Navigating the Global Economic Landscape: Key Outlooks & Trends Explained for Beginners

The global economy can seem like a complex, ever-shifting puzzle, with headlines about inflation, interest rates, trade wars, and technological breakthroughs swirling constantly. For beginners, it’s easy to feel lost. But understanding the big picture of the world economy isn’t just for economists; it’s crucial for everyone, as it impacts everything from job prospects and prices at the grocery store to investment opportunities and the future of our planet.

This long-form, SEO-friendly article aims to demystify the global economic outlook and key trends, breaking down complex ideas into easy-to-understand language. We’ll explore the major forces shaping our economic future, touching upon dozens of interconnected ideas that paint a comprehensive picture of where we are and where we might be headed.

Understanding the Global Economic Pulse: What is the "Outlook"?

Think of the "global economic outlook" like a weather forecast for the world’s money and markets. It’s a prediction of how the overall economy – including jobs, prices, production, and trade – is expected to perform in the near future (the next year or two) and the longer term. This forecast is based on analyzing a vast array of factors, from consumer spending habits to geopolitical tensions.

Why does it matter to you?

- Your Job: A strong economy often means more job opportunities and potentially higher wages.

- Your Wallet: Economic trends influence the prices you pay for goods (inflation) and how much interest you earn on savings or pay on loans.

- Your Investments: Understanding the outlook can help you make smarter decisions about saving and investing for the future.

- Your Future: Long-term trends like climate change and AI will shape the world your children inherit.

I. Core Drivers of the Global Economy: The Fundamental Forces

To understand the outlook, we first need to grasp the foundational elements that drive economic activity worldwide.

A. Inflation & Interest Rates: The Cost of Living and Borrowing

Perhaps the most talked-about economic topic lately, inflation and interest rates are two sides of the same coin, directly impacting your daily life.

-

What is Inflation?

- Simple Definition: Inflation is the general increase in the prices of goods and services over time, meaning your money buys less than it used to. Think of it as your dollar losing some of its "buying power."

- Causes: Often driven by strong demand (people want to buy a lot), supply shortages (not enough goods available), or too much money circulating in the economy.

- Impact: Reduces purchasing power, makes saving less attractive (unless interest rates keep up), and can hurt those on fixed incomes.

-

What are Interest Rates?

- Simple Definition: Interest rates are essentially the "cost of borrowing money" or the "reward for lending money." When you take out a loan, you pay interest; when you save money in a bank, the bank pays you interest. Central banks (like the Federal Reserve in the US or the European Central Bank) set key interest rates.

- Central Bank’s Role: Central banks raise interest rates to cool down an overheating economy and fight inflation (making borrowing more expensive, which slows spending). They lower rates to stimulate a sluggish economy (making borrowing cheaper, encouraging spending and investment).

- Impact: Higher rates mean more expensive mortgages, car loans, and business loans, which can slow down economic growth but help control inflation. Lower rates have the opposite effect.

