How Income Tax Brackets Affect Your Take-Home Pay: A Beginner’s Guide

Ever wonder why your gross salary looks so much bigger than your actual take-home pay? You’re not alone! For many, the journey from gross income to net income can feel like a mysterious shrinking act. The primary culprit (or, perhaps, necessary participant) in this process is the income tax bracket system.

Understanding how income tax brackets work is fundamental to grasping your financial picture. It’s not just about knowing how much you pay, but why you pay it, and how seemingly small changes can impact your wallet. This comprehensive guide will demystify income tax brackets, explain their impact on your take-home pay, and empower you with the knowledge to navigate your personal finances with greater clarity.

What Are Income Tax Brackets? Understanding the Basics

At its core, an income tax bracket is a range of income that is taxed at a specific rate. Think of it like a series of buckets, or layers of an onion. As your income increases, it fills up one bucket and then spills into the next, getting taxed at a progressively higher rate for each new bucket.

The U.S. federal income tax system (and most state income tax systems) operates on a progressive tax system. This means that as your taxable income increases, the percentage of tax you pay on additional income also increases. It’s designed so that those with higher incomes contribute a larger percentage of their income in taxes, not just a larger dollar amount.

Key Concepts to Remember:

- Taxable Income: This is the portion of your gross income that is actually subject to tax. It’s calculated by taking your gross income and subtracting any deductions (like contributions to a 401(k) or health savings account, or the standard/itemized deduction).

- Marginal Tax Rate: This is the tax rate applied to the last dollar of your taxable income. It’s the rate of your highest tax bracket.

- Effective Tax Rate: This is the total percentage of your taxable income that you pay in taxes. It’s calculated by dividing your total tax liability by your total taxable income. We’ll explore this crucial distinction more below.

How Tax Brackets Work: The "Marginal" Magic Explained

This is where the biggest misconception often lies. Many people mistakenly believe that if their income pushes them into a higher tax bracket, all of their income will be taxed at that higher rate. This is incorrect!

Instead, each portion of your income is taxed at the rate of the bracket it falls into. Let’s use a simplified example (using hypothetical, rounded 2023 single-filer federal tax brackets for illustration):

