ETFs vs. Mutual Funds: Which is Better for Your Investments? A Beginner’s Guide

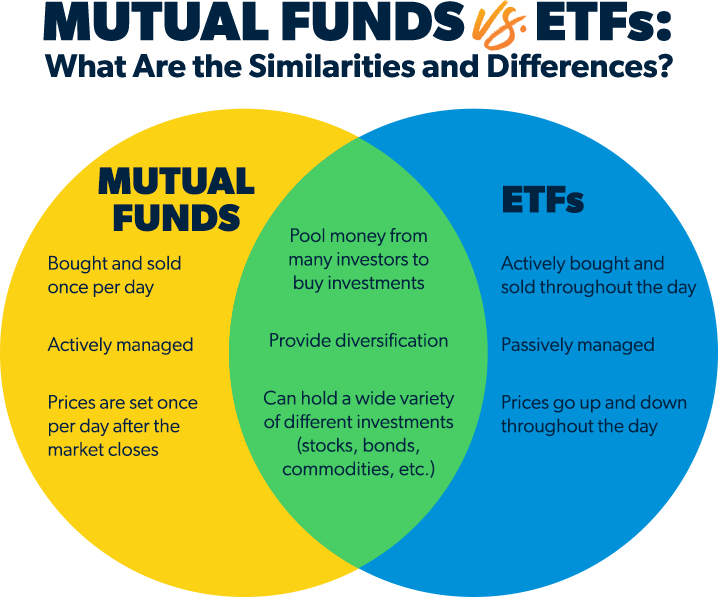

Investing can feel like stepping into a dense forest without a map. With so many paths to choose from, it’s easy to get lost. Two of the most common and often confusing options for new investors are Exchange-Traded Funds (ETFs) and Mutual Funds. Both offer ways to diversify your investments and potentially grow your wealth, but they operate in fundamentally different ways.

So, which one is better for you? The truth is, there’s no single "better" answer. It depends on your financial goals, investment style, risk tolerance, and how hands-on you want to be.

This comprehensive guide will break down ETFs and Mutual Funds in simple terms, compare their key features, and help you understand which might be the right fit for your investment journey.

Understanding the Basics: What Are We Talking About?

Before we dive into the comparison, let’s get a clear picture of what each of these investment vehicles is.

What Are Mutual Funds?

Imagine a large group of people pooling their money together to invest. That’s essentially what a mutual fund is. A professional fund manager then takes this collective money and invests it in a diversified portfolio of stocks, bonds, or other securities, according to the fund’s stated investment objective.

-

How They Work:

- When you buy shares in a mutual fund, you’re buying a piece of that entire portfolio.

- The value of your shares is determined once a day, after the market closes, by calculating the fund’s Net Asset Value (NAV) per share. This NAV is the total value of all assets in the fund, minus its liabilities, divided by the number of outstanding shares.

- You buy and sell mutual fund shares directly from the fund company (or through a brokerage that handles this for you).

-

Types of Mutual Funds (Briefly):

- Actively Managed Funds: These funds have a dedicated manager (or team) who actively researches and picks investments, aiming to outperform a specific market index (like the S&P 500). They involve more research and trading, which typically leads to higher fees.

- Passively Managed Funds (Index Funds): These funds aim to simply track a specific market index. The manager’s job is just to ensure the fund holds the same investments as the index, in the same proportions. Because they don’t involve active stock picking, their fees are generally much lower.

-

Advantages of Mutual Funds:

- Professional Management: Experts handle the research, selection, and ongoing management of the investments. This is great if you’re new to investing or prefer a hands-off approach.

- Diversification: By investing in a single fund, you instantly get exposure to many different stocks or bonds, which helps spread out risk.

- Convenience: Many funds allow for automatic investments, making it easy to contribute regularly.

- Variety: There are mutual funds for almost every investment objective, from conservative bond funds to aggressive growth funds, and even target-date funds that automatically adjust their asset allocation as you approach retirement.

-

Disadvantages of Mutual Funds:

- Higher Fees: Actively managed mutual funds often come with higher expense ratios (the annual fee charged as a percentage of your investment) compared to many ETFs. They may also have "load" fees (sales charges) when you buy (front-end load) or sell (back-end load) shares.

- Less Control Over Trading: You can only buy or sell mutual fund shares once a day, at the end-of-day NAV. You can’t react to market fluctuations throughout the day.

