Types of Bonds: A Beginner’s Guide to Corporate, Municipal, and Treasury Bonds

Investing can seem like a complex maze, but understanding the different types of assets is your first step to navigating it successfully. While stocks often grab the headlines, bonds are a foundational component of many well-rounded investment portfolios. They are the quiet workhorses, often providing stability and income.

But what exactly is a bond, and what are the key differences between a Corporate, Municipal, and Treasury bond? If you’re new to the world of fixed income, you’ve come to the right place. This guide will break down these essential bond types in an easy-to-understand way, helping you decide which might be right for your financial goals.

What Exactly Is a Bond? Your Basic IOU

Imagine you lend money to a friend. They promise to pay you back by a certain date and, in the meantime, they’ll pay you a small amount of interest every month for the privilege of using your money.

A bond works in a very similar way. When you buy a bond, you are essentially lending money to an entity – which could be a corporation, a city, or even the U.S. government. In return, that entity promises to:

- Pay you regular interest payments (called coupon payments) over a set period.

- Return your original investment (the principal or face value) on a specific date (the maturity date).

Think of a bond as an "IOU" with a fixed interest rate and a repayment schedule.

Key Bond Terms to Know:

- Issuer: The entity that borrows the money (e.g., Apple, City of New York, U.S. Treasury).

- Face Value (Par Value): The amount of money the bond is worth at maturity, and typically the amount you initially invest. Most bonds have a face value of $1,000.

- Coupon Rate (Interest Rate): The fixed interest rate the issuer pays you, usually annually or semi-annually.

- Maturity Date: The date when the issuer repays the face value of the bond to the bondholder. Bonds can have short maturities (a few months) or long maturities (30 years or more).

Why Invest in Bonds? The Benefits of Fixed Income

Bonds play a crucial role in a diversified investment portfolio. Here’s why investors often include them:

- Income Generation: Bonds provide a predictable stream of income through regular interest payments, which can be particularly attractive for retirees or those seeking consistent cash flow.

- Diversification: Bonds often behave differently than stocks. When the stock market is volatile or declining, bonds can sometimes hold their value or even increase, helping to cushion your portfolio against losses.

- Capital Preservation: While not entirely risk-free, bonds from financially stable issuers are generally considered less risky than stocks. If held to maturity, you are guaranteed to get your principal back (barring issuer default).

- Lower Volatility: Compared to the often wild swings of the stock market, bonds tend to be more stable, offering a smoother ride for your investments.

Now, let’s dive into the three main types of bonds you’ll encounter.

1. Corporate Bonds: Lending to Businesses

When you buy a corporate bond, you are lending money to a company. Companies issue bonds to raise capital for various purposes, such as expanding operations, funding research and development, acquiring other companies, or refinancing existing debt.

Who Issues Them?

Publicly traded and even some private companies, from giants like Amazon and Microsoft to smaller businesses.

Key Characteristics:

- Purpose: To fund company operations, expansion, or general corporate needs.

- Risk: Generally higher risk than government bonds, as a company can default on its debt if it faces financial difficulties.

- Credit Risk: The risk that the company won’t be able to make its interest payments or repay the principal. This risk is assessed by credit rating agencies (like Moody’s, Standard & Poor’s, and Fitch), which assign ratings (e.g., AAA, AA, BBB, C) based on the company’s financial health.

- Bonds with higher credit ratings (like AAA) are considered "investment grade" and have lower risk, but also lower interest rates.

- Bonds with lower credit ratings (below BBB) are considered "junk bonds" or "high-yield bonds." They offer higher interest rates to compensate investors for the increased risk.

- Return: Typically offer higher interest rates (yields) than Treasury bonds due to the higher risk involved.

- Taxation: Interest earned on corporate bonds is generally subject to federal, state, and local income taxes.

- Callability: Some corporate bonds are "callable," meaning the issuer has the right to buy back the bond from you before its maturity date. This usually happens if interest rates fall, allowing the company to refinance at a lower rate, which can be a disadvantage to the investor.

Who Are They Good For?

Investors seeking higher potential income than government bonds, who are comfortable taking on a bit more risk, and who want to diversify their fixed-income portfolio beyond government debt.

2. Municipal Bonds (Munis): Funding Local Communities

Municipal bonds, often called "munis," are debt securities issued by state and local governments, as well as their agencies, to finance public projects. Think of schools, roads, bridges, hospitals, and water systems.

Who Issues Them?

States, cities, counties, towns, and various local government agencies.

Key Characteristics:

- Purpose: To fund public works projects and essential services within a community.

- Risk: Generally lower risk than corporate bonds, but higher than U.S. Treasury bonds. While rare, municipal defaults can occur (e.g., Detroit’s bankruptcy).

- Return: Often offer lower interest rates than corporate bonds because of their significant tax advantages.

- Taxation: The Big Advantage! Interest earned on municipal bonds is often exempt from federal income taxes. If you buy a muni issued by a government in your state of residence, the interest may also be exempt from state and local taxes. This "triple tax-exempt" status makes them particularly attractive to high-income earners.

- Types of Municipal Bonds:

- General Obligation (GO) Bonds: Backed by the "full faith and credit" (taxing power) of the issuing government. They promise to repay the debt using any available revenue sources.

- Revenue Bonds: Backed by the revenue generated from a specific project, such as tolls from a bridge or fees from a water utility. If the project doesn’t generate enough revenue, there’s a higher risk of default than with GO bonds.

Who Are They Good For?

High-income earners looking to reduce their tax burden, especially those living in states with high income taxes. They are also suitable for investors who prioritize stability and moderate income.

3. Treasury Bonds (Treasuries): The Safest Bet (in the U.S.)

When you buy a Treasury bond, you are lending money to the U.S. federal government. Treasuries are considered among the safest investments in the world because they are backed by the "full faith and credit" of the U.S. government, meaning it has the power to tax and print money to meet its obligations.

