Banking Crisis: Understanding Systemic Risk – A Beginner’s Guide to Financial Stability

Have you ever heard news headlines about a "banking crisis" or "financial meltdown" and felt a knot in your stomach, wondering what it all means for your money and the economy? You’re not alone. While these events can sound complex, understanding the core concepts – especially "systemic risk" – is crucial for anyone who wants to grasp how our financial world works.

This article will break down what a banking crisis is, explain the powerful concept of systemic risk in simple terms, look at how it spreads, and discuss the safeguards in place to protect us.

What is a Banking Crisis? (The Basics)

Imagine a bank as a trust factory. People deposit their money, trusting the bank to keep it safe and lend it out wisely. A banking crisis happens when that trust breaks down, leading to a widespread loss of confidence in the banking system.

Here’s what it often looks like:

- Bank Runs: This is the classic image. People get scared that their bank might fail, so they rush to withdraw all their money at once. Since banks don’t keep all deposited money in their vaults (they lend most of it out), a sudden rush can quickly deplete their cash reserves, forcing even a healthy bank to collapse.

- Credit Crunch: Banks become afraid to lend money to each other or to businesses and individuals. Why? Because they’re unsure who might be the next to fail, or they simply want to hoard their cash. This "freezing" of credit makes it incredibly hard for businesses to operate, expand, or even pay their employees, leading to job losses and economic slowdown.

- Loss of Confidence: If a few banks fail, people start to lose faith in the entire system. This can create a vicious cycle where fear fuels more withdrawals, causing more banks to falter.

A banking crisis isn’t just about one bank failing; it’s about the widespread instability that threatens the entire financial system. And that’s where "systemic risk" comes in.

Enter Systemic Risk – The Real Monster

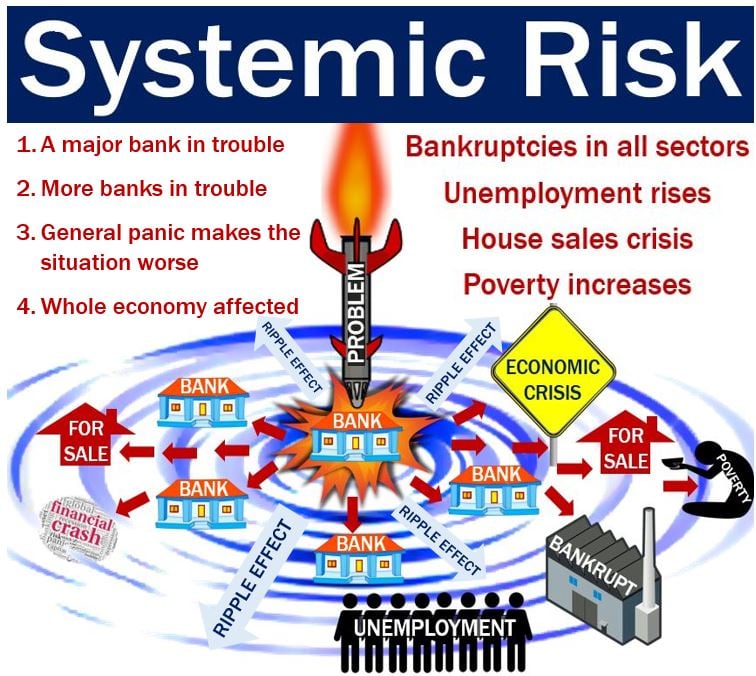

Think of the global financial system like a giant, intricate spiderweb. Every bank, investment firm, and financial market is a strand in that web, connected to many others. Systemic risk is the danger that the failure of one or a few key parts of this web could cause the entire web to collapse.

It’s like a row of dominoes: if one falls, it knocks over the next, and the next, until the whole line is down. In the financial world, this is often called the "domino effect" or "contagion."

Why is it so dangerous?

- Interconnectedness: Banks lend money to each other, invest in each other’s securities, and rely on each other for daily operations. If Bank A owes money to Bank B, and Bank A suddenly collapses, Bank B might not get its money back, putting it at risk, and so on.

- Confidence Contagion: Fear is highly contagious. If a major bank fails, even if your bank isn’t directly exposed, people might still panic and withdraw their money, just in case. This widespread loss of trust can quickly destabilize otherwise healthy institutions.

- "Too Big to Fail": Some financial institutions are so large and so deeply intertwined with the rest of the system that their failure would have catastrophic consequences for the entire economy. Governments often feel compelled to bail out these institutions to prevent a wider collapse, leading to controversy but also potentially averting a deeper crisis.

Systemic risk isn’t just about financial losses; it’s about the potential for a complete breakdown of the mechanisms that allow money to flow, businesses to operate, and people to live their daily lives.

How Does Systemic Risk Spread? (Mechanisms of Contagion)

The dominoes fall in several ways when systemic risk is at play:

- Interbank Lending: Banks constantly lend money to each other overnight to manage their daily cash needs. If one bank is perceived as unstable, other banks stop lending to it. This can quickly starve the struggling bank of the cash it needs to operate, leading to its collapse and potentially causing other banks that lent to it to suffer losses.

- Shared Assets & Investments: Many banks hold similar types of assets (like mortgages, government bonds, or corporate debt). If the value of these assets suddenly drops across the board (e.g., a housing market crash), multiple banks could simultaneously face significant losses, threatening their solvency.

- Derivatives and Complex Instruments: These are financial contracts whose value is derived from an underlying asset (like stocks, bonds, or commodities). They can be incredibly complex and often involve multiple parties. If one party in a derivative chain defaults, it can create a cascade of defaults, as seen in the 2008 crisis with credit default swaps.

