Catch-Up Contributions for Retirement Accounts: Your Guide to Boosting Savings After 50

Are you approaching your golden years and feeling a little behind on your retirement savings? Perhaps you started saving later in life, faced unexpected expenses, or simply wish you had put away more. The good news is, the IRS understands this common challenge and offers a powerful tool specifically designed for those aged 50 and over: Catch-Up Contributions.

This comprehensive guide will demystify catch-up contributions, explaining what they are, who qualifies, why they’re so important, and how you can take advantage of them to supercharge your retirement nest egg.

What Exactly Are Catch-Up Contributions?

Simply put, catch-up contributions are additional amounts of money that individuals aged 50 or older are allowed to contribute to their retirement accounts above the standard annual contribution limits set by the IRS. Think of them as a "bonus" contribution allowance, giving you an extra opportunity to save more as you get closer to retirement.

The purpose of these special provisions is to give older workers a chance to "catch up" on their retirement savings, especially if they haven’t been able to save as much earlier in their careers. It’s a recognition that time is a finite resource, and those nearing retirement need every possible avenue to build a secure financial future.

Who Qualifies for Catch-Up Contributions? The "Over 50" Rule

The primary and most straightforward qualification for making catch-up contributions is your age.

- Age 50 by Year-End: If you will be 50 years old or older at any point during the calendar year, you are eligible to make catch-up contributions for that entire year. For example, if your 50th birthday is in December, you can still make catch-up contributions for the full year.

There are generally no income restrictions or other complex requirements specifically for the catch-up portion of the contribution, though your regular contributions might have such limits depending on the account type and your income.

Why Are Catch-Up Contributions So Important?

Catch-up contributions offer a significant advantage for older savers, providing multiple benefits that can dramatically impact your retirement security:

-

Supercharge Your Savings Power:

- Accelerated Growth: By contributing more, you’re giving your money more fuel to grow. Even a few extra years of higher contributions can make a substantial difference due to the power of compounding.

- Closing the Gap: If you feel behind on your retirement goals, catch-up contributions provide a direct path to closing that gap faster.

-

Maximize Tax Advantages:

- Tax-Deferred Growth (Traditional Accounts): Money contributed to traditional 401(k)s, 403(b)s, and IRAs grows tax-deferred. This means you don’t pay taxes on the investment gains year after year. Taxes are only paid when you withdraw the money in retirement, often when you’re in a lower tax bracket.

- Potential Tax Deductions (Traditional Accounts): Contributions to traditional retirement accounts are often tax-deductible in the year they are made, which can lower your taxable income now. This means you save on taxes today while saving for tomorrow!

- Tax-Free Withdrawals (Roth Accounts): If you contribute to a Roth 401(k) or Roth IRA, your contributions are made with after-tax money. In exchange, qualified withdrawals in retirement are completely tax-free. This is incredibly powerful, especially if you expect to be in a higher tax bracket in retirement.

-

Peace of Mind and Security:

- Knowing you’re actively taking steps to maximize your retirement savings can reduce financial stress and provide a greater sense of security as you approach retirement.

- A larger nest egg offers more flexibility and options in retirement, whether it’s for travel, healthcare, or simply enjoying your well-deserved free time.

Which Retirement Accounts Allow Catch-Up Contributions?

