Charting Your Course to Financial Freedom: A Beginner’s Guide to Setting Up Your Annual Financial Calendar

Are you tired of financial surprises? Do late fees sneak up on you, or do you find yourself wondering where all your money went? Imagine a year where your finances feel organized, predictable, and even empowering. This isn’t a pipe dream; it’s the reality you can create by setting up a financial calendar for the year.

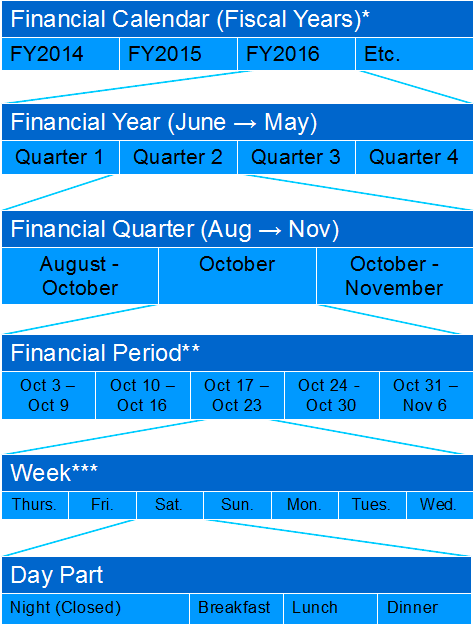

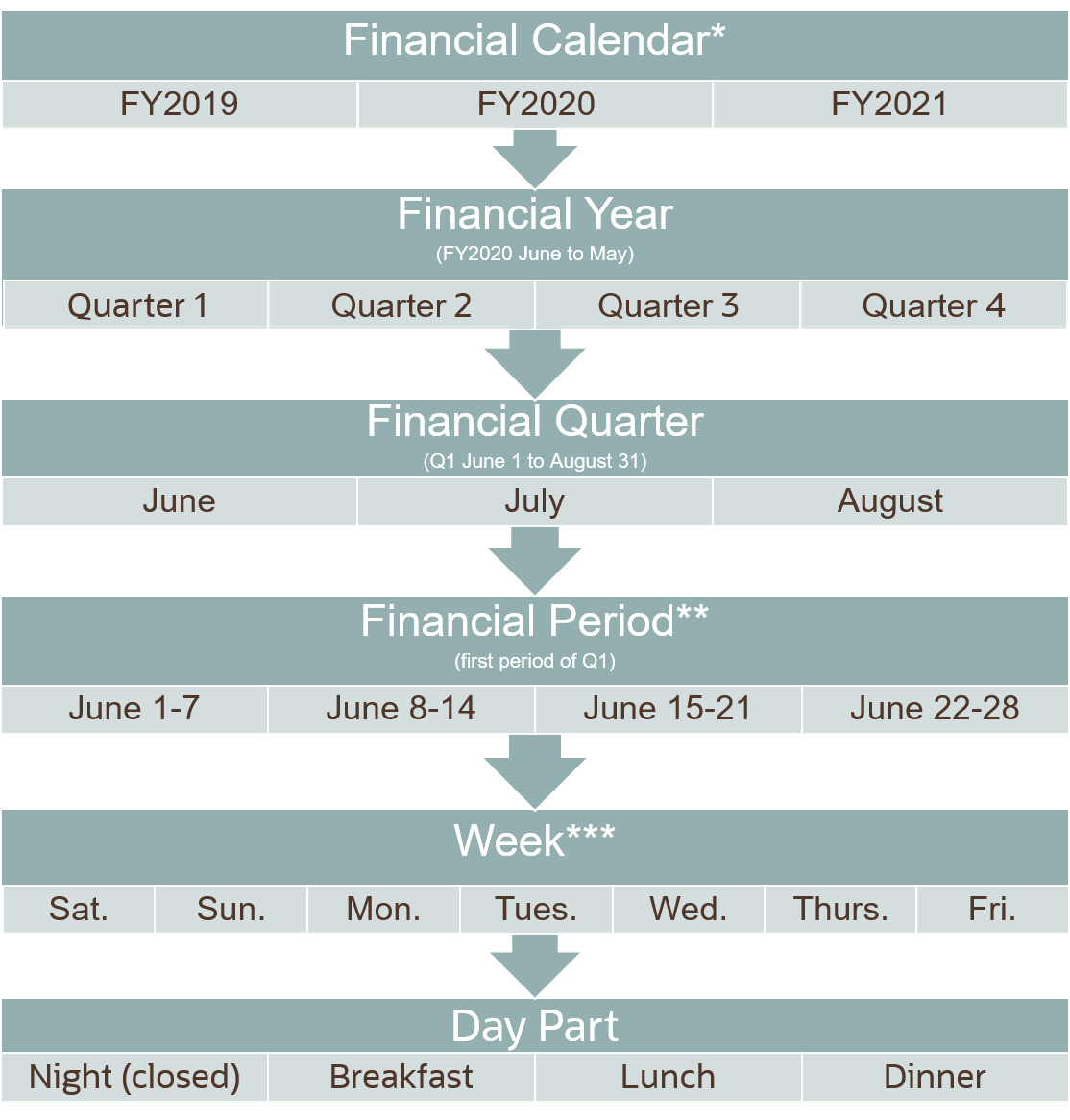

Think of your financial calendar as your personal financial roadmap. It’s a proactive tool that helps you anticipate income, track expenses, manage debts, plan for savings, and ultimately, achieve your financial goals without the stress and chaos. Whether you’re a complete beginner or just looking to bring more order to your money, this comprehensive guide will walk you through creating a system that works for you.

What is a Financial Calendar and Why Do You Need One?

At its core, a financial calendar is a schedule of all your money-related activities throughout the year. It’s a living document that keeps you informed and in control.

Why is it absolutely essential, especially for beginners?

- Reduces Stress and Anxiety: No more last-minute scrambles or forgotten bills. You’ll know exactly what’s coming and when.

- Avoids Late Fees and Penalties: By scheduling payments, you eliminate costly mistakes that chip away at your savings.

- Boosts Savings and Investments: When you plan for savings, they become a priority, not an afterthought.

- Helps Achieve Financial Goals: Whether it’s a down payment on a house, a dream vacation, or retirement, a calendar helps you stay on track.

- Identifies Spending Patterns: By regularly reviewing your finances, you can spot trends, identify areas for improvement, and make smarter spending choices.

- Facilitates Better Decision-Making: With a clear overview of your financial landscape, you can make informed choices about major purchases, debt repayment, and investment opportunities.

