Building Good Money Habits for Life: Your Essential Guide to Financial Freedom

Ever feel like your money just disappears? Do you dream of a future where financial stress is a distant memory, where you can afford your dreams, and live life on your own terms? The secret isn’t a lottery win or a massive inheritance; it’s something far more accessible and powerful: building good money habits.

Good money habits are simply the routine ways you handle your finances. They’re the small, consistent actions that, over time, add up to significant financial success and peace of mind. Whether you’re just starting your financial journey or looking to get your money back on track, this comprehensive guide will break down the essential habits you need to cultivate for a lifetime of financial well-being.

Let’s dive in and start building your path to financial freedom!

Why Good Money Habits Matter More Than You Think

Before we get into the "how," let’s understand the "why." Why are habits so crucial when it comes to your money?

- They Create Predictability: When you have routines, you know what to expect. This reduces financial anxiety and helps you stay in control.

- They Build Momentum: Small, consistent actions lead to big results. Saving $50 a week might not seem like much, but over years, it becomes a substantial sum.

- They Automate Success: Once a habit is formed, it becomes second nature. You don’t have to constantly think about saving or budgeting; it just happens.

- They Lead to Financial Security: Good habits are the foundation of an emergency fund, debt repayment, investing, and ultimately, reaching your financial goals.

- They Reduce Stress: When you’re in control of your money, you worry less about unexpected bills, future expenses, or simply making ends meet.

The Cornerstone of Financial Success: Budgeting

If there’s one habit to start with, it’s budgeting. Think of a budget not as a restrictive diet for your money, but as a roadmap that shows you exactly where your money is going and where you want it to go.

What is Budgeting?

It’s simply tracking your income and expenses to ensure you’re spending less than you earn. It helps you identify wasteful spending and allocate your money towards your goals.

Why is it Essential?

You can’t manage what you don’t measure. A budget gives you clarity, helping you make informed decisions instead of guessing.

How to Build the Habit:

-

Choose a Method:

- Pen and Paper: Simple, tactile, but requires discipline.

- Spreadsheet (Excel/Google Sheets): Customizable, good for those comfortable with basic tech.

- Budgeting Apps (Mint, YNAB, Rocket Money, Simplifi): Many are free or low-cost, automate tracking, and categorize expenses. Highly recommended for beginners.

- The 50/30/20 Rule: A popular guideline where 50% of your income goes to Needs (housing, utilities, food), 30% to Wants (entertainment, dining out, hobbies), and 20% to Savings & Debt Repayment.

-

Track Every Dollar: For at least a month, meticulously track every single dollar you spend. This is often the most eye-opening step. You’ll be surprised where your money truly goes.

-

Categorize Your Spending: Group similar expenses together (e.g., Groceries, Utilities, Entertainment, Transportation).

-

Set Spending Limits: Based on your tracking, decide how much you want to spend in each category. Be realistic!

-

Review Regularly: Check your budget weekly or bi-weekly. Adjust as needed. Life happens, and your budget should be flexible.

Beginner Tip: Don’t aim for perfection immediately. The goal is consistency. Even a rough budget is better than no budget at all.

Pay Yourself First: The Power of Saving

Once you know where your money is going, the next crucial step is to make sure some of it is always going to you – specifically, into your savings.

What is "Paying Yourself First"?

It means that as soon as you get paid, you immediately transfer a set amount of money into a dedicated savings account before you pay any bills or spend on anything else.

Why is it Essential?

It prioritizes your financial future. If you wait until the end of the month to save what’s "left over," there’s often nothing left.

How to Build the Habit:

-

Set Clear Savings Goals: What are you saving for?

- Short-term (1-2 years): Vacation, new phone, holiday gifts.

- Medium-term (2-5 years): Down payment for a car, home renovation.

- Long-term (5+ years): Down payment for a house, retirement, child’s education.

Having a goal makes saving tangible and motivating.