Who Issues Them?

The U.S. Department of the Treasury.

Key Characteristics:

- Purpose: To finance the U.S. national debt and fund government operations (e.g., defense, social security, federal programs).

- Risk: Considered virtually risk-free in terms of default. The primary risks are interest rate risk (the value of your bond going down if interest rates rise) and inflation risk (your purchasing power eroding).

- Return: Typically offer the lowest interest rates (yields) compared to corporate and municipal bonds because of their extremely low default risk.

- Taxation: Interest earned on Treasury bonds is exempt from state and local income taxes, but is subject to federal income tax.

- Types of Treasuries (by Maturity):

- Treasury Bills (T-Bills): Short-term debt with maturities of a few days up to 52 weeks. They are sold at a discount and don’t pay regular interest; you get the face value at maturity.

- Treasury Notes (T-Notes): Mid-term debt with maturities of 2, 3, 5, 7, and 10 years. They pay interest every six months.

- Treasury Bonds (T-Bonds): Long-term debt with maturities of 20 or 30 years. They also pay interest every six months.

- Treasury Inflation-Protected Securities (TIPS): A unique type of Treasury bond where the principal value adjusts with inflation, protecting investors from rising prices.

Who Are They Good For?

Conservative investors, those seeking the highest level of safety and liquidity, and those looking for a stable foundation for their portfolio. They are often used as a benchmark for other bond yields.

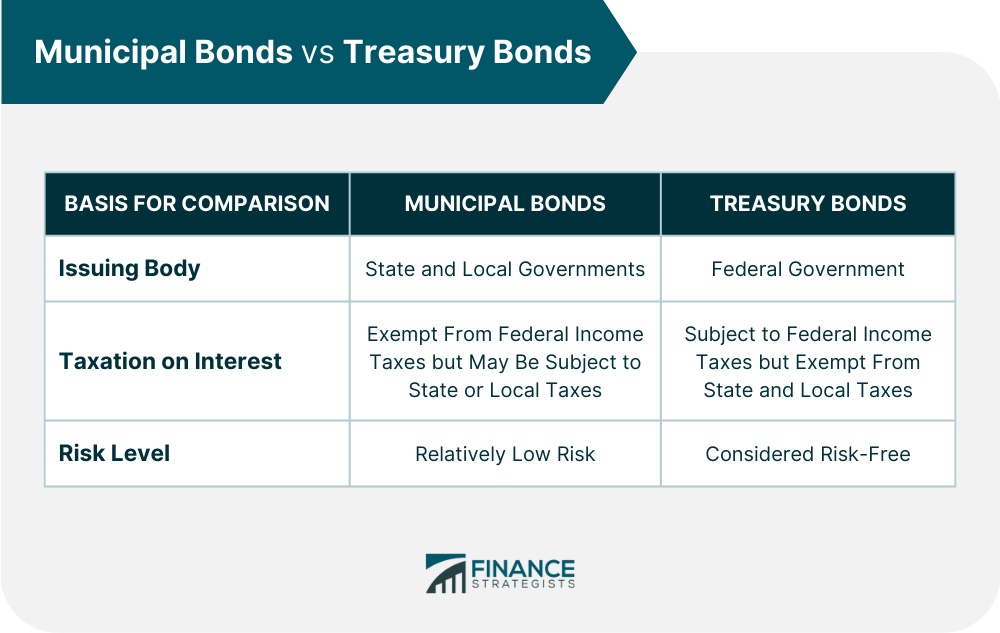

Comparing the Types: A Quick Glance

| Feature | Corporate Bonds | Municipal Bonds | Treasury Bonds (Treasuries) |

|---|---|---|---|

| Issuer | Corporations | State & Local Governments | U.S. Federal Government |

| Purpose | Corporate operations, expansion | Public works projects, essential services | Funding federal debt & operations |

| Default Risk | Moderate to High (varies by credit rating) | Low to Moderate (generally very low) | Virtually Zero (backed by U.S. government) |

| Interest Rate | Higher (to compensate for risk) | Lower (due to tax advantages) | Lowest (due to lowest risk) |

| Taxation | Fully taxable (federal, state, local) | Federal tax-exempt (often state/local too) | State & local tax-exempt (federal taxable) |

| Liquidity | Varies (larger companies often more liquid) | Varies (larger issues more liquid) | Very High (actively traded) |

| Best For | Higher income, diversified portfolio | High-income earners, tax-conscious investors | Conservative investors, portfolio stability |

Factors to Consider Before Investing in Bonds

Choosing the right type of bond depends on your individual financial situation and goals. Ask yourself:

- Your Risk Tolerance: How comfortable are you with the possibility of losing money? If safety is paramount, Treasuries are a good starting point.

- Your Investment Horizon: When do you need the money? Shorter-term bonds are less sensitive to interest rate changes.

- Your Income Needs: Are you looking for steady income now, or are you focused on long-term growth?

- Your Tax Situation: Are you in a high tax bracket? Municipal bonds might offer significant tax savings.

- Diversification: How do bonds fit into your overall investment portfolio? They can balance out the risk of stocks.

Are Bonds Right for You?

Bonds are a vital component of a well-diversified investment strategy. They can provide a stable income stream, reduce overall portfolio volatility, and help preserve capital. Whether you’re looking to lend to a cutting-edge tech company, support your local community, or simply safeguard your savings with the backing of the U.S. government, there’s a bond type that can align with your financial objectives.

Understanding the differences between Corporate, Municipal, and Treasury bonds empowers you to make informed decisions and build a robust portfolio tailored to your unique needs. As always, consider consulting with a qualified financial advisor to discuss how bonds fit into your personal financial plan.

Post Comment