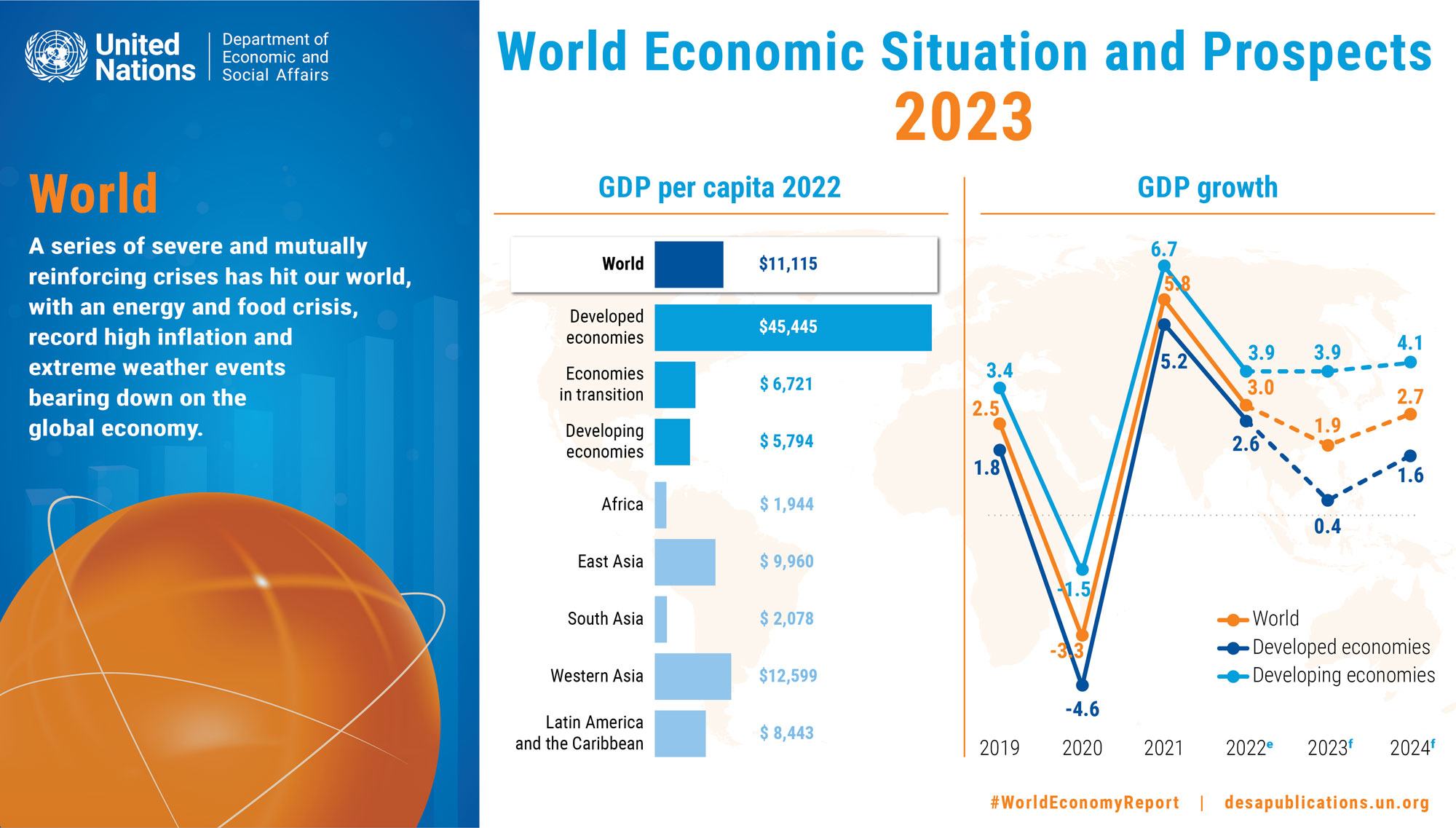

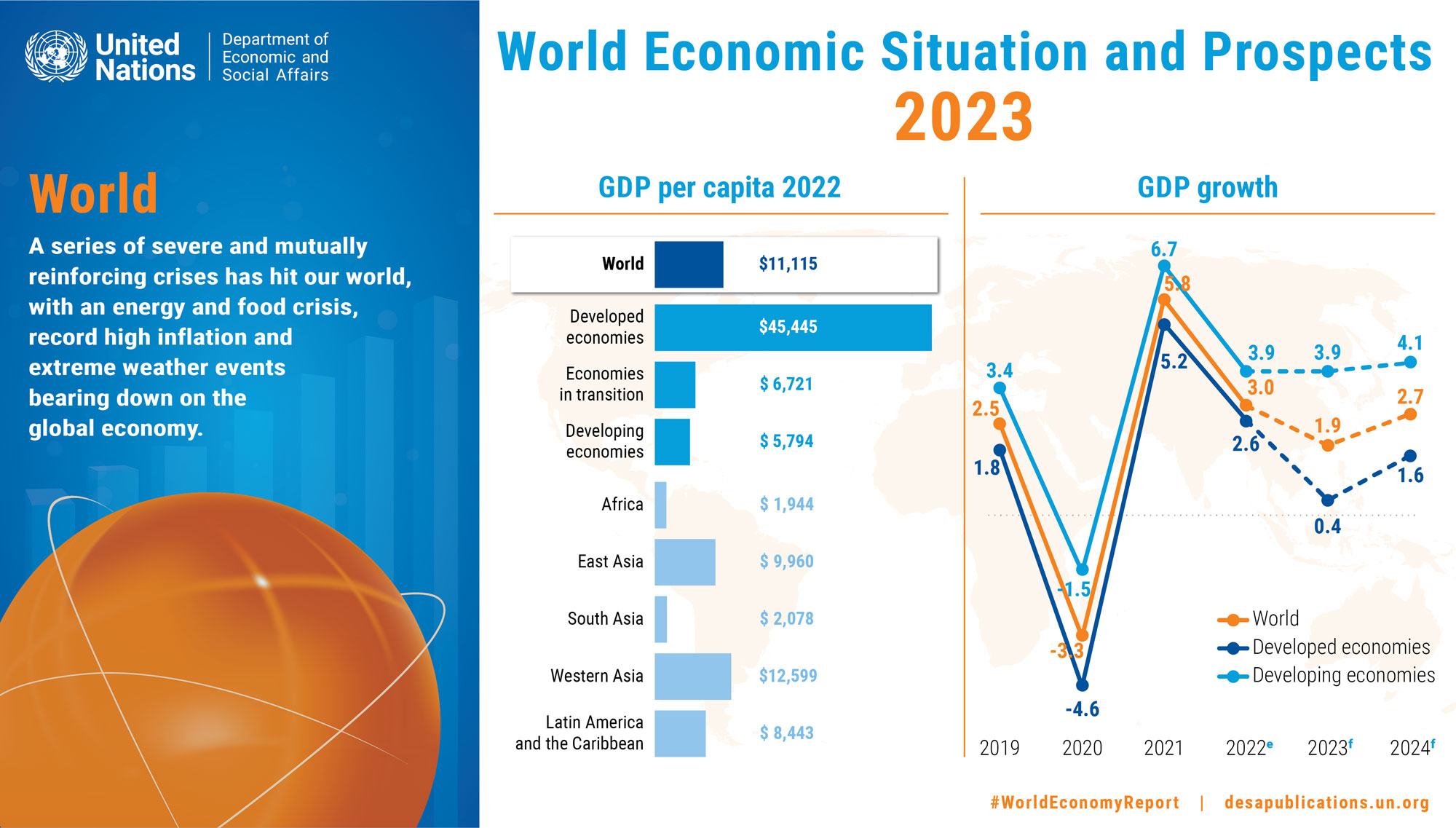

B. Economic Growth (GDP): The World’s Report Card

Gross Domestic Product (GDP) is the most common measure of a country’s economic health, and by extension, the global economy.

- What is GDP?

- Simple Definition: GDP is the total value of all goods and services produced within a country’s borders over a specific period (usually a year or a quarter). It’s like the country’s "income statement."

- Growth vs. Recession: When GDP is growing, the economy is expanding, jobs are often being created, and incomes are rising. When GDP shrinks for two consecutive quarters, it’s typically considered a recession.

- Global Impact: The collective GDP of all countries gives us a picture of global economic growth. Strong growth in major economies often spills over to others through trade and investment.

C. Labor Markets: Jobs, Wages, and the Workforce

The state of the labor market tells us a lot about economic health and consumer confidence.

- Key Indicators:

- Unemployment Rate: The percentage of the workforce that is actively looking for a job but can’t find one. Low unemployment generally indicates a strong economy.

- Wage Growth: How fast workers’ pay is increasing. Healthy wage growth is good for consumers but can also contribute to inflation if it outpaces productivity.

- Labor Force Participation: The percentage of the working-age population that is either employed or actively looking for work.

- Trends to Watch: Shifting demographics (aging populations), the rise of the gig economy, and the impact of automation on job types.

D. Supply Chains: The Flow of Goods

The journey products take from raw materials to your doorstep is called the supply chain. Recent years have highlighted its critical importance.

