10 Essential Market Research Techniques for Early-Stage Startups (Your Ultimate Guide)

Starting a business is exhilarating! You have a brilliant idea, boundless energy, and a vision for the future. But here’s a sobering truth: many startups fail, not because their idea was bad, but because they didn’t truly understand their market or their customers. This is where market research comes in – it’s your compass in the vast ocean of business.

For early-stage startups with limited resources, extensive, costly market research might seem out of reach. But fear not! This comprehensive guide will walk you through 10 powerful, budget-friendly market research techniques that any early-stage entrepreneur can use to validate their idea, understand their audience, and build a product or service that truly resonates.

Why Market Research Isn’t a Luxury, It’s a Necessity for Startups

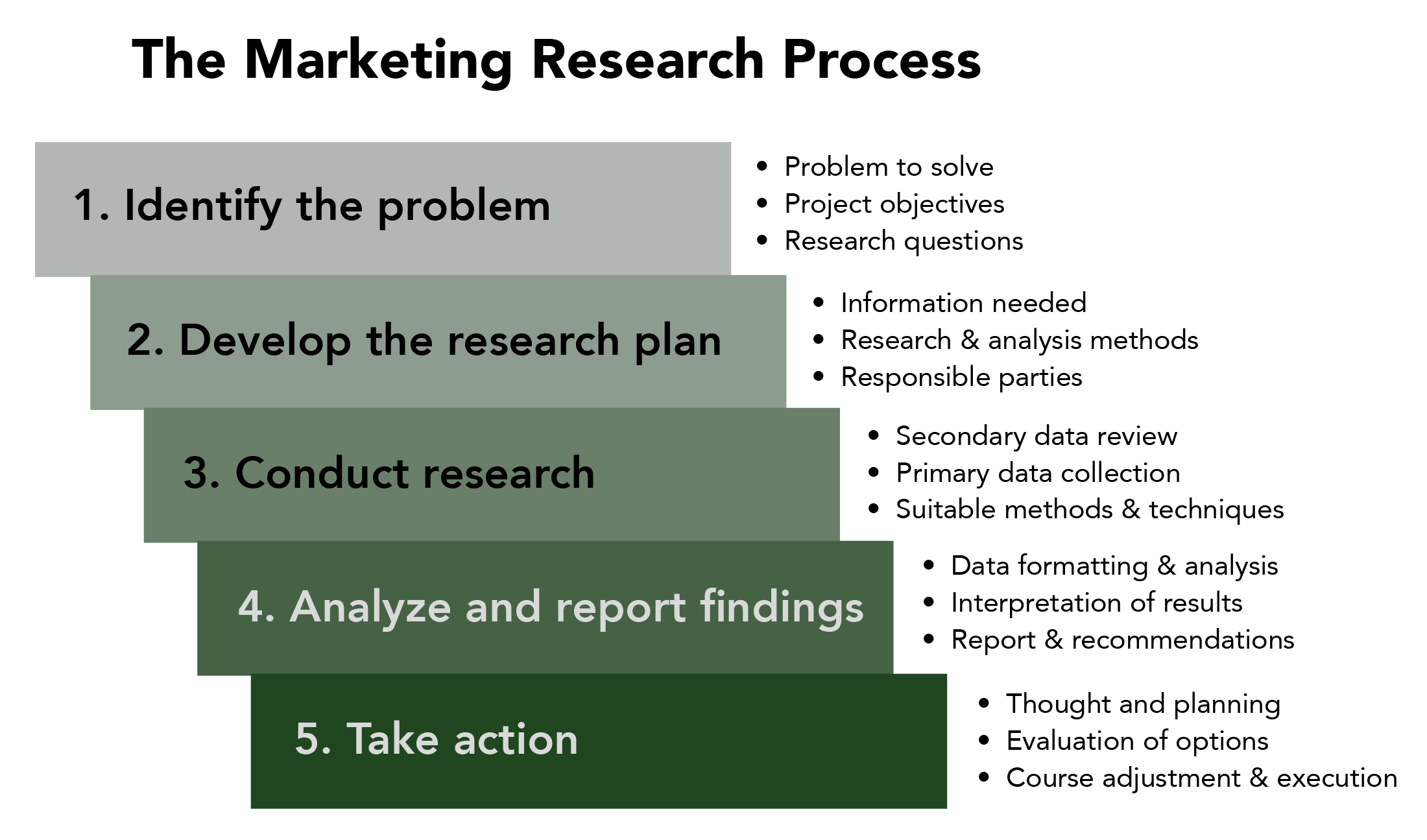

Before we dive into the techniques, let’s quickly understand why market research is non-negotiable for early ventures:

- Reduces Risk: Knowing what your potential customers want (or don’t want) before you invest heavily can save you immense time and money.