- Promotes Financial Literacy: The act of setting up and maintaining a calendar naturally deepens your understanding of your own money.

Getting Started: The Essentials Before You Begin

Before you dive into scheduling, gather your financial "ingredients." This initial step is crucial for building an accurate and effective calendar.

-

Gather Your Financial Information:

- Income Sources: List all your income (salary, freelance, side hustle, benefits, etc.) and their payment dates.

- Regular Bills: Collect statements for rent/mortgage, utilities (electricity, gas, water), internet, phone, streaming services, insurance premiums, loan payments (car, student, personal), credit card minimums, and any other recurring subscriptions. Note their due dates and amounts.

- Irregular or Annual Expenses: Think about things like car registration, property taxes (if applicable), annual software subscriptions, holiday spending, or annual doctor visits.

- Debt Information: For each debt (credit cards, loans), know the outstanding balance, interest rate, and minimum payment.

- Savings and Investment Accounts: Have details for your savings accounts, retirement funds (401k, IRA), and any brokerage accounts.

-

Choose Your Calendar Tool:

- Digital Calendars: Google Calendar, Outlook Calendar, Apple Calendar are excellent for setting recurring events and reminders.

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), Personal Capital, or Simplifi can integrate with your bank accounts and automatically track transactions, making calendar integration easier.

- Spreadsheets: Google Sheets or Microsoft Excel offer complete customization for a DIY approach.

- Physical Planners/Wall Calendars: If you prefer a tangible system, a dedicated financial planner or a large wall calendar can work wonders.

- Hybrid Approach: Many people combine a digital calendar for reminders with a spreadsheet for detailed tracking.

-

Define Your Financial Goals:

- Short-Term (1-12 months): Build an emergency fund, pay off a small credit card debt, save for a vacation.

- Medium-Term (1-5 years): Save for a down payment, pay off a larger student loan, purchase a car.

