Creating a Debt Repayment Plan: Your Step-by-Step Guide to Financial Freedom

Feeling overwhelmed by debt? You’re not alone. Millions of people grapple with credit card balances, student loans, car payments, and mortgages. The good news is that taking control of your debt is not just a dream – it’s an achievable goal with the right strategy. Creating a debt repayment plan is the most powerful step you can take towards financial peace and long-term security.

This comprehensive guide will walk you through everything you need to know, from understanding your current financial situation to choosing the best repayment strategy for you, and staying motivated on your journey to becoming debt-free.

Why Do You Need a Debt Repayment Plan?

Before we dive into the "how," let’s quickly understand the "why." A structured debt repayment plan offers numerous benefits:

- Clarity and Control: It replaces anxiety with a clear roadmap, showing you exactly how and when you’ll become debt-free.

- Reduced Stress: Knowing you have a plan in place can significantly lower financial stress and improve your overall well-being.

- Faster Debt Payoff: Strategic planning helps you pay off debt more quickly, saving you hundreds or even thousands in interest.

- Improved Credit Score: Consistently making payments on time and reducing your debt-to-income ratio positively impacts your credit score.

- Financial Freedom: Ultimately, it frees up your income, allowing you to save, invest, and achieve other financial goals.

Ready to take charge? Let’s begin!

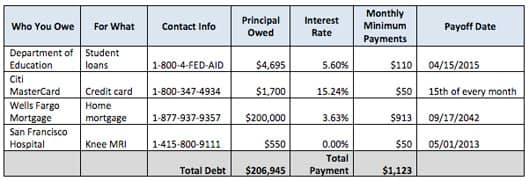

Step 1: Get Real – Your Financial Snapshot

You can’t effectively tackle a problem until you fully understand its scope. This first step is about gathering all the necessary information about your debts and your overall financial situation.

A. List All Your Debts

This might feel daunting, but it’s crucial. Grab a notebook, a spreadsheet, or use a budgeting app to list every single debt you owe. For each debt, record the following:

- Creditor: Who do you owe? (e.g., Chase, Sallie Mae, Capital One, Ford Credit)

- Type of Debt: What is it? (e.g., credit card, student loan, car loan, personal loan, medical bill)

- Current Balance: How much do you still owe?

- Interest Rate (APR): This is critical! How much interest are you paying?

- Minimum Monthly Payment: What’s the smallest amount you must pay each month?

- Due Date: When is the payment due?

Example Debt List:

| Creditor | Type of Debt | Current Balance | Interest Rate (APR) | Minimum Payment | Due Date |

|---|---|---|---|---|---|

| Credit Card A | Credit Card | $2,500 | 24.99% | $75 | 15th |

| Credit Card B | Credit Card | $1,000 | 18.00% | $30 | 22nd |

| Student Loan | Student Loan | $15,000 | 6.8% | $160 | 5th |

| Car Loan | Auto Loan | $8,000 | 4.5% | $180 | 10th |

| Personal Loan | Personal Loan | $3,000 | 12.0% | $100 | 1st |

B. Understand Your Income and Expenses (Your Budget)

A debt repayment plan is built on the foundation of a solid budget. You need to know how much money you have coming in and how much is going out.

1. Calculate Your Net Income:

This is your take-home pay after taxes and deductions. If you have multiple income sources, add them all up.

2. Track Your Expenses:

This is where many people get tripped up. Don’t just guess! For at least one month (ideally two or three), meticulously track every dollar you spend. Categorize your expenses:

- Fixed Expenses: These are usually the same amount each month and are difficult to change quickly.

- Rent/Mortgage

- Car Payment

- Insurance Premiums (Health, Auto, Home)

- Loan Payments (Student, Personal)

- Subscription Services (Netflix, Gym Membership)

- Variable Expenses: These fluctuate each month and offer more opportunities for reduction.

- Groceries

- Utilities (Electricity, Water, Gas – can vary)

- Transportation (Gas, Public Transit)

- Dining Out/Entertainment

- Clothing

- Personal Care (Haircuts, Toiletries)

Budgeting Tip: Use a spreadsheet, a budgeting app (like Mint, YNAB, EveryDollar), or even just a notebook to track. The goal is to see exactly where your money is going.

