<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<meta name="viewport" content="width=device-width, initial-scale=1.0">

<title>What Are Dividends and How Do They Work? Your Beginner's Guide to Stock Dividends</title>

<meta name="description" content="Unlock the mystery of stock dividends! This comprehensive beginner's guide explains what dividends are, how they work, the dividend timeline, types of dividends, and key metrics like dividend yield for smart income investing. Learn how to earn passive income from your stocks.">

<meta name="keywords" content="what are dividends, how do dividends work, stock dividends, dividend investing, passive income, dividend yield, ex-dividend date, record date, payment date, dividend payout, types of dividends, income investing, beginner investing, wealth building">

<link rel="canonical" href="https://yourwebsite.com/what-are-dividends-how-they-work">

<style>

body font-family: 'Arial', sans-serif; line-height: 1.6; color: #333; margin: 0; padding: 20px; background-color: #f9f9f9;

.container max-width: 900px; margin: auto; background: #fff; padding: 30px; border-radius: 8px; box-shadow: 0 0 15px rgba(0,0,0,0.1);

h1, h2, h3 color: #2c3e50; margin-top: 1.5em; margin-bottom: 0.5em;

h1 font-size: 2.5em; text-align: center; color: #0056b3;

h2 font-size: 1.8em; border-bottom: 2px solid #eee; padding-bottom: 5px;

h3 font-size: 1.4em; color: #34495e;

p margin-bottom: 1em;

ul list-style-type: disc; margin-left: 20px; margin-bottom: 1em;

ol list-style-type: decimal; margin-left: 20px; margin-bottom: 1em;

strong color: #0056b3;

.highlight background-color: #e6f7ff; padding: 10px; border-left: 5px solid #007bff; margin-bottom: 1.5em;

.cta text-align: center; margin-top: 30px; padding: 15px; background-color: #007bff; color: white; border-radius: 5px; font-size: 1.1em;

.cta a color: white; text-decoration: none; font-weight: bold;

.image-placeholder background-color: #eee; height: 200px; text-align: center; line-height: 200px; color: #777; margin-bottom: 20px; border-radius: 5px;

footer text-align: center; margin-top: 40px; padding-top: 20px; border-top: 1px solid #eee; color: #777; font-size: 0.9em;

</style>

</head>

<body>

<div class="container">

<header>

<h1>What Are Dividends and How Do They Work? Your Beginner's Guide to Stock Dividends</h1>

<p class="highlight">

Are you curious about how some investors earn regular income just by owning stocks? It's often thanks to **dividends**! This comprehensive guide will demystify dividends, explaining what they are, why companies pay them, and how you can benefit from them as an investor. Get ready to unlock a powerful way to generate passive income from your investments.

</p>

</header>

<main>

<div class="image-placeholder">

[Image: Hand holding cash with stock charts in background, or a plant with money growing on it]

</div>

<section id="what-are-dividends">

<h2>1. What Exactly Are Dividends?</h2>

<p>Imagine you own a small share of a very successful lemonade stand. At the end of a hot summer, the stand has made a lot of profit. As a thank you for being an owner (a shareholder), the owner decides to share a portion of that profit with you and all the other owners. That shared profit is essentially what a **dividend** is in the world of stocks.</p>

<p>In formal terms, a **dividend** is a distribution of a portion of a company's earnings, decided by its board of directors, to its shareholders. When you own shares of a company, you are a part-owner, and dividends are your reward for that ownership.</p>

<h3>Key Characteristics of Dividends:</h3>

<ul>

<li><strong>Not Guaranteed:</strong> Companies are not obligated to pay dividends. The decision rests with the company's board of directors, who can choose to initiate, increase, decrease, or suspend dividend payments.</li>

<li><strong>Usually Cash:</strong> Most commonly, dividends are paid out as cash directly into your brokerage account.</li>

<li><strong>Regular Payments:</strong> While not mandatory, many companies that pay dividends do so on a regular schedule – typically quarterly, but sometimes monthly, semi-annually, or annually.</li>

<li><strong>Paid Per Share:</strong> The dividend amount is usually stated as a certain amount per share (e.g., $0.50 per share). If you own 100 shares and the dividend is $0.50 per share, you would receive $50.</li>