- Long-Term (5+ years): Retirement planning, child’s education, mortgage payoff.

Knowing your goals helps you prioritize and allocate funds within your calendar.

Building Your Financial Calendar: A Step-by-Step Guide

Now, let’s populate your calendar. We’ll break it down by frequency, starting with annual tasks and moving to more regular check-ins.

1. Annual Tasks (Once a Year)

These are big-picture financial reviews and planning sessions. Mark these clearly in your calendar for the beginning of the year, or spread them out if you prefer.

- Tax Planning & Preparation:

- When: January/February (to gather documents), April (filing deadline).

- Action: Collect W-2s, 1099s, receipts for deductions, charitable contributions. Consider consulting a tax professional or using tax software.

- Insurance Review:

- When: Annually (e.g., July or when policies renew).

- Action: Review home, auto, health, life, and disability insurance policies. Check coverage limits, deductibles, and premiums. Shop around for better rates if necessary.

- Investment Portfolio Review:

- When: Annually (e.g., December or January).

- Action: Assess your investment performance, rebalance your portfolio if needed, and ensure your asset allocation still aligns with your risk tolerance and goals. Review contributions to retirement accounts (401k, IRA).

- Credit Report Check:

- When: Annually (you’re entitled to one free report from each bureau: Experian, Equifax, TransUnion).

- Action: Visit AnnualCreditReport.com to pull your reports. Check for errors, suspicious activity, or inaccuracies that could affect your credit score.

- Financial Goal Review & Adjustment:

- When: Annually (e.g., December or January).

- Action: Revisit your short, medium, and long-term goals. Have they changed? Are you on track? Adjust your budget and savings plan accordingly for the coming year.

- Subscription Audit:

- When: Annually (e.g., January).

- Action: List all recurring subscriptions (streaming, apps, gym memberships). Cancel any you no longer use or need.

2. Quarterly Tasks (Every 3 Months)

These check-ins help you stay on track and make minor adjustments throughout the year.

- Budget Review and Adjustment:

- When: End of March, June, September, December.

- Action: Compare your actual spending to your budget for the past quarter. Identify categories where you overspent or underspent. Adjust your budget for the next quarter based on what you’ve learned.

- Debt Progress Check:

- When: End of March, June, September, December.

- Action: Review your debt balances. Are you making progress on your repayment plan? Celebrate milestones and adjust strategies if needed (e.g., allocating more to a high-interest debt).

- Savings Goal Check-In:

- When: End of March, June, September, December.

- Action: Review your progress towards specific savings goals (emergency fund, down payment, vacation). Are you contributing enough? Can you increase contributions?

- Investment Account Check-In (Quick):

- When: End of March, June, September, December.

- Action: A quick glance at your balances and general performance. No need for a deep dive like the annual review, just ensure everything looks normal.

- Review Variable Expenses:

- When: End of March, June, September, December.

- Action: Look at categories like groceries, dining out, entertainment. Are these in line with your expectations? Can you make small tweaks?

3. Monthly Tasks (Every Month)

This is where the day-to-day management happens, ensuring you stay on top of your bills and tracking.

- Pay All Recurring Bills:

- When: As per due dates (schedule them a few days early to be safe).

- Action: Rent/mortgage, utilities, loan payments, credit card minimums, subscriptions. Automate as many as possible!

- Budget Reconciliation:

- When: End of the month or beginning of the next.

- Action: Compare your income to your expenses for the past month. Categorize all transactions. This is where you see where your money actually went.

- Track All Expenses:

- When: Daily or weekly (as transactions occur).

- Action: Use an app, spreadsheet, or notebook to log every dollar you spend. This feeds into your monthly reconciliation.

- Transfer to Savings/Investment Accounts:

- When: Immediately after payday.

- Action: "Pay yourself first" by moving your planned savings contributions to their designated accounts. Automate these transfers!

- Review Upcoming Expenses:

- When: Beginning of the month.

- Action: Look ahead to the next 30 days. Are there any irregular expenses coming up (birthdays, car maintenance, doctor’s visits)? Adjust your spending plan accordingly.

- Credit Card Statement Review:

- When: As statements arrive.

- Action: Check for fraudulent charges or errors. Ensure you understand all transactions.