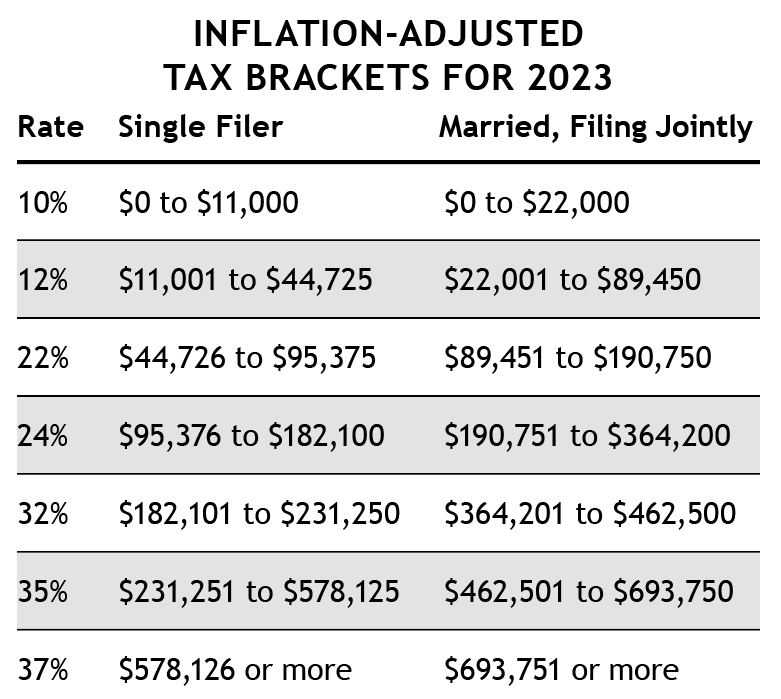

| Tax Rate | Taxable Income Range (Single Filer) |

|---|---|

| 10% | $0 to $11,000 |

| 12% | $11,001 to $44,725 |

| 22% | $44,726 to $95,375 |

| 24% | $95,376 to $182,100 |

| … | … |

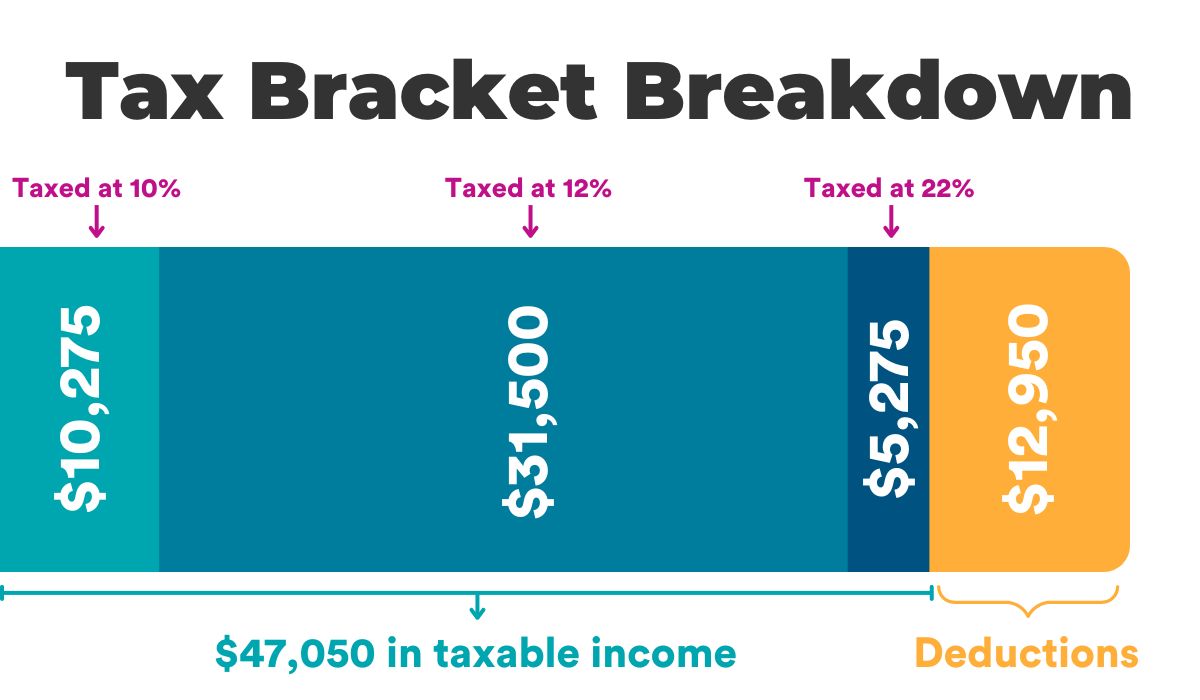

Scenario: Let’s say your Taxable Income is $50,000.

Here’s how your tax would be calculated, piece by piece:

- First $11,000: This portion of your income falls into the 10% bracket.

- $11,000 * 0.10 = $1,100

- Next $33,725: (The difference between $44,725 and $11,000). This portion falls into the 12% bracket.

- $33,725 * 0.12 = $4,047

- Remaining $5,274: (The difference between $50,000 and $44,726). This portion falls into the 22% bracket.

- $5,274 * 0.22 = $1,150.28

Your Total Tax Liability: $1,100 + $4,047 + $1,150.28 = $6,297.28

In this example, even though your income reached the 22% bracket, only a small portion of it was taxed at 22%. The majority was taxed at 10% and 12%. This is the essence of the progressive marginal tax system.

Marginal Tax Rate vs. Effective Tax Rate: Why the Difference Matters

Understanding the difference between your marginal tax rate and your effective tax rate is crucial for truly grasping your tax burden.

-

Marginal Tax Rate: As discussed, this is the rate at which your last dollar of income is taxed. In our example above, if your taxable income was $50,000, your marginal tax rate would be 22% because that’s the highest bracket your income reached. This rate is often what people refer to when they say, "I’m in the X% tax bracket."

-

Effective Tax Rate: This is the actual percentage of your total taxable income that you pay in taxes. It’s a more accurate reflection of your overall tax burden.

Using our previous example ($50,000 taxable income, $6,297.28 total tax liability):

- Effective Tax Rate = Total Tax Liability / Taxable Income

- Effective Tax Rate = $6,297.28 / $50,000 = 0.1259 or 12.59%

Notice how your effective tax rate (12.59%) is significantly lower than your marginal tax rate (22%). This is why simply knowing your highest bracket doesn’t tell the whole story of how much you’re truly paying in taxes. When considering financial decisions like a raise or a bonus, it’s the marginal rate that applies to those extra dollars, but your effective rate is what truly reflects your overall tax efficiency.

How Tax Brackets Directly Impact Your Take-Home Pay

Now, let’s connect the dots to your paycheck. Your take-home pay (or net pay) is what’s left after your employer withholds various amounts from your gross pay. Federal income tax is a significant portion of these withholdings.

Here’s a simplified breakdown of the flow:

- Gross Pay: Your total earnings before any deductions.

- Pre-Tax Deductions: Contributions to retirement accounts (like a 401(k)), health savings accounts (HSAs), or certain health insurance premiums are typically deducted before your taxable income is calculated. These deductions reduce your taxable income, which can potentially lower the tax bracket your highest dollars fall into, thus reducing your overall tax liability.