- Validates Your Idea: Is there a real need for what you’re offering? Market research helps you confirm if your solution actually solves a problem for a significant group of people.

- Finds Your Target Audience: Who exactly are you trying to reach? What are their demographics, behaviors, and pain points? This is crucial for effective marketing and product development.

- Informs Product Development: Don’t build in a vacuum! Customer insights guide your features, pricing, and user experience, leading to a better product-market fit.

- Identifies Competitors & Opportunities: Understand who else is in the game, what they do well, and where the gaps (your opportunities!) lie.

- Saves Money & Time: By making informed decisions early on, you avoid costly pivots or building features nobody wants.

Ready to gain a competitive edge? Let’s explore the techniques!

The 10 Market Research Techniques for Early-Stage Startups

These techniques range from simple desk research to direct customer engagement, offering a holistic view of your market.

1. One-on-One Customer Interviews (Qualitative Research)

This is arguably the most powerful technique for early-stage startups. Forget fancy surveys for a moment – talking directly to potential customers provides invaluable qualitative insights. You learn the "why" behind their behaviors, their true pain points, and their deepest desires.

- What it is: Directly interviewing individuals who fit your ideal customer profile. These are open-ended conversations, not just a list of questions.

- Why it’s great for startups:

- Deep Understanding: Uncovers nuanced perspectives, emotions, and motivations you can’t get from numbers.

- Idea Validation: Helps you understand if your problem statement resonates and if your proposed solution is appealing.

- Uncovers Unmet Needs: People often tell you what they really need, not just what they think they want.

- How to do it:

- Identify your ideal customer: Who would benefit most from your solution?

- Find them: Use your network, social media groups, LinkedIn, or even local community events.

- Prepare open-ended questions: Instead of "Do you like X?", ask "Tell me about your experience with X." or "What challenges do you face when trying to do Y?"

- Listen more, talk less: Your goal is to understand, not to sell.

- Record (with permission): This allows you to focus on the conversation and review details later.

- Aim for 5-10 initial interviews: You’ll start seeing patterns surprisingly quickly.

2. Online Surveys & Questionnaires (Quantitative Research)

Once you’ve gained some qualitative insights from interviews, online surveys allow you to quantify those findings across a larger group. They help you confirm trends and preferences identified in your one-on-one chats.

- What it is: Distributing a set of structured questions to a larger audience, typically through online platforms.

- Why it’s great for startups:

- Scalable: Reach many people quickly and cost-effectively.

- Quantitative Data: Get measurable data (percentages, averages) on preferences, demographics, and behaviors.

- Confirms Hypotheses: Test assumptions you’ve formed from qualitative research.

- How to do it:

- Choose a platform: Google Forms, SurveyMonkey (free tier available), Typeform.

- Keep it short and focused: Respect people’s time. 5-10 questions is often ideal.

- Mix question types: Multiple choice, Likert scale (agree/disagree), yes/no, and a few open-ended for richer insights.

- Target your audience: Share in relevant online communities, email lists, or social media groups.

- Offer an incentive (optional): A small gift card or entry into a draw can boost response rates.

3. Competitive Analysis (Secondary Research)

Understanding your competitors isn’t about copying them; it’s about learning from them, identifying their strengths and weaknesses, and finding your unique selling proposition (USP).

- What it is: Researching existing businesses that offer similar products or services, or solve the same problem.

- Why it’s great for startups:

- Identifies Market Gaps: Find underserved customer needs or areas where competitors fall short.

- Learns Best Practices: See what’s working well in your industry.

- Defines Your USP: Understand how you can differentiate your offering.

- Benchmarking: Set realistic expectations for pricing, features, and marketing.

- How to do it:

- Identify direct and indirect competitors: Who solves the same problem, even if differently?