- Minimum Investments: Many mutual funds require a minimum initial investment, which can sometimes be several thousand dollars, making them less accessible for some beginners.

What Are Exchange-Traded Funds (ETFs)?

Think of an ETF as a basket of securities (like stocks, bonds, or commodities) that trades on a stock exchange, just like a single stock. When you buy an ETF, you’re buying shares of that basket.

-

How They Work:

- Like mutual funds, ETFs pool money to invest in a diversified portfolio.

- The key difference is that ETF shares can be bought and sold throughout the trading day at market prices, which fluctuate based on supply and demand, just like individual stocks.

- Most ETFs are passively managed, meaning they aim to track a specific index (like the S&P 500, a specific industry, or a commodity like gold). There are some actively managed ETFs, but they are less common.

-

Types of ETFs (Briefly):

- Broad Market ETFs: Track major stock indexes (e.g., S&P 500, total stock market).

- Sector ETFs: Focus on specific industries (e.g., technology, healthcare, energy).

- Bond ETFs: Invest in various types of bonds (e.g., government bonds, corporate bonds).

- Commodity ETFs: Track the price of commodities like gold, oil, or silver.

- International ETFs: Focus on markets outside your home country.

-

Advantages of ETFs:

- Lower Fees: Because most ETFs are passively managed and simply track an index, their expense ratios are generally much lower than actively managed mutual funds.

- Flexibility (Intra-Day Trading): You can buy and sell ETF shares at any point during market hours, allowing you to react to market changes or implement specific trading strategies.

- Transparency: Most ETFs disclose their holdings daily, so you always know exactly what you own.

- Tax Efficiency: ETFs are often more tax-efficient than mutual funds due to their unique "in-kind" creation and redemption process, which minimizes capital gains distributions to shareholders.

- No Minimum Investment (Usually): You can typically buy just one share of an ETF, making them very accessible for investors with limited capital.

-

Disadvantages of ETFs:

- Brokerage Commissions: While many brokers now offer commission-free ETF trading, some still charge a fee per trade, which can eat into returns for small, frequent investments.

- Price Fluctuations: Because they trade like stocks, ETF prices can fluctuate throughout the day, and you might not always get the exact price you expect unless you use limit orders.

- Requires a Brokerage Account: You need a brokerage account to buy and sell ETFs, which is also true for many mutual funds but worth noting.

- Less Convenient for Regular Investments: While you can set up recurring purchases for ETFs with some brokers, it’s generally not as seamless as mutual fund automatic investments.

The Head-to-Head Showdown: ETFs vs. Mutual Funds

Now that we understand each one, let’s put them side-by-side on the most important comparison points.

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Trading Flexibility | Traded once a day at end-of-day NAV. | Traded throughout the day on exchanges like stocks. |

| Cost/Fees | Often higher expense ratios (especially active); may have loads. | Generally lower expense ratios (especially passive); typically no loads. |

| Management Style | Can be actively or passively managed. | Predominantly passively managed (track an index). |

| Minimum Investment | Often require higher initial minimums ($500 – $3,000+). | Typically just the price of one share (very accessible). |

| Tax Efficiency | Can be less tax-efficient due to capital gains distributions. | Generally more tax-efficient. |

| Diversification | Excellent diversification. | Excellent diversification. |

| Convenience | Easy for automatic, recurring investments. | Can be slightly less seamless for recurring investments (though improving). |

| Price | Buy/sell at NAV. | Buy/sell at market price (fluctuates throughout day). |

Let’s elaborate on a few key points:

-

Cost (Expense Ratios): This is often the biggest differentiator. The Expense Ratio is the annual fee you pay, expressed as a percentage of your investment. For example, a 0.50% expense ratio means you pay $5 annually for every $1,000 invested.

- Actively Managed Mutual Funds: Can have expense ratios ranging from 0.50% to over 2.00%.

- Passively Managed Mutual Funds (Index Funds) & ETFs: Often have expense ratios as low as 0.03% to 0.25%.

- Over decades, even small differences in expense ratios can amount to tens of thousands of dollars in lost returns due to compounding. This is why low fees are crucial!

-

Tax Efficiency: This is a bit complex, but here’s the simple version:

- When mutual fund investors redeem their shares, the fund manager might have to sell securities to raise cash, which can trigger capital gains that are then distributed to all shareholders, even those who didn’t sell. This can happen annually.

