CD vs. Savings Account: When to Use Which for Your Money (A Beginner’s Guide)

Saving money is a fundamental step towards financial security, but with so many options available, it’s easy to feel overwhelmed. Two of the most common and safest places to stash your cash are a savings account and a Certificate of Deposit (CD). While both are designed to help your money grow, they operate very differently and serve distinct financial goals.

If you’ve ever wondered whether to put your emergency fund in a savings account or if a CD is a smart move for your next big purchase, you’re in the right place. This beginner-friendly guide will break down the differences, pros, and cons of each, helping you decide when to use a CD vs. a savings account for your unique financial journey.

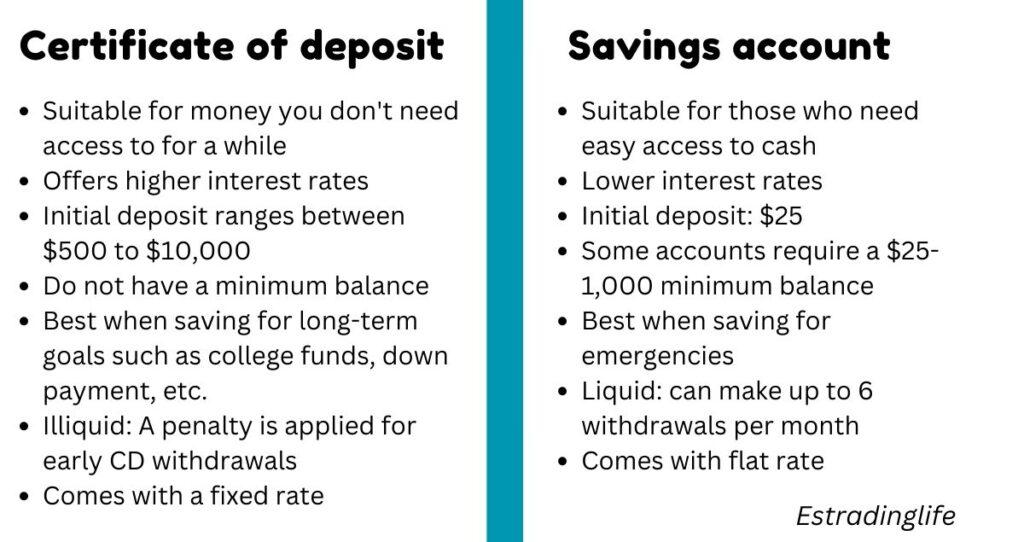

Understanding the Basics: What is a Savings Account?

Think of a savings account as your financial home base – a readily accessible place to keep your money safe while it earns a little extra through interest. It’s the most common type of deposit account, offered by virtually all banks and credit unions.

How a Savings Account Works:

- Easy Access: You can deposit and withdraw money relatively freely, often through ATMs, online transfers, or in-person at a branch.

- Variable Interest Rate: The interest rate your savings account earns can change over time, fluctuating with the market.

- No Fixed Term: Your money isn’t locked in for a specific period. You can keep it there for as long or as short as you need.

- FDIC Insured: Savings accounts at FDIC-member banks (or NCUA-member credit unions) are insured up to $250,000 per depositor, per institution, per ownership category. This means your money is safe even if the bank fails.

Pros of a Savings Account:

- High Liquidity: This is a fancy way of saying "easy access to your cash." Need money for an unexpected expense? It’s typically just a few clicks or a trip to the ATM away.

- Flexibility: There are no penalties for withdrawing your money whenever you need it (though some accounts may limit the number of free withdrawals per month).

- Ideal for Emergency Funds: Because of its accessibility, a savings account is the perfect place for your emergency fund, ensuring you can quickly cover unexpected costs.

- No Minimum Term: You’re not committed to keeping your money in the account for a set period.

Cons of a Savings Account:

- Lower Interest Rates: Generally, savings accounts offer lower interest rates (Annual Percentage Yield or APY) compared to CDs, especially in a low-interest-rate environment.

- Variable Rates: The interest rate can change without much notice, meaning your earnings might go up or down.

- Potential for Fees: Some accounts might charge monthly maintenance fees if you don’t meet certain requirements (like a minimum balance).

Understanding the Basics: What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is like a time-locked savings account. When you buy a CD, you agree to keep a specific amount of money deposited for a fixed period, known as the "term." In return for locking up your money, the bank typically offers a higher, fixed interest rate than a traditional savings account.

How a CD Works:

- Fixed Term: CDs come with specific terms, ranging from a few months (e.g., 3 months, 6 months) to several years (e.g., 1 year, 3 years, 5 years).

- Fixed Interest Rate: Once you open a CD, the interest rate is locked in for the entire term. This means your earnings are predictable and won’t change, even if market rates fluctuate.

