Consumer Confidence Index: Predicting Global Spending Trends (A Beginner’s Guide)

Have you ever thought about buying a new car, taking a big vacation, or investing in a home, and then suddenly hesitated because you felt uncertain about your job, the economy, or the future in general? That feeling – whether it’s optimism or worry – is a huge driver of economic activity. It’s also the core of what the Consumer Confidence Index (CCI) tries to measure.

In a world increasingly interconnected, understanding what makes people spend (or save) is crucial for businesses, investors, and even governments. The CCI isn’t just a fancy economic term; it’s a powerful barometer that offers a sneak peek into the collective mood of consumers, and by extension, a valuable clue about predicting global spending trends.

This comprehensive guide will demystify the Consumer Confidence Index, explaining what it is, why it matters, how it influences spending, and what its numbers truly mean for the global economy.

What is the Consumer Confidence Index (CCI)?

At its heart, the Consumer Confidence Index is a survey designed to gauge how optimistic or pessimistic consumers feel about the economy. Think of it as a national temperature check on the financial mood of households.

In the United States, the most widely cited CCI is published monthly by The Conference Board, a global, independent business research organization. They conduct surveys asking thousands of households across the country a series of questions about:

- Current Economic Conditions: How do you feel about the present business conditions and employment situation?

- Future Expectations: How do you expect business conditions, employment, and your family income to be in the next six months?

The answers to these questions are then compiled and weighted to create a single index number. This number provides a snapshot of consumer sentiment, indicating whether people feel secure enough to spend, or cautious enough to save.

Key Components of the CCI:

- Present Situation Index: Reflects consumers’ assessment of current business and labor market conditions.

- Expectations Index: Reflects consumers’ short-term outlook (next six months) regarding income, business, and labor market conditions. This component is often considered a more forward-looking indicator.

How it’s Measured (Simply):

