Budgeting for Couples: A Collaborative Approach to Financial Harmony

Money can be a tricky subject in any relationship. For couples, it’s often cited as one of the leading causes of arguments and stress. But what if instead of being a source of conflict, your finances became a powerful tool to strengthen your bond and achieve shared dreams? That’s the magic of collaborative budgeting for couples.

This comprehensive guide will walk you through how to transform your financial journey from individual struggles to a united front. We’ll break down complex concepts into easy-to-understand steps, helping you and your partner build a solid financial foundation together.

Why Collaborative Budgeting is a Game-Changer for Couples

Before we dive into the "how," let’s understand the immense benefits of tackling your finances as a team:

- Reduced Stress & Anxiety: When you both know where your money is going, the mystery (and the stress) disappears. No more "what if?" scenarios about bills or unexpected expenses.

- Clearer Financial Picture: You get a comprehensive view of your combined income, expenses, assets, and debts. This clarity empowers you to make informed decisions.

- Achieve Shared Goals Faster: Want to buy a house? Pay off debt? Travel the world? When you’re both pulling in the same direction, your financial goals become attainable realities much quicker.

- Improved Communication: Budgeting forces you to talk about money, opening up vital lines of communication that often spill over into other areas of your relationship.

- Stronger Relationship Bond: Successfully navigating your finances together builds trust, teamwork, and a deeper sense of partnership. You become a true financial power couple.

- Eliminate Blame & Resentment: Instead of one person feeling like they’re carrying the financial burden or constantly scrutinizing the other’s spending, you’re both accountable and supportive.

Getting Started: Laying the Foundation for Your Couple’s Budget

Embarking on a joint financial journey requires intention and a few crucial first steps.

1. Schedule Your "Money Date"

This isn’t a casual chat; it’s a dedicated time for financial planning. Treat it like an important meeting, but make it enjoyable!

- Choose the Right Time: Pick a moment when you’re both relaxed, not rushed, and free from distractions. Maybe a quiet evening, a weekend morning, or over a cup of coffee.

- Set the Mood: Make it comfortable. Have snacks, your favorite drinks, and a positive mindset. This isn’t a blame session; it’s a planning session.

- Agree on a Time Limit: Especially for your first few dates, keep it manageable (e.g., 60-90 minutes). You can always schedule another.

2. Embrace Open & Honest Communication

This is the cornerstone of successful collaborative budgeting.

- No Judgment Zone: This is paramount. You both need to feel safe sharing your financial history, habits, fears, and dreams without criticism.

- Share Everything: Be completely transparent about your income, debts (including credit card balances, student loans, car loans), past financial mistakes, and any money habits you might be embarrassed about.

- Listen Actively: Pay attention to your partner’s perspective, concerns, and goals. Try to understand their "money story" and how it shapes their current approach.

- Use "We" Language: Shift from "my money" or "your debt" to "our money" and "our debt." You’re a team now.

