Understanding Economic Contraction: Signs and Symptoms – A Comprehensive Beginner’s Guide

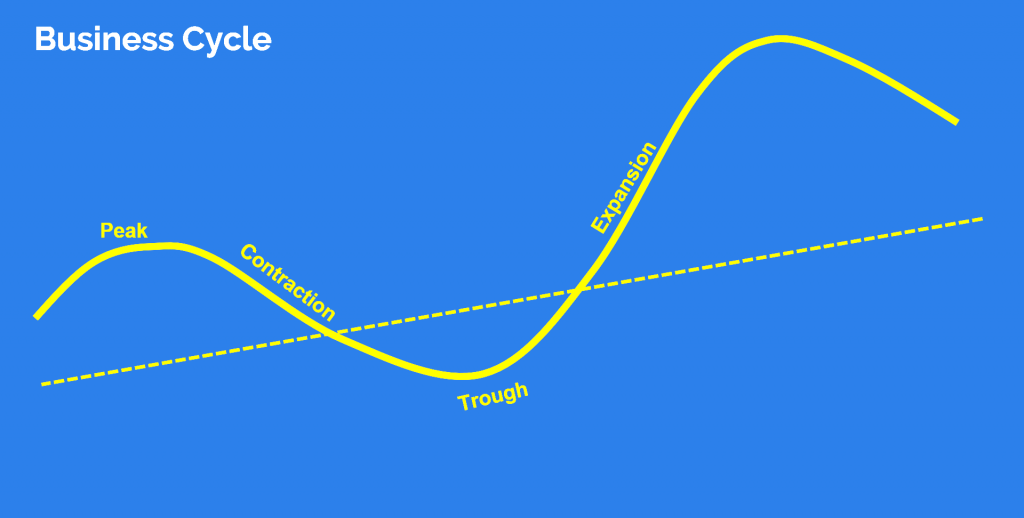

The economy is a bit like the weather – it has its seasons. Sometimes it’s sunny and growing (expansion), and other times it’s cloudy and shrinking (contraction). While economic contractions are a natural part of the business cycle, understanding them is crucial for individuals, businesses, and policymakers alike.

This guide will break down what economic contraction means, explore its key signs and symptoms in an easy-to-understand way, and help you recognize when the economic climate might be shifting.

What Exactly is Economic Contraction? The Basics

Imagine the economy as a giant pie that represents all the goods and services produced in a country. When the pie gets bigger, the economy is growing. When the pie starts to shrink, that’s an economic contraction.

In simpler terms, an economic contraction is a period when a country’s economic activity slows down and its overall production of goods and services decreases. It’s the opposite of economic growth.

The most common and widely accepted way to measure this economic activity is through something called Gross Domestic Product (GDP).

- Gross Domestic Product (GDP): This is the total value of all goods and services produced within a country’s borders over a specific period (usually a quarter or a year).

- If GDP is consistently going up, the economy is expanding.

- If GDP is consistently going down, the economy is contracting.

A commonly used rule of thumb to define a recession (a significant form of economic contraction) is two consecutive quarters of declining GDP. However, it’s important to note that official declarations of recessions often consider a broader range of economic indicators, not just GDP.

Why Does Economic Contraction Matter?

When the economy contracts, it has real-world impacts that affect everyone:

- Job Losses: Businesses may cut back, leading to layoffs and higher unemployment.

- Reduced Income: People might earn less, or wages may stagnate.

- Lower Consumer Confidence: People become more cautious about spending.

- Business Struggles: Companies face reduced sales and profits, potentially leading to bankruptcies.

- Investment Decline: Fewer new businesses are started, and existing ones put expansion plans on hold.

Understanding the signs of contraction can help you make more informed decisions about your finances, career, and investments.

Key Signs and Symptoms of Economic Contraction

Economic contractions rarely happen overnight. They are usually preceded by a series of warning signs and manifest through various symptoms across different sectors. Let’s explore these in detail:

1. Economic Indicators: The Data Points

These are the official statistics that economists and governments track closely.

-

Declining Gross Domestic Product (GDP):

- Sign: The most direct indicator. If the quarterly GDP report shows a negative number (meaning the economy shrank) and then another negative number the following quarter, it’s a strong sign of a recession.

- Why it matters: It means less is being produced and sold overall, indicating a slowdown in the entire economy.

-

Rising Unemployment Rate:

- Sign: More people are looking for work, and fewer jobs are available. The unemployment rate, which measures the percentage of the workforce that is unemployed but actively seeking work, starts to climb steadily.

- Why it matters: Job losses mean less income for households, which translates to less spending, further slowing down the economy.

-

Falling Industrial Production:

- Sign: Factories and mines are producing less. This metric measures the output of the manufacturing, mining, and utility sectors. A consistent decline indicates less demand for goods.