- Review Bank Account Balances:

- When: Weekly or bi-weekly.

- Action: Just a quick check to ensure your checking account has enough funds for upcoming bills and your savings are growing.

4. Weekly Tasks (Every Week)

These are quick check-ins to maintain momentum and awareness.

- Review Spending for the Week:

- When: A designated day (e.g., Sunday evening).

- Action: Take 10-15 minutes to review transactions from the past week. How are you doing against your budget categories?

- Check Bank Balances:

- When: A designated day (e.g., Monday morning).

- Action: Ensure you have enough money for upcoming expenses and identify any discrepancies.

- Plan for the Upcoming Week’s Spending:

- When: A designated day (e.g., Sunday evening).

- Action: Look at your calendar for the next 7 days. Any social events, appointments, or purchases planned? Allocate funds if necessary.

5. Daily Habits (Optional, but Powerful)

While not "calendar" events, these daily habits reinforce your financial discipline.

- Quick Check-in: A few minutes to glance at your bank account or budgeting app.

- Mindful Spending: Before every purchase, ask yourself: "Do I truly need this? Does it align with my goals?"

Tips for Success with Your Financial Calendar

Creating the calendar is just the first step. Here’s how to make it stick and truly transform your financial life:

- Start Small and Build Up: Don’t try to implement everything at once. Begin with monthly bill payments and monthly budget reviews. Once those are routine, add weekly or quarterly tasks.

- Be Realistic: Your budget and calendar should reflect your real life, not an ideal fantasy. If you love coffee, budget for it instead of depriving yourself entirely.

- Automate Everything You Can: Set up automatic bill payments, direct deposits to savings, and investment contributions. This takes the effort out of routine tasks.

- Review Regularly, Adjust as Needed: Life changes, and so should your financial calendar. A job change, new expenses, or shifting goals all warrant adjustments.

- Be Patient and Forgiving: You’ll miss a task, or overspend sometimes. That’s okay! The goal is progress, not perfection. Get back on track.

- Make it Visible: Whether it’s a digital reminder or a physical calendar on your wall, keep your financial tasks in sight.

- Celebrate Small Wins: Paid off a credit card? Saved an extra $50? Acknowledge your progress to stay motivated.

- Don’t Be Afraid to Seek Help: If you feel overwhelmed, consider talking to a financial advisor or a credit counselor.

Choosing Your Financial Calendar Tool: A Quick Look

The best tool is the one you’ll actually use!

-

For the Digital Enthusiast:

- Google Calendar/Outlook Calendar: Free, integrates with other apps, great for recurring reminders.

- Budgeting Apps (Mint, YNAB, Personal Capital): Offer comprehensive tracking, budgeting, and often integrate bill reminders. YNAB is particularly good for "zero-based budgeting" which forces you to allocate every dollar.

- Spreadsheets (Excel, Google Sheets): Highly customizable. Requires more manual input but offers ultimate control.

-

For the Analog Lover:

- Physical Planner/Notebook: Great for visual learners and those who enjoy writing things down.

- Wall Calendar: Excellent for seeing the month at a glance and marking due dates.

-

The Hybrid Approach: Use a digital calendar for automated reminders and a spreadsheet or app for detailed tracking and analysis. This often provides the best of both worlds.

Common Pitfalls to Avoid

- Overcomplicating It: Don’t create a system so complex you can’t maintain it. Start simple.

- Giving Up Too Soon: It takes time to build a habit. Stick with it for at least 2-3 months before evaluating.

- Ignoring It: A calendar is useless if you don’t look at it or act on its reminders.

- Not Adjusting: Life is dynamic. Your calendar needs to be flexible enough to adapt to changes in income, expenses, and goals.

- Expecting Perfection: Financial management is an ongoing process. There will be good months and challenging months. Focus on consistent effort.

Your Year of Financial Control Awaits!

Setting up a financial calendar for the year isn’t just about managing money; it’s about gaining control over your life. It’s about replacing dread with direction, and stress with security. By taking the time to plan, organize, and review your finances, you’re not just paying bills; you’re actively building a stronger, more resilient financial future.

Start small, stay consistent, and watch as your financial picture transforms from a chaotic puzzle into a clear, achievable roadmap. Your journey to financial peace of mind begins today!

Post Comment