- Visit their websites & social media: What’s their messaging? Who are they targeting?

- Read reviews: Check Yelp, Google Reviews, app store reviews, G2, Capterra. What do customers love/hate?

- Analyze their pricing, features, and marketing strategies.

- Sign up for their newsletters or trials: See their onboarding process and customer communication.

- Create a simple spreadsheet: Compare competitors side-by-side on key criteria.

4. Secondary Research (Desk Research)

This is the easiest and often first step in market research. It involves gathering existing information from publicly available sources.

- What it is: Collecting data that has already been compiled by others (e.g., government reports, industry statistics, academic studies, articles).

- Why it’s great for startups:

- Cost-Effective: Often free or low-cost.

- Quick Insights: Get a broad overview of market size, trends, and demographics quickly.

- Foundation for Primary Research: Helps you frame your questions for direct customer engagement.

- How to do it:

- Google is your friend: Use specific search terms related to your industry, target audience, and problem.

- Government websites: (e.g., Bureau of Labor Statistics, Census Bureau) for demographic and economic data.

- Industry associations: Often publish reports and statistics.

- Trade publications & reputable news sources: For industry-specific trends and news.

- Academic journals & university research: For deeper, evidence-based insights.

- Market research firms (e.g., Statista, Gartner): Some offer free snippets or reports.

5. Social Listening & Online Community Analysis

People are openly discussing their problems, preferences, and desires on social media and in online forums. This is a goldmine for insights.

- What it is: Monitoring social media platforms, forums (like Reddit), and online communities for mentions of your industry, competitors, or problem area.

- Why it’s great for startups:

- Authentic Feedback: People often share unfiltered opinions in these spaces.

- Trend Spotting: Identify emerging needs, complaints, or popular discussions.

- Language Insights: Learn the exact words and phrases your target audience uses, which is invaluable for marketing.

- Identify Influencers: Find people already talking about topics related to your business.

- How to do it:

- Manual search: Use platform search bars (Twitter, Reddit, Facebook Groups, LinkedIn Groups) for keywords related to your product, problem, or competitors.

- Use free tools: Google Alerts for keyword mentions, TweetDeck for Twitter monitoring.

- Join relevant groups: Observe discussions, but don’t just jump in and sell. Listen first.

- Look for pain points: What frustrates people? What are they asking for help with?

- Note positive and negative sentiment: What do people love or hate about existing solutions?

6. Focus Groups (Qualitative Research)

While more involved than one-on-one interviews, focus groups can provide a dynamic environment for discussion and debate among a small group of potential customers.

- What it is: A moderated discussion with a small group (typically 6-10 people) who represent your target audience.

- Why it’s great for startups:

- Group Dynamics: Observe how people influence each other’s opinions and preferences.

- Diverse Perspectives: Get multiple viewpoints on a topic quickly.

- Brainstorming: Can be useful for generating new ideas or refining concepts.

- How to do it:

- Recruit 6-10 participants: Ensure they fit your target demographic.

- Prepare a discussion guide: A list of open-ended questions and topics to cover.

- Find a neutral moderator: Someone who can facilitate discussion without bias.

- Choose a comfortable location: Or conduct virtually via video conferencing.

- Record the session (with permission): For later analysis.

- Look for consensus and dissent: What are the common themes? What are the disagreements?

7. Minimum Viable Product (MVP) Testing

This isn’t just a development technique; it’s a powerful market research tool. An MVP is the simplest version of your product with just enough features to solve a core problem and be usable.

- What it is: Launching a bare-bones version of your product or service to a small group of early adopters to gather real-world feedback.

- Why it’s great for startups:

- Real-World Validation: See if people actually use your product and if it solves their problem in practice.

- Early Feedback Loop: Get actionable insights on what’s working and what’s not before building out full features.

- Saves Development Costs: Don’t build expensive features that nobody wants.

- Builds Early Community: Creates a core group of passionate users.

- How to do it:

- Define your core problem and solution: What’s the absolute minimum needed to test this?

- Build quickly and cheaply: Use no-code tools, existing templates, or simple prototypes.

- Recruit early adopters: Friends, family, people from your customer interviews, online communities.

- Gather feedback relentlessly: Use surveys, in-app feedback, interviews, and analytics.