C. Find Your "Debt Avalanche" Money

Once you have your total net income and total expenses, calculate the difference:

Net Income – Total Expenses = Money Available for Debt Repayment

This "extra" money is what you can use to accelerate your debt payoff. If this number is zero or negative, don’t despair! It means you need to either cut expenses further or find ways to increase your income (we’ll cover this in Step 3).

Step 2: Pick Your Path – Debt Snowball vs. Debt Avalanche

With your financial snapshot complete, it’s time to choose a strategy for attacking your debt. The two most popular and effective methods are the Debt Snowball and the Debt Avalanche. Both involve making minimum payments on all debts except one, which you aggressively pay down.

A. The Debt Snowball Method

How it works: You list your debts from the smallest balance to the largest balance, regardless of interest rate. You then focus all your extra money on paying off the smallest debt first. Once that debt is paid off, you take the money you were paying on it (its minimum payment + any extra you were sending) and add it to the minimum payment of the next smallest debt. You continue this "snowballing" effect until all debts are gone.

Example (using our debt list):

- Credit Card B: $1,000 (Min. $30)

- Credit Card A: $2,500 (Min. $75)

- Personal Loan: $3,000 (Min. $100)

- Car Loan: $8,000 (Min. $180)

- Student Loan: $15,000 (Min. $160)

- You’d attack Credit Card B first. Once $1,000 is paid off, you’d take the $30 (or more) you were paying and add it to Credit Card A’s payment.

- Once Credit Card A is paid off, you’d add its former payment ($75 + $30 = $105, plus its original minimum) to the Personal Loan payment, and so on.

Pros of the Debt Snowball:

- Psychological Wins: Paying off the first few small debts quickly provides a huge motivational boost. You see progress faster.

- Builds Momentum: Each debt paid off frees up more money for the next, creating a powerful "snowball" effect.

- Great for Beginners: It’s easy to understand and stick with, especially if you need quick wins to stay motivated.

Cons of the Debt Snowball:

- More Interest Paid: Because it ignores interest rates, you might end up paying more in interest over the long run compared to the avalanche method.

B. The Debt Avalanche Method

How it works: You list your debts from the highest interest rate to the lowest interest rate, regardless of the balance. You then focus all your extra money on paying off the debt with the highest interest rate first. Once that debt is paid off, you take the money you were paying on it and add it to the minimum payment of the next highest interest rate debt.

Example (using our debt list):

- Credit Card A: 24.99% (Balance $2,500, Min. $75)

- Credit Card B: 18.00% (Balance $1,000, Min. $30)

- Personal Loan: 12.0% (Balance $3,000, Min. $100)

- Student Loan: 6.8% (Balance $15,000, Min. $160)

- Car Loan: 4.5% (Balance $8,000, Min. $180)

- You’d attack Credit Card A first. Once $2,500 is paid off, you’d take the $75 (or more) you were paying and add it to Credit Card B’s payment.

- Once Credit Card B is paid off, you’d add its former payment ($30 + $75 = $105, plus its original minimum) to the Personal Loan payment, and so on.

Pros of the Debt Avalanche:

- Saves Money: By targeting high-interest debts first, you pay less overall interest, making it the mathematically most efficient method.

- Faster Overall Payoff: Because you’re saving more on interest, you can often pay off your total debt faster.

Cons of the Debt Avalanche:

- Less Immediate Gratification: If your highest interest debt also has a large balance, it might take a while to see that first debt completely paid off, which can be discouraging for some.

Which Method is Right for You?

- Choose Debt Snowball if: You need quick wins and motivation to stick with your plan. You’re easily discouraged by long stretches without seeing a debt completely disappear.

- Choose Debt Avalanche if: You are highly disciplined, motivated by saving money, and comfortable with a longer initial payoff period for your first debt.

The best method is the one you will stick with! Both are effective, but consistency is key.

