Applying for a Business Loan: A Beginner’s Guide to Securing Funding

Securing funding is often one of the biggest hurdles for entrepreneurs, whether you’re just starting a new venture or looking to expand an existing one. The phrase "business loan" can sound daunting, conjuring images of complex paperwork and intimidating bank meetings. But it doesn’t have to be!

This comprehensive guide is designed to demystify the business loan application process, breaking it down into easy-to-understand steps. We’ll cover everything from preparing your business to understanding different loan types and what lenders look for. By the end, you’ll feel confident and ready to pursue the funding your business needs to thrive.

Why Do You Need a Business Loan? Defining Your Purpose

Before you even think about approaching a lender, the absolute first step is to clearly define why you need the money. Lenders want to see a well-thought-out plan for how their funds will be used. Common reasons include:

- Startup Costs: Covering initial expenses like equipment, inventory, rent, and marketing for a new business.

- Working Capital: To cover day-to-day operational expenses, manage cash flow, or bridge gaps between revenue and expenses.

- Equipment Purchase: Buying machinery, vehicles, or technology essential for your business operations.

- Inventory Purchase: Stocking up on products to meet demand, especially during peak seasons.

- Business Expansion: Funding for opening new locations, hiring more staff, or developing new products/services.

- Debt Refinancing: Consolidating or refinancing existing business debts to get better terms or lower interest rates.

- Marketing & Advertising: Investing in campaigns to reach new customers and grow your market share.

Tip: Be specific! Instead of "I need money for my business," say "I need $50,000 to purchase a new CNC machine, which will increase our production capacity by 30% and allow us to take on two new large contracts."

Are You Loan Ready? Essential Pre-Application Steps

Lenders don’t just hand out money; they need to be confident you can pay it back. This means you need to present your business as a low-risk, high-potential investment. Here’s what you need to have in order before you apply:

1. Your Personal Credit Score

Even for a business loan, your personal credit score (FICO score) is incredibly important, especially for small businesses and startups. Lenders see it as an indicator of your financial responsibility.

- What’s a Good Score? Generally, a score of 680 or higher is considered good, while 720+ is excellent.

- Why it Matters: A strong personal credit score can help you secure better interest rates and terms. If your personal credit is poor, it can make getting a loan very difficult.

- Action: Check your credit report from all three major bureaus (Experian, Equifax, TransUnion) for free annually at AnnualCreditReport.com. Dispute any errors.

2. Your Business Credit Score

Just like you, your business can have its own credit score. This score is based on how your business pays its suppliers, vendors, and other creditors.

- How to Build It: Open a business bank account, get a business credit card, ensure timely payments to all suppliers, and establish trade lines with vendors who report to business credit bureaus (Dun & Bradstreet, Experian Business, Equifax Business).

- Why it Matters: A strong business credit score shows your company’s financial reliability independent of your personal finances.

3. A Solid Business Plan

Think of your business plan as a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. Lenders use it to understand your vision and viability.

- Key Components:

- Executive Summary: A concise overview of your entire plan.

- Company Description: What your business does, its mission, legal structure.

- Market Analysis: Who are your customers? Who is your competition? What’s your competitive advantage?

- Organization & Management: Who runs the business? Their experience and roles.

- Service or Product Line: Detailed description of what you sell.

- Marketing & Sales Strategy: How will you reach customers and make sales?

- Financial Projections: The most crucial part for lenders – detailed forecasts of revenue, expenses, and profits.

- Funding Request: Exactly how much money you need and how you plan to use it.

4. Strong Financial Statements

Lenders will pore over your financial history to assess your business’s health and repayment capacity.

- For Existing Businesses (typically 2-3 years of history):

- Profit & Loss (P&L) Statements / Income Statements: Shows your revenues, costs, and profits over a period.

- Balance Sheets: A snapshot of your business’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Tracks the actual cash coming in and going out of your business.

- Business Tax Returns: For the past 2-3 years.

- For Startups: While you won’t have historical data, you’ll need detailed financial projections (pro forma statements) for the next 3-5 years, showing how you expect to generate revenue and profit.

5. Collateral and Guarantees

Many business loans, especially traditional ones, require some form of security.

- Collateral: Assets you pledge to the lender that they can seize if you default on the loan. This can include real estate, equipment, inventory, or accounts receivable.

- Personal Guarantee: You, as the business owner, personally promise to repay the loan if your business cannot. This means your personal assets could be at risk. Most small business loans require a personal guarantee.

Understanding Different Types of Business Loans

Not all loans are created equal. The best type of loan for your business depends on your specific needs, financial situation, and how quickly you need the funds.