-

Automate Your Savings: This is the most powerful tip. Set up an automatic transfer from your checking account to your savings account to occur every payday. Even $25 or $50 to start is great. You won’t miss what you don’t see.

-

Open Separate Savings Accounts: Consider having different accounts for different goals (e.g., "Emergency Fund," "Dream Vacation," "House Down Payment"). This helps you visualize progress and prevents you from accidentally spending money meant for a specific goal.

-

Increase Savings Gradually: As your income grows or your expenses shrink, challenge yourself to increase your automated savings amount.

Beginner Tip: Start small! Even $10 or $20 per paycheck is a fantastic start. The habit of saving is more important than the amount saved initially.

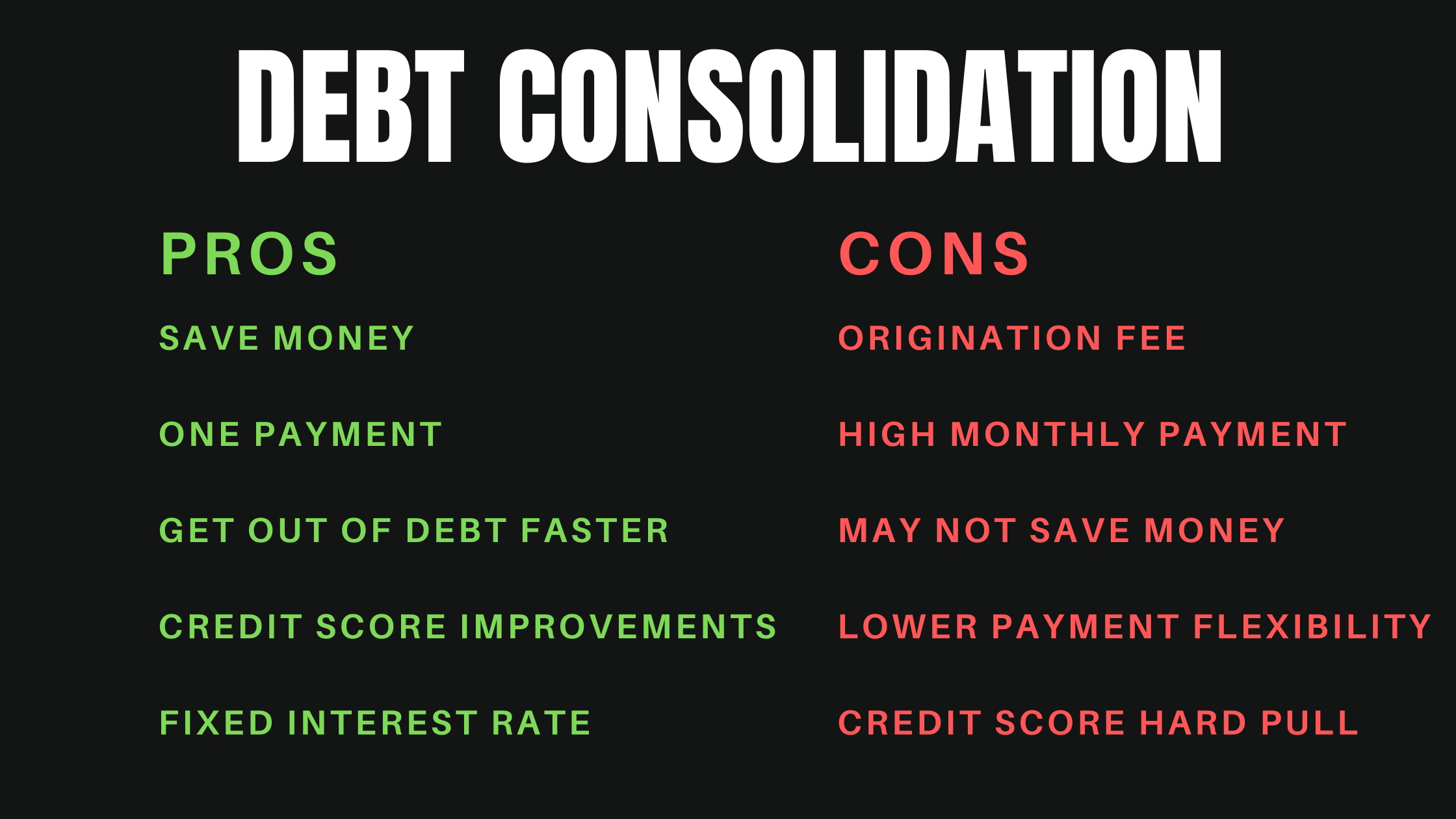

Taming the Debt Monster: Smart Debt Management

Debt, especially high-interest debt like credit card balances, can feel like a heavy chain around your financial future. Building a habit of smart debt management is key to breaking free.

What is Smart Debt Management?

It’s about understanding your debts, prioritizing them, and actively working to reduce and eliminate them.

Why is it Essential?

High-interest debt eats away at your income, making it harder to save and invest. Eliminating it frees up significant cash flow for your goals.

How to Build the Habit:

-

List All Your Debts: Create a comprehensive list including:

- Lender (e.g., Visa, Student Loan Servicer)

- Current Balance

- Interest Rate

- Minimum Monthly Payment

-

Understand Your Interest Rates: This is crucial. Debts with higher interest rates cost you more money over time.

-

Choose a Repayment Strategy:

- Debt Snowball Method: Pay the minimum on all debts except the smallest balance. Throw all extra money at the smallest debt until it’s paid off. Then, take the money you were paying on that debt and add it to the payment for the next smallest debt. This builds psychological momentum.

- Debt Avalanche Method: Pay the minimum on all debts except the one with the highest interest rate. Throw all extra money at that debt. Once it’s paid, move to the next highest interest rate. This method saves you the most money in interest.

- Choose the method that motivates you most!

-