Step 3: Accelerate Your Progress – Tactics for Success

Once you have your budget and chosen your repayment strategy, it’s time to find ways to supercharge your efforts and pay off debt even faster.

A. Cut Your Expenses Aggressively

This is where your budget from Step 1 becomes your most valuable tool. Look for areas where you can trim spending and redirect that money towards debt.

- Review Variable Expenses:

- Dining Out: Can you cook more meals at home? Pack your lunch?

- Groceries: Meal plan, use coupons, buy store brands, avoid impulse buys.

- Entertainment: Look for free or low-cost activities. Cut back on streaming services you don’t use regularly.

- Subscriptions: Cancel unused gym memberships, apps, or recurring deliveries.

- Shopping: Implement a "no-spend" challenge for a week or month. Think twice before every non-essential purchase.

- Re-evaluate Fixed Expenses: While harder to change, some fixed costs can be reduced.

- Insurance: Shop around for better rates on auto, home, or health insurance.

- Utilities: Be mindful of energy consumption (turn off lights, adjust thermostat).

- Cell Phone Plan: Are you on the best plan for your usage? Can you switch to a cheaper provider?

- Transportation: Can you carpool, bike, or use public transport more often?

The Goal: Find extra money in your budget, no matter how small the amount seems. Every dollar you free up can go towards your debt.

B. Increase Your Income

More money coming in means more money to throw at your debt. Consider these options:

- Side Hustle: Deliver food, drive for a ride-share service, freelance your skills (writing, graphic design, web development), dog walking, babysitting.

- Sell Unused Items: Declutter your home and sell clothes, electronics, furniture, or collectibles on platforms like eBay, Facebook Marketplace, or local consignment shops.

- Ask for a Raise: If you’ve been excelling at your job, prepare a case for why you deserve a raise.

- Overtime Hours: If available, pick up extra shifts at your current job.