- Penalty for Early Withdrawal: If you need to withdraw your money before the term ends, you’ll usually pay a penalty, which often means forfeiting a portion of the interest you’ve earned.

- FDIC Insured: Like savings accounts, CDs at FDIC-member banks (or NCUA-member credit unions) are also insured up to $250,000.

Pros of a CD:

- Higher, Fixed Interest Rates: This is the main appeal. CDs typically offer better rates than savings accounts, and that rate is guaranteed for the entire term, providing predictable growth.

- Predictable Earnings: You know exactly how much interest you’ll earn by the end of the term, making it easier to plan.

- Encourages Discipline: Because of the early withdrawal penalty, a CD can help you avoid dipping into your savings for non-essential purchases.

- Safe Investment: With FDIC insurance, your principal is protected.

Cons of a CD:

- Lower Liquidity: Your money is tied up for the duration of the term. If you need it sooner, you’ll pay a penalty.

- Early Withdrawal Penalties: These penalties can eat into your interest earnings, or even your principal in some cases, if you withdraw early.

- Inflation Risk (for long terms): If inflation rises significantly during a long CD term, your fixed interest rate might not keep pace with the rising cost of living, diminishing your purchasing power.

- Miss Out on Higher Rates: If interest rates in the market rise after you open a CD, you’ll be stuck with your lower, fixed rate until your CD matures.

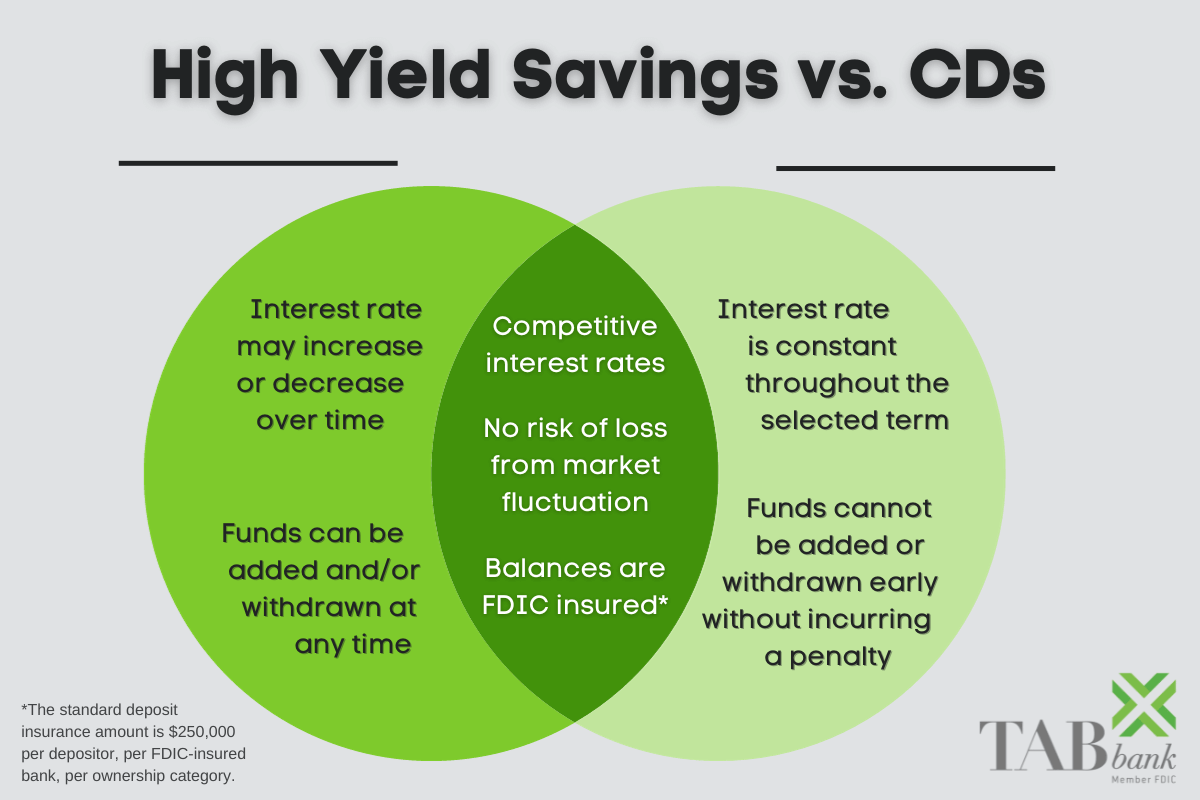

Head-to-Head: CD vs. Savings Account – Key Differences

To make it even clearer, here’s a direct comparison of the most important factors:

| Feature | Savings Account | Certificate of Deposit (CD) |

|---|---|---|

| Liquidity | High (easy access to funds) | Low (money locked for a term) |

| Interest Rate | Variable (changes with market) | Fixed (guaranteed for the term) |

| Interest Yield | Generally lower | Generally higher (especially for longer terms) |

| Term | No fixed term (money can stay indefinitely) | Fixed term (e.g., 3 months, 1 year, 5 years) |

| Penalties | No penalties for withdrawal (may have transaction limits) | Penalties for early withdrawal |

| Flexibility | High (can deposit/withdraw freely) | Low (money is committed for the term) |

| Best For | Emergency funds, short-term goals, accessible cash | Longer-term goals, predictable growth, disciplined savings |