1. Traditional Bank Loans

- What they are: Loans offered by conventional banks (e.g., Chase, Wells Fargo, Bank of America).

- Pros: Often have the lowest interest rates and longest repayment terms. Good for larger, long-term investments.

- Cons: Strictest eligibility requirements, lengthy application process, often require significant collateral and strong credit.

- Best for: Established businesses with strong credit, collateral, and a proven track record.

2. SBA Loans (Small Business Administration Loans)

- What they are: Loans facilitated by the U.S. Small Business Administration. The SBA doesn’t lend money directly; it guarantees a portion of the loan made by participating lenders (banks, credit unions). This guarantee reduces risk for lenders, making them more willing to lend to small businesses.

- Pros: Lower down payments, longer repayment terms, and often more flexible eligibility criteria than traditional bank loans. Excellent for startups and smaller businesses.

- Cons: Can still have a lengthy application process due to government oversight.

- Best for: Small businesses, startups, and those who might not qualify for conventional bank loans but have a solid plan.

3. Online Lenders

- What they are: Companies that provide loans exclusively through online platforms (e.g., Kabbage, OnDeck, Fundbox).

- Pros: Fast application and approval process (sometimes within hours or days), more flexible eligibility requirements (some cater to lower credit scores or newer businesses).

- Cons: Often have higher interest rates and shorter repayment terms compared to traditional banks.

- Best for: Businesses needing quick access to funds, those with slightly weaker credit, or those who don’t qualify for traditional loans.

4. Business Lines of Credit

- What they are: A flexible loan that allows you to borrow up to a certain limit, repay it, and then borrow again, similar to a credit card. You only pay interest on the amount you’ve borrowed.

- Pros: Great for managing cash flow fluctuations, covering unexpected expenses, or purchasing inventory as needed.

- Cons: Can have variable interest rates, and the temptation to overspend exists.

- Best for: Businesses with fluctuating cash flow, managing working capital, or as a safety net for unexpected needs.

5. Equipment Financing

- What they are: Loans specifically for purchasing new or used business equipment (e.g., machinery, vehicles, computers). The equipment itself often serves as collateral.

- Pros: Easier to qualify for since the equipment acts as security, can cover up to 100% of the equipment cost.

- Cons: Only for equipment purchases, not for general working capital.

- Best for: Businesses needing to acquire specific assets to operate or expand.

6. Invoice Factoring / Accounts Receivable Financing

- What they are: You sell your outstanding invoices (accounts receivable) to a third-party company (a "factor") at a discount, receiving immediate cash. The factor then collects the payment from your customer.

- Pros: Quick access to cash tied up in unpaid invoices, good for businesses with long payment terms, doesn’t rely on your credit score as much.

- Cons: Can be expensive (the discount is essentially a fee), you lose control over customer collections.

- Best for: Businesses with a large volume of unpaid invoices and long payment cycles, looking to improve cash flow without taking on debt.

7. Merchant Cash Advances (MCAs)

- What they are: Not technically a loan, but an advance on your future credit card sales. The lender gives you a lump sum, and in return, takes a percentage of your daily credit card sales until the advance plus a fee is repaid.

- Pros: Very fast funding, easy to qualify for (often don’t require good credit).

- Cons: Extremely expensive (high effective APR), can trap businesses in a cycle of debt.

- Best for: Businesses with high credit card sales volume and an urgent, short-term need for cash, but generally should be a last resort.

The 5 C’s of Credit: What Lenders Look For

Lenders use a framework known as the "5 C’s of Credit" to evaluate your loan application. Understanding these will help you present your business in the best light.

- Character: This refers to your trustworthiness and integrity as a borrower. Lenders assess your personal and business credit history, your experience in the industry, and your reputation. They want to see a history of responsible financial behavior.

- Capacity: Your ability to repay the loan. Lenders will analyze your cash flow, debt-to-income ratio, and financial projections to ensure you generate enough income to cover loan payments comfortably.

- Capital: The amount of money you’ve personally invested in your business. Lenders want to see that you have "skin in the game." The more capital you’ve invested, the more committed you appear, and the less risky you seem to the lender.

- Collateral: Assets you can pledge to secure the loan. As discussed, this reduces the lender’s risk. If you default, they can seize and sell the collateral to recover their losses.

- Conditions: The overall economic climate and industry-specific factors that could affect your business’s ability to repay. This includes things like industry trends, competition, and general economic stability.