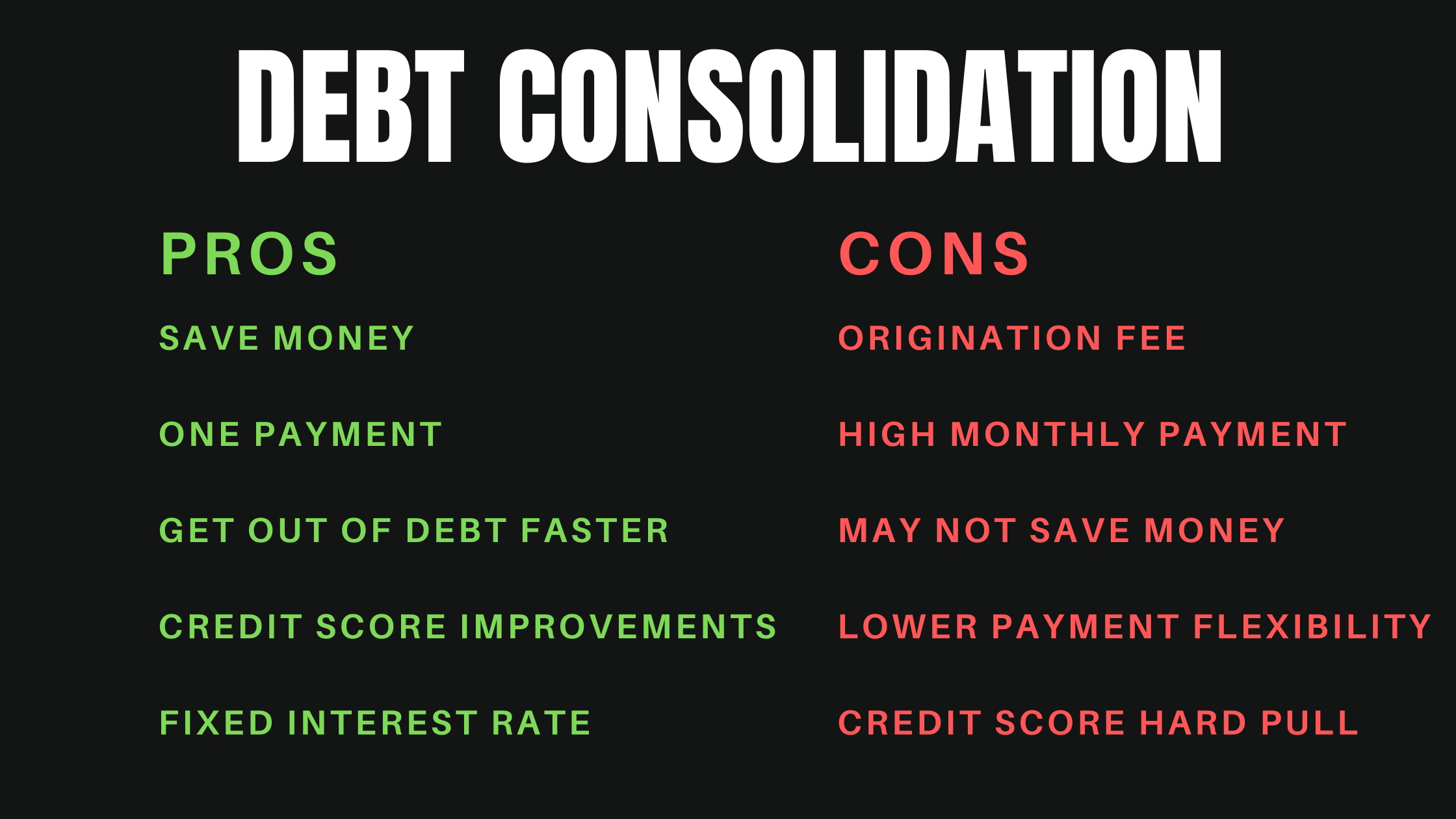

C. Consider Debt Consolidation (Use with Caution!)

Debt consolidation involves taking out a new loan or using a credit card balance transfer to combine multiple debts into a single, usually lower-interest, monthly payment.

- Personal Debt Consolidation Loan: You get a single loan to pay off your existing debts. This can simplify payments and potentially lower your interest rate if your credit is good.

- Balance Transfer Credit Card: You transfer high-interest credit card balances to a new credit card with a 0% introductory APR for a promotional period (e.g., 12-18 months).

Important Cautions with Debt Consolidation:

- Don’t Incur More Debt: This is the biggest pitfall. If you consolidate credit card debt, you must avoid using those newly empty cards again. Cut them up if necessary!

- Check Fees: Balance transfers often have a fee (e.g., 3-5% of the transferred amount). Personal loans may have origination fees.

- Understand Terms: Make sure you can pay off the balance transfer before the 0% APR expires, or your interest rate could skyrocket.

- Not a Magic Bullet: Consolidation is a tool to make repayment easier, not a substitute for addressing the underlying spending habits that led to debt.

D. Negotiate with Creditors

Don’t be afraid to call your credit card companies or lenders!

- Lower Interest Rates: Explain your situation and ask if they can lower your interest rate. Highlight your history of on-time payments if you have one.

- Hardship Programs: If you’re experiencing a temporary financial hardship (job loss, medical emergency), some creditors may offer temporary payment reductions or deferrals.

- Payment Plans: For overdue bills (like medical debt), you can often negotiate a payment plan that fits your budget.

E. Automate Payments

Set up automatic minimum payments for all your debts to ensure you never miss a due date. This avoids late fees and negative impacts on your credit score. Then, manually apply any extra payments to your target debt.

F. Make Extra Payments (Even Small Ones)

Even an extra $20 or $50 added to your principal payment each month can make a significant difference over time, especially with high-interest debts. Every little bit counts and shortens your debt journey.

Step 4: Stay the Course – Motivation and Maintenance

Paying off debt is a marathon, not a sprint. Maintaining motivation and regularly reviewing your plan are crucial for long-term success.

A. Celebrate Milestones

As you pay off each debt (especially with the snowball method) or hit significant balance reduction targets (e.g., 25%, 50% paid off), take time to celebrate!

- Small Rewards: Treat yourself to a favorite coffee, a movie night at home, or a new book – something inexpensive that reinforces your progress.