</ul>

</section>

<section id="why-companies-pay-dividends">

<h2>2. Why Do Companies Pay Dividends?</h2>

<p>It might seem counterintuitive for a company to give away its profits, but there are several strategic reasons why companies choose to pay dividends:</p>

<ul>

<li><strong>Signal of Financial Health:</strong> Consistently paying dividends indicates that a company is financially stable and profitable enough to share its earnings. This can attract more investors.</li>

<li><strong>Attract Income-Focused Investors:</strong> Many investors, especially retirees or those seeking passive income, prioritize stocks that pay regular dividends. Companies that pay dividends cater to this specific segment of the market.</li>

<li><strong>Return Capital to Shareholders:</strong> For mature companies with fewer immediate growth opportunities, returning profits to shareholders via dividends can be a more efficient use of capital than reinvesting it internally at low returns.</li>

<li><strong>Boost Shareholder Confidence:</strong> Regular dividend payments can build trust and loyalty among shareholders, encouraging them to hold onto their shares for the long term.</li>

<li><strong>Offset Volatility:</strong> In volatile markets, dividend payments can provide a steady stream of income, helping to cushion investors against potential drops in stock price.</li>

</ul>

<p>Generally, **mature, well-established companies** in stable industries (like utilities, consumer staples, or financials) are more likely to pay dividends. Growth companies, on the other hand, often reinvest all their profits back into the business to fund rapid expansion, choosing not to pay dividends.</p>