When to Use a Savings Account: Ideal Scenarios

A savings account is your go-to option for money you might need access to relatively soon, or for funds that serve as a safety net.

- Your Emergency Fund: This is paramount. You need immediate access to these funds if a car breaks down, you lose your job, or an unexpected medical bill arrives. A savings account provides that crucial liquidity without penalties. Aim for 3-6 months of living expenses.

- Short-Term Financial Goals: Saving for a vacation next year? A down payment on a car in 6 months? A new appliance? A savings account allows you to add to your fund regularly and withdraw it easily when the time comes.

- Day-to-Day Cash Overflow: If you have extra cash from your paycheck that you don’t need immediately but might use within the next few weeks or months, a savings account is a better place for it than your checking account, as it will earn a little interest.

- Building a Savings Habit: For those just starting to save, a savings account is simple, straightforward, and encourages consistent deposits.

When to Use a CD: Ideal Scenarios

A CD is best for money you know you won’t need for a specific period and want to earn a higher, guaranteed rate of return.

- Longer-Term Financial Goals (with a known timeline):

- Future Down Payment: If you’re saving for a house down payment in 3-5 years, a CD with a matching term could offer a better rate than a savings account.

- College Savings (Short-to-Mid Term): If a child is nearing college age (e.g., 2-5 years away) and you have a lump sum saved, a CD can protect the principal while earning predictable interest.

- Planned Large Purchase: Saving for a new roof, a major home renovation, or a wedding that’s a few years out? A CD can be a good fit.

- Taking Advantage of Higher Interest Rates: When overall interest rates are high, CDs become particularly attractive because you can lock in those elevated rates for a longer period, protecting your earnings even if rates fall later.

- Disciplined Savings: If you’re prone to spending money that’s too easily accessible, a CD’s early withdrawal penalty can serve as a valuable deterrent, helping you stick to your savings goals.

- CD Laddering Strategy: This is a more advanced technique but very useful. Instead of putting all your money into one CD, you open several CDs with staggered maturity dates (e.g., a 1-year, 2-year, 3-year, 4-year, and 5-year CD). As each short-term CD matures, you reinvest it into a new long-term CD. This strategy provides regular access to some of your funds while still benefiting from higher long-term CD rates.

Important Considerations Before Choosing

Before you decide where to put your hard-earned money, ask yourself these questions:

- What are My Financial Goals? Are you saving for something specific, or just building a general safety net?

- What is My Time Horizon? When do I realistically need this money? Tomorrow? Next year? In five years?

- How Much Liquidity Do I Need? How important is it to have immediate access to these funds without penalty?

- What are Current Interest Rates Like? Are CD rates significantly higher than savings account rates? Are they expected to rise or fall?

- Is My Money FDIC-Insured? Always confirm that the bank or credit union is an FDIC or NCUA member. This is crucial for protecting your principal.

Can You Use Both? Absolutely!

The smart money strategy often involves using both a savings account and CDs to maximize your earnings while maintaining necessary liquidity.

- Scenario: You have a $10,000 emergency fund and are saving for a $20,000 down payment on a house in 3 years.

- Emergency Fund: Keep the $10,000 in a high-yield savings account. It’s accessible, earns a decent rate, and is there for immediate needs.

- Down Payment: Consider putting the $20,000 (or portions of it as you save more) into a 3-year CD. You won’t need this money until the house purchase, and the CD will likely offer a better, guaranteed rate.

- CD Laddering: For even more flexibility with your down payment savings, you could consider a CD ladder. Perhaps $5,000 in a 1-year CD, $5,000 in a 2-year CD, and $10,000 in a 3-year CD. This way, a portion of your funds becomes available each year, giving you options if your plans change slightly or if you want to reinvest at new rates.

The Bottom Line: Make Your Money Work for You

Both savings accounts and Certificates of Deposit are excellent, safe tools for growing your money. The "best" choice isn’t universal; it depends entirely on your personal financial goals, your timeline, and your need for liquidity.

By understanding the unique features of each, you can make informed decisions that align with your financial plan, helping you reach your savings goals more effectively. Don’t let indecision keep your money from working as hard as it can for you! Start exploring your options today.

Post Comment