Index Funds Explained: The Easiest Way to Invest for Beginners

Are you new to investing and feel overwhelmed by complex jargon, stock market volatility, and the pressure to pick the "right" companies? You’re not alone. Many people delay investing because it seems too complicated, too risky, or only for financial experts.

But what if there was a simple, low-cost, and historically effective way to invest that didn’t require you to be a Wall Street wizard? Enter index funds. Often hailed by legendary investors like Warren Buffett as the smartest choice for most people, index funds are truly the easiest way to start building wealth.

In this comprehensive guide, we’ll break down exactly what index funds are, how they work, why they’re so powerful, and how you can start investing in them today, even if you’re a complete beginner.

What Exactly Are Index Funds? (Think of a Basket, Not a Single Apple)

Imagine you want to invest in the entire U.S. economy, or at least a big chunk of it. Trying to buy a little bit of every single company would be impossible and expensive. This is where index funds come in.

An index fund is a type of investment fund that is designed to passively track a specific market index. What’s a market index? It’s simply a collection of stocks or bonds that represent a particular segment of the market.

Here are some famous examples of market indices:

- S&P 500: This index tracks the performance of 500 of the largest publicly traded companies in the United States, representing about 80% of the total U.S. stock market value. When you hear "the market did well today," they’re often referring to the S&P 500.

- Dow Jones Industrial Average (DJIA): Tracks 30 large, publicly owned companies trading on the NASDAQ and/or the New York Stock Exchange. It’s a narrower view than the S&P 500.

- NASDAQ Composite: Heavily weighted towards technology and growth companies, tracking thousands of stocks listed on the NASDAQ exchange.

- Russell 2000: Focuses on small-cap (smaller company) stocks in the U.S.

- Total Stock Market Index: As the name suggests, this index aims to track nearly all publicly traded U.S. stocks, large and small.

So, an S&P 500 index fund, for instance, doesn’t try to beat the S&P 500; it is the S&P 500. It holds all 500 companies in the same proportion as the index itself. When you invest in an S&P 500 index fund, you’re essentially buying a tiny piece of all 500 of those companies.

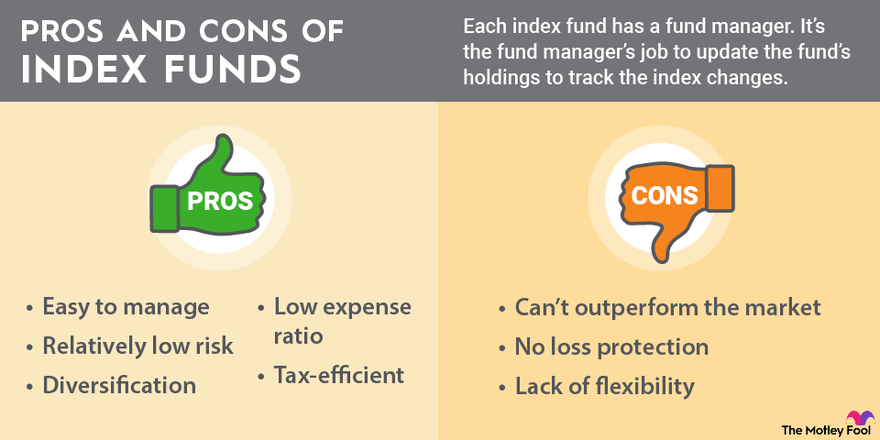

Key Characteristics of Index Funds:

- Passive Management: Unlike actively managed funds where a fund manager constantly buys and sells stocks trying to "beat the market," index funds simply follow their designated index. This "set it and forget it" approach dramatically reduces costs.

- Diversification: Because they hold many different securities (stocks or bonds), index funds automatically provide broad diversification. You’re not putting all your eggs in one basket.

- Low Costs: Due to their passive nature, index funds have very low operating expenses, known as "expense ratios." This means more of your money stays invested and works for you.

How Do Index Funds Work? (The "Set It and Forget It" Magic)

The beauty of index funds lies in their simplicity. Here’s a step-by-step breakdown of their operation:

- Index Creation: A financial organization (like Standard & Poor’s for the S&P 500) creates and maintains a specific market index. They set rules for which companies are included, how they are weighted, and when the index is rebalanced.

- Fund Replication: An investment company (like Vanguard, Fidelity, or Charles Schwab) creates an index fund designed to mirror that specific index. They buy all the stocks (or bonds) that are in the index, in the exact same proportions.