- Why it matters: If businesses aren’t producing as much, it means they anticipate less consumer demand, or they’re already facing it. This can lead to reduced work hours or layoffs for factory workers.

-

Decreased Retail Sales:

- Sign: People are spending less money in stores and online. This covers everything from cars and electronics to clothing and groceries.

- Why it matters: Consumer spending is a huge driver of economic growth. When people cut back, businesses suffer, leading to reduced profits and potentially job cuts.

-

Declining Personal Income and Wages:

- Sign: People’s earnings are stagnating or even decreasing. This can be due to reduced work hours, pay cuts, or the inability to find higher-paying jobs.

- Why it matters: Less disposable income means less money available for spending, reinforcing the economic slowdown.

-

Deflation (or very low inflation after high inflation):

- Sign: While not always a direct sign of contraction, deflation (a general decrease in prices) is a strong symptom. When prices fall, consumers often delay purchases, hoping for even lower prices, which further stifles demand. Conversely, if high inflation suddenly drops sharply, it can signal a rapid cooling of the economy.

- Why it matters: Deflation can create a vicious cycle where falling prices lead to reduced profits for businesses, which then cut production and jobs, leading to less spending and even lower prices.

2. Consumer Behavior: The Everyday Pulse

How people feel and act about their finances is a powerful indicator.

-

Reduced Consumer Confidence:

- Sign: Surveys show that people are feeling less optimistic about the economy’s future, their job prospects, and their personal financial situation. They become more cautious.

- Why it matters: When people are worried, they tend to save more and spend less, especially on big-ticket items like cars or home renovations, which directly impacts businesses.

-

Cutback on Discretionary Spending:

- Sign: People stop buying non-essential items like new clothes, dining out, vacations, or luxury goods. They prioritize necessities.

- Why it matters: Businesses that rely on these "nice-to-have" purchases feel the pinch first, often leading to layoffs in those sectors.

-

Increased Savings Rate (sometimes):

- Sign: Faced with uncertainty, people may choose to save more of their income rather than spending it, building a financial cushion.

- Why it matters: While good for individual security, widespread increased saving means less money circulating in the economy, which can exacerbate a slowdown.

-

Rising Credit Card Defaults and Loan Delinquencies:

- Sign: More people are struggling to make their loan payments on time, whether it’s credit cards, mortgages, or car loans.

- Why it matters: This indicates financial distress among households and can lead to problems for banks and lenders, potentially tightening credit for everyone.

3. Business Behavior: The Corporate Barometer

Businesses react quickly to changing economic conditions.

-

Layoffs and Hiring Freezes:

- Sign: Companies announce plans to reduce their workforce, stop hiring new employees, or postpone planned expansions.

- Why it matters: This is one of the most visible and impactful signs, directly contributing to higher unemployment and lower consumer confidence.

-

Reduced Business Investment:

- Sign: Businesses delay or cancel plans for new factories, equipment upgrades, or research and development projects.

- Why it matters: Less investment means slower innovation, reduced capacity for future growth, and fewer jobs created.

-

Inventory Buildup:

- Sign: Companies find themselves with too many unsold goods sitting in warehouses because consumer demand has fallen.

- Why it matters: High inventory levels often force businesses to cut production, offer discounts (reducing profits), and potentially lay off workers.

-

Increased Bankruptcies:

- Sign: More businesses, especially small and medium-sized ones, are unable to sustain themselves and declare bankruptcy.

- Why it matters: This is a severe symptom, leading to further job losses and a reduction in overall economic capacity.

4. Financial Markets: The Nervous System

Financial markets are highly sensitive and often react quickly to anticipated economic shifts.

-

Stock Market Decline (Bear Market):

- Sign: Share prices of companies consistently fall over a sustained period (often defined as a 20% drop from recent highs).

- Why it matters: A falling stock market reflects investor pessimism about future corporate profits and the overall economic outlook. It can also reduce household wealth, impacting spending.

-

Tightening Credit Conditions (Credit Crunch):

- Sign: Banks become more hesitant to lend money to businesses and individuals, or they demand higher interest rates and stricter collateral.

- Why it matters: If it’s harder and more expensive to borrow money, businesses can’t expand, and consumers can’t make large purchases, stifling economic activity.

-

Yield Curve Inversion:

- Sign: This is a more technical indicator. Normally, longer-term bonds (e.g., 10-year Treasury bonds) have higher interest rates (yields) than shorter-term bonds (e.g., 2-year Treasury bonds). An "inversion" occurs when short-term yields become higher than long-term yields.

- Why it matters: Historically, an inverted yield curve has been a very reliable predictor of upcoming recessions, as it suggests investors expect lower long-term interest rates due to a future economic slowdown.