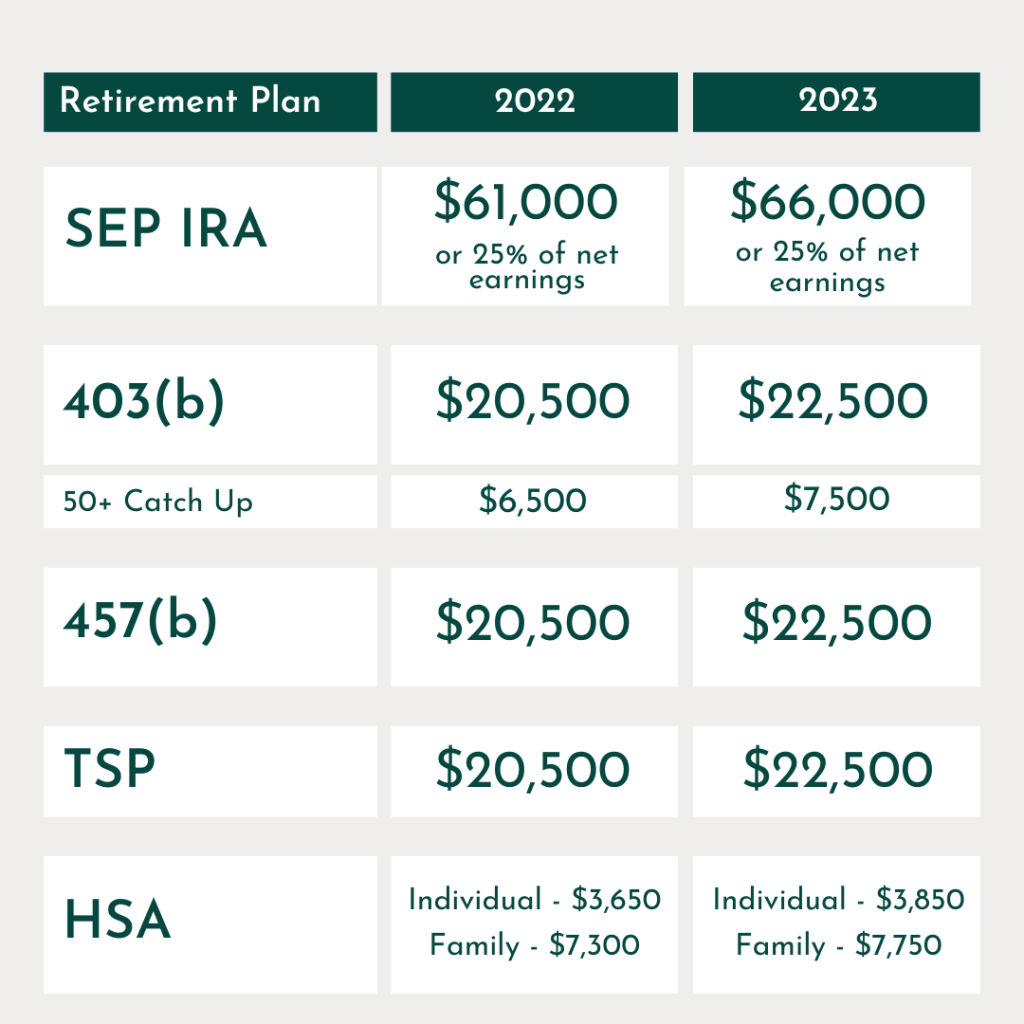

Catch-up contributions are available for most popular types of retirement accounts, though the specific limits vary. Here’s a breakdown:

-

Employer-Sponsored Plans:

- 401(k)s: The most common employer-sponsored plan. If your employer offers a 401(k), you can typically make catch-up contributions once you turn 50.

- 403(b)s: Often used by employees of public schools and certain tax-exempt organizations. These also allow catch-up contributions.

- 457(b)s: Deferred compensation plans primarily for state and local government employees, and some non-governmental tax-exempt organizations. These plans also have catch-up provisions.

- SIMPLE IRAs: (Savings Incentive Match Plan for Employees) – Smaller employers often use these. They also have their own catch-up contribution limits.

-

Individual Retirement Accounts (IRAs):

- Traditional IRAs: Individual retirement accounts where contributions may be tax-deductible, and growth is tax-deferred.

- Roth IRAs: Individual retirement accounts where contributions are made with after-tax money, and qualified withdrawals in retirement are tax-free.

-

Important Note on SEP IRAs:

- Simplified Employee Pension (SEP) IRAs generally do not have a specific "catch-up" contribution provision. However, their standard contribution limits are already very high (tied to a percentage of compensation, up to a much larger cap than 401ks), which often makes a separate catch-up unnecessary for most individuals.

Understanding the Contribution Limits (and How Catch-Up Adds On)

The IRS sets annual contribution limits for various retirement accounts, and these limits are subject to change each year (often adjusted for inflation). It’s crucial to check the latest IRS guidelines or consult a financial advisor for the most current figures.

Let’s look at examples based on recent (e.g., 2023/2024) limits to illustrate how catch-up contributions work:

1. 401(k), 403(b), and 457(b) Plans:

- Standard Limit (Example): $23,000 (for 2024)

- Catch-Up Contribution Limit (Example): $7,500 (for 2024)

- Total Possible Contribution for Age 50+: $23,000 (standard) + $7,500 (catch-up) = $30,500

This means if you’re 50 or older, you could potentially contribute an additional $7,500 to your employer-sponsored plan beyond what younger employees can contribute.

2. Traditional and Roth IRAs:

- Standard Limit (Example): $7,000 (for 2024)

- Catch-Up Contribution Limit (Example): $1,000 (for 2024)

- Total Possible Contribution for Age 50+: $7,000 (standard) + $1,000 (catch-up) = $8,000

While the IRA catch-up is smaller, it’s still a valuable extra $1,000 you can put away each year.

3. SIMPLE IRAs:

- Standard Limit (Example): $16,000 (for 2024)

- Catch-Up Contribution Limit (Example): $3,500 (for 2024)

- Total Possible Contribution for Age 50+: $16,000 (standard) + $3,500 (catch-up) = $19,500

Important Considerations:

- Employer Matching: Catch-up contributions do not typically affect your employer’s matching contributions. Your employer will usually match your contributions up to a certain percentage of your salary, regardless of whether you’re making catch-up contributions. Don’t leave free money on the table!

