Climate Change: A Ticking Economic Time Bomb – Understanding the Financial Risks of Global Warming

For a long time, discussions about climate change were primarily confined to environmental science and ecology. We pictured melting ice caps, endangered polar bears, and shrinking rainforests. While these environmental consequences are undeniably crucial, the conversation has rapidly shifted. Today, climate change is no longer just an environmental issue; it is a massive economic risk factor, reshaping financial markets, threatening businesses, and impacting the livelihoods of billions across the globe.

This article will break down, in simple terms, how climate change acts as an economic threat, why it affects your wallet and the global economy, and what steps are being taken to manage this unprecedented challenge.

Beyond Polar Bears: Why Climate Change is an Economic Issue

Imagine the global economy as a complex, interconnected machine. Every part – from agriculture to manufacturing, energy production to tourism, finance to healthcare – relies on a stable environment and predictable resources. Climate change disrupts this stability, creating new costs, destroying assets, and introducing immense uncertainty.

Think of it like this: if your house is constantly being hit by storms, floods, or wildfires, it’s not just an "environmental" problem for your home; it’s a huge financial burden. You have to pay for repairs, maybe move, deal with insurance, and potentially lose income. Multiply that by every business, city, and nation on Earth, and you start to grasp the scale of the economic challenge posed by a changing climate.

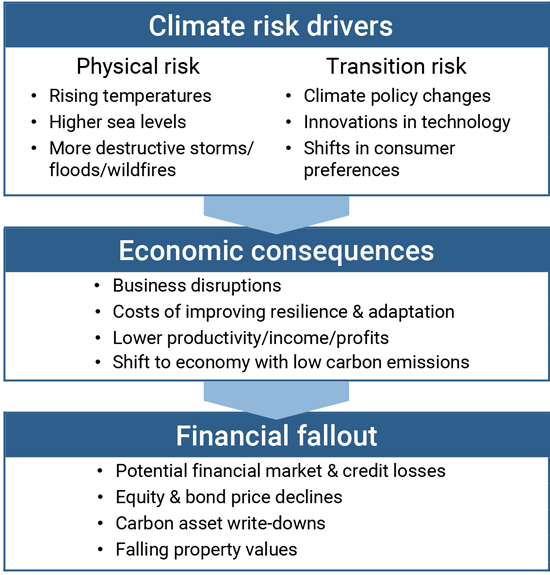

Economists and financial experts now categorize climate risks into two main types:

- Physical Risks: These are the direct, tangible impacts of climate change that cause damage or disruption.

- Transition Risks: These arise from the global shift towards a low-carbon economy, as industries and businesses adapt (or fail to adapt) to new policies, technologies, and market demands.

Let’s dive deeper into how these risks manifest.

1. Direct Economic Impacts: Feeling the Heat (Physical Risks)

Physical risks are the most visible and often the most immediate economic threats. They are the costs associated with the actual changes in our climate.

-

Extreme Weather Events:

- What it is: More frequent and intense hurricanes, typhoons, floods, droughts, wildfires, and heatwaves.

- Economic Impact:

- Property Damage: Homes, businesses, infrastructure (roads, bridges, power grids) are destroyed or severely damaged, costing billions in repairs and rebuilding.

- Agricultural Losses: Droughts wipe out crops, floods drown fields, and heatwaves stress livestock, leading to food shortages and higher prices.

- Business Interruption: Companies cannot operate during and after events, leading to lost revenue, supply chain disruptions, and job losses.

- Insurance Costs: As disasters become more common, insurance premiums rise, or coverage becomes unavailable in high-risk areas.

- Recovery Costs: Governments spend vast sums on disaster relief, emergency services, and long-term recovery efforts, diverting funds from other public services.

-

Sea-Level Rise:

- What it is: As glaciers and ice sheets melt and oceans warm (causing water to expand), global sea levels are steadily rising.

- Economic Impact:

- Coastal Flooding: Low-lying coastal cities and communities face increased flooding, damaging infrastructure and property.

- Infrastructure at Risk: Ports, airports, coastal roads, and water treatment plants are vulnerable to inundation.

- Real Estate Value Decline: Properties in vulnerable coastal areas lose value, impacting homeowners and lenders.

- Displacement and Migration: Entire communities may need to relocate, leading to social and economic disruption.

- Saltwater Intrusion: Farmlands and freshwater sources near coasts can become contaminated with saltwater, affecting agriculture and drinking water.

-

Resource Scarcity and Degradation:

- What it is: Changes in rainfall patterns, increased temperatures, and ecosystem degradation can lead to shortages of vital resources like fresh water and fertile land.

- Economic Impact:

- Agricultural Productivity Decline: Less water and suitable land mean lower crop yields, leading to higher food prices and food insecurity.

- Energy Sector Strain: Water scarcity impacts hydropower generation and cooling for thermal power plants.

- Industrial Disruptions: Many industries rely on water for production, facing shortages and increased costs.

- Increased Competition and Conflict: Scarce resources can lead to heightened tensions and conflicts, impacting regional stability and trade.

-

Health Impacts:

- What it is: Heatwaves cause heatstroke, changes in disease vectors spread illnesses like malaria, and air pollution from wildfires impacts respiratory health.

- Economic Impact:

- Increased Healthcare Costs: More people getting sick puts a strain on healthcare systems and budgets.

- Lost Productivity: Sick workers cannot work, leading to decreased output and economic losses for businesses.

- Reduced Labor Capacity: Extreme heat can make outdoor work impossible, particularly in agriculture and construction.

