Target-Date Funds: Are They Right for Your Retirement? A Beginner’s Guide

Retirement planning can feel like navigating a complex maze. With so many investment options, strategies, and financial jargon, it’s easy to feel overwhelmed. But what if there was an investment designed to simplify the entire process, adapting to your needs as you get closer to your golden years? Enter Target-Date Funds (TDFs).

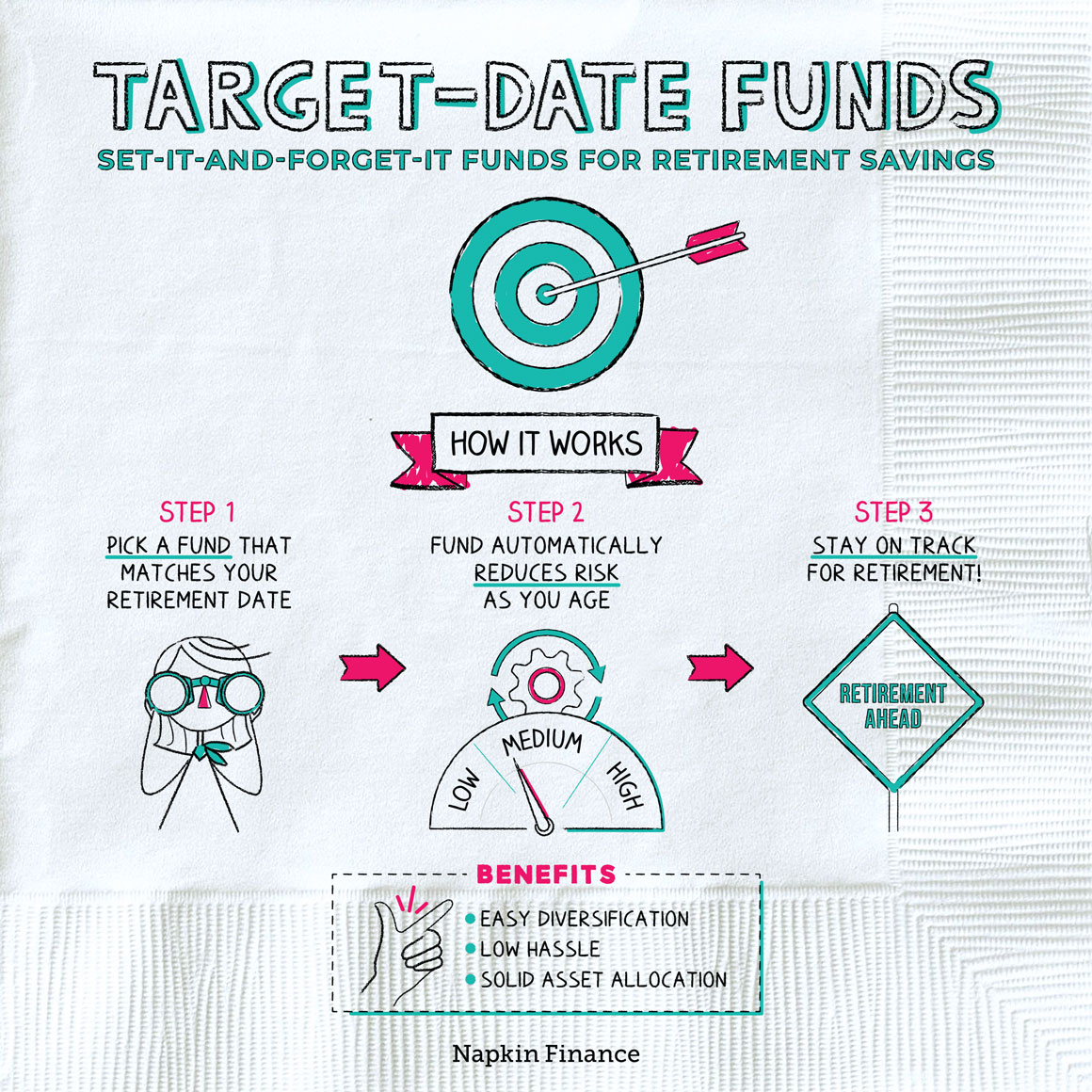

Often hailed as the "set it and forget it" solution for retirement savings, Target-Date Funds have become incredibly popular, especially as default options in many 401(k) plans. But are they truly the silver bullet for your retirement dreams, or are there nuances you need to understand?

In this comprehensive guide, we’ll demystify Target-Date Funds, explaining how they work, their pros and cons, and whether they’re the right fit for your unique financial journey.

What Exactly Are Target-Date Funds?

Imagine you’re planning a cross-country road trip. You wouldn’t use the same car for a rugged mountain trail as you would for a smooth highway cruise, right? Similarly, your investment strategy should change as you get closer to your retirement "destination."

That’s precisely what a Target-Date Fund does. It’s a type of mutual fund or Exchange-Traded Fund (ETF) that holds a diversified mix of investments – typically stocks, bonds, and sometimes other assets – and automatically adjusts that mix over time.