</section>

<section id="how-dividends-work-timeline">

<h2>3. How Do Dividends Work? The Dividend Timeline Explained</h2>

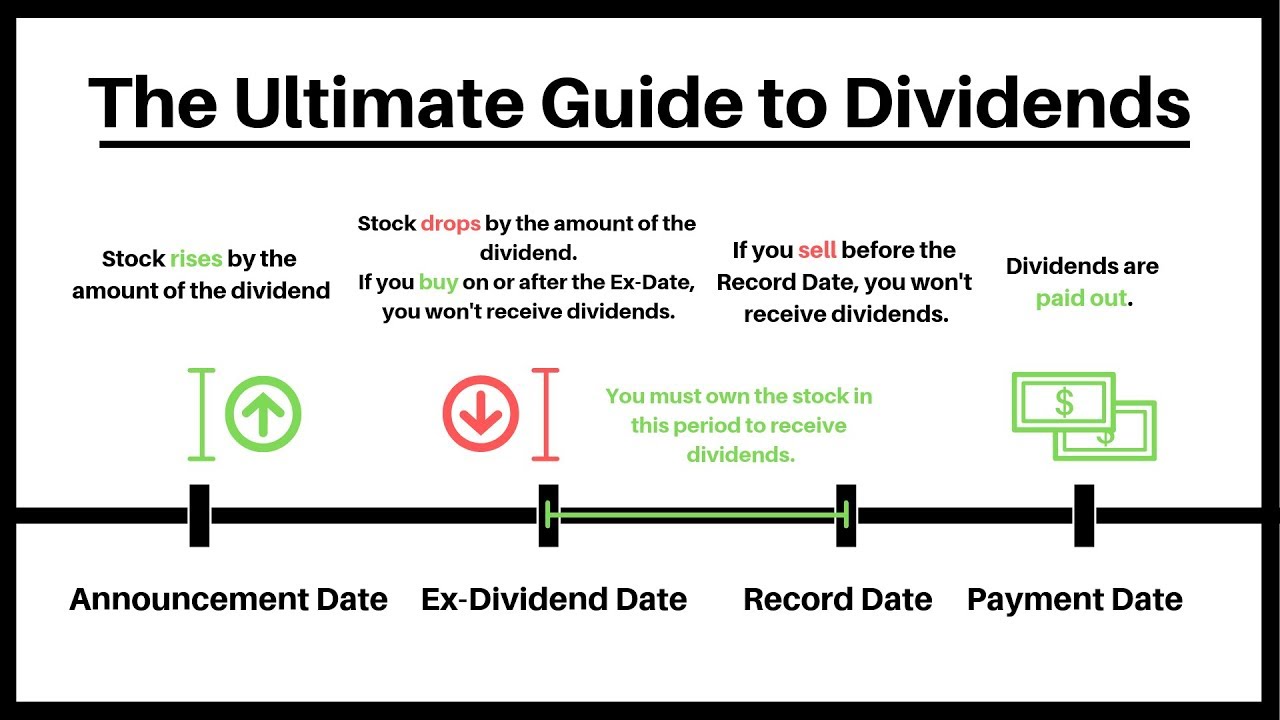

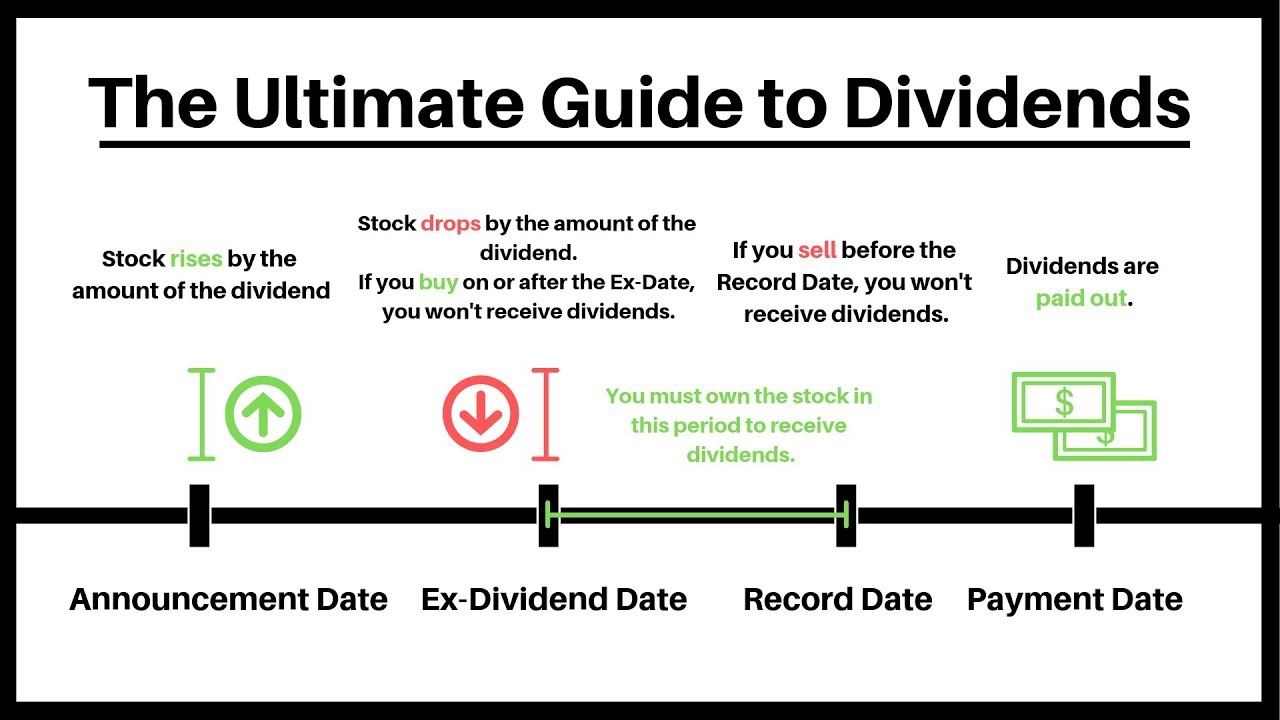

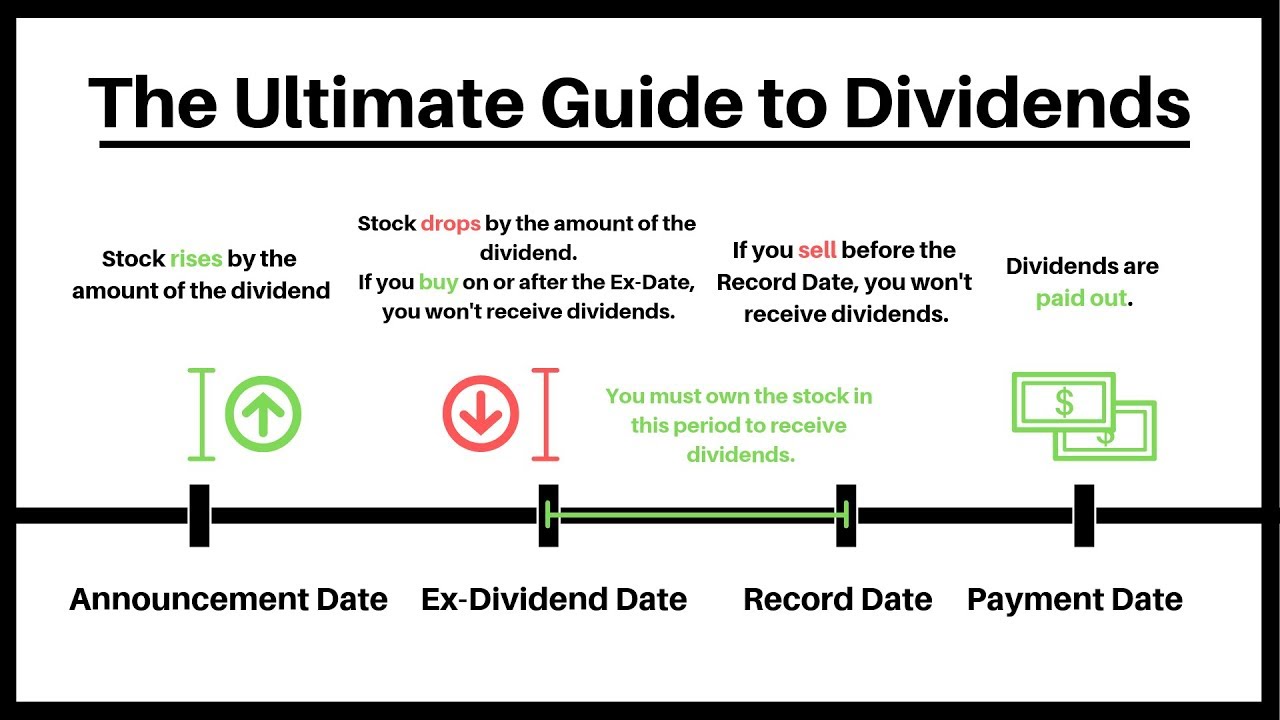

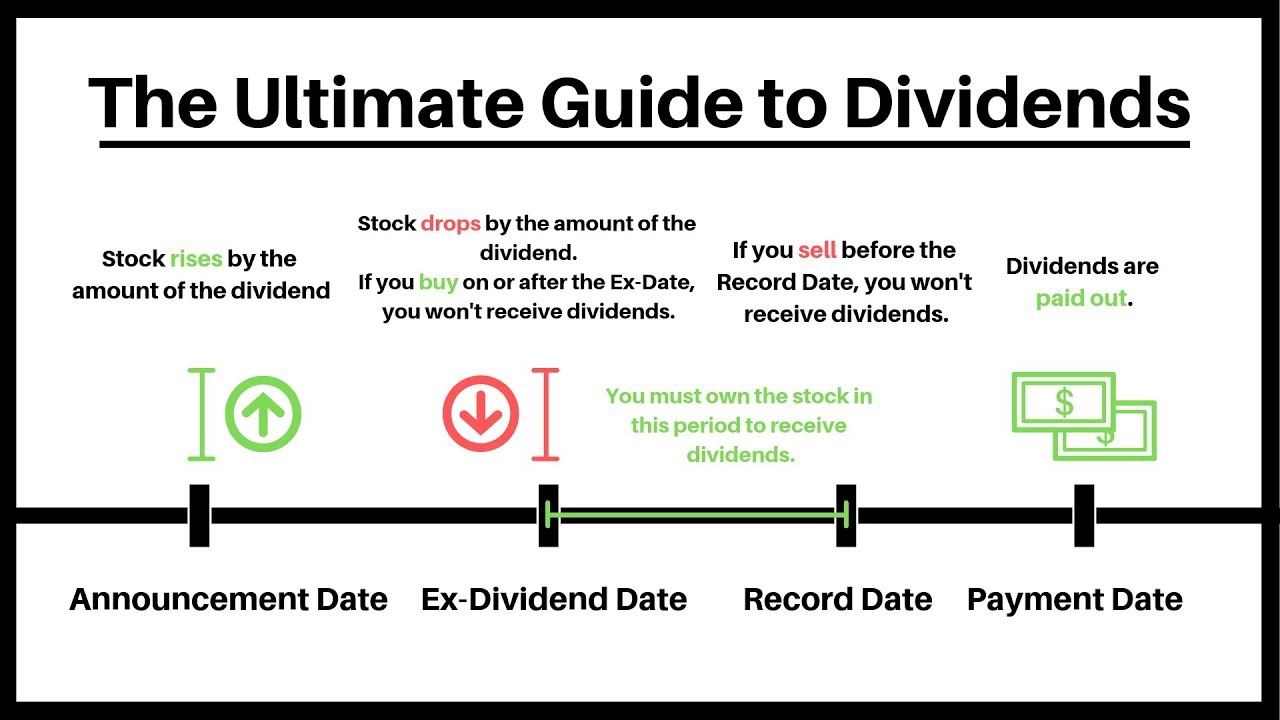

<p>Understanding how dividends work involves knowing a few key dates. These dates determine who gets the dividend and when.</p>

<ol>

<li>

<h3>Declaration Date (Announcement Date)</h3>

<p>This is the day the company's board of directors officially announces its intention to pay a dividend. The announcement typically includes:</p>

<ul>

<li>The **amount** of the dividend per share.</li>

<li>The **record date** (who is eligible).</li>

<li>The **payment date** (when the dividend will be paid).</li>

<li>The **ex-dividend date** (a crucial date for buyers/sellers).</li>

</ul>

<p><strong>Example:</strong> ABC Corp. announces on January 10th that it will pay a $0.50 per share dividend.</p>

</li>

<li>

<h3>Ex-Dividend Date (Crucial for Investors!)</h3>

<p>This is arguably the most important date for investors. The **ex-dividend date** (often shortened to "ex-date") is the first day a stock trades <em>without</em> the right to receive the next dividend payment.</p>