Make Extra Payments: Whenever possible, pay more than the minimum. Even a small extra payment can significantly reduce the total interest paid and the time it takes to become debt-free.

-

Avoid New Debt: While working to pay off existing debt, try to avoid taking on new debt, especially high-interest consumer debt.

Beginner Tip: Focus on one debt at a time (if using snowball/avalanche). Celebrate each debt you pay off – it’s a huge win!

Your Financial Safety Net: Building an Emergency Fund

Life is unpredictable. Cars break down, jobs are lost, medical emergencies happen. An emergency fund acts as a financial cushion to protect you from these unexpected curveballs, preventing you from going into debt when trouble strikes.

What is an Emergency Fund?

It’s a dedicated savings account holding 3 to 6 months’ worth of essential living expenses (rent/mortgage, utilities, food, transportation, insurance).

Why is it Essential?

It prevents you from dipping into retirement savings, accumulating credit card debt, or selling assets when an unexpected expense arises. It buys you peace of mind.

How to Build the Habit:

-

Calculate Your Target Amount: Add up your essential monthly expenses. Multiply that by 3, 6, or even 12 months (depending on your comfort level and job security).

-

Set Up a Separate, Accessible Account: This money should be in a separate savings account (ideally a high-yield savings account) that is not linked to your everyday spending. It needs to be easily accessible but not too easy to accidentally spend.

-

Automate Contributions: Just like regular savings, set up an automatic transfer from your checking account to your emergency fund account every payday.

-

Prioritize It: Before you start investing heavily or paying off low-interest debt, focus on building at least a small "starter" emergency fund ($1,000) and then work towards your full 3-6 months.

-

Replenish When Used: If you have to use your emergency fund, make it a priority to build it back up as quickly as possible.

Beginner Tip: Aim for a "starter" $1,000 emergency fund first. This provides a basic safety net and builds confidence.

Making Your Money Work for You: Basic Investing

Once you have your budget in place, are saving consistently, and have a handle on high-interest debt and an emergency fund, it’s time to make your money grow through investing.

What is Investing?