- Iterate quickly: Use the feedback to improve your MVP.

8. User Testing / Usability Testing

Once you have an MVP or even a prototype, user testing helps you understand how people interact with your product and if it’s intuitive and easy to use.

- What it is: Observing actual users as they attempt to complete specific tasks using your product, website, or app.

- Why it’s great for startups:

- Identifies Friction Points: Uncovers areas where users get stuck, confused, or frustrated.

- Improves User Experience (UX): Leads to a more intuitive and enjoyable product.

- Validates Design Decisions: Confirms if your interface makes sense to real users.

- How to do it:

- Define specific tasks: "Find X feature," "Complete Y process," "Purchase Z item."

- Recruit 3-5 users: Often, just a few users can reveal most major usability issues.

- Observe them: Ask them to "think aloud" as they perform tasks.

- Don’t interrupt or offer help: Let them struggle if they do; that’s where the insights are.

- Note where they get stuck, express frustration, or seem confused.

- Use tools: Lookback.io, UserTesting.com (paid, but good for structured tests), or simply screen recording during a video call.

9. A/B Testing (Split Testing)

While often considered a marketing technique, A/B testing is a powerful market research tool that helps you understand what resonates best with your audience.

- What it is: Comparing two versions of a webpage, email, ad, or product feature (A and B) to see which one performs better based on a specific metric (e.g., clicks, sign-ups, conversions).

- Why it’s great for startups:

- Data-Driven Decisions: Removes guesswork about what your audience prefers.

- Optimizes Marketing & Product: Improve conversion rates, user engagement, and feature adoption.

- Refines Messaging: Test different headlines, calls-to-action, or value propositions.

- How to do it:

- Identify one variable to test: Change only one thing between version A and version B.

- Define your success metric: What are you trying to improve?

- Split your audience: Show version A to half and version B to the other half.

- Run the test long enough: Gather sufficient data to draw statistically significant conclusions.

- Use tools: Google Optimize (free, for websites), built-in A/B testing features in email marketing platforms or ad platforms.

10. Trend Analysis & Future Forecasting

Looking at current and emerging trends helps you position your startup for future success and identify potential new opportunities or threats.

- What it is: Researching broader societal, technological, economic, environmental, and political (STEEP) trends that could impact your industry or target market.

- Why it’s great for startups:

- Identifies Opportunities: Spot emerging needs or shifts in consumer behavior.

- Future-Proofs Your Business: Prepare for upcoming challenges or changes.

- Informs Long-Term Strategy: Helps you build a product or service that remains relevant.

- Competitive Advantage: Be ahead of the curve.

- How to do it:

- Follow industry thought leaders: Read their blogs, listen to their podcasts, follow them on social media.

- Read trend reports: Companies like Gartner, Forrester, PwC, and Deloitte often publish free summaries.

- Monitor tech news: TechCrunch, Wired, The Verge.

- Observe consumer behavior: What are people talking about online? What new problems are arising?

- Look at adjacent industries: What innovations are happening there that could spill over?

- Think globally: Are there trends in other countries that might come to yours?

Key Tips for Successful Market Research as an Early-Stage Startup

- Start Early, Iterate Often: Don’t wait until your product is built. Research is an ongoing process.

- Combine Techniques: Use a mix of qualitative (interviews, focus groups) and quantitative (surveys, A/B tests) methods for a complete picture.

- Be Objective: Listen to what people say, even if it contradicts your assumptions. Don’t seek validation; seek truth.

- Don’t Over-Research: There’s a point of diminishing returns. Get enough data to make informed decisions, then act.

- Focus on the "Why": Always try to understand the underlying motivations and pain points, not just surface-level preferences.

- Take Actionable Insights: Research is useless if you don’t use the findings to inform your product, marketing, or business strategy.

Conclusion

Market research isn’t a daunting academic exercise for early-stage startups; it’s a vital, practical tool that can significantly increase your chances of success. By thoughtfully applying these 10 techniques, you can gain a deep understanding of your potential customers, validate your core idea, identify your unique selling points, and build a product that truly resonates with the market.

Don’t launch in the dark. Equip yourself with knowledge, learn from your audience, and build a startup that’s truly poised for growth. Start researching today!

Post Comment