AI in Finance: Transforming Banking & Investments – Your Easy Guide to the Future of Money

Remember a time when banking meant long queues, physical paperwork, and waiting days for a transaction to clear? While some of that still exists, the world of finance is rapidly changing, and one of the biggest drivers of this change is Artificial Intelligence (AI).

AI isn’t just a buzzword; it’s a powerful set of technologies that are revolutionizing how we manage our money, how banks operate, and how investments are made. From catching fraudsters to giving you personalized financial advice, AI is quietly working behind the scenes to make finance smarter, safer, and more accessible.

In this comprehensive guide, we’ll break down what AI in finance means, how it’s being used, and what exciting changes it brings to the world of banking and investments.

What Exactly is AI? (Simplified for Beginners)

Before we dive into its financial applications, let’s quickly understand what AI is in simple terms.

Imagine a computer program that can "think" or "learn" like a human, but much faster and without getting tired. That’s essentially AI. It’s a broad field, but two key areas you’ll hear about are:

- Machine Learning (ML): This is the most common type of AI used today. It allows computer systems to learn from vast amounts of data without being explicitly programmed for every single task. Think of it like teaching a child by showing them many examples until they figure out the pattern. For instance, an ML system can learn to identify spam emails by analyzing thousands of examples of spam and non-spam.

- Deep Learning (DL): A more advanced type of Machine Learning, Deep Learning uses "neural networks" inspired by the human brain. These networks are great at recognizing complex patterns in things like images, speech, and even financial data, often leading to more accurate predictions.

So, when we talk about AI in finance, we’re talking about these smart computer systems using data to perform tasks that traditionally required human intelligence, but at an unprecedented scale and speed.