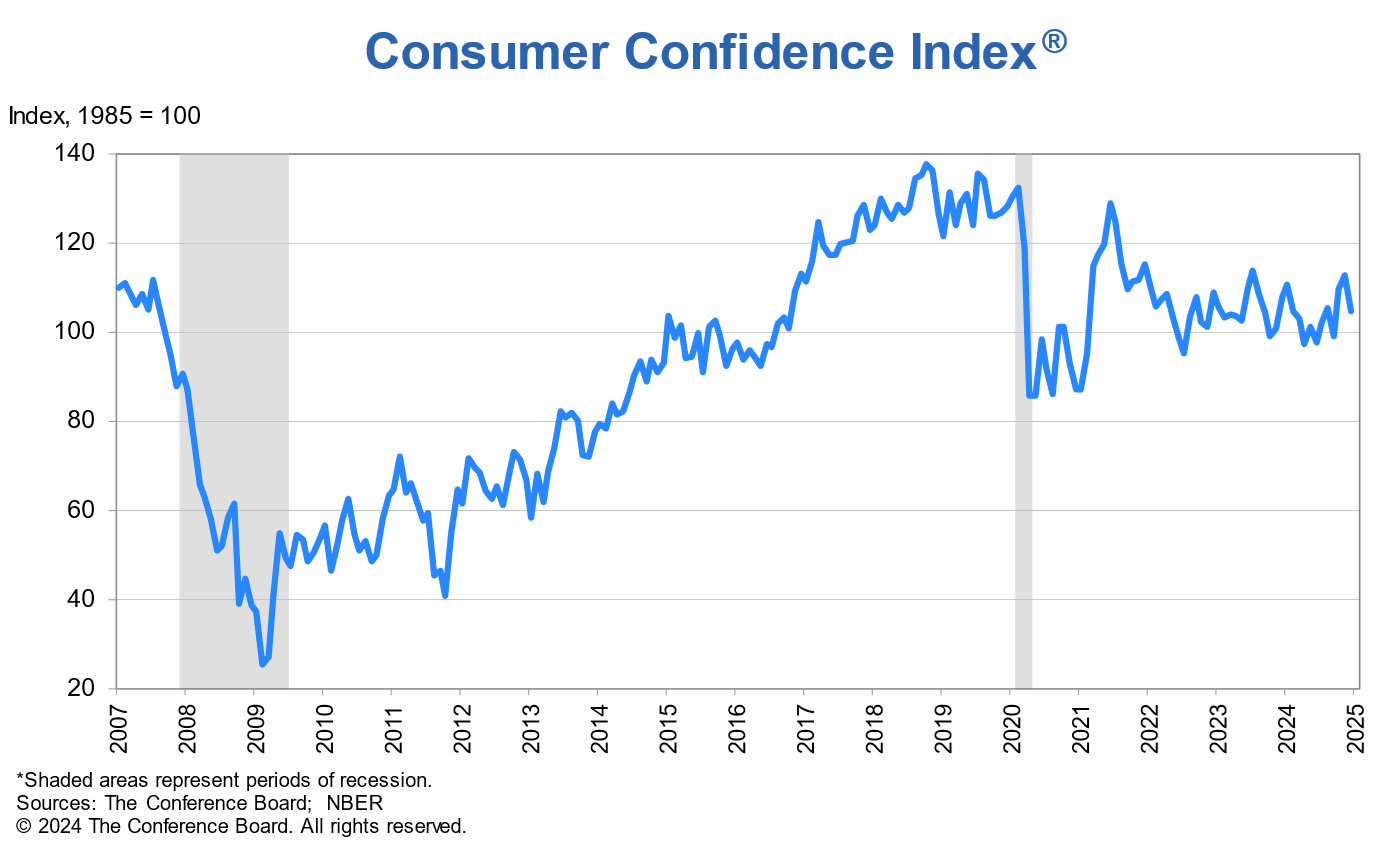

The index is based on a baseline year (currently 1985), where the index was set at 100.

- An index above 100 suggests that consumers are generally optimistic.

- An index below 100 indicates a prevailing sense of pessimism.

- A rising CCI means consumers are becoming more confident.

- A falling CCI means consumers are becoming less confident.

Why Does Consumer Confidence Matter So Much?

Consumer spending is the engine of most economies. In many developed nations, it accounts for 60-70% of the Gross Domestic Product (GDP) – the total value of goods and services produced in a country. When consumers feel good about their financial situation and the economy, they are more likely to:

- Buy Big-Ticket Items: Purchase new cars, homes, appliances, or take expensive vacations.

- Spend More on Discretionary Goods & Services: Go out to eat more often, buy new clothes, enjoy entertainment.

- Invest in Their Future: Spend on education, home improvements, or save for retirement.

Conversely, when consumer confidence is low, people tend to:

- Postpone Major Purchases: Delay buying a new car or house.

- Cut Back on Non-Essential Spending: Eat out less, cancel subscriptions, look for cheaper alternatives.

- Increase Savings: Hold onto their cash in anticipation of tougher times.

This direct link to spending makes the CCI a powerful leading economic indicator. It often signals shifts in economic activity before those shifts are reflected in hard data like retail sales or GDP growth.

How the CCI Predicts Global Spending Trends

The magic of the CCI lies in its ability to predict future behavior. Here’s how it works:

-

The Psychology of Spending: Our spending decisions are not purely rational. They are heavily influenced by our emotions and expectations. If you feel secure in your job and believe the economy is improving, you’re more likely to feel comfortable taking on debt for a new car or booking that expensive trip. If you’re worried about layoffs or rising prices, you’ll naturally tighten your belt. The CCI captures this collective psychological state.

-

Leading Indicator Status: Unlike some economic indicators (like GDP or unemployment rates) that tell us what has already happened, the CCI gives us a hint about what might happen next. A significant drop in consumer confidence today could foreshadow a slowdown in retail sales a few months down the line. Similarly, a surge in confidence could signal a coming boom in consumer spending.

-

Impact on Businesses: Businesses closely watch the CCI because it helps them make strategic decisions:

- Inventory Management: If confidence is high, they might stock more products, anticipating higher demand. If low, they might reduce inventory to avoid overstocking.

- Hiring Decisions: Confident consumers mean businesses expect more sales, which could lead to hiring more staff.

- Marketing & Investment: Businesses might increase marketing spend or invest in new production lines when confidence is strong.

