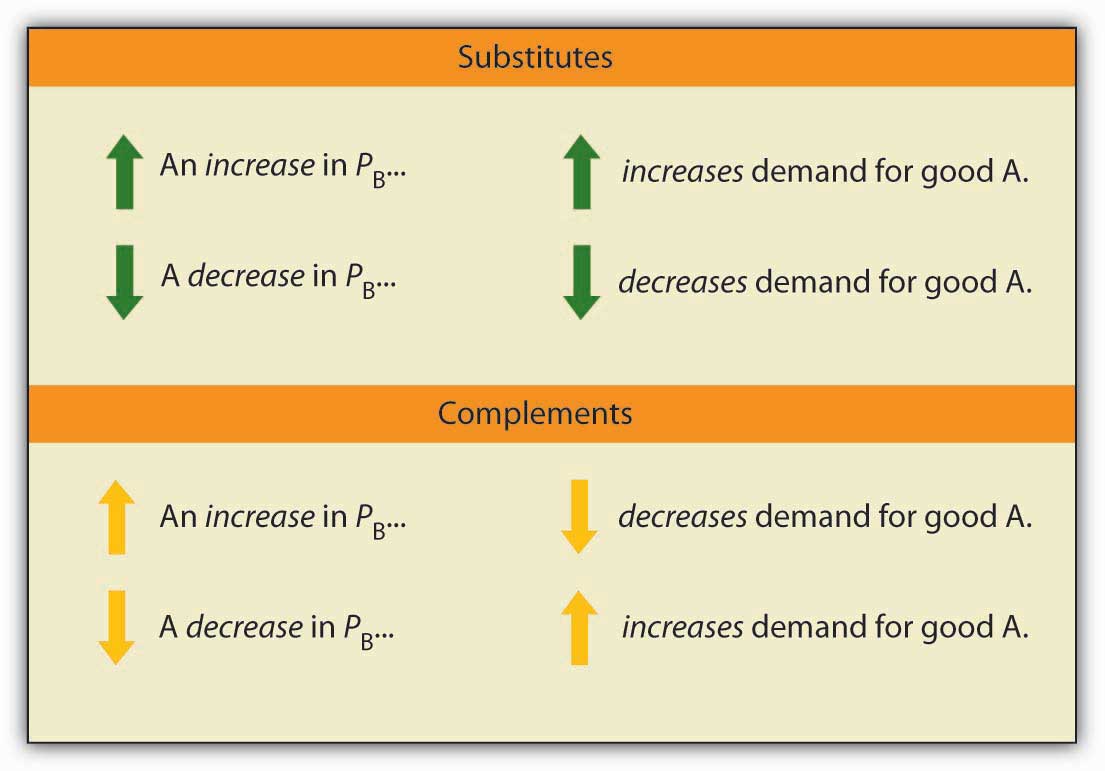

- What it Means: If the price of Product A goes up, the demand for Product B also goes up. Conversely, if the price of Product A goes down, the demand for Product B goes down.

- The Relationship: Products A and B are substitutes. This means they are competing goods that consumers can choose to buy instead of each other. They serve a similar purpose.

Think of it as the "either/or" choice. If one option becomes more expensive, you switch to the other.

Examples of Substitutes:

- Coffee vs. Tea: If the price of coffee significantly increases, some coffee drinkers might switch to tea, increasing tea’s demand.

- Coca-Cola vs. Pepsi: A classic example. If Coke’s price rises, many consumers will opt for Pepsi.

- Butter vs. Margarine: Used for similar cooking and spreading purposes.

- Netflix vs. Hulu: Streaming services that offer similar entertainment.

- Ford F-150 vs. Chevrolet Silverado: Competing pickup trucks.

The higher the positive CPED value, the closer the substitutes are. For example, the CPED between Coke and Pepsi would likely be very high, indicating they are very close substitutes. The CPED between a Ford F-150 and a bicycle would be positive, but very low, as they are not close substitutes.

2. Negative Cross-Price Elasticity: Complements

- The Sign: The CPED value is negative (-).

- What it Means: If the price of Product A goes up, the demand for Product B goes down. Conversely, if the price of Product A goes down, the demand for Product B goes up.

- The Relationship: Products A and B are complements. This means they are goods that are typically consumed together. The consumption of one often enhances or requires the consumption of the other.

Think of it as the "together" items. If one part of the pair becomes too expensive, you’re less likely to buy the other part.

Examples of Complements:

- Cars vs. Gasoline: If gas prices skyrocket, people might drive less, reducing the demand for new cars.

- Printers vs. Ink Cartridges: A printer is useless without ink, and ink is useless without a printer. If ink becomes prohibitively expensive, people might buy fewer printers.

- Coffee vs. Sugar/Creamer: If coffee becomes very expensive, people might buy less coffee, and consequently less sugar and creamer.

- Game Consoles vs. Video Games: If a new console is very expensive, fewer people might buy it, leading to lower demand for games designed for that console.

- Toothbrush vs. Toothpaste: You generally use them together.

The larger the negative CPED value (meaning, further away from zero in the negative direction), the stronger the complementary relationship.