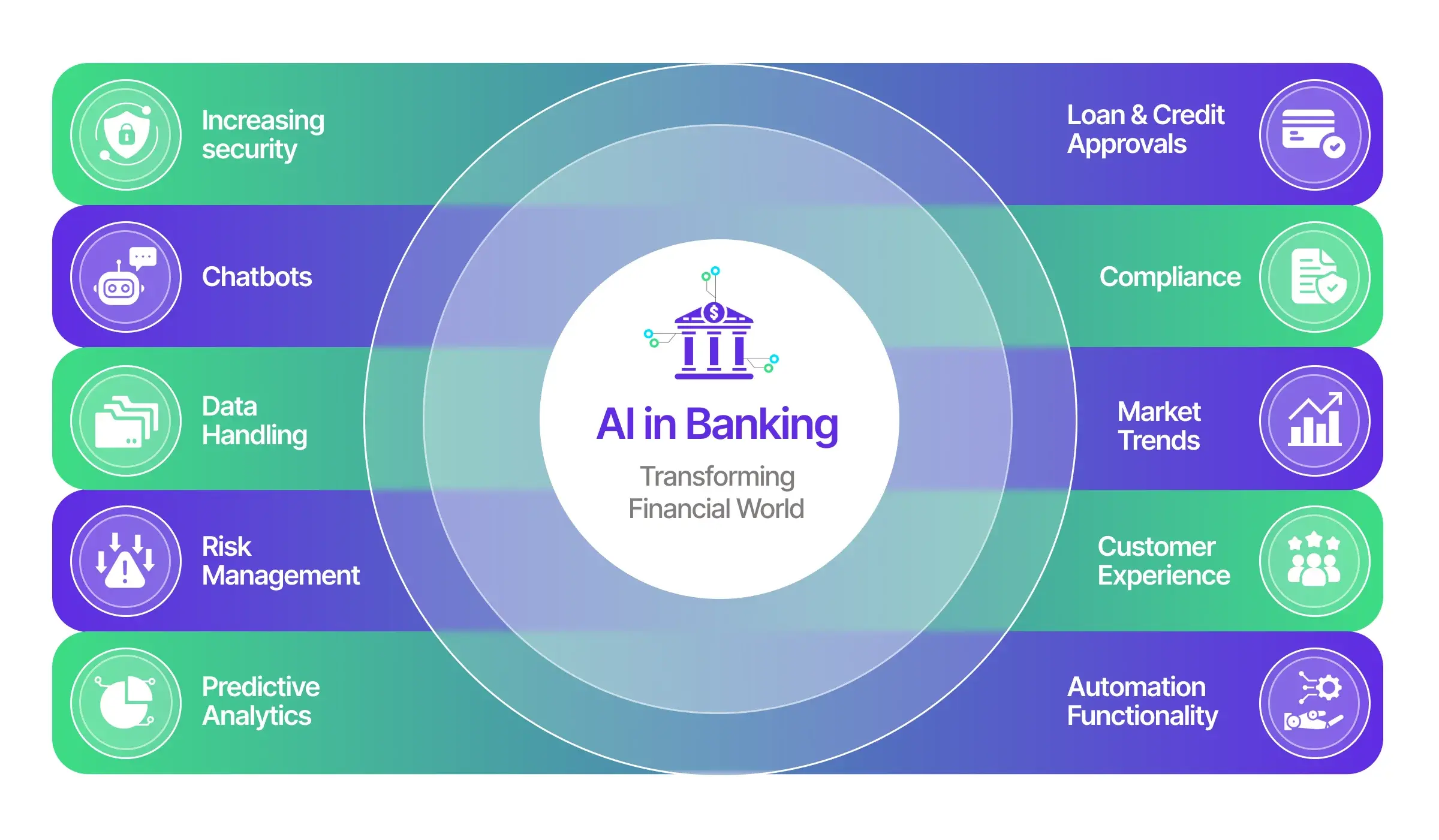

How AI is Transforming Banking and Financial Services

AI’s impact on finance is widespread, touching almost every aspect of the industry. Let’s explore the key areas:

1. Enhanced Customer Service & Personalization

Gone are the days when customer service was just about talking to a representative. AI is making financial interactions faster, smarter, and more tailored to your needs.

- 24/7 Chatbots and Virtual Assistants:

- Instant Support: AI-powered chatbots can answer common questions, provide account balances, and help with transactions instantly, anytime, anywhere.

- Reduced Wait Times: They handle routine inquiries, freeing up human staff for more complex issues.

- Personalized Responses: Some advanced bots can understand your tone and offer more empathetic or specific advice based on your past interactions.

- Hyper-Personalized Banking Experiences:

- Tailored Product Recommendations: AI analyzes your spending habits, financial goals, and risk tolerance to suggest suitable credit cards, loans, or investment products.

- Spending Insights: Many banking apps use AI to categorize your spending, identify subscription services, and even predict future expenses, helping you budget better.

- Proactive Alerts: AI can notify you of unusual spending, potential overdrafts, or even opportunities to save money based on your financial patterns.

2. Superior Fraud Detection and Security

Financial crime is a constant threat, but AI is proving to be a powerful ally in the fight against it.

- Real-time Anomaly Detection:

- Spotting Unusual Patterns: AI systems constantly monitor millions of transactions in real-time. They learn what "normal" activity looks like for each customer. If your card is suddenly used for a large purchase in a foreign country you’ve never visited, or for multiple small, rapid transactions, AI flags it instantly.

- Minimizing False Positives: While traditional rule-based systems might block legitimate transactions, AI is much better at distinguishing genuine anomalies from harmless ones, reducing inconvenience for customers.

- Anti-Money Laundering (AML) & KYC (Know Your Customer):

- Identifying Suspicious Networks: AI can analyze vast datasets to uncover complex money laundering schemes, identifying hidden relationships and transactions that human analysts might miss.

- Faster Customer Verification: AI helps banks quickly and accurately verify customer identities during onboarding, reducing the risk of fraud from the outset.

3. Smarter Risk Management and Compliance

Managing financial risk and adhering to complex regulations are critical for banks. AI is making these processes more efficient and accurate.

- Credit Risk Assessment:

- Beyond Traditional Scores: AI can analyze a wider range of data points (beyond just credit history) to assess an applicant’s creditworthiness, potentially leading to more accurate lending decisions and even financial inclusion for those with thin credit files.

- Predicting Defaults: Machine learning models can predict the likelihood of a borrower defaulting on a loan with greater accuracy, helping banks manage their loan portfolios better.

- Market Risk Analysis:

- Predictive Analytics: AI can analyze market trends, economic indicators, and news sentiment to predict potential market downturns or opportunities, helping institutions manage their investment risks more effectively.

- Regulatory Compliance:

- Automated Reporting: AI can automate the collection, analysis, and reporting of data required by financial regulators, saving time and reducing human error.

- Staying Up-to-Date: AI systems can monitor regulatory changes in real-time and alert institutions to necessary adjustments in their operations.