-

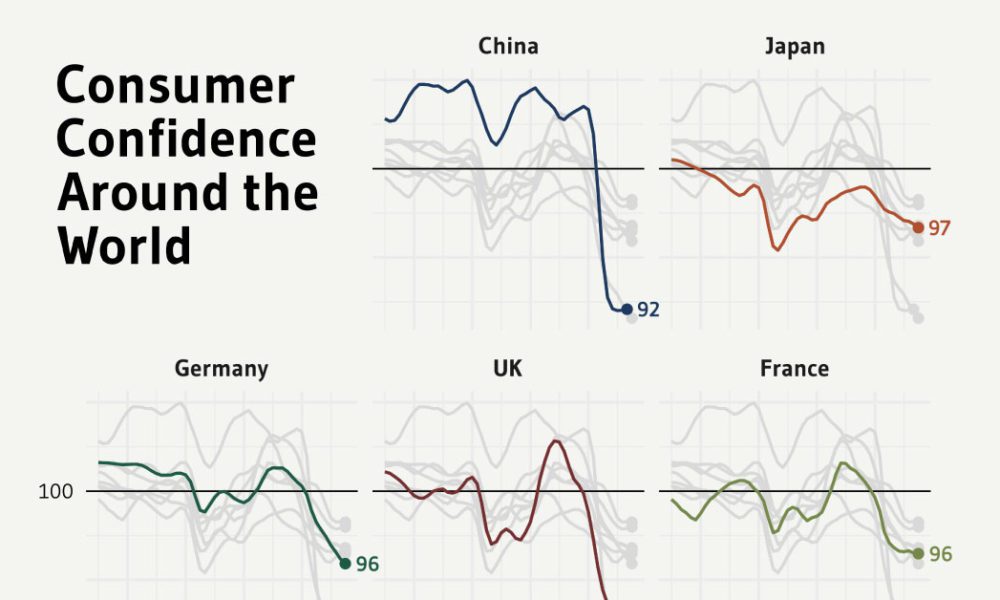

Influence on Global Markets: While the CCI is often country-specific (e.g., US CCI, Eurozone CCI), consumer sentiment in major economies like the US can have a ripple effect globally.

- Trade: If US consumers are confident and spending, they’ll likely buy more imported goods, boosting economies in exporting countries.

- Investment: A strong CCI in one major economy can signal opportunities for global investors, influencing capital flows.

- Global Supply Chains: Reduced spending in one large market due to low confidence can lead to a slowdown in demand across global supply chains.

Example:

Imagine the CCI rises sharply. This suggests consumers are optimistic. What might happen next?

- More people apply for mortgages and buy homes.

- Car dealerships see an increase in sales.

- Airlines and hotels experience higher bookings.

- Retailers report stronger sales figures.

- Businesses respond by increasing production and potentially hiring more staff.

This positive cycle can contribute to overall economic growth, both domestically and internationally through trade and investment.

Factors Influencing Consumer Confidence

Consumer confidence isn’t static; it fluctuates based on a variety of internal and external factors. Understanding these influences helps us interpret the CCI more accurately:

- Employment Situation: This is perhaps the most critical factor. Job security and the availability of good jobs directly impact a person’s willingness to spend. Low unemployment rates and rising wages typically boost confidence.

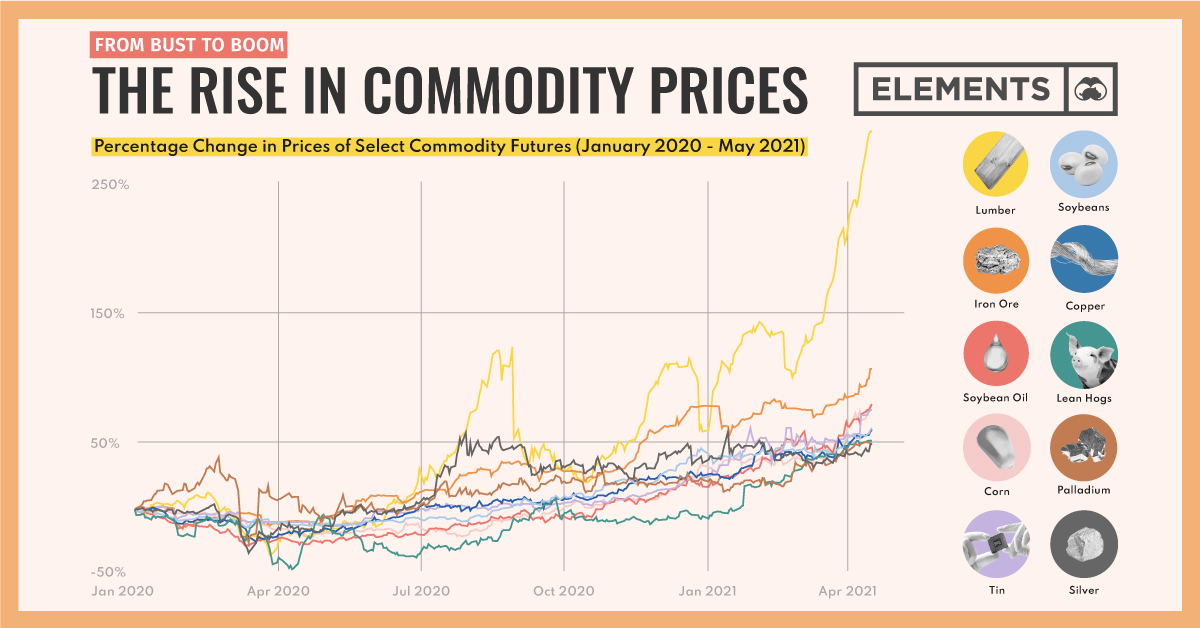

- Inflation: When prices for everyday goods (food, gas) rise rapidly, consumers’ purchasing power decreases. This can make them feel poorer and less confident, leading to reduced spending, even if their income remains stable.