- ETFs have a unique structure that allows them to avoid many of these taxable distributions, making them generally more tax-efficient, especially for taxable brokerage accounts. (This is less of a concern in tax-advantaged accounts like IRAs or 401(k)s, where gains aren’t taxed until withdrawal).

-

Management Style (Active vs. Passive):

- The vast majority of academic research suggests that passive investing (tracking an index) outperforms active management over the long term, especially after accounting for fees.

- Most ETFs are passive, which is a major reason for their lower fees and often better long-term performance. While there are passive mutual funds (index funds), the mutual fund world is still heavily dominated by active management.

Which One Is Better for YOU? Answering the "It Depends"

Now for the personalized part. Consider your investing style and goals:

Choose ETFs if you:

- Are very cost-conscious: ETFs generally offer the lowest expense ratios, which is a huge advantage over the long term.

- Prefer a hands-on approach and want intra-day trading flexibility: If you like the idea of buying and selling throughout the day, like stocks, ETFs offer that.

- Are investing smaller amounts regularly: With no minimum investment (beyond the price of one share) and often commission-free trading, ETFs are very accessible.

- Are comfortable using a brokerage platform: ETFs require you to place trades like stocks.

- Prioritize tax efficiency: Especially for investments in a taxable brokerage account, ETFs tend to be more tax-efficient.

- Believe in passive investing and index tracking: The vast majority of ETFs are designed for this purpose.

Choose Mutual Funds if you:

- Prefer a completely hands-off approach: Let the professional managers handle everything, especially with actively managed funds (though often at a higher cost).

- Want to set up automatic, recurring investments easily: Many mutual funds are designed for seamless regular contributions directly from your bank account.

- Are comfortable with a single, end-of-day price: You don’t need to worry about market fluctuations throughout the day.

- Are looking for specific "target-date" funds: These are mutual funds that automatically adjust their asset allocation as you get closer to a specific retirement year, offering ultimate simplicity.

- Are investing within a 401(k) or other employer-sponsored plan: These plans often have a limited menu of investment options, which are frequently mutual funds.

Can You Have Both? Absolutely!

It’s not an either/or situation. Many investors hold both ETFs and mutual funds in their portfolios. For example:

- You might have mutual funds in your 401(k) because those are the only options provided by your employer.

- At the same time, you might invest in low-cost ETFs in your Roth IRA or a taxable brokerage account for broader market exposure or specific sector bets.

- You might start with a simple target-date mutual fund and later add a few specific ETFs as you gain more experience and confidence.

The key is to understand what you own, why you own it, and how it fits into your overall financial plan.

Important Considerations Before You Invest

No matter whether you choose ETFs, mutual funds, or both, remember these fundamental investing principles:

- Your Financial Goals: Are you saving for retirement, a down payment, or something else? Your goal will influence your investment choices.

- Risk Tolerance: How comfortable are you with the value of your investments going up and down? This will help you decide on the mix of stocks, bonds, and other assets.

- Time Horizon: How long do you plan to invest? Longer time horizons generally allow you to take on more risk.

- Research, Research, Research! Always look up the expense ratio, holdings, and past performance (though past performance doesn’t guarantee future returns) of any fund you’re considering.

- Diversification is Key: Don’t put all your eggs in one basket. Both ETFs and mutual funds help with this, but ensure your overall portfolio is well-diversified across different asset classes and geographies.

- Start Early and Invest Consistently: The power of compounding works best over long periods. Even small, regular contributions can grow significantly over time.

- Consult a Financial Advisor: If you’re feeling overwhelmed or have complex financial situations, a qualified financial advisor can provide personalized guidance.

Conclusion: Your Best Choice is Your Most Informed Choice

Ultimately, the question of "ETFs vs. Mutual Funds: Which is Better?" has a personal answer.

- For many beginners, especially those looking for low-cost, hands-off broad market exposure, a low-cost, passively managed ETF (like one tracking the S&P 500 or total stock market) is an excellent starting point. They offer diversification, low fees, and tax efficiency.

- If you prioritize extreme simplicity, automatic investments, or are investing through an employer-sponsored plan, mutual funds (especially low-cost index mutual funds or target-date funds) can be an equally valid and effective choice.

Both ETFs and mutual funds are powerful tools for building wealth over time. Take the time to understand their differences, consider your own needs and preferences, and then choose the option that aligns best with your investment philosophy. The most important step is to start investing!

Post Comment