4. Intelligent Investment and Trading

AI is no longer just for Wall Street giants; it’s becoming accessible to everyday investors and transforming how assets are managed.

- Algorithmic Trading:

- High-Frequency Trading: AI-powered algorithms can execute trades at lightning speed, analyzing market data and making decisions in milliseconds, often faster than human traders ever could.

- Optimized Strategies: AI can test and refine complex trading strategies against historical data to find the most profitable approaches.

- Robo-Advisors:

- Automated Portfolio Management: These AI-driven platforms provide automated, personalized investment advice and portfolio management based on your financial goals, risk tolerance, and time horizon.

- Lower Fees: Robo-advisors often come with lower fees than traditional human financial advisors, making professional investment management more accessible.

- Market Sentiment Analysis:

- News & Social Media Monitoring: AI can "read" and analyze vast amounts of news articles, social media posts, and financial reports to gauge public sentiment towards companies or markets, providing insights that can influence investment decisions.

5. Operational Efficiency and Automation

Beyond customer-facing roles, AI is streamlining the "back office" operations of financial institutions.

- Automating Repetitive Tasks:

- Data Entry & Processing: AI-powered Robotic Process Automation (RPA) can handle routine, rule-based tasks like data entry, reconciliation, and processing invoices, significantly reducing manual effort and errors.

- Document Processing: AI can extract key information from financial documents, speeding up processes like loan applications and contract reviews.

- Cost Reduction: By automating tasks and improving efficiency, AI helps financial institutions reduce operational costs, which can ultimately translate to better services or lower fees for customers.

The Benefits of AI in Finance: A Summary

The widespread adoption of AI in finance brings a multitude of advantages:

- Improved Accuracy: AI systems, when fed good data, are less prone to human error.

- Enhanced Security: Better fraud detection and risk management protect both institutions and customers.

- Better Customer Experience: Faster service, personalized advice, and 24/7 availability lead to happier clients.

- Increased Efficiency: Automation frees up human employees to focus on more complex, strategic tasks.

- New Opportunities: AI enables innovative financial products and services that weren’t possible before.

- Greater Financial Inclusion: AI’s ability to analyze non-traditional data can help extend financial services to underserved populations.

Challenges and Considerations for AI in Finance

While the benefits are clear, it’s important to acknowledge the challenges that come with implementing AI:

- Data Privacy and Security: AI relies heavily on data. Ensuring this data is protected and used ethically is paramount.

- Ethical Concerns and Bias: If AI systems are trained on biased data, they can perpetuate or even amplify existing biases, leading to unfair outcomes (e.g., in credit scoring).

- Regulatory Hurdles: Regulators are still catching up with the rapid pace of AI innovation, creating uncertainty about guidelines and compliance.

- Job Displacement: As AI automates routine tasks, there are concerns about job losses in certain areas, though new roles requiring AI expertise are also emerging.

- Implementation Costs & Complexity: Integrating AI into existing legacy systems can be expensive and challenging.

- Explainability (XAI): Sometimes, it’s hard to understand why an AI made a particular decision (the "black box" problem). In finance, where accountability is crucial, this can be a significant issue.

The Future of AI in Finance: What’s Next?

The journey of AI in finance has only just begun. We can expect to see:

- Hyper-Personalization: Even more tailored financial products and advice, potentially even anticipating your needs before you realize them.

- Proactive Financial Health: AI moving beyond just reacting to your finances to actively helping you improve your financial well-being and achieve long-term goals.

- Further Automation: More complex processes will be automated, from back-office functions to parts of financial advisory roles.

- Integration with Emerging Technologies: AI will increasingly combine with other technologies like blockchain (for secure, transparent transactions) and the Internet of Things (IoT) for new data sources.

- Human-AI Collaboration: The future isn’t about AI replacing humans entirely, but rather augmenting human capabilities, allowing financial professionals to make better decisions faster.

Conclusion: AI – The New Brain of Finance

Artificial Intelligence is no longer a futuristic concept but a present-day reality rapidly reshaping the financial landscape. From providing instant customer support and detecting sophisticated fraud to optimizing investment portfolios and ensuring regulatory compliance, AI is making banking and investments smarter, more efficient, and more accessible than ever before.

While challenges exist, the financial industry is embracing AI’s transformative power, paving the way for a future where your money works harder, your financial security is stronger, and managing your finances becomes a seamless, intelligent experience. Get ready for a smarter financial future, powered by AI!

Post Comment