2. Indirect Economic Impacts: The Ripple Effect (Transition & Systemic Risks)

Beyond the direct damage, climate change creates a complex web of indirect economic consequences as the world tries to respond and adapt.

-

Supply Chain Disruptions:

- How it happens: Extreme weather events or resource scarcity in one part of the world can halt production, disrupt transport routes, and delay shipments of goods to other parts of the world.

- Economic Impact:

- Increased Costs: Companies face higher shipping costs, storage fees, and the need for more expensive alternative suppliers.

- Product Shortages: Consumers may find shelves empty or pay higher prices for goods that are in short supply.

- Manufacturing Delays: Factories may shut down due to lack of raw materials or components.

-

Financial Market Volatility and "Stranded Assets":

- How it happens: As the world moves away from fossil fuels, assets tied to these industries (like coal mines, oil reserves, or gas pipelines) may lose significant value, becoming "stranded assets."

- Economic Impact:

- Investment Losses: Investors holding shares in fossil fuel companies or related infrastructure may see their investments plummet.

- Bank Risks: Banks that have lent money to these companies face the risk of loan defaults.

- Market Instability: Large-scale revaluation of assets can lead to financial market shocks and instability.

- Insurance Industry Strain: Insurers face growing claims from physical damages, making it harder to offer affordable coverage.

-

Investment Shifts and Innovation:

- How it happens: Investors are increasingly directing capital away from high-carbon industries and towards sustainable, low-carbon solutions (renewable energy, electric vehicles, green technology).

- Economic Impact:

- Job Creation in New Sectors: Growth in green industries creates new jobs and economic opportunities.

- Job Losses in Old Sectors: Industries reliant on fossil fuels may see job cuts and economic decline if they don’t adapt.

- Infrastructure Upgrades: Massive investments are needed to modernize energy grids, develop charging stations, and build climate-resilient infrastructure.

-

National Security and Geopolitical Instability:

- How it happens: Climate change can exacerbate existing tensions by intensifying competition for scarce resources (water, fertile land), driving mass migration, and creating unstable regions.

- Economic Impact:

- Increased Defense Spending: Nations may allocate more resources to manage conflicts and humanitarian crises.

- Disruption to Trade: Geopolitical instability can disrupt international trade routes and supply chains.

- Refugee Crises: Large-scale climate migration places economic and social strain on host countries.

Key Economic Sectors at High Risk

While climate change impacts everything, some sectors are particularly vulnerable:

- Agriculture: Directly dependent on stable climate conditions, water availability, and healthy soil. Yields are highly susceptible to extreme weather.

- Energy: The transition away from fossil fuels poses risks to traditional energy companies, while renewables require significant upfront investment but offer long-term stability.

- Tourism: Coastal resorts are threatened by sea-level rise and extreme weather; ski resorts by less snow; and natural attractions by ecosystem degradation.

- Real Estate & Construction: Properties in flood zones, fire-prone areas, or coastal regions face declining values and higher insurance costs. Construction needs to adapt to more resilient building standards.

- Insurance: The frequency and intensity of climate-related disasters are pushing the industry to its limits, leading to rising premiums or withdrawal from high-risk markets.

- Financial Services: Banks, investment firms, and asset managers are exposed to climate risks through their loans, investments, and portfolios. They are increasingly integrating "Environmental, Social, and Governance" (ESG) factors into their decision-making.

What Can Be Done? Mitigating Risks and Building a Resilient Economy

The good news is that understanding climate change as an economic risk also highlights the massive opportunities for innovation, investment, and job creation in building a more sustainable and resilient future.

-

Investing in Renewable Energy and Green Technologies:

- Shifting from fossil fuels to solar, wind, geothermal, and hydropower reduces emissions and creates a stable, domestic energy supply.

- Investing in electric vehicles, battery storage, and energy efficiency technologies creates new industries and jobs.

-

Building Resilient Infrastructure:

- Designing and constructing roads, bridges, power grids, and buildings to withstand extreme weather events (e.g., higher sea walls, better drainage systems, fire-resistant materials).

- Investing in early warning systems for natural disasters.

-

Implementing Smart Policies and Regulations:

- Carbon Pricing: Putting a price on carbon emissions (e.g., through taxes or cap-and-trade systems) incentivizes businesses to reduce their footprint.

- Green Building Codes: Requiring energy-efficient and climate-resilient construction.

- Support for Innovation: Funding research and development into sustainable solutions.

-

Promoting Sustainable Finance and ESG Investing:

- Encouraging financial institutions to assess and disclose their climate risks.

- Directing investments towards companies with strong environmental, social, and governance practices.

- Developing "green bonds" and other financial instruments to fund climate solutions.

-

International Cooperation:

- Working together globally to reduce emissions, share best practices, and support vulnerable nations in adapting to climate impacts.

- Establishing frameworks like the Paris Agreement to set global climate targets.

Conclusion: A Call to Economic Action

Climate change is no longer a distant threat; it is an immediate and growing economic reality that is already impacting businesses, governments, and individuals worldwide. From the direct costs of disaster recovery to the systemic risks of financial instability and supply chain disruptions, the economic consequences of inaction are staggering.

However, recognizing climate change as an economic risk also opens the door to unprecedented opportunities. Investing in a low-carbon, resilient future is not just an environmental imperative; it is an economic strategy. It drives innovation, creates new jobs, strengthens supply chains, and builds a more stable and prosperous global economy for generations to come. The choice is clear: we can either pay the increasingly high price of climate inaction, or we can invest in a sustainable future that offers not just environmental health, but robust economic growth and stability. The time for economic action on climate change is now.

Post Comment