- Acknowledge Your Hard Work: Pat yourself on the back. You’re doing something difficult and important.

B. Regularly Review and Adjust Your Plan

Life happens. Your income might change, unexpected expenses might pop up, or you might find new ways to save.

- Monthly Check-ins: At least once a month, review your budget, your debt progress, and your remaining balances.

- Adjust as Needed: If you found more "extra" money, add it to your debt payment. If an emergency came up, adjust your payment strategy temporarily, but get back on track as soon as possible.

- Re-evaluate Strategy: If the avalanche method is feeling too slow, consider switching to the snowball for a burst of motivation, then switch back if you feel ready.

C. Stay Flexible, Not Rigid

While discipline is key, remember that your plan is a guide, not a rigid set of rules that will break if you deviate. If you have an off month, don’t give up! Just reset and recommit for the next month.

D. Find Accountability and Support

Share your goals with a trusted friend, family member, or partner who can support and encourage you. There are also online communities and forums dedicated to debt repayment where you can find advice and camaraderie.

E. Avoid New Debt

This is perhaps the most critical rule. While on your debt repayment journey, make a strict commitment to not take on any new debt.

- Emergency Fund: Build a small emergency fund ($1,000 or 1 month of essential expenses) before aggressively paying down debt. This acts as a buffer for unexpected costs, preventing you from reaching for credit cards.

- Cash is King: If you can’t pay for it with cash (or money in your checking account), you can’t afford it.

- Cut Up Credit Cards: If credit cards are a major temptation, consider cutting up all but one (for emergencies) or even all of them.

F. Visualize Your Debt-Free Future

Keep your "why" at the forefront of your mind. Imagine what life will be like without debt: the freedom, the reduced stress, the ability to save for big goals like a down payment on a house, retirement, or your children’s education. This vision can be a powerful motivator.

Common Mistakes to Avoid When Creating a Debt Repayment Plan

Even with the best intentions, it’s easy to stumble. Be aware of these common pitfalls:

- Ignoring the Problem: The biggest mistake is doing nothing. Debt doesn’t disappear on its own.

- Not Having a Budget: Without knowing where your money goes, you can’t effectively direct it towards debt.

- No Clear Strategy: Just making minimum payments without a targeted approach will keep you in debt longer.

- Giving Up Too Soon: Debt repayment takes time and perseverance. Don’t get discouraged by setbacks.

- Taking on New Debt: Using credit cards or loans while trying to pay off old ones is like trying to fill a bucket with a hole in the bottom.

- Unrealistic Expectations: Don’t expect to be debt-free overnight. Set realistic timelines and celebrate small wins.

- Neglecting an Emergency Fund: Without a safety net, one unexpected expense can derail your entire plan.

When to Seek Professional Help

For some, managing debt feels impossible, even with a solid plan. Don’t be ashamed to seek professional guidance if:

- You’re consistently unable to make your minimum payments.

- You’re receiving constant calls from debt collectors.

- Your debt is causing severe emotional distress or impacting your relationships.

- You feel completely overwhelmed and don’t know where to start.

Consider these options:

- Non-profit Credit Counseling Agencies: These organizations offer free or low-cost advice, help you create a budget, and can sometimes negotiate with creditors on your behalf through a Debt Management Plan (DMP).

- Financial Advisors: A certified financial planner can help you create a holistic financial plan that includes debt repayment, savings, and investments.

- Bankruptcy Attorneys: If your situation is dire and you’ve exhausted all other options, bankruptcy might be a last resort. Consult with a qualified attorney to understand the implications.

Conclusion: Your Journey to Financial Freedom Starts Now

Creating a debt repayment plan is more than just crunching numbers; it’s about taking control, building new habits, and empowering yourself to achieve financial freedom. It won’t always be easy, and there will be challenges along the way, but every step you take brings you closer to a life free from the burden of debt.

Start today. Gather your statements, assess your income, choose your strategy, and commit to the process. The path to a debt-free future is within your reach, and it all begins with your first intentional step.

Post Comment