- You Invest: You, the investor, buy shares of this index fund. When you do, you’re essentially buying a tiny piece of every company (or bond) within that fund.

- Performance Tracking: The index fund’s performance will closely track the performance of its underlying index. If the S&P 500 goes up 1% in a day, your S&P 500 index fund will also go up by approximately 1% (minus tiny fees).

- Rebalancing: Periodically, the index fund will adjust its holdings to match any changes in the underlying index (e.g., if a company is added or removed from the S&P 500). This happens automatically, without you needing to do anything.

Example: Let’s say you invest in a Vanguard Total Stock Market Index Fund. This fund aims to track the entire U.S. stock market. When you put money into it, Vanguard uses your money (and that of other investors) to buy thousands of U.S. stocks – from Apple and Amazon to smaller, less-known companies – in the same proportions as their market value. You now own a slice of almost every publicly traded company in America!

Why Are Index Funds the "Easiest Way to Invest"? (The Benefits You Can’t Ignore)

The "easiest way" isn’t just a catchy phrase; it’s a profound truth about index funds. Here’s why they are such a fantastic option for beginners and seasoned investors alike:

-

Unbeatable Simplicity (No Stock Picking Required):

- You don’t need to research individual companies, analyze financial statements, or predict market trends.

- Just pick an index that aligns with your goals (e.g., broad market, international, bonds), invest, and let it ride.

- This "set it and forget it" approach saves enormous amounts of time and stress.

-

Instant Diversification (Lower Risk):

- Instead of putting all your money into one company, you’re spreading it across hundreds or even thousands of companies.

- If one company performs poorly, it has a minimal impact on your overall portfolio because it’s just one small piece of a much larger pie. This significantly reduces your risk compared to owning individual stocks.

- Diversification is the only "free lunch" in investing – it lowers risk without necessarily sacrificing returns.

-

Low Costs (More Money for You):

- Because index funds are passively managed, they don’t have high overhead costs associated with research teams, active trading, and marketing.

- Their "expense ratios" (the annual fee charged as a percentage of your investment) are typically very low, often less than 0.10% per year.

- Over decades, these low fees can save you tens of thousands, even hundreds of thousands, of dollars compared to actively managed funds that might charge 1% or more annually. Every dollar saved on fees is another dollar working for you.

-

Strong Historical Performance (Beating Most Pros):

- Paradoxically, the passive nature of index funds often leads to better returns than actively managed funds over the long term.

- Studies consistently show that the vast majority of active fund managers fail to beat their benchmark index after fees. By simply being the market, index funds capture the market’s full returns.

- While past performance doesn’t guarantee future results, broad market index funds have historically delivered impressive returns over the long run, helping investors build significant wealth.

-

Transparency:

- You always know exactly what you own because the fund simply mirrors its stated index. There are no hidden strategies or surprises.

-

Tax Efficiency:

- Index funds tend to have lower capital gains distributions compared to actively managed funds, as they don’t trade as frequently. This can lead to better tax efficiency in taxable brokerage accounts.

Index Funds vs. Other Investments: A Quick Comparison

To further illustrate why index funds are so appealing, let’s briefly compare them to a few other common investment vehicles:

-

Individual Stocks:

- Pros: Potential for very high returns if you pick a winner.

- Cons: Extremely high risk (if one company fails, you lose big); requires significant research, time, and expertise; difficult to achieve proper diversification for beginners.

- Index Fund Advantage: Low risk, instant diversification, no research needed.

-

Actively Managed Mutual Funds:

- Pros: Professional management (supposedly).

- Cons: High fees (often 1% to 2% annually or more), rarely beat their benchmark index after fees, less transparent.

- Index Fund Advantage: Low fees, historically better performance (after fees), transparency.

-

Exchange-Traded Funds (ETFs):

- Crucial Clarification: Many ETFs are index funds! ETFs are simply a type of fund that trades on a stock exchange like individual stocks throughout the day. Index funds can be structured as traditional mutual funds (bought/sold once a day) or as ETFs.

- Index Fund ETF Advantage: Offers the same benefits of diversification and low costs as traditional index mutual funds, plus the flexibility to trade throughout the day. Often preferred by beginners for their ease of access.

How to Get Started with Index Funds (Your Action Plan)

Ready to harness the power of index funds? Here’s a simple step-by-step guide to begin your investing journey:

-

Open an Investment Account:

- Brokerage Account: This is a standard investment account you can open with an online broker like Vanguard, Fidelity, Charles Schwab, E*TRADE, or TD Ameritrade. You’ll fund it with after-tax money.