It’s putting your money into assets (like stocks, bonds, real estate) with the expectation that it will generate a return over time, allowing your money to grow faster than inflation. This is where the magic of compound interest truly shines – earning returns on your initial investment and on the accumulated interest.

Why is it Essential?

Savings accounts alone won’t keep pace with inflation over the long term. Investing is how you build true wealth and achieve long-term goals like retirement or financial independence.

How to Build the Habit (Simplified):

-

Understand Your Goals & Timeline: Are you investing for retirement (long-term, 30+ years) or a house down payment (medium-term, 5-10 years)? This influences your investment choices.

-

Start Early: Time is your biggest asset in investing. The sooner you start, the more time your money has to grow through compounding.

-

Open an Investment Account:

- Retirement Accounts (Tax-Advantaged):

- 401(k) / 403(b): Offered through employers. If your employer offers a match, contribute at least enough to get the full match – it’s free money!

- IRA (Individual Retirement Account): You can open this yourself (Traditional or Roth).

- Taxable Brokerage Account: For non-retirement goals.

- Retirement Accounts (Tax-Advantaged):

-

Keep it Simple (Especially at First):

- ETFs (Exchange-Traded Funds) & Mutual Funds: These are popular choices for beginners because they allow you to invest in a basket of many different stocks or bonds, providing instant diversification. Look for "index funds" (e.g., S&P 500 index fund) as they are low-cost and generally perform well over the long term.

- Robo-Advisors (e.g., Betterment, Wealthfront): These services automate investing for you based on your risk tolerance and goals, making it incredibly easy for beginners.

-

Invest Consistently: Set up automated transfers from your checking account to your investment account, just like savings. This is called "dollar-cost averaging" and helps smooth out market ups and downs.

-

Don’t Panic During Market Swings: The stock market goes up and down. Focus on the long term. Avoid checking your investments daily.

Beginner Tip: Don’t let the complexity of investing intimidate you. Start with a simple index fund or a robo-advisor, and focus on consistent contributions.

Planning for Tomorrow: Setting Financial Goals

Money habits aren’t just about managing what you have; they’re about working towards what you want. Setting clear financial goals provides direction and motivation for all your other money habits.

What are Financial Goals?

They are specific, measurable objectives you want to achieve with your money within a defined timeframe.

Why is it Essential?

Goals transform vague desires into actionable plans. They answer the "why" behind your budgeting, saving, and investing efforts.

How to Build the Habit:

-

Dream Big, Then Get Specific:

- Short-term (1 year): Pay off a specific credit card, save for a new laptop, save for a weekend trip.

- Medium-term (1-5 years): Save for a car down payment, pay off student loans, save for a wedding.

- Long-term (5+ years): Retirement, home down payment, child’s college fund, financial independence.

-

Make Your Goals SMART:

- Specific: What exactly do you want? (e.g., "Save $5,000 for a down payment on a car.")

- Measurable: How will you know when you’ve reached it? (e.g., "$5,000")

- Achievable: Is it realistic given your income and expenses?

- Relevant: Does it align with your values and overall financial plan?

- Time-bound: When do you want to achieve it? (e.g., "by December 2025")

-

Break Down Big Goals: A $10,000 goal can feel overwhelming. Break it into smaller, manageable chunks (e.g., $200 a month for 50 months).

-

Write Them Down: Physically writing your goals makes them more real and helps engrain them in your mind. Place them where you’ll see them regularly.

-

Review and Adjust: Life changes, so your goals might too. Review them quarterly or annually and make adjustments as needed.

Beginner Tip: Start with one or two achievable short-term goals. Achieving them will give you the confidence and momentum to tackle bigger ones.

Never Stop Learning: Continuous Financial Education

The world of personal finance is always evolving. Products change, regulations shift, and your own life circumstances will certainly change. Building a habit of continuous learning keeps you informed and empowered.

Why is it Essential?

Financial literacy empowers you to make better decisions, avoid scams, and adapt your strategies as your life evolves.