- Simple Definition: The network of organizations, people, activities, information, and resources involved in moving a product or service from supplier to customer.

- Disruptions: Events like pandemics, natural disasters, or geopolitical conflicts can disrupt supply chains, leading to shortages, delays, and higher prices.

- Resilience: Businesses are increasingly focusing on making their supply chains more robust and less reliant on single sources or long, vulnerable routes. This can involve "reshoring" (bringing production back home) or "friend-shoring" (sourcing from politically aligned countries).

E. Geopolitics & Policy: The Influence of World Events & Government Decisions

Wars, trade agreements, political stability, and government policies significantly impact the global economic landscape.

- Geopolitical Risks: Conflicts (e.g., in Ukraine, Middle East), trade tensions (e.g., between the US and China), and political instability in key regions can disrupt trade, energy supplies, and investment flows, leading to uncertainty and economic slowdowns.

- Government Policies:

- Fiscal Policy: How governments spend money and collect taxes. Big spending on infrastructure or social programs can stimulate the economy, while tax hikes can slow it down.

- Monetary Policy: As discussed, how central banks manage money supply and interest rates.

- Trade Policy: Tariffs (taxes on imports), trade agreements, and restrictions on certain goods can alter global trade patterns and affect industries.

II. Transformative Global Economic Trends: Shaping the Future

Beyond the immediate drivers, several powerful, long-term trends are fundamentally reshaping the global economy.

A. Digital Transformation & Artificial Intelligence (AI): The New Industrial Revolution

Technology has always been an economic game-changer, and the current wave of digital transformation and AI is no exception.