- Retirement Accounts (Highly Recommended!):

- Roth IRA: Contributions are made with after-tax money, but qualified withdrawals in retirement are tax-free. Excellent for long-term growth.

- Traditional IRA: Contributions might be tax-deductible now, but withdrawals in retirement are taxed.

- 401(k) or 403(b): If your employer offers one, this is often the best place to start, especially if they offer a matching contribution (which is free money!). Look for low-cost index fund options within your plan.

-

Choose Your Index Fund(s):

- For U.S. Stocks: A Total Stock Market Index Fund (e.g., Vanguard Total Stock Market Index Fund Admiral Shares – VTSAX, or its ETF equivalent, VTI) or an S&P 500 Index Fund (e.g., VFIAX or SPY ETF) are excellent starting points. They offer broad diversification across the U.S. economy.

- For International Stocks: Consider an International Stock Index Fund (e.g., VTIAX or VXUS ETF) to diversify globally.

- For Bonds (as you get older or more risk-averse): A Total Bond Market Index Fund (e.g., VBTLX or BND ETF) can add stability to your portfolio.

Pro Tip: For beginners, a single Total Stock Market Index Fund or an S&P 500 Index Fund is often all you need to start. You can add international or bonds later if you wish. Many providers also offer "Target Date Funds," which are essentially diversified portfolios of index funds that automatically adjust their risk level as you approach a specific retirement year – perfect for ultimate simplicity.

-

Check the Expense Ratio:

- Always look for funds with very low expense ratios, ideally below 0.15% (e.g., 0.04% or 0.08%). The lower, the better! This is crucial for long-term returns.

-

Set Up Automatic Investments:

- This is the "easiest" part! Set up an automatic transfer from your checking account to your investment account on a regular basis (e.g., $50 every two weeks, $200 every month).

- This practice, known as dollar-cost averaging, is incredibly powerful. It means you invest a fixed amount regularly, buying more shares when prices are low and fewer when prices are high. This smooths out your returns and removes the temptation to "time the market."

-

Stay the Course (The Most Important Step!):

- Investing in index funds is a long-term game. The market will have ups and downs.

- Resist the urge to panic and sell during downturns. History shows that those who stay invested through volatility are ultimately rewarded.

- Continue to contribute regularly, rebalance occasionally (if needed, though many funds do this automatically), and let the power of compound interest work its magic over decades.

Common Myths About Index Funds (Debunked!)

Let’s address some misconceptions that might hold you back:

- Myth 1: "They’re too simple to work effectively."

- Reality: Their simplicity is their strength. By not trying to beat the market, they capture the market’s full return, which historically beats most complex strategies after fees.

- Myth 2: "You need a lot of money to start investing."

- Reality: Many index funds (especially ETFs) can be bought with as little as the cost of one share (e.g., $100-$300). Many brokers also offer fractional shares, allowing you to invest any amount you want. You can start with $50 a month and build from there.

- Myth 3: "You need to constantly monitor them."

- Reality: Index funds are designed for passive investing. Once you set up your automatic contributions, you rarely need to touch them. Check in once or twice a year if you like, but daily monitoring is unnecessary and often detrimental.

- Myth 4: "They’re boring."

- Reality: While they might not offer the thrill of picking a hot stock, the "boring" consistent growth of index funds is precisely what makes them so effective for building long-term wealth. Boring is good when it comes to investing your future!

Who Are Index Funds For?

Index funds are ideal for:

- Beginners: They provide an incredibly straightforward entry point into the world of investing.

- Busy Individuals: If you don’t have time (or desire) to research individual stocks, index funds are perfect.

- Long-Term Investors: They are best suited for those with a time horizon of 5+ years (ideally decades).

- Cost-Conscious Investors: If you want to maximize your returns by minimizing fees.

- Those Seeking Diversification: They offer instant, broad diversification.

- Anyone Who Believes in the Long-Term Growth of the Economy: If you believe that economies generally grow over time, then index funds are a logical choice.

The Bottom Line: Your Path to Financial Freedom Starts Here

Index funds are not a get-rich-quick scheme. They are a proven, low-cost, and incredibly effective strategy for long-term wealth creation. They remove the complexity, emotion, and high costs often associated with investing, making it accessible and achievable for everyone.

By embracing the simplicity of index funds and committing to consistent, long-term investing, you can confidently build a diversified portfolio that quietly grows over time, helping you achieve your financial goals and secure your future. Stop procrastinating and start your index fund journey today – it truly is the easiest way to invest.

.jpg?format=1500w)

Post Comment