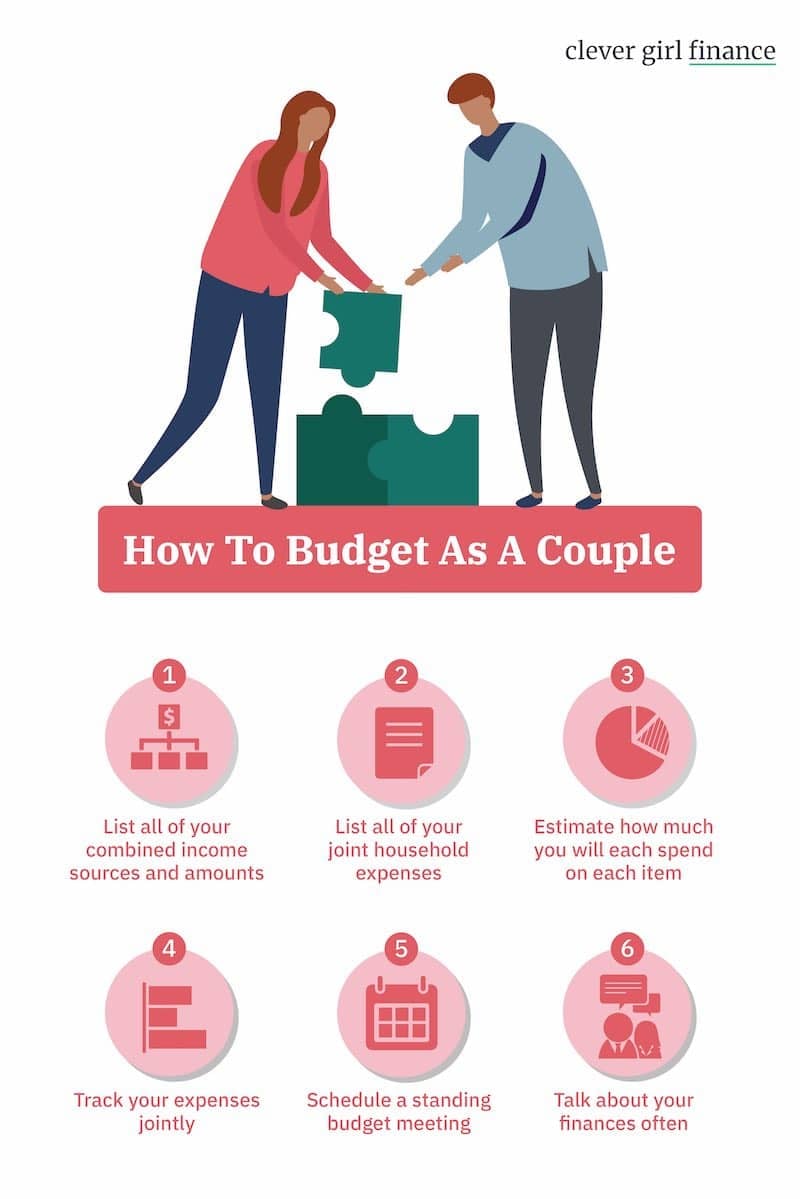

Understanding Your Combined Financial Picture

Before you can budget, you need to know exactly what you’re working with. This involves gathering all the numbers.

1. Calculate Your Joint Income

- List All Sources: Include salaries, freelance income, rental income, side hustles, etc.

- Net Income (Take-Home Pay): Focus on the amount that actually hits your bank account after taxes and deductions. This is the money you have to budget with.

2. Track Your Expenses

This is often the most revealing part. For 30 days, track every single dollar you both spend. This can be done with:

- Budgeting Apps: Many apps link directly to your bank accounts and categorize spending automatically (e.g., Mint, YNAB, Rocket Money, Personal Capital).

- Spreadsheets: Create a simple Excel or Google Sheet to manually input transactions.

- Pen and Paper: A small notebook can work if you’re diligent about writing everything down.

Categorize your expenses into:

- Fixed Expenses (Non-Negotiable): These are bills that are generally the same amount each month and are difficult to change quickly.

- Rent/Mortgage

- Loan Payments (car, student, personal)

- Insurance Premiums (health, car, home)

- Utility Bills (often somewhat variable, but generally fixed amounts)

- Subscriptions (streaming services, gym memberships)

- Variable Expenses (Flexible): These amounts fluctuate month to month and offer opportunities for adjustment.

- Groceries

- Dining Out

- Entertainment

- Shopping/Personal Care

- Transportation (gas, public transit)

- Travel

- Gifts

3. List All Assets & Debts

While not directly part of your monthly budget, having a clear picture of your overall financial health is crucial for long-term planning.

- Assets: What you own.

- Savings Accounts

- Checking Accounts

- Investment Accounts (401k, IRA, brokerage)

- Real Estate Equity

- Valuable Possessions (though usually not included in budget planning)

- Debts: What you owe.

- Credit Card Balances

- Student Loans

- Car Loans

- Mortgage

- Personal Loans

Setting Shared Financial Goals

Budgeting without goals is like driving without a destination. Goals give your money purpose and keep you motivated.

- Brainstorm Individually, Then Together: Each of you should think about your personal financial aspirations. Then, come together to discuss and align on shared goals.

- Categorize Your Goals:

- Short-Term (1-2 years): Emergency fund (3-6 months of living expenses), vacation, new furniture, paying off a small credit card debt.