<ul>

<li>If you buy the stock <strong>on or after</strong> the ex-dividend date, you will NOT receive the upcoming dividend.</li>

<li>If you buy the stock <strong>before</strong> the ex-dividend date, you WILL receive the upcoming dividend.</li>

</ul>

<p>The ex-dividend date is usually set one business day before the record date. This allows time for stock trades to settle (T+2 settlement period).</p>

<p><strong>Example:</strong> If the ex-dividend date is January 25th, you must own the shares by the close of trading on January 24th to be eligible for the dividend. If you buy on January 25th, you miss out on that specific payment.</p>

<p class="highlight"><strong>Pro Tip:</strong> On the ex-dividend date, the stock price typically drops by roughly the amount of the dividend, reflecting the fact that new buyers will not receive the payment.</p>

</li>

<li>

<h3>Record Date</h3>

<p>This is the date on which a company determines which shareholders are officially registered on its books and are therefore eligible to receive the dividend. To be on the company's books on the record date, you must have purchased the stock *before* the ex-dividend date.</p>

<p><strong>Example:</strong> If the record date is January 26th, and you bought the stock on January 24th (before the January 25th ex-date), your trade would settle, and you'd be officially recorded as an owner by January 26th.</p>

</li>

<li>

<h3>Payment Date (Payable Date)</h3>

<p>This is the day the company actually distributes the dividend payment to eligible shareholders. The cash will typically appear in your brokerage account.</p>

<p><strong>Example:</strong> The payment date might be February 15th. On this day, the $0.50 per share dividend would be deposited into your account for every share you owned.</p>

</li>

</ol>

<p><strong>Simplified Timeline Recap:</strong></p>

<ol>

<li><strong>Declare:</strong> Company says it will pay a dividend.</li>

<li><strong>Ex-Date:</strong> Last day to buy to get the dividend is the day *before* this date.</li>

<li><strong>Record Date:</strong> Company checks who owns the stock.</li>

<li><strong>Pay:</strong> Dividend money lands in your account.</li>

</ol>

</section>

<section id="types-of-dividends">

<h2>4. Types of Dividends</h2>

<p>While cash dividends are the most common, companies can distribute profits in other forms:</p>