Documents You’ll Need for Your Business Loan Application

Gathering these documents before you apply will significantly speed up the process. The exact list can vary by lender and loan type, but this is a comprehensive starting point:

- Business Plan: As detailed above, outlining your business goals, strategies, and financial projections.

- Business Legal Documents:

- Business registration documents (e.g., Articles of Incorporation, LLC operating agreement)

- Employer Identification Number (EIN)

- Business licenses and permits

- Franchise agreement (if applicable)

- Business Financial Statements:

- Profit & Loss (P&L) Statements (past 2-3 years)

- Balance Sheets (past 2-3 years)

- Cash Flow Statements (past 2-3 years)

- Accounts Receivable and Accounts Payable aging reports

- Projected Financial Statements (for startups or expansion)

- Business Tax Returns: For the past 2-3 years.

- Business Bank Statements: For the past 6-12 months.

- Personal Financial Statements:

- Personal tax returns (past 2-3 years)

- Personal bank statements

- Proof of personal assets (real estate, investments)

- Proof of personal liabilities (mortgages, other loans)

- Resumes of Business Owners/Key Management: Highlighting relevant experience.

- Loan Application Form: Provided by the lender.

- Debt Schedule: A list of all existing business debts (lender, amount, interest rate, repayment terms).

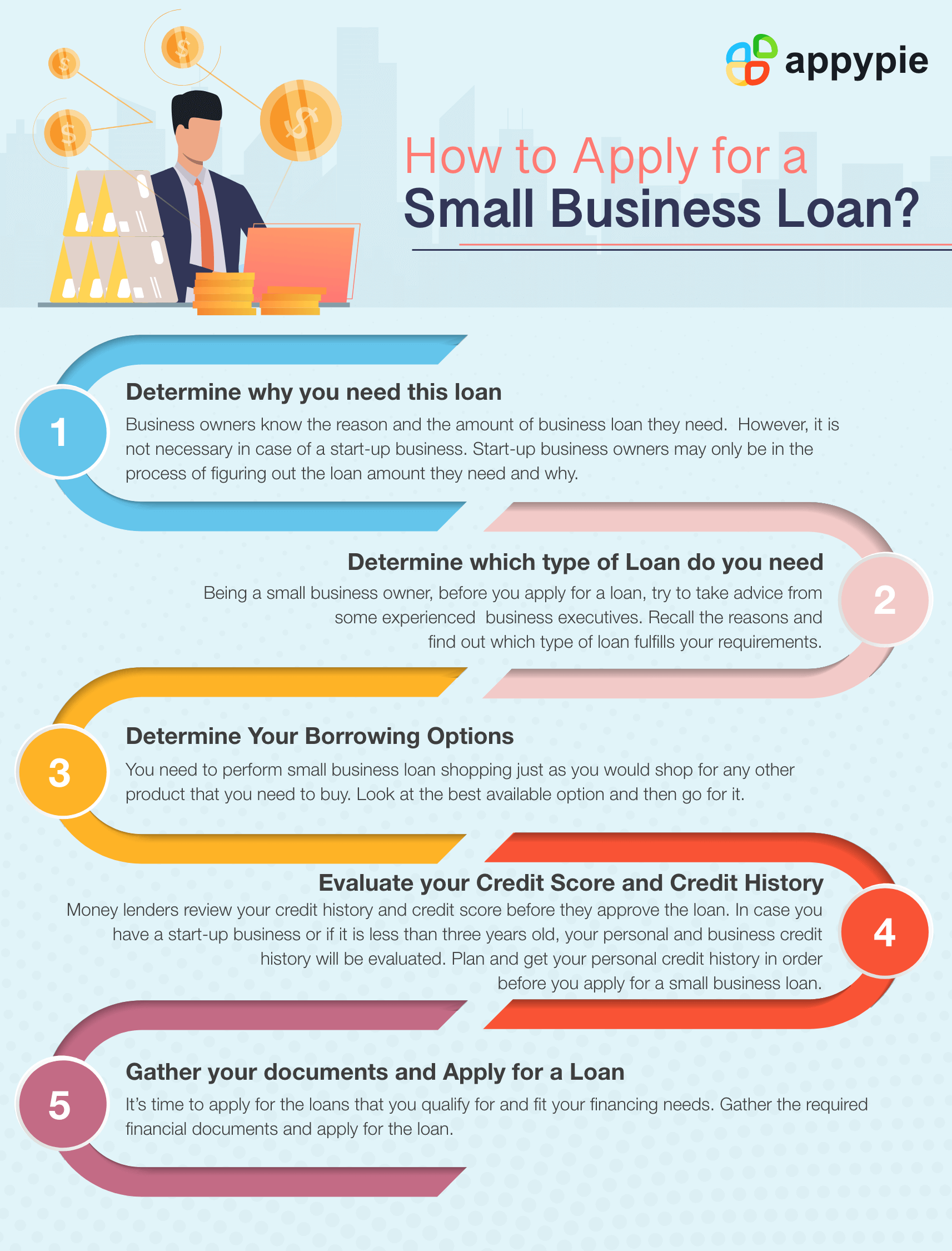

The Business Loan Application Process: Step-by-Step

Once you’re loan-ready and have your documents in order, here’s a typical journey from application to funding:

Step 1: Assess Your Needs & Loan Type

- How much do you need? Be realistic but also ensure you’re asking for enough.

- What will it be used for? (As discussed in the first section).

- What’s your repayment capacity? Can your business generate enough cash flow to comfortably make payments?

- What loan type fits best? Based on your needs, eligibility, and urgency.

Step 2: Research and Choose Lenders

- Don’t just go to the first bank you see. Shop around!

- Consider traditional banks, credit unions, online lenders, and SBA-preferred lenders.

- Compare interest rates, terms, fees, eligibility requirements, and the application process for each.

- Read reviews and ask for recommendations.

Step 3: Gather All Required Documents

- Use the list above and any specific list provided by your chosen lender.

- Organize everything neatly, ideally in digital format (PDFs).

Step 4: Complete and Submit the Application

- Fill out the application form accurately and completely.

- Attach all supporting documents.

- Double-check everything for errors before submitting.

Step 5: Underwriting Process

- This is where the lender thoroughly reviews your application and documents.

- They will verify your financial information, assess your creditworthiness, and evaluate your business’s risk profile.

- They may ask for additional documents or clarifications. Be responsive and provide information quickly.

Step 6: Loan Decision: Approval or Denial

- Approval: Congratulations! The lender will provide a loan agreement outlining the terms (amount, interest rate, repayment schedule, fees, covenants). Read it carefully and ask questions.

- Denial: Don’t get discouraged. Ask the lender why your application was denied. This feedback is invaluable for improving your chances next time. It could be due to credit score, insufficient cash flow, or a weak business plan.

Step 7: Loan Closing and Funding

- If approved, you’ll sign the final loan agreement and any related legal documents.

- The funds will then be disbursed to your business bank account.

Tips for a Successful Business Loan Application

- Be Prepared: The more organized and complete your application is, the better impression you’ll make.

- Know Your Numbers Inside Out: Be able to confidently discuss your financials, projections, and how the loan will impact your bottom line.

- Shop Around: Different lenders offer different terms. Don’t settle for the first offer.

- Be Honest and Transparent: Don’t try to hide anything. Lenders appreciate honesty, even about challenges.

- Build Relationships: If possible, establish a relationship with a business banker before you need a loan. They can offer advice and guide you.

- Understand the "Why" Behind Every Question: If a lender asks for something, it’s because it helps them assess risk. Knowing this helps you provide better answers.

- Proofread Everything: A sloppy application can signal a sloppy business owner.

What If Your Application is Denied?

A denial isn’t the end of the road. It’s an opportunity to learn and improve.

- Ask for the Reason: This is crucial. Lenders are often required to provide a reason for denial.

- Address the Issues:

- Credit Score: Work on improving your personal and/or business credit.

- Insufficient Cash Flow: Focus on increasing revenue or reducing expenses to improve your ability to repay.

- Weak Business Plan: Refine your plan, especially the financial projections.

- Lack of Collateral: Explore loans that don’t require as much collateral, or consider what assets you do have.

- Time in Business: If you’re too new, gain more operating history.

- Explore Alternatives:

- Microloans: Smaller loans from non-profit organizations, often for startups or underserved businesses.

- Grants: Though often competitive and specific, they don’t require repayment.

- Crowdfunding: Raising small amounts of money from many individuals.

- Friends & Family: A common source for initial capital.

- Angel Investors/Venture Capital: For high-growth businesses seeking equity investment rather than debt.

- Reapply: Once you’ve addressed the issues, you can reapply, possibly with a different lender or for a different type of loan.

Conclusion: Empowering Your Business Growth

Applying for a business loan might seem like a complex journey, but by understanding the process, preparing thoroughly, and knowing your options, you can significantly increase your chances of success. Think of it not as a hurdle, but as a strategic step towards achieving your business goals. With careful planning and perseverance, you can secure the funding necessary to grow, innovate, and thrive. Good luck!

Post Comment