- Taxable Income: Gross Pay – Pre-Tax Deductions.

- Federal Income Tax Withholding: Based on your W-4 form (which tells your employer how much to withhold based on your filing status, dependents, and other adjustments), your employer estimates your annual tax liability using the tax bracket system and withholds a portion from each paycheck.

- Other Deductions:

- FICA Taxes: Social Security (6.2%) and Medicare (1.45%) taxes are mandatory federal taxes. These are separate from income tax and are applied to a certain portion of your income regardless of brackets (though Social Security has an income cap).

- State and Local Taxes: Many states and some cities have their own income taxes, which also operate on bracket systems (though some are flat tax systems).

- Post-Tax Deductions: Things like Roth 401(k) contributions, some insurance premiums, or union dues are taken out after taxes are calculated.

The direct impact of tax brackets on your take-home pay comes from step 4. The higher your estimated taxable income, and the higher the marginal tax rates applied to portions of that income, the more federal income tax will be withheld from each paycheck, leaving you with less take-home pay.

Factors That Influence Your Tax Bracket and Take-Home Pay

While tax brackets are fixed by law, several personal factors can influence which brackets your income falls into and, consequently, your take-home pay.

-

1. Your Filing Status: This is one of the most significant determinants of which tax bracket ranges apply to you. The IRS offers five filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Each status has different standard deduction amounts and income thresholds for tax brackets, often making the income ranges wider for married couples filing jointly or heads of household.

-

2. Standard Deduction vs. Itemized Deductions:

- Standard Deduction: A fixed dollar amount that you can subtract from your adjusted gross income (AGI) if you choose not to itemize. This immediately reduces your taxable income.

- Itemized Deductions: Certain eligible expenses (like mortgage interest, state and local taxes, charitable contributions, medical expenses) that you can subtract from your AGI if their total exceeds the standard deduction.

The higher your deductions, the lower your taxable income, potentially moving you into a lower marginal tax bracket or reducing the amount of income taxed at your highest bracket.

-

3. Tax Credits: Unlike deductions, which reduce your taxable income, tax credits directly reduce your tax liability dollar-for-dollar. For example, a $1,000 tax credit reduces your tax bill by $1,000. Common credits include the Child Tax Credit, Earned Income Tax Credit, and education credits. Tax credits can significantly lower your final tax bill, effectively increasing your take-home pay over the year (or resulting in a larger refund).

-

4. Pre-Tax Contributions: As mentioned, contributions to retirement accounts (like a traditional 401(k) or IRA) or health savings accounts (HSAs) reduce your taxable income. This means those dollars are not subject to income tax in the current year, potentially lowering your marginal tax rate and increasing your current take-home pay.

-

5. Other Income Sources: If you have income from sources other than your primary job (e.g., freelance work, investments, rental property), this income adds to your total taxable income and can push you into a higher tax bracket.

Practical Tips for Understanding and Potentially Optimizing Your Taxes

Navigating the tax system might seem daunting, but a little knowledge goes a long way.

- Review Your W-4 Form Annually: Your W-4 form tells your employer how much federal income tax to withhold from each paycheck. Life changes (marriage, new baby, second job) can significantly impact your tax situation. Reviewing and updating your W-4 ensures you’re not over- or under-withholding. The IRS Tax Withholding Estimator is a free online tool to help you.

- Understand Your Pay Stub: Your pay stub isn’t just a number; it’s a detailed breakdown of your earnings and deductions. Familiarize yourself with the various line items, especially federal income tax, state income tax, and FICA taxes.

- Utilize Deductions and Credits: Don’t leave money on the table! Understand which deductions and credits you qualify for. Maximize contributions to pre-tax retirement accounts or HSAs if financially feasible.

- Plan Ahead: Don’t wait until April 15th. Consider doing a tax projection mid-year to estimate your annual tax liability, especially if you anticipate significant income changes or life events.

- Seek Professional Advice: For complex financial situations or if you’re unsure about specific deductions or credits, consulting a qualified tax professional (CPA or Enrolled Agent) can save you money and stress in the long run.

Conclusion

Income tax brackets are a fundamental component of our progressive tax system, directly influencing how much of your hard-earned money makes it into your bank account. By understanding the distinction between marginal and effective tax rates, recognizing how your taxable income is calculated, and being aware of the various factors that influence your tax liability, you gain greater control and clarity over your finances.

While the "shrinking paycheck" might still sting a little, knowing why it happens and how you can strategically manage your tax situation empowers you to make smarter financial decisions. Take the time to understand your tax obligations, and you’ll be well on your way to a more confident financial future.

Post Comment