<ul>

<li>

<strong>Cash Dividends:</strong>

<p>The most frequent type, paid directly in cash to shareholders. These are typically paid quarterly.</p>

</li>

<li>

<strong>Stock Dividends:</strong>

<p>Instead of cash, the company issues additional shares of its own stock to shareholders. For example, a 5% stock dividend means you get 5 new shares for every 100 shares you own. This increases the number of shares you own, but it also dilutes the value of each individual share, as the total value of your holding remains the same (just spread across more shares).</p>

</li>

<li>

<strong>Property Dividends:</strong>

<p>Less common, these involve a company distributing assets other than cash or stock to shareholders. This could be shares of a subsidiary company or other physical assets.</p>

</li>

<li>

<strong>Special Dividends:</strong>

<p>These are one-time, non-recurring dividend payments, usually larger than regular dividends. Companies might issue a special dividend if they have an exceptionally profitable quarter, sell off a major asset, or have a large cash surplus.</p>

</li>

</ul>

</section>

<section id="key-dividend-metrics">

<h2>5. Key Dividend Metrics to Understand</h2>

<p>When evaluating dividend stocks, two metrics are particularly important:</p>

<h3>Dividend Yield</h3>

<p>The **dividend yield** tells you the percentage return on your investment from dividends alone. It's calculated by dividing the annual dividend per share by the stock's current share price.</p>

<p><code>Dividend Yield = (Annual Dividend Per Share / Current Share Price) x 100%</code></p>

<p><strong>Example:</strong> If a stock trades at $100 per share and pays an annual dividend of $4, its dividend yield is (4 / 100) x 100% = <strong>4%</strong>.</p>

<ul>

<li><strong>Higher Yields Aren't Always Better:</strong> A very high dividend yield could signal that the stock price has fallen significantly, perhaps due to concerns about the company's future ability to sustain the dividend. Always investigate why a yield is exceptionally high.</li>

<li><strong>Comparison Tool:</strong> Dividend yield is useful for comparing the income potential of different dividend stocks.</li>

</ul>

<h3>Dividend Payout Ratio</h3>

<p>The **dividend payout ratio** indicates what percentage of a company's earnings are paid out as dividends. It's calculated by dividing the total dividends paid out by the company's net income (or earnings per share).</p>

<p><code>Dividend Payout Ratio = (Total Dividends Paid / Net Income) x 100%</code></p>

<p>Or, using earnings per share (EPS):</p>

<p><code>Dividend Payout Ratio = (Dividend Per Share / Earnings Per Share) x 100%</code></p>

<ul>

<li><strong>Sustainability Indicator:</strong> A payout ratio that is too high (e.g., consistently over 80-90%) might suggest the dividend is unsustainable, as the company isn't retaining enough earnings for growth, debt repayment, or a rainy day.</li>

<li><strong>Industry Varies:</strong> What's considered a healthy payout ratio can vary by industry. Utilities, for instance, often have higher payout ratios than tech companies.</li>

<li><strong>Low Payout Ratio:</strong> A low payout ratio means the company retains more earnings, which could be reinvested for growth, or it could indicate room for future dividend increases.</li>

</ul>

</section>

<section id="pros-and-cons-of-dividend-investing">

<h2>6. Pros and Cons of Dividend Investing</h2>

<p>Like any investment strategy, dividend investing has its advantages and disadvantages.</p>

<h3>Pros of Dividend Investing:</h3>

<ul>

<li><strong>Passive Income Stream:</strong> Dividends provide regular cash flow, which can be used to cover living expenses, reinvest, or save.</li>

<li><strong>Potential for Compounding:</strong> Reinvesting dividends (buying more shares) can significantly boost your returns over time due to the power of compounding.</li>

<li><strong>Sign of Financial Stability:</strong> Companies that consistently pay and grow dividends often exhibit strong fundamentals and disciplined management.</li>

<li><strong>Lower Volatility:</strong> Dividend-paying stocks tend to be less volatile than non-dividend-paying growth stocks, offering some stability during market downturns.</li>