-

Housing Market Slump:

- Sign: Fewer homes are being sold, housing prices start to fall, and new construction projects decline.

- Why it matters: The housing market is a significant part of the economy, affecting construction, real estate, and consumer spending on home-related goods. A slump here can have widespread ripple effects.

5. Government and Central Bank Actions (Response to Contraction)

While not direct symptoms of contraction, the actions taken by governments and central banks often signal that a contraction is underway or highly anticipated.

-

Interest Rate Cuts by the Central Bank:

- Sign: The central bank (like the Federal Reserve in the U.S.) lowers its benchmark interest rates to make borrowing cheaper and encourage spending and investment.

- Why it matters: This is a powerful tool used to stimulate the economy, and its deployment often indicates that policymakers believe a slowdown is significant enough to warrant intervention.

-

Government Stimulus Packages:

- Sign: The government introduces measures like tax cuts, increased government spending on infrastructure, or direct payments to citizens to inject money into the economy.

- Why it matters: These are deliberate attempts to counteract a contraction by boosting demand and creating jobs, confirming the seriousness of the economic situation.

Recession vs. Depression: What’s the Difference?

While "economic contraction" is the umbrella term, it’s important to distinguish between a recession and a depression.

- Recession: A significant, widespread, and prolonged downturn in economic activity. As mentioned, it’s often defined by two consecutive quarters of negative GDP growth, along with other indicators like rising unemployment. Recessions can last anywhere from a few months to over a year. Most economic contractions are recessions.

- Depression: A severe and prolonged recession. There’s no strict definition, but it involves a much larger decline in GDP, significantly higher unemployment, and a much longer duration than a typical recession. The Great Depression of the 1930s is the most famous example, lasting for years and causing widespread hardship. Depressions are much rarer than recessions.

Think of it like this: a recession is a bad cold, while a depression is a severe, long-lasting pneumonia.

What Causes Economic Contractions? (Briefly)

Economic contractions can be triggered by a variety of factors, often a combination of them:

- Sudden Shocks: Unexpected events like a global pandemic (e.g., COVID-19), a major natural disaster, or a sharp rise in oil prices.

- Asset Bubbles Bursting: When the price of an asset (like housing or stocks) rises unsustainably and then crashes, leading to widespread financial losses.

- High Interest Rates: Central banks might raise interest rates to combat high inflation, which can slow down borrowing and spending too much, leading to a contraction.

- Lack of Consumer Demand: If people simply stop buying things, businesses will produce less.

- Financial Crises: Problems within the banking system or credit markets can make it hard for businesses and individuals to get loans, stifling activity.

- Geopolitical Events: Wars, trade disputes, or political instability can disrupt supply chains and economic confidence.

What Happens Next? The Path to Recovery

Economic contractions are a natural part of the business cycle. They are typically followed by a period of recovery and then a new phase of expansion. Governments and central banks often implement policies to soften the blow of a contraction and help stimulate a recovery.

Conclusion

Understanding economic contraction isn’t about predicting the future with certainty, but about recognizing the signs and symptoms that indicate a shift in the economic landscape. By keeping an eye on key indicators like GDP, unemployment rates, consumer behavior, and financial market trends, you can gain a clearer picture of the economy’s health.

Being informed allows you to make more thoughtful decisions for your personal finances and career, and it helps you understand the broader economic discussions that impact us all. While contractions can be challenging, they are also a cyclical part of economic life, eventually paving the way for recovery and renewed growth.

Frequently Asked Questions (FAQs)

Q1: How long do economic contractions typically last?

A1: Recessions (the most common form of contraction) vary in length, but they typically last from a few months to over a year. The average length of a recession in the U.S. since World War II has been about 10-11 months.

Q2: Can I prepare for an economic contraction?

A2: Yes! While you can’t prevent one, you can prepare. This includes building an emergency savings fund, paying down debt, diversifying investments, and ensuring your job skills are in demand.

Q3: What’s the difference between an "economic slowdown" and a "contraction"?

A3: An "economic slowdown" means the economy is still growing, but at a slower pace than before. A "contraction" means the economy is actually shrinking (negative growth). A slowdown can precede a contraction.

Q4: Who officially declares a recession?

A4: In the United States, recessions are officially declared by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER). They look at a range of indicators, not just the two-quarter GDP rule, to make their determination. Other countries have similar bodies or rely on government statistical agencies.

Q5: Is inflation always bad during a contraction?

A5: Not always, but high inflation combined with a contraction (a situation called "stagflation") can be particularly challenging because it means prices are rising while the economy is shrinking and jobs are being lost. On the other hand, deflation (falling prices) during a contraction is generally seen as very problematic as it can lead to a downward spiral of reduced spending and investment.

Post Comment