- Confidence & Information Asymmetry: In a crisis, no one knows exactly which banks are truly healthy and which are on the brink. This lack of clear information fuels panic. Rumors, true or false, can spread rapidly, leading to widespread withdrawals even from sound banks.

- Asset Fire Sales: When banks need to raise cash quickly (e.g., to meet withdrawal demands), they might be forced to sell off their assets (like loans or securities) at deeply discounted prices. This "fire sale" can further depress the value of those assets, causing losses for other banks holding similar assets, creating a downward spiral.

Famous Examples of Systemic Risk in Action

Understanding past crises helps illustrate how systemic risk plays out in the real world:

- The Great Depression (1929 and 1930s): This was a classic example of widespread bank runs. After the stock market crash, people lost faith in banks. They rushed to withdraw their money, and with no federal deposit insurance (like we have today), thousands of banks failed. This led to a massive credit crunch, soaring unemployment, and a decade-long economic downturn.

- The 2008 Global Financial Crisis: This was a more complex, modern systemic crisis.

- Origin: It began with the collapse of the U.S. housing market, specifically "subprime mortgages" (loans given to people with poor credit who were likely to struggle with repayments).

- Contagion: These risky mortgages were packaged into complex financial products (like mortgage-backed securities and collateralized debt obligations) and sold to banks and investors worldwide. When homeowners started defaulting, the value of these products plummeted, causing massive losses for financial institutions globally.

- Lehman Brothers: The collapse of the investment bank Lehman Brothers in September 2008 sent shockwaves through the system because it was so deeply interconnected. Banks stopped trusting each other, lending froze, and the global economy teetered on the brink of collapse, necessitating massive government bailouts and interventions.

- Silicon Valley Bank (2023): While not a full-blown systemic crisis, the rapid failure of SVB highlighted systemic vulnerabilities. Its concentrated customer base (tech startups) and large holdings of long-term bonds (whose value fell when interest rates rose) made it susceptible. The speed of its demise, fueled by social media and digital withdrawals, sparked fears of contagion. However, swift action by U.S. regulators (guaranteeing all deposits, not just insured ones) and the Federal Reserve’s emergency lending facility helped contain the panic and prevent a wider systemic collapse, demonstrating the importance of modern safeguards.

The Ripple Effect: What Happens When the System Fails?

When systemic risk turns into a full-blown crisis, the consequences extend far beyond the financial sector:

- Economic Recession or Depression: Businesses can’t get loans, consumers stop spending, and investment dries up. This leads to widespread job losses, business failures, and a significant contraction of the economy.

- Credit Freeze: Access to loans for homes, cars, and education becomes extremely difficult or impossible, stifling economic activity.

- Increased Poverty and Inequality: Job losses and reduced economic activity hit vulnerable populations the hardest, exacerbating social issues.

- Government Debt Soars: Governments often have to spend huge sums on bailouts, stimulus packages, and increased social safety nets, leading to higher national debt.

- Loss of Public Trust: People lose faith not just in banks, but often in government and economic institutions, which can have long-term social and political consequences.

Preventing the Next Collapse: Safeguards & Solutions

Learning from past crises, governments and central banks have implemented various measures to mitigate systemic risk and promote financial stability:

- Deposit Insurance (e.g., FDIC in the U.S.): This is a cornerstone of confidence. Agencies like the Federal Deposit Insurance Corporation (FDIC) insure your deposits up to a certain amount (currently $250,000 per depositor per bank). This prevents bank runs because people know their money is safe, even if the bank fails.

- Central Banks as "Lender of Last Resort": Institutions like the U.S. Federal Reserve or the European Central Bank can provide emergency loans to banks facing short-term cash shortages. This prevents liquidity crises from spiraling into solvency crises (where a bank runs out of cash even if its assets are good).

- Financial Regulation (e.g., Dodd-Frank Act, Basel Accords):

- Capital Requirements: Banks are required to hold a certain amount of their own money (capital) as a cushion against losses. This makes them more resilient.

- Stress Tests: Regulators regularly put major banks through hypothetical severe economic downturns to see if they could withstand the shock.

- Liquidity Requirements: Banks must hold enough easily convertible assets (like cash) to meet short-term obligations.

- Oversight of "Too Big to Fail" Institutions: Regulators pay extra attention to Systemically Important Financial Institutions (SIFIs) due to their potential to cause contagion.

- Resolution Authorities: New frameworks allow regulators to orderly wind down a failing "too big to fail" bank without resorting to a full-scale bailout, reducing the risk to taxpayers and preventing market panic.

- Early Warning Systems: Regulators constantly monitor the financial system for signs of stress or emerging risks (e.g., rapid asset price inflation, excessive lending).

Conclusion: Staying Vigilant for Financial Stability

Understanding banking crises and systemic risk isn’t just for economists or bankers. It’s about recognizing the interconnectedness of our financial world and the importance of stability. While the thought of a financial meltdown can be daunting, the good news is that policymakers and regulators have learned valuable lessons from history.

The safeguards in place today, from deposit insurance protecting your savings to robust regulations on major banks, are designed to make the system more resilient and prevent a single point of failure from bringing down the entire economy. However, vigilance is key. The financial landscape constantly evolves, and new challenges can always emerge. By understanding these fundamental concepts, we can better appreciate the ongoing efforts to maintain financial stability and protect our collective economic well-being.

Post Comment