- Mid-Term (3-5 years): Down payment on a house, new car, significant debt repayment, starting a family.

- Long-Term (5+ years): Retirement planning, children’s education, major home renovations, early retirement.

- Make Goals Specific & Measurable: Instead of "save money," say "save $10,000 for a down payment by December 2025."

- Prioritize Your Goals: You can’t do everything at once. Decide which goals are most important to you both right now.

Choosing Your Couple’s Budgeting Style

There’s no one-size-fits-all budget. Find a method that resonates with both of you and fits your lifestyle.

1. The 50/30/20 Rule

- How it Works:

- 50% Needs: Housing, utilities, groceries, transportation, insurance, minimum debt payments.

- 30% Wants: Dining out, entertainment, hobbies, shopping, vacations, subscriptions you could live without.

- 20% Savings & Debt Repayment: Emergency fund, retirement contributions, extra debt payments.

- Why Couples Like It: It’s simple, flexible, and easy to understand. It provides clear guidelines without being overly restrictive.

2. Zero-Based Budgeting

- How it Works: Every dollar of your income is assigned a "job" (expense, savings, debt payment) until your income minus your expenses equals zero. You literally budget down to the last penny.

- Why Couples Like It: Offers maximum control and ensures no money is wasted. It’s great for quickly paying down debt or saving aggressively.

- Considerations: Requires more detailed tracking and commitment.

3. The Envelope System (Cash Budgeting)

- How it Works: You allocate a certain amount of cash to different spending categories (e.g., groceries, entertainment, dining out) and put it into physical envelopes. Once the cash in an envelope is gone, you can’t spend more in that category until the next budgeting period.

- Why Couples Like It: Excellent for overspenders or for categories where you struggle with impulse purchases. It provides a tangible barrier to overspending.

- Considerations: Less convenient in a digital world; not suitable for all expenses (e.g., online bills).

4. The Hybrid Approach

- How it Works: Many couples combine elements of different systems. For example, you might use 50/30/20 for broad categories but use an envelope system for your "wants" categories like dining out or entertainment.

- Why Couples Like It: Offers the best of both worlds, allowing you to tailor the budget to your unique needs and preferences.

Navigating Joint vs. Separate Accounts: What’s Right for You?

This is a common question for couples. There’s no single "right" answer; it depends on your comfort level, trust, and financial habits.

1. Fully Joint Accounts

- How it Works: All income goes into one shared checking account, and all bills and expenses are paid from it. Savings accounts are also joint.

- Pros:

- Simplicity: Easy to see all finances at a glance.

- Shared Responsibility: Reinforces the "our money" mindset.

- Easier Bill Payment: No confusion about who pays what.

- Transparency: Full visibility for both partners.

- Cons:

- Loss of Independence: Some feel a lack of personal financial freedom.

- Potential for Conflict: Disagreements over individual spending can arise.

- Credit History: If one partner has poor spending habits, it could indirectly affect the other.

2. Fully Separate Accounts

- How it Works: Each partner maintains their own checking and savings accounts. Bills are typically divided and paid individually.

- Pros:

- Financial Independence: Each person maintains full control over their own money.

- Privacy: No need to justify every purchase to your partner.

- Avoids Blame: Less direct conflict over spending habits.

- Cons:

- Complexity: Can be difficult to manage shared expenses and joint goals.

- Less Transparency: Can lead to one partner feeling in the dark about the other’s finances.

- Reduced Teamwork: Might hinder the "our money" mentality.

3. The Hybrid Approach (Most Popular)

- How it Works: This combines the best of both worlds. You have a joint checking account for shared expenses (rent/mortgage, utilities, groceries, joint savings goals) and individual checking accounts for personal spending (hobbies, individual shopping, "fun money").

- Pros:

- Shared Responsibility for Joint Bills: Clearly defined contributions to household expenses.

- Individual Freedom: Each partner has discretionary money without needing approval.

- Reduced Conflict: Minimizes arguments over personal spending.

- Transparency for Shared Goals: You can easily track progress on collective savings.

- How to Implement:

- Decide on a percentage or fixed amount each partner contributes to the joint account for shared expenses.