<li><strong>Inflation Hedge:</strong> Growing dividends can help offset the eroding power of inflation on your purchasing power.</li>

</ul>

<h3>Cons of Dividend Investing:</h3>

<ul>

<li><strong>Taxation:</strong> Dividends are generally taxable income (though at potentially favorable rates for "qualified" dividends).</li>

<li><strong>Not All Growth Stocks Pay Dividends:</strong> Focusing solely on dividends might mean missing out on high-growth companies that reinvest all their earnings.</li>

<li><strong>Dividend Cuts/Suspensions:</strong> A company can reduce or eliminate its dividend, especially during economic downturns or if its financial health deteriorates. This can also lead to a drop in the stock price.</li>

<li><strong>"Yield Traps":</strong> As mentioned, a very high dividend yield can be a red flag, indicating underlying problems with the company that could lead to a dividend cut.</li>

<li><strong>Opportunity Cost:</strong> Capital paid out as dividends isn't available for the company to reinvest for future growth, which could limit its long-term appreciation potential.</li>

</ul>

</section>

<section id="how-to-invest-in-dividend-stocks">

<h2>7. How to Invest in Dividend Stocks</h2>

<p>Ready to start earning dividends? Here's how you can approach it:</p>

<ul>

<li>

<strong>Research Individual Dividend Stocks:</strong>

<p>Look for companies with a long history of paying and ideally increasing dividends (often called "dividend aristocrats" or "dividend kings" if they have decades of increases). Evaluate their financial health, payout ratio, and industry stability.</p>

</li>

<li>

<strong>Dividend Reinvestment Plans (DRIPs):</strong>

<p>Many brokerage firms and companies offer DRIPs, which automatically use your dividend payments to buy more shares (or fractional shares) of the same company. This is a powerful way to leverage compounding without manual effort.</p>

</li>

<li>

<strong>Dividend ETFs and Mutual Funds:</strong>

<p>If you prefer diversification and professional management, consider investing in **Dividend Exchange-Traded Funds (ETFs)** or **Dividend Mutual Funds**. These funds hold a basket of dividend-paying stocks, spreading your risk across many companies.</p>

<ul>

<li><strong>Pros:</strong> Instant diversification, often lower fees than actively managed funds, no need to research individual stocks.</li>

<li><strong>Cons:</strong> You don't pick individual stocks, and the fund's strategy might not perfectly align with your specific goals.</li>

</ul>

</li>

<li>

<strong>Open a Brokerage Account:</strong>

<p>To buy stocks or ETFs, you'll need an investment account with a reputable online brokerage firm. These platforms provide the tools and access to the stock market.</p>

</li>

</ul>

</section>

<section id="are-dividends-taxed">

<h2>8. Are Dividends Taxed?</h2>

<p>Yes, dividends are generally considered taxable income. However, the tax rate can vary depending on the type of dividend and your income bracket.</p>

<ul>

<li>

<strong>Qualified Dividends:</strong>

<p>These are taxed at lower long-term capital gains rates, which are typically more favorable than ordinary income tax rates. To qualify, you usually need to hold the stock for a certain period (e.g., more than 60 days during a 121-day period that begins 60 days before the ex-dividend date).</p>

</li>

<li>

<strong>Non-Qualified (Ordinary) Dividends:</strong>

<p>These are taxed at your regular income tax rate. Most dividends from REITs (Real Estate Investment Trusts) or those from stocks held for a short period fall into this category.</p>

</li>

</ul>

<p class="highlight"><strong>Always Consult a Tax Professional:</strong> Tax laws are complex and can change. It's always best to consult with a qualified tax advisor for personalized advice on your specific situation.</p>

</section>

</main>

<footer>

<p><strong>Disclaimer:</strong> This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risks, including the potential loss of principal. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions.</p>

<p>Ready to dive deeper? Explore our other guides on <a href="[Link to your article on 'Understanding Stock Market Basics']">Understanding Stock Market Basics</a> or <a href="[Link to your article on 'How to Choose a Brokerage Account']">How to Choose a Brokerage Account</a>.</p>

<p>© 2023 [Your Website Name]. All rights reserved.</p>

</footer>

</div>

</body>

</html>

Post Comment