- Interest Rates: Changes in interest rates affect borrowing costs for mortgages, car loans, and credit cards. Lower rates can encourage spending, while higher rates can make consumers more cautious.

- Stock Market Performance: Many households have investments in the stock market (directly or through retirement funds). A rising stock market can create a "wealth effect," making people feel richer and more willing to spend. A falling market can have the opposite effect.

- Personal Income & Debt Levels: A steady increase in personal income and manageable debt levels contribute to higher confidence.

- Geopolitical Events: Major global events like wars, pandemics, or political instability can introduce uncertainty and significantly dampen consumer confidence, regardless of domestic economic conditions.

- Government Policy: Fiscal policies (tax changes, stimulus packages) and monetary policies (interest rate changes by central banks) can directly influence economic conditions and, by extension, consumer confidence.

- Media & News Cycles: Constant negative news about the economy can erode confidence, even if underlying conditions aren’t dire. Positive news can have a reinforcing effect.

Reading the CCI: What Do the Numbers Mean?

As mentioned, the CCI is indexed to 100 in 1985. Here’s a deeper look at interpreting the numbers:

- CCI > 100 (e.g., 120): Strong consumer optimism. Consumers feel good about the present and are hopeful about the future. This typically signals robust spending ahead.

- CCI < 100 (e.g., 80): Consumer pessimism. Consumers are worried about current conditions and/or future prospects. This often precedes a slowdown in spending.

- Significant Month-over-Month Changes: A sharp jump or drop (e.g., 10 points or more) is more significant than small fluctuations. It indicates a rapid shift in sentiment.

- Trends Over Time: It’s more important to look at the trend of the CCI over several months rather than focusing on a single number. A sustained upward trend suggests growing confidence, while a prolonged downward trend indicates deepening concerns.

- Present vs. Expectations Components: Pay attention to both. If the Present Situation Index is high but the Expectations Index is falling, it could mean consumers feel good now but are worried about what’s coming, which could lead to a future spending slowdown. If Expectations are rising, it’s a strong positive signal.

Example Scenario:

- CCI at 115, rising: Consumers are feeling great! They’re likely buying homes, cars, and spending on travel. Businesses are probably ramping up production and hiring.

- CCI at 90, falling: Consumers are nervous. They might be delaying big purchases, saving more, and cutting back on luxuries. Businesses might hold off on hiring and investment.

Limitations and Nuances of the CCI

While incredibly useful, the CCI isn’t a perfect crystal ball. It’s important to consider its limitations:

- Survey-Based: It reflects intentions and feelings, not actual spending. People might say they’re confident but still hold back on spending for various reasons.

- Lag Between Sentiment and Action: There’s often a delay between a change in confidence and a change in actual spending behavior. Big purchases like homes or cars take time to materialize after a decision is made.

- Regional Differences: The national CCI might not accurately reflect sentiment in specific regions or states, which can have unique local economic conditions.

- Other Economic Factors: The CCI should always be viewed in conjunction with other economic indicators like inflation rates, unemployment figures, retail sales data, and interest rates for a more complete picture.

- Volatility: The index can sometimes be quite volatile month-to-month, especially in response to major news events. It’s the sustained trends that are most telling.

Who Uses the CCI and Why?

The Consumer Confidence Index is a vital piece of information for a wide range of individuals and organizations:

- Businesses & Corporations: To forecast demand for their products and services, plan inventory levels, make hiring decisions, and strategize marketing campaigns.

- Investors: To anticipate market movements. A strong CCI might suggest a bullish stock market, particularly for consumer discretionary stocks (companies that sell non-essential goods and services). A weak CCI might indicate a potential market downturn.

- Economists & Analysts: To predict future economic growth, inflation, and employment trends. It helps them build comprehensive economic models.

- Policymakers & Governments: Central banks (like the Federal Reserve) and government agencies use the CCI to assess the health of the economy and inform decisions about monetary policy (interest rates) and fiscal policy (spending, taxes).

- Individuals: While not directly guiding daily purchases, understanding the CCI can help individuals make more informed decisions about major purchases, career planning, and personal investments. If confidence is consistently low, it might be a signal to be more financially cautious.

Conclusion: The Pulse of the Economy

The Consumer Confidence Index is far more than just a number; it’s a powerful reflection of the collective hope, fear, and financial well-being of a nation’s households. By capturing these crucial sentiments, the CCI serves as an invaluable leading indicator for predicting global spending trends.

While it’s not a perfect predictor and should be viewed alongside other economic data, the CCI offers a unique window into the future of consumer behavior. Whether you’re a business owner, an investor, a policymaker, or simply someone trying to understand the economic winds, keeping an eye on the Consumer Confidence Index provides critical insights into the pulse of the economy and the likely direction of global spending. Stay informed, and you’ll be better equipped to navigate the ever-changing economic landscape.

Post Comment