- Set up automatic transfers from individual accounts to the joint account on payday.

- Agree on how much "fun money" each person gets for their separate accounts.

Making It Work: Practical Tips for Budgeting Success

Setting up the budget is just the beginning. Consistency and adaptability are key.

- Schedule Regular Financial Check-ins: Once a month (or bi-weekly initially), sit down and review your budget.

- How did you do last month?

- Are you on track for your goals?

- Are there any upcoming expenses?

- Do you need to make adjustments?

- Be 100% Transparent: No hiding purchases, no secret accounts. Full honesty builds trust.

- Be Flexible & Forgiving: Life happens! Unexpected expenses come up, and sometimes you’ll go over budget in a category. Don’t beat yourselves up. Adjust and move forward.

- Celebrate Small Wins: Did you stick to your grocery budget? Did you make an extra payment on debt? High-five each other! Acknowledge progress to stay motivated.

- Avoid the Blame Game: If one person overspends, approach it as a team problem to solve, not an individual failure to criticize. "How can we prevent this next month?"

- Automate Your Savings: Set up automatic transfers from your checking account to your savings and investment accounts right after payday. "Pay yourselves first."

- Build an Emergency Fund: This is non-negotiable. Aim for 3-6 months of living expenses saved in an easily accessible, separate savings account. It prevents debt when unexpected things happen.

- Review Your Budget Annually (or When Life Changes): Major life events (new job, baby, moving, pay raise) warrant a full budget re-evaluation.

Common Challenges & How to Overcome Them

No couple’s financial journey is perfectly smooth. Here are some common hurdles and strategies to clear them:

- Different Money Personalities (Saver vs. Spender):

- Strategy: Acknowledge and respect each other’s styles. The hybrid account approach works well here. The saver can feel secure with shared savings, while the spender has freedom within their "fun money" budget. Find a middle ground where both feel comfortable.

- Past Financial Baggage (Debt, Poor Habits):

- Strategy: This requires empathy and patience. Discuss the past without judgment. Focus on how you’ll move forward together. Create a joint debt repayment plan. Consider financial therapy if old patterns are deeply ingrained.

- Unequal Incomes:

- Strategy: Decide if contributions to shared expenses will be proportional to income or a fixed amount. There’s no right answer, only what feels fair and comfortable to both of you. The goal is partnership, not keeping score.

- Decision Fatigue & Burnout:

- Strategy: Don’t try to perfect everything at once. Start simple. Delegate tasks (one person tracks expenses, the other pays bills). Keep check-ins concise. Remember why you’re doing this – your shared goals.

- One Partner is More Engaged Than the Other:

- Strategy: Gently encourage participation. Make the "money date" more appealing. Emphasize the shared benefits. If one partner is truly disinterested, the more engaged partner can take the lead but must maintain full transparency and regular (even if brief) updates.

Tools and Resources to Help Your Budgeting Journey

- Budgeting Apps:

- Mint: Free, tracks spending, categorizes transactions, sets budgets.

- YNAB (You Need A Budget): Paid, zero-based budgeting, powerful for debt repayment and saving.

- Rocket Money (formerly Truebill): Helps track subscriptions, negotiate bills, and categorize spending.

- Personal Capital: Good for investment tracking alongside budgeting.

- Spreadsheets: Free templates available online (Google Sheets, Excel).

- Financial Advisors/Coaches: For complex situations, significant wealth planning, or deep-seated financial issues.

- Books/Podcasts: "The Total Money Makeover" by Dave Ramsey, "I Will Teach You To Be Rich" by Ramit Sethi, "Broke Millennial" by Erin Lowry, "Afford Anything" podcast.

Conclusion: Your Journey to Financial Harmony Begins Now

Budgeting for couples isn’t about restriction; it’s about freedom – the freedom to make choices that align with your shared values and dreams. It’s about replacing stress and arguments with clarity, trust, and a powerful sense of teamwork.

It won’t always be easy, but with open communication, a willingness to compromise, and a commitment to your shared goals, you can transform your financial life. Take the first step today. Schedule that money date, start tracking your spending, and begin building a future of financial harmony, together. Your relationship, and your bank account, will thank you for it.

Post Comment