- Impact on Business: AI and automation are streamlining operations, improving efficiency, and creating new products and services across almost every industry, from healthcare to finance.

- Job Market Evolution: While AI can automate some tasks, it also creates new jobs requiring different skills. The focus shifts towards roles involving creativity, critical thinking, and human interaction.

- Productivity Growth: AI has the potential to significantly boost productivity, allowing more to be produced with the same or fewer resources, which is a key driver of long-term economic growth.

- Data Economy: Data is the new oil, fueling AI and driving new business models based on insights and personalization.

B. Climate Change & the Green Economy: A Necessary Shift

The urgent need to address climate change is driving a massive global economic transformation towards sustainability.

- Investment in Renewables: Huge investments are pouring into solar, wind, and other renewable energy sources, creating new industries and jobs.

- Sustainable Practices: Businesses are adopting greener production methods, reducing waste, and focusing on circular economy principles (reusing and recycling materials).

- Carbon Pricing & Regulations: Governments are implementing policies like carbon taxes and emissions limits to incentivize cleaner practices, which can impact industries heavily reliant on fossil fuels.

- Climate Risks: Extreme weather events, rising sea levels, and resource scarcity pose significant economic risks, disrupting agriculture, infrastructure, and human migration.

C. Demographics: Population Shifts and Their Economic Echoes

Changes in population size, age structure, and migration patterns have profound economic implications.

- Aging Populations: Many developed countries (and increasingly some developing ones like China) face aging populations, leading to fewer workers, higher healthcare costs, and pressure on pension systems.

- Youth Bulges: In contrast, some developing nations have young, growing populations, offering a potential "demographic dividend" of a large workforce, but also requiring massive investment in education and job creation.

- Migration: International migration patterns, driven by economic opportunity, conflict, or climate, impact labor markets, remittances (money sent home by migrants), and social services in both origin and host countries.

D. Globalization vs. Deglobalization: A Shifting World Order

The long trend of increasing global interconnectedness is facing new challenges.

- Globalization: The process of increasing interdependence among countries, driven by free trade, cross-border investment, and cultural exchange. It generally leads to greater efficiency and lower costs through specialization.

- Deglobalization/Slowbalization: A trend where countries become less interconnected, driven by protectionism, national security concerns, supply chain vulnerabilities, and geopolitical rivalries. This can lead to higher costs but potentially more resilient domestic industries.

- Regionalization: Instead of full deglobalization, we might see more emphasis on regional trade blocs and supply chains, fostering stronger economic ties within specific geographic areas.

III. Regional Economic Snapshots: A Quick Global Tour

The global economy is a mosaic of diverse regional performances.

A. Developed Economies (e.g., North America, Europe, Japan)

- Characteristics: High income per person, advanced technology, stable institutions, often slower population growth and aging workforces.

- Current Outlook: Grappling with inflation, rising interest rates, and the challenges of an aging population. Focus on innovation, green transition, and managing public debt. Growth is generally slower but more stable.

B. Emerging Markets (e.g., China, India, Brazil, African Nations)

- Characteristics: Rapid economic growth potential, large populations, often younger workforces, but also higher volatility, infrastructure gaps, and sometimes political instability.

- Current Outlook:

- China: Facing structural challenges like a property market slowdown, demographic shifts, and increased geopolitical tensions, transitioning from export-led growth to domestic consumption.

- India: Often seen as a rising economic powerhouse with a young population and strong digital adoption, poised for significant growth.

- Other Emerging Economies: Diverse outlooks, often dependent on commodity prices, political stability, and their ability to attract foreign investment and manage debt. Many are investing heavily in infrastructure and technology.

IV. Key Challenges & Opportunities in the Global Economic Outlook

Navigating the future requires acknowledging both the hurdles and the pathways to progress.

A. Major Challenges

- Persistent Inflation: The risk that inflation remains higher than central banks’ targets, forcing continued high interest rates and potentially slowing growth.

- Rising Debt Levels: High government and corporate debt globally, which can limit governments’ ability to respond to future crises and increase financial instability.

- Geopolitical Fragmentation: Increased trade barriers, technology decoupling, and political rivalries could slow down global growth and make cooperation on shared challenges more difficult.

- Inequality: The widening gap between the rich and the poor, both within and between countries, can lead to social unrest and hinder sustainable economic development.

- Climate-Related Disasters: The increasing frequency and intensity of extreme weather events cause immense economic damage and displacement.

B. Significant Opportunities

- Technological Innovation: AI, biotechnology, and renewable energy offer transformative potential for productivity, new industries, and solutions to global problems.

- Green Economy Transition: The shift to sustainable practices creates massive investment opportunities in clean energy, sustainable agriculture, and resource efficiency.

- Emerging Market Growth: Many developing countries offer huge potential for economic expansion, driven by young populations, urbanization, and increasing consumer markets.

- Global Collaboration: Despite fragmentation, there’s a recognized need for international cooperation on issues like climate change, pandemics, and financial stability.

- Resilience Building: Lessons learned from recent crises are driving efforts to build more robust supply chains, diversified economies, and adaptable workforces.

V. How to Stay Informed & Make Sense of It All (For Beginners)

Understanding the global economy doesn’t require a degree in economics. Here’s how you can keep up:

- Follow Reputable News Sources: Stick to established financial news outlets (e.g., Wall Street Journal, Financial Times, Bloomberg, Reuters) and major news organizations (e.g., BBC, New York Times) that have dedicated economic sections.

- Understand Key Terms: Don’t be intimidated by jargon. When you see a term you don’t understand (like "quantitative easing" or "yield curve inversion"), look it up simply. Many websites and apps offer easy explanations.

- Focus on the "Why": Instead of just reading what happened (e.g., "inflation rose"), try to understand why it happened and what its potential consequences are.

- Look for Trends, Not Just Headlines: A single day’s news is less important than observing patterns over weeks or months.

- Listen to Podcasts/Watch Videos: Many economists and financial experts create content specifically designed to explain complex topics in an accessible way.

- Visit International Organization Websites: Institutions like the International Monetary Fund (IMF), World Bank, and Organization for Economic Co-operation and Development (OECD) publish regular reports and data that are often simplified for public consumption.

Conclusion: A Dynamic and Interconnected World

The global economic outlook is rarely static. It’s a dynamic interplay of countless forces, from the decisions of central bankers to the innovations of tech entrepreneurs and the shifting sands of geopolitics. While the landscape is filled with both challenges and uncertainties, it’s also brimming with opportunities driven by human ingenuity and the pursuit of a better future.

By understanding these core drivers and transformative trends, even as a beginner, you can gain a clearer perspective on the forces shaping our world. This knowledge empowers you to make more informed decisions, whether it’s about your personal finances, your career path, or simply being a more engaged and aware global citizen. The journey to economic literacy begins with curiosity, and the world economy offers an endless supply of fascinating insights.

Frequently Asked Questions (FAQs) about the Global Economic Outlook

Q1: What’s the difference between inflation and recession?

A1: Inflation is when prices generally go up, meaning your money buys less. A recession is when the overall economy shrinks for an extended period (typically two consecutive quarters of negative GDP growth), leading to job losses and reduced business activity. While inflation can sometimes contribute to a recession (if central banks raise rates too much to fight it), they are distinct concepts.

Q2: How does the global economy affect my daily life?

A2: Directly! Global economic trends influence:

- Prices: If global oil prices rise, so does the cost of gas and many goods.

- Job Market: A strong global economy can mean more demand for products, leading to more jobs and higher wages in your country.

- Investments: Global market performance impacts your retirement savings or stock investments.

- Cost of Borrowing: Global interest rate trends influence your mortgage, car loan, or credit card rates.

Q3: Is a global recession likely soon?

A3: Economic forecasts are always uncertain. While many economists have worried about a global recession due to high inflation and rising interest rates, recent data has shown some resilience. However, risks remain, including ongoing geopolitical tensions, persistent inflation, and financial instability. It’s a continuous balancing act for policymakers.

Q4: What are "emerging markets" and why are they important?

A4: Emerging markets are countries that are in the process of rapid industrialization and economic growth, transitioning from lower to higher income economies. They are important because they represent a significant portion of the world’s population, future economic growth, and often offer unique investment opportunities. Examples include India, Brazil, Mexico, and many countries in Southeast Asia and Africa.

Q5: How does climate change impact the economy?

A5: Climate change has significant economic impacts:

- Direct Costs: Damage from extreme weather events (storms, floods, droughts) costs billions.

- Resource Scarcity: Affects agriculture, water supply, and energy.

- Transition Costs: Shifting to green energy and sustainable practices requires massive investment, but also creates new industries and jobs.

- Productivity Loss: Heat stress and health issues reduce worker productivity.

- Migration: Climate-induced migration can strain resources in host areas.

Q6: What’s the role of central banks in the economy?

A6: Central banks are like the economy’s "financial doctors." Their main roles are to:

- Control Inflation: By adjusting interest rates and managing the money supply.

- Promote Full Employment: By encouraging economic growth when appropriate.

- Maintain Financial Stability: By overseeing banks and financial systems to prevent crises.

- They aim to create a stable environment for businesses and consumers to thrive.

Post Comment