- Contribution Order: You don’t have to contribute the full standard amount before you can start contributing the catch-up amount. As long as you’re 50 or older, you can contribute up to the combined limit. Your plan administrator or financial institution will track this for you.

How to Make Catch-Up Contributions

Making catch-up contributions is usually a straightforward process, depending on the type of account you have:

-

For Employer-Sponsored Plans (401k, 403b, 457b, SIMPLE IRA):

- Contact Your HR Department or Plan Administrator: This is the first and most important step. They will provide you with the necessary forms or guide you through their online portal.

- Adjust Your Contribution Percentage: You’ll typically need to increase the percentage of your salary that you contribute to your retirement plan. Your HR or payroll department will handle the deduction from your paycheck.

- Confirm Your Elections: Double-check that your new contribution amount, including the catch-up, is correctly reflected in your payroll deductions.

-

For Individual Retirement Accounts (Traditional & Roth IRAs):

- Contact Your Brokerage or Financial Institution: If you have an IRA, you can contribute directly through the firm where your account is held (e.g., Fidelity, Vanguard, Schwab).

- Make Direct Contributions: You can transfer funds from your bank account to your IRA up to the combined standard and catch-up limit. You can do this as a lump sum or set up recurring contributions.

- Self-Designation: When you file your taxes, you’ll simply report your total contributions. The IRS doesn’t require a separate designation for the catch-up portion; they just verify that your total contribution is within the allowable limit for your age.

Common Questions & Misconceptions About Catch-Up Contributions

Let’s clear up some common queries people have about catch-up contributions:

-

"Can I contribute to both a 401(k) and an IRA (Traditional or Roth) with catch-up contributions?"

- Yes! The contribution limits for employer-sponsored plans (like 401k) and IRAs are separate. You can make catch-up contributions to both if you qualify and have the financial capacity. For example, in 2024, you could contribute up to $30,500 to your 401(k) and up to $8,000 to your IRA, for a total of $38,500.

-

"Do I have to contribute the full standard amount before I can make catch-up contributions?"

- No. As long as you are age 50 or older, you can contribute any amount up to the combined standard and catch-up limit. For example, if you only contribute $10,000 to your 401(k) in a year (less than the standard limit), that $10,000 is simply part of your total contribution and doesn’t need to be broken down into "standard" vs. "catch-up" components by you. Your plan administrator or the IRS will simply look at your total contribution for the year.

-

"What if I turn 50 mid-year?"

- As long as you turn 50 at any point during the calendar year (even on December 31st), you are eligible to make catch-up contributions for that entire year.

-

"Are catch-up contributions always tax-deductible?"

- It depends on the account type. Contributions to traditional 401(k)s and IRAs are generally tax-deductible (though IRA deductions can be limited by income if you’re also covered by a workplace plan). Contributions to Roth accounts are not tax-deductible because the withdrawals are tax-free in retirement.

-

"Do catch-up contributions affect my Social Security benefits?"

- No, directly contributing to your retirement accounts does not impact your Social Security benefits. Social Security benefits are based on your earnings history.

Tips for Maximizing Your Catch-Up Contributions

Ready to take advantage of this powerful opportunity? Here are some tips:

- Start as Soon as You Turn 50: Don’t wait! The moment you hit age 50, you become eligible. The sooner you start, the more time your additional contributions have to grow.

- Automate Your Contributions: Set up automatic deductions from your paycheck (for employer plans) or automatic transfers from your bank account (for IRAs). This makes saving consistent and effortless.

- Review Your Budget: To find the extra money for catch-up contributions, take a close look at your monthly expenses. Even small adjustments can free up significant funds over a year.

- Prioritize Your Retirement Savings: If you have other financial goals, consider how catch-up contributions fit into your overall plan. For many, maximizing retirement savings in the years leading up to retirement is a top priority.

- Consider Tax Implications: Understand whether a pre-tax (Traditional) or after-tax (Roth) contribution makes more sense for your individual tax situation. A financial advisor can help you make this decision.

- Seek Professional Financial Advice: A qualified financial advisor can help you assess your current retirement readiness, determine how much you can realistically contribute, and integrate catch-up contributions into a comprehensive retirement plan.

Conclusion: Don’t Miss Your Opportunity to Catch Up!

Catch-up contributions are an invaluable tool for anyone aged 50 and older looking to enhance their retirement savings. They offer a unique opportunity to accelerate your wealth accumulation, take advantage of significant tax benefits, and build a more secure and comfortable future.

Don’t let the opportunity pass you by. Take action today by contacting your HR department, your financial institution, or a trusted financial advisor to learn how you can start making catch-up contributions and give your retirement savings the boost they deserve!

Post Comment