How to Build the Habit:

-

Read Regularly:

- Books: Start with classics on personal finance (e.g., "The Total Money Makeover" by Dave Ramsey, "The Richest Man in Babylon" by George S. Clason, "I Will Teach You To Be Rich" by Ramit Sethi).

- Blogs/Websites: Follow reputable personal finance blogs and news sites.

- Articles: Dedicate a few minutes each week to reading articles on topics like investing, debt, or tax strategies.

-

Listen to Podcasts: There are many excellent personal finance podcasts that make learning enjoyable and accessible during commutes or chores.

-

Follow Reputable Experts: On social media, follow financial advisors, educators, and organizations that provide reliable, unbiased information.

-

Attend Webinars/Workshops: Many financial institutions or non-profits offer free educational sessions.

-

Ask Questions: Don’t be afraid to ask for clarification if something doesn’t make sense. If you have significant questions, consider consulting a fee-only financial advisor.

Beginner Tip: Dedicate just 15-30 minutes a week to learning about personal finance. Consistency is key, not intensity.

Practical Tips for Cultivating Good Money Habits

Building habits takes time and effort. Here are some actionable tips to make the process smoother and more effective:

- Start Small: Don’t try to overhaul everything at once. Pick one habit (like tracking expenses for a week) and master it before adding another. Small wins build confidence.

- Automate Everything Possible: Savings, investments, bill payments – set them and forget them. Automation is the secret sauce of consistent financial progress.

- Track Your Progress: Seeing your savings grow, your debt shrink, or your net worth increase is incredibly motivating. Use apps, spreadsheets, or even a simple chart on your wall.

- Find an Accountability Partner: Share your goals with a trusted friend or family member. They can offer encouragement and keep you on track.

- Be Patient and Consistent: Habits aren’t built overnight. There will be slip-ups. Don’t get discouraged. Just get back on track the next day. Consistency over time beats sporadic perfection.

- Celebrate Small Wins: Paid off a credit card? Saved your first $1,000? Acknowledge your achievements! This positive reinforcement encourages you to keep going.

- Review Regularly: Life changes, and so should your financial plan. Set aside time monthly or quarterly to review your budget, goals, and progress.

- Educate Yourself Continuously: The more you understand about money, the better decisions you’ll make.

- Make it Fun (or at least less painful): Gamify your saving, find budgeting apps with good interfaces, or reward yourself (responsibly) when you hit milestones.

Common Pitfalls to Avoid on Your Financial Journey

Even with the best intentions, it’s easy to stumble. Being aware of common pitfalls can help you avoid them.

- Impulse Spending: Buying things you don’t need, especially online, can derail your budget. Implement a "24-hour rule" – if you want something non-essential, wait 24 hours before buying it.

- Ignoring Debt: Pretending debt doesn’t exist only makes it worse. Face it head-on with a plan.

- "Keeping Up With The Joneses": Comparing your lifestyle to others and trying to match their spending leads to financial stress and debt. Focus on your own goals and values.

- Lack of a Plan: Without clear goals and a budget, your money is just drifting without direction.

- Giving Up After a Slip-Up: Everyone makes mistakes. The key is to learn from them and get back on track, not to abandon your entire plan.

- Getting Overwhelmed: Don’t try to do everything at once. Focus on one or two habits until they stick, then add more.

- Not Building an Emergency Fund First: Skipping this step leaves you vulnerable to unexpected expenses, often leading to new debt.

Conclusion: Your Journey to Financial Freedom Starts Today

Building good money habits isn’t a sprint; it’s a marathon. It’s a journey of continuous learning, small adjustments, and consistent effort. But the rewards – reduced stress, increased security, and the ability to achieve your biggest dreams – are immeasurable.

Remember, you don’t need to be a financial expert to start. You just need to be willing to take the first step. Pick one habit from this guide that resonates with you, commit to it, and start building the foundation for a financially secure and fulfilling life. Your future self will thank you.

Ready to take control of your money? Start with budgeting, automate your savings, and begin your journey toward financial freedom today!

Post Comment