3. Zero Cross-Price Elasticity: Unrelated Goods

- The Sign: The CPED value is zero (0) or very close to zero.

- What it Means: A change in the price of Product A has no significant impact on the demand for Product B.

- The Relationship: Products A and B are unrelated goods. They have no direct connection in consumer purchasing decisions.

Think of it as "no connection." One item’s price doesn’t sway your decision to buy the other.

Examples of Unrelated Goods:

- Pencils vs. Bicycles: The price of pencils changing won’t affect how many bicycles people buy.

- Bread vs. Televisions: No direct link between their prices and demands.

- Shoes vs. Breakfast Cereal: Unlikely to influence each other’s demand.

Why Does Cross-Price Elasticity of Demand Matter? Practical Applications

Understanding CPED is not just an academic exercise; it’s a powerful tool with significant implications for various stakeholders:

For Businesses and Marketers:

- Optimized Pricing Strategies:

- For Substitutes: If a competitor lowers their price (high positive CPED), you know you might lose customers, and you may need to adjust your own pricing or offer promotions to retain market share.

- For Complements: If the price of a complementary good increases (high negative CPED), you can anticipate a drop in demand for your own product. For example, if gas prices are high, car dealerships might offer more incentives.

- Product Bundling and Promotions:

- For Complements: Businesses can strategically bundle complementary goods together (e.g., a printer with a set of ink cartridges at a discount) to increase sales of both.

- For Substitutes: Offering discounts on a substitute product might be a way to draw customers away from a competitor.

- Marketing and Advertising Decisions:

- For Substitutes: Ads might highlight how a product is a superior alternative to a competitor’s (e.g., "Tired of X? Try Y!").

- For Complements: Marketing campaigns can emphasize how well products work together (e.g., a camera brand partnering with a memory card brand).

- New Product Development: By understanding existing substitute and complement relationships, companies can identify gaps in the market or develop products that complement existing popular items.

- Anticipating Competitor Moves: Monitoring the pricing strategies of competitors and knowing the CPED between your product and theirs allows you to predict their impact on your sales. If a competitor cuts prices significantly, a business with a high positive CPED will know to prepare for a dip in demand.

- Supply Chain Management: If you rely on a complementary product that’s experiencing price volatility, you can anticipate changes in demand for your own product and adjust your inventory and production accordingly.

For Consumers:

- Informed Purchasing Decisions: Understanding CPED helps consumers make more rational choices. If the price of a complementary good (like printer ink) is consistently high, you might factor that into your decision when buying a printer.

- Spotting Value: Consumers can identify when a price drop in one product makes another complementary product a better value.

For Policymakers and Economists:

- Antitrust Regulations: Governments use CPED to assess market power and identify potential monopolies. If a company’s product has very few close substitutes (low positive CPED with competitors), it might indicate a lack of competition.

- Taxation Impacts: Understanding how taxes on one product might affect the demand for others can help policymakers predict broader economic impacts.

- Market Analysis: CPED provides valuable insights into the structure and dynamics of different industries.

Factors Influencing Cross-Price Elasticity

Several factors can influence the strength of the cross-price elasticity between products:

- Closeness of the Relationship: The more similar two substitutes are, or the more essential two complements are to each other, the higher the elasticity will be. (e.g., Coke and Pepsi are very close substitutes; a car and gasoline are strong complements).

- Availability of Alternatives: If there are many close substitutes available, the CPED will be higher. If there are few alternatives, it will be lower.

- Consumer Preferences and Habits: Strong brand loyalty or deeply ingrained habits can reduce elasticity. If consumers are fiercely loyal to one brand, they might not switch even if a substitute’s price drops significantly.

- Time Horizon: In the short run, consumers might be less responsive to price changes. Over a longer period, they have more time to find substitutes or adjust their consumption patterns, leading to higher elasticity.

- Market Definition: How broadly or narrowly products are defined can impact CPED. For example, the CPED between "luxury cars" and "economy cars" will be different from the CPED between "Toyota Camry" and "Honda Accord."

Common Misconceptions and Key Takeaways

- Not the Same as Price Elasticity of Demand: Remember, CPED looks at two different products, while regular Price Elasticity of Demand looks at how a product’s own price affects its own demand.

- The Sign is Everything: For CPED, the positive, negative, or zero sign is far more important than the numerical value itself for understanding the relationship.

- Context is Key: The elasticity can vary depending on the specific market, time frame, and consumer segment being analyzed.

Conclusion

Cross-Price Elasticity of Demand is a powerful, yet often overlooked, concept in economics. By understanding whether products are substitutes, complements, or unrelated, businesses can make more informed pricing decisions, develop effective marketing strategies, and anticipate competitor moves. Consumers, in turn, can use this knowledge to navigate the marketplace more intelligently and make purchasing choices that align with their needs and budget.

In an interconnected economy, nothing exists in a vacuum. The price of your morning coffee might just influence your decision to buy sugar, and the cost of your favorite soda could send you straight to a competing brand. CPED helps us decode these subtle, yet significant, relationships that shape our economic world.

Post Comment