The "target date" in the name refers to the approximate year you plan to retire or start withdrawing your money. For example, if you plan to retire around 2050, you might choose a "Target-Date 2050 Fund."

How Do They Work? The Magic of the "Glide Path"

The core concept behind a TDF is its "glide path." This is the predetermined trajectory of its asset allocation (the mix of stocks, bonds, and other investments) over time.

Here’s the general idea:

-

When you’re young and retirement is far off: The fund will be more aggressive, holding a higher percentage of stocks. Stocks offer greater growth potential but also come with higher risk. This is because you have plenty of time to recover from market downturns.

- Example: A Target-Date 2060 Fund might hold 90% stocks and 10% bonds.

-

As you get closer to your target retirement date: The fund gradually and automatically becomes more conservative. It shifts its allocation from stocks to bonds. Bonds are generally less volatile than stocks and provide more income stability, though with lower growth potential. This shift aims to protect your accumulated savings from significant market swings as you approach the time you’ll need the money.

- Example: A Target-Date 2030 Fund might hold 50% stocks and 50% bonds.

-

At and beyond your retirement date: The fund reaches its most conservative allocation, typically maintaining a significant portion in bonds and cash equivalents to preserve capital and provide income during your retirement years.

- Example: A Target-Date 2025 Fund might hold 30% stocks and 70% bonds.

This automatic rebalancing is what makes TDFs so appealing for many investors. You don’t have to worry about adjusting your portfolio yourself – the fund does it for you.

Why Are Target-Date Funds So Popular? (The Benefits)

Target-Date Funds offer several compelling advantages, especially for those new to investing or those who prefer a hands-off approach:

- Simplicity and Convenience: This is the biggest draw. You pick one fund based on your approximate retirement year, and you’re done. No need to research individual stocks, bonds, or other funds. It’s truly a "set it and forget it" solution.

- Automatic Diversification: Each TDF holds a broad mix of investments, usually including U.S. stocks, international stocks, U.S. bonds, and international bonds. This built-in diversification helps spread risk across different asset classes and geographies.

- Automatic Rebalancing: As the market fluctuates, your original asset allocation can get out of whack. A TDF automatically rebalances its portfolio to maintain its target allocation for that specific point on its glide path. This saves you the time and effort of doing it yourself.

- Professional Management: The fund’s asset allocation and rebalancing are handled by professional fund managers who monitor market conditions and adjust the underlying investments as needed.

- Appropriate Risk Level (Generally): The glide path is designed to gradually reduce risk as you age, aligning your portfolio’s risk level with your time horizon. This helps prevent you from taking on too much risk right before retirement or being too conservative when you’re young and need growth.

- Accessibility: TDFs are widely available in employer-sponsored retirement plans (like 401(k)s and 403(b)s) and can also be purchased through brokerage accounts for IRAs or taxable accounts.

Are There Any Downsides? (The Drawbacks)

While TDFs offer undeniable advantages, they also come with certain limitations and potential drawbacks:

- Fees (Expense Ratios): While often lower than actively managed funds, TDFs do have expense ratios, which are annual fees charged as a percentage of your investment. Because TDFs are "funds of funds" (they invest in other underlying funds), their expense ratios can sometimes be higher than investing in plain-vanilla index funds or ETFs yourself. Over decades, even a small difference in fees can eat significantly into your returns.

- "Cookie-Cutter" Approach: TDFs are designed for the "average" investor with a specific retirement date. They don’t consider your individual risk tolerance, other assets you might have, or your personal financial goals beyond retirement. For instance, if you have a very high risk tolerance or significant pension income coming in, a TDF might be too conservative for you.

- Lack of Personalization: You can’t customize the underlying investments or the glide path. If you have strong opinions about certain types of investments (e.g., avoiding fossil fuels) or prefer a different asset allocation strategy, a TDF won’t give you that control.

- Varying Glide Paths ("To" vs. "Through"): Not all TDFs are created equal! Different fund providers (e.g., Vanguard, Fidelity, Schwab, T. Rowe Price) have different philosophies for their glide paths:

- "To" Retirement Funds: These funds typically reach their most conservative allocation at the target date and maintain that level. They assume you’ll start withdrawing money immediately.

- "Through" Retirement Funds: These funds continue to become more conservative for several years after the target date, assuming you’ll spend some years in retirement before fully drawing down your assets. This usually means they maintain a slightly higher stock allocation at the target date.

- Why it matters: A "through" fund will generally be more aggressive than a "to" fund at the same target date. Understanding your fund’s specific glide path is crucial.

- Potential for Over-Diversification/Duplication: If you hold a TDF and also invest in other mutual funds or ETFs, you might inadvertently be over-diversified or duplicating holdings, which can dilute your returns or add unnecessary complexity.

Who Are Target-Date Funds Best Suited For?

TDFs are an excellent choice for a specific type of investor:

- Beginner Investors: If you’re just starting out and find the world of investing intimidating, a TDF offers an incredibly easy entry point.

- Hands-Off Investors: If you prefer a "set it and forget it" approach and don’t want to spend time managing your investments, TDFs are ideal.

- Busy Professionals: For those with demanding careers or family lives who simply don’t have the time or inclination to regularly rebalance their portfolio.

- 401(k) and Workplace Plan Participants: TDFs are often the default or a primary option in employer-sponsored plans, making them a convenient choice for these accounts.

- Those Who Value Simplicity Over Customization: If the peace of mind that comes with automated management outweighs the desire for precise control.

Who Might Want to Look Elsewhere?

While great for many, TDFs aren’t the perfect fit for everyone:

- Experienced or DIY Investors: If you enjoy researching investments, constructing your own portfolio, and rebalancing regularly, you might prefer to build your own diversified portfolio using low-cost index funds or ETFs.

- Investors with Specific Risk Tolerances: If your personal risk tolerance is significantly higher or lower than the average person your age, a TDF’s pre-set glide path might not align with your comfort level.

- Those Seeking Lower Fees: If you’re highly fee-conscious, you might be able to create a similar, diversified portfolio with slightly lower expense ratios by selecting individual broad market index funds.

- Investors with Complex Financial Situations: If you have multiple income streams, unique estate planning needs, or very specific financial goals beyond standard retirement, a TDF might not be comprehensive enough.

- Those Who Want More Control: If you prefer to have direct control over every asset in your portfolio and how it’s allocated, a TDF’s black-box approach won’t appeal to you.

Important Considerations Before Investing in a Target-Date Fund

If you’re leaning towards a TDF, keep these crucial points in mind:

- Understand the Expense Ratio: Always check the expense ratio (the annual fee) of the TDF. A difference of even 0.5% can amount to tens of thousands of dollars over a 30-year investing horizon. Look for funds with expense ratios typically below 0.50%, and ideally closer to 0.10-0.20% for index-based TDFs.

- Know Your Fund’s Glide Path (To vs. Through): As discussed, this is critical. Make sure the fund’s strategy aligns with your post-retirement spending plans. You can usually find this information in the fund’s prospectus or on the fund provider’s website.

- Check the Underlying Investments: Most TDFs invest in broad market index funds, which is generally good. However, some might include actively managed funds or niche investments. Understand what you’re actually invested in.

- Provider Reputation: Stick with reputable fund providers like Vanguard, Fidelity, Schwab, BlackRock (iShares), etc., which are known for low-cost, well-managed TDFs.

- Don’t Overlap: If you choose a TDF, it should be the primary, if not the only, investment in that account. Adding other funds on top of it can lead to unnecessary complexity, over-diversification, and potentially higher fees.

How to Choose the Right Target-Date Fund

- Determine Your Target Retirement Year: This is the most straightforward step. Choose the fund closest to your intended retirement date.

- Compare Expense Ratios: Look for the lowest expense ratio among reputable providers. Low-cost index-based TDFs are generally preferred.

- Understand the Glide Path: Research whether the fund follows a "to" or "through" glide path and how it aligns with your post-retirement needs.

- Review Performance (with caution): While past performance doesn’t guarantee future results, you can look at a fund’s historical returns relative to its peers. Focus more on consistency and fees than short-term spikes.

- Read the Prospectus: This document contains all the nitty-gritty details about the fund, its strategy, risks, and fees.

Beyond Target-Date Funds: Other Retirement Options

If TDFs don’t quite fit your needs, here are some common alternatives:

- Build Your Own Portfolio of Index Funds/ETFs: This involves choosing a few broad market index funds (e.g., U.S. total stock market, international total stock market, total bond market) and adjusting their allocation yourself over time. This offers more control and potentially lower fees.

- Robo-Advisors: Services like Betterment or Wealthfront use algorithms to build and manage diversified portfolios based on your risk tolerance and goals. They offer similar automation to TDFs but with more personalization and often tax-loss harvesting.

- Financial Advisor: For complex situations or if you simply prefer personalized guidance, a human financial advisor can help you create a tailored retirement plan.

Conclusion: Are Target-Date Funds Right for Your Retirement?

Target-Date Funds have revolutionized retirement saving, offering an incredibly simple, automated, and diversified approach for millions of investors. They are an excellent choice for those who value convenience, professional management, and a hands-off approach to investing.

However, they are not a one-size-fits-all solution. Their "cookie-cutter" nature, potential for higher fees compared to self-managed index funds, and varying glide paths mean they might not be ideal for every investor, especially those who are highly fee-conscious, have unique risk tolerances, or prefer more direct control over their portfolio.

Ultimately, the decision comes down to your personal preferences, financial knowledge, and willingness to manage your own investments. For many, a Target-Date Fund is a fantastic co-pilot on the journey to retirement. For others, a more custom-built approach might be the better route.

The most important step is to understand your options and choose the path that empowers you to save consistently and confidently